William_Potter

Investment thesis

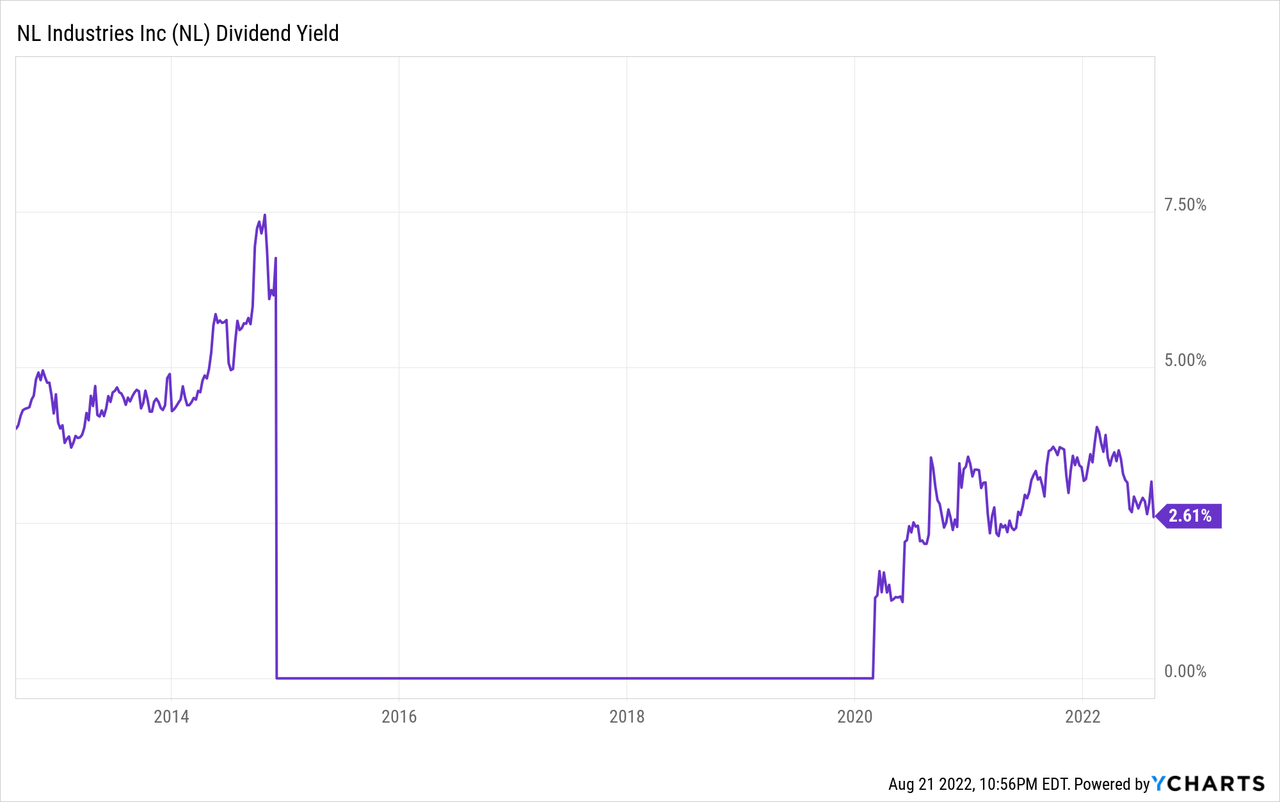

In September 2021, I wrote an article about NL Industries (NYSE:NL) as it was trading at a discount of ~60% from the last price spike experienced in 2017. Since then, the share price has increased by 58% to $9.95, causing the dividend yield to drop from 3.70% to 2.61% despite the fact that the company raised it again in 2022 by 17.6%. On the other hand, NL announced a special dividend of $0.35 in August 2022, which will be paid with cash on hand. The company keeps paying its fixed dividend with half the dividends received by its stake in Kronos Worldwide (KRO), which suggests the dividend is safe as long as Kronos Worldwide keeps paying the dividend with a relatively conservative cash payout ratio. Furthermore, stable margins in CompX International are allowing strong cash flow generation year after year.

Despite the recent increase in the share price, NL Industries is still a company that a conservative investor can hold for the long term while reaping the dividend, but it is not as attractive as it was at the moment I wrote the last article due to its cyclical nature. The parameters that I analyzed in the previous article have improved along with the increase in the price of the shares: net sales, margins, cash position, and the dividend payout. But NL Industries is a company that I think you should buy during bad times in order to take advantage of the pessimism of investors and thus buy shares at a low price, and not when everything is going well, because the risk of fading tailwinds or an unexpected headwind increases along with good performance and optimism.

A brief overview of NL Industries

NL Industries is a multinational smelting holding company that operates through a majority stake of 87% in CompX International (CIX) from a total market cap of ~$300 million, and a noncontrolling 30% interest in Kronos Worldwide (KRO) from a total market cap of ~$1.7 billion. On the other hand, Valhi (VHI) owns 83% of NL Industries’ shares, and Contran Corporation owns 92% of Valhi.

It was founded in 1891 and its market cap currently stands at ~$485 million, so it’s a small-cap company with a very long history behind it.

NL Industries logo (2021 Annual report)

CompX International is a leading manufacturer of security products for a wide range of industries, including recreational transportation, postal, office and institutional furniture, cabinetry, tool storage, healthcare, gas stations, and vending equipment. CompX also manufactures stainless steel exhaust systems, gauges, throttle controls, wake enhancement systems, and trim tabs for the recreational marine industry.

On the other hand, Kronos Worldwide is a leading multinational manufacturer of value-added titanium dioxide pigments (TiO2), serving over 4,000 customers in 100 countries for over a century. Most of Kronos’ sales take place within Europe, North America, and the Asian Pacific region. TiO2 is a base industrial product used in a wide range of industries. It is the largest commercially used whitening pigment due to its superior characteristics compared to other alternatives and represents a critical material for coatings, plastics, paper, inks, food, and cosmetics, which gives some stability to Kronos’ sales.

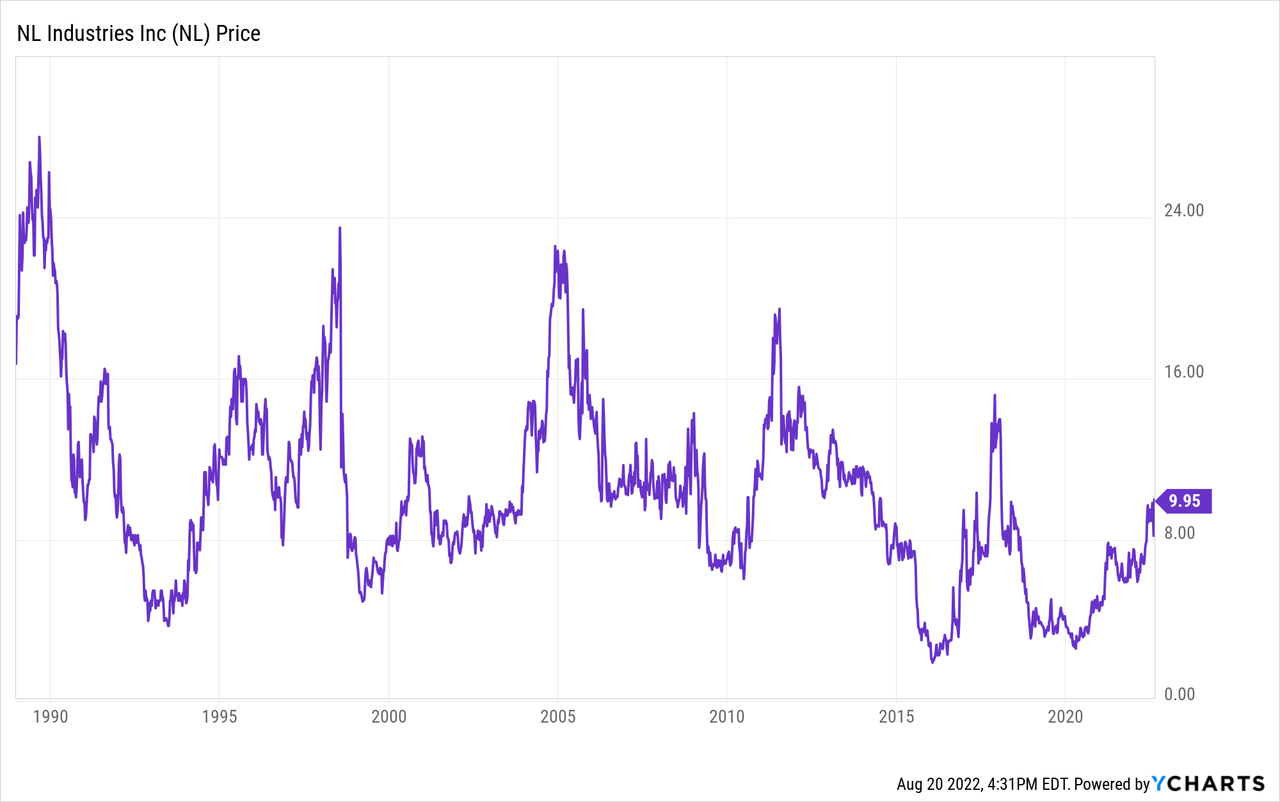

Currently, the share price of NL Industries stands at $9.95, which represents a 59.75% decline from the spike of $24.72 on March 29, 2005, a 50% decline from the spike of $19.90 on June 9, 2011, and a 38.01% decline from the most recent spike of $16.05 on November 30, 2017. Looking closely at the price chart, it is clear that the cyclical nature of NL Industries is very strong, so the recent rise in the share price has significantly increased the risk of a downturn shattering current positive expectations. This is why I consider that, although it is very acceptable to hold the shares in order to have an income in the form of dividends, I do not consider that it is a good time to acquire new shares since the current dividend yield does not compensate for the added risk.

Net sales are getting a boost

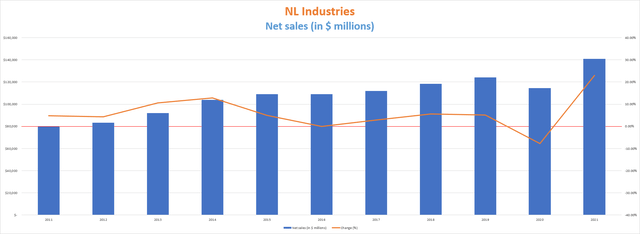

The company’s consolidated net sales have increased steadily over the years, with a slight drop of 7.81% during 2020. In 2021, net sales increased by 22.94% year over year, or 13.36% compared to 2019, to $140.82 million, so we could say that NL Industries sales are at their best moment. What is more, trailing twelve months’ net sales currently stands at $152.4 million, which suggests that 2022 will be a year in which consolidated sales will be surpassed again.

NL Industries net sales (10-K filings)

The global leisure boat market is expected to grow at a CAGR of ~4.73% by 2030, and CompX International is doing strong efforts to expand its market share in the industry, so investors can expect further sales increases for NL Industries in the long term. On the other hand, the global TiO2 market is expected to grow at a CAGR of ~6% by 2028, with which its stake in Kronos Worldwide is destined to contribute even more cash in the form of dividends as net sales of Kronos are expected to keep growing in the coming years.

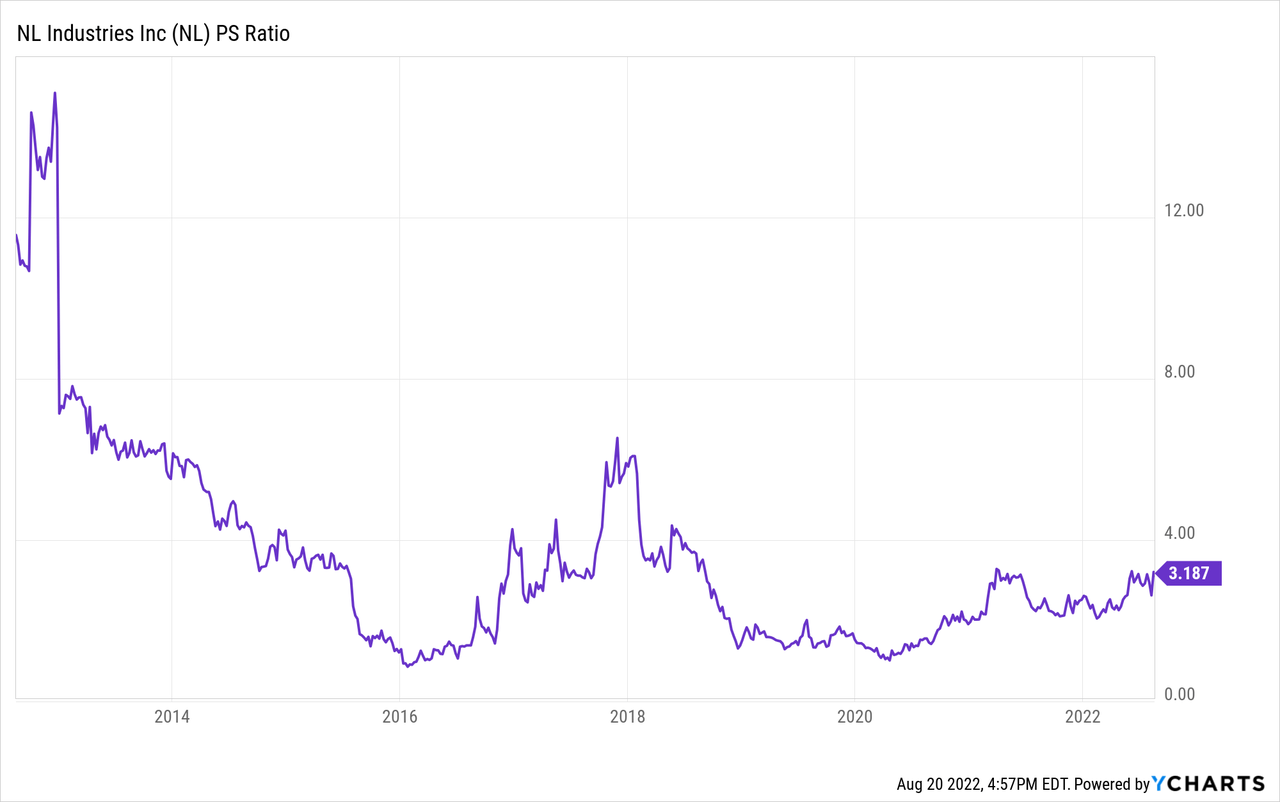

Currently, the PS ratio stands at 3.187, which means the company generates $0.31 for each dollar held in shares, annually. This ratio has increased considerably in the past two years despite the increase in sales, and this is a consequence of a faster increase in the share price compared to the sales increase.

This increase in the PS ratio is due to two main reasons: first, investors expect an increase in sales in the short, medium, and long term as CompX International is heavily investing in the marine recreative industry, which is expected to grow at a fast pace during the coming years. Also, Kronos Worldwide’s estimated sales of $2.18 billion for 2022 and $2.23 in 2023 are 2.83% and 5.19% higher, respectively, than the current trailing twelve months’ sales of $2.12 billion, and this should allow higher dividend income for NL Industries, which increases the optimism of investors looking for a reliable dividend stream.

CompX International and Kronos Worldwide are highly profitable

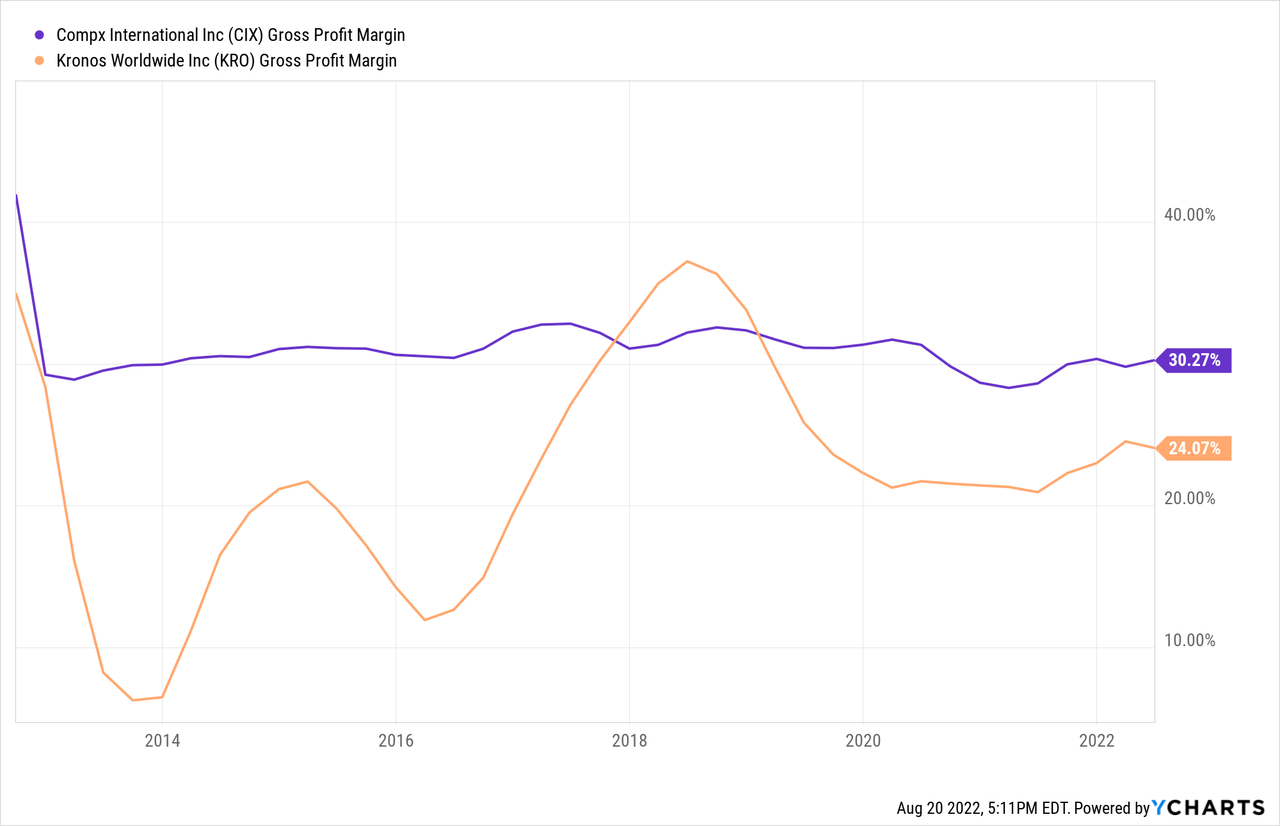

Gross profit margins for both Kronos and CompX have improved during the second half of 2021 and the first half of 2022 after the low performance experienced in 2020. CompX currently enjoys a trailing twelve months gross profit margin of 30.27%, although results were even more positive in the second quarter of 2022 as gross profit margins reached 32.70% for the quarter. For Kronos, trailing twelve months’ gross profit margins currently stand at 24.07%, although they have been negatively affected in the last quarter as they fell to 21.32%.

In this sense, the drop in profit margins of Kronos is being somewhat compensated by the increase in profit margins of CompX International, something very positive considering that the sales of both companies are increasing at a great rate due to price increases as inflationary tensions don’t cease. The profitability of both companies has made it possible for NL Industries to generate cash steadily, which becomes evident when looking at its ability to raise cash after covering the dividend.

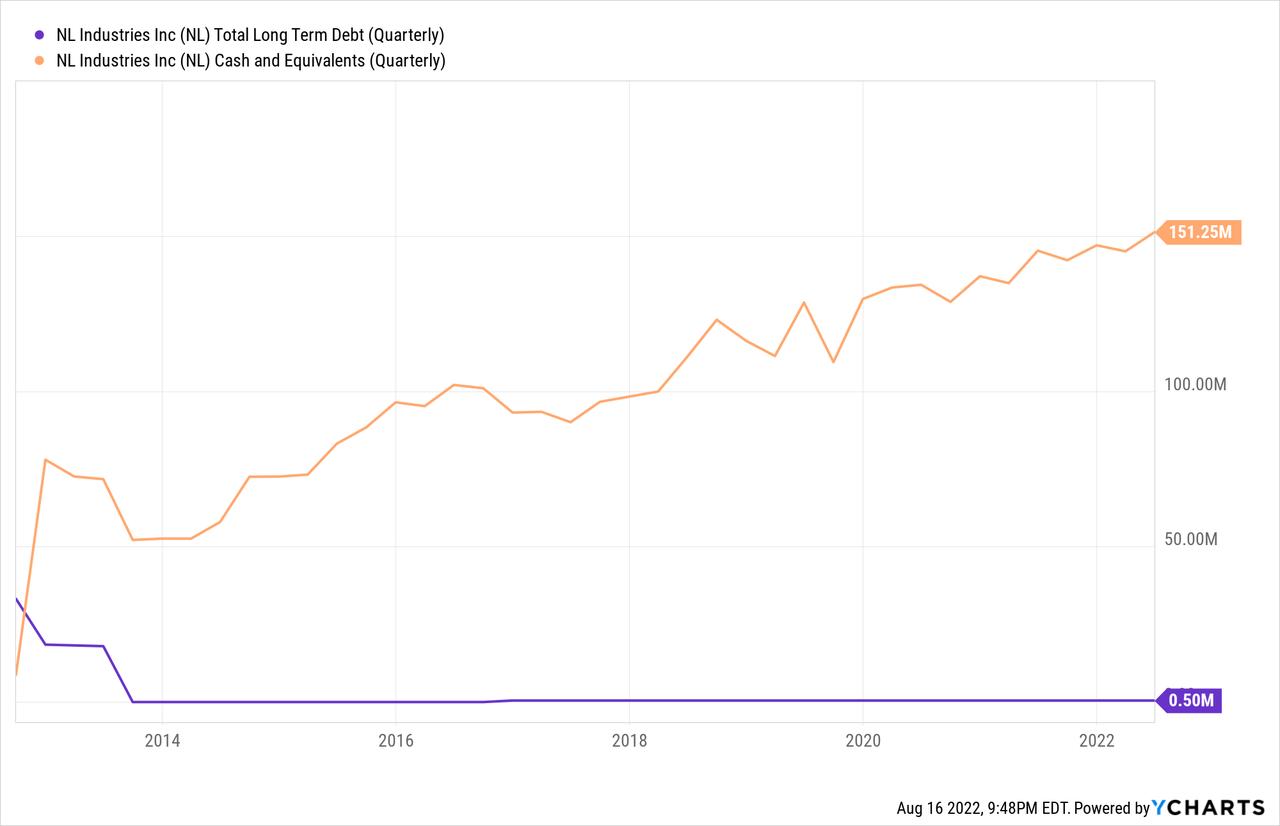

NL Industries’ cash on hand is very high and debt is non-existent

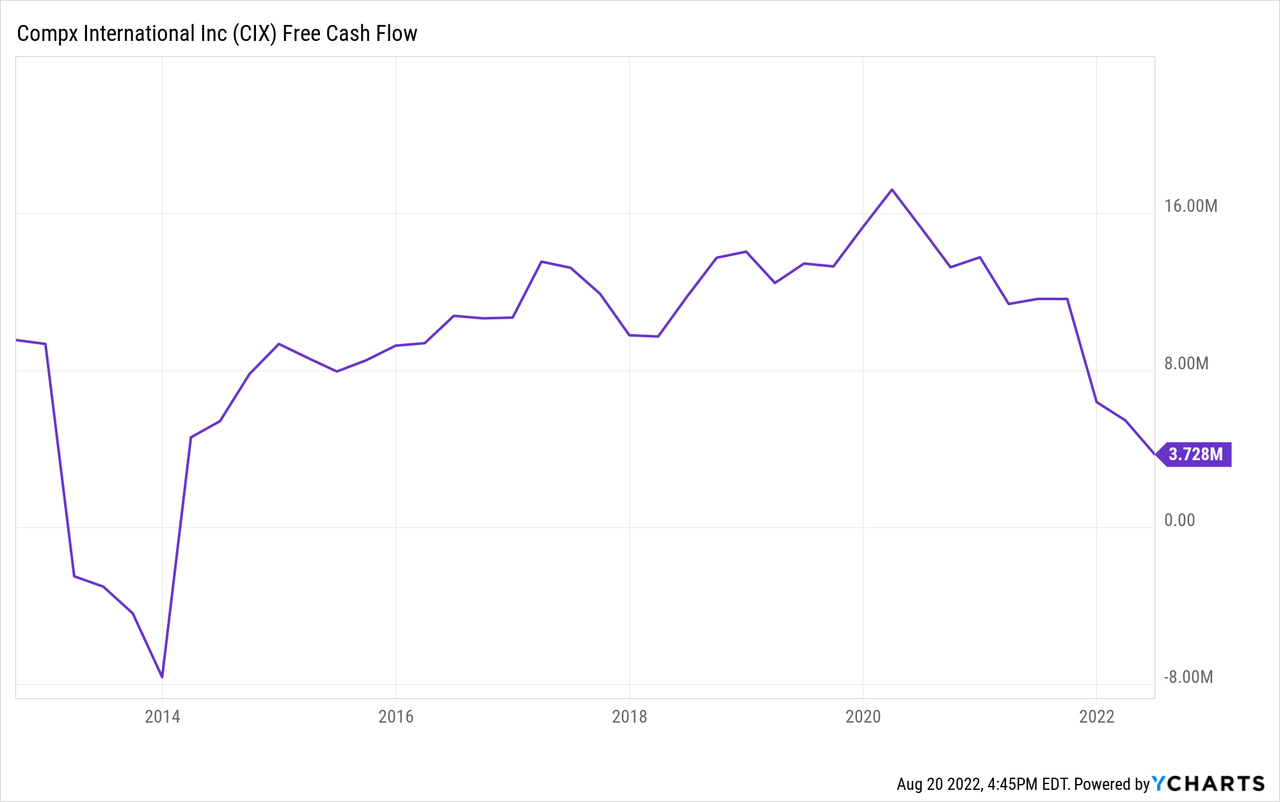

The company has steadily raised cash on hand year after year thanks to a relatively low cash payout ratio. This is because it usually paid fewer dividends than those received by Kronos Worldwide in order to keep growing the company’s cash reserves. CompX International also generates positive free cash flows year after year.

NL Industries’ ability to continuously raise cash represents the ultimate proof to demonstrate its profitability and is also a huge safety net for investors.

Currently, the company holds 151 million in cash on hand, and the special dividend of $0.35 declared in August will cost around 10% of the company’s cash reserves despite representing a yield of 3.52% based on the current share price. Furthermore, the company has enough cash reserves to keep paying the fixed dividend for many years even if unexpected headwinds arise considering the annual fixed dividend expense is ~$14.83 million, and has even some room to increase it or keep paying special dividends.

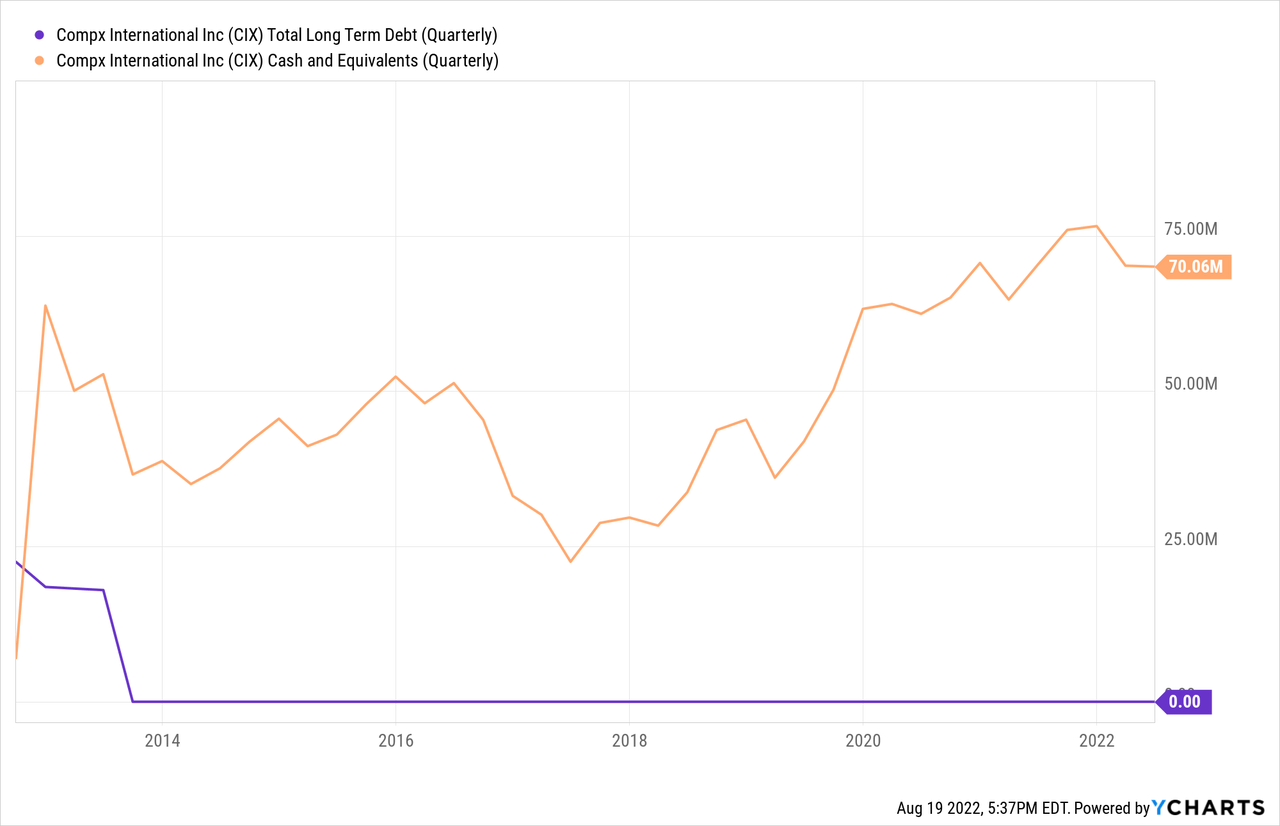

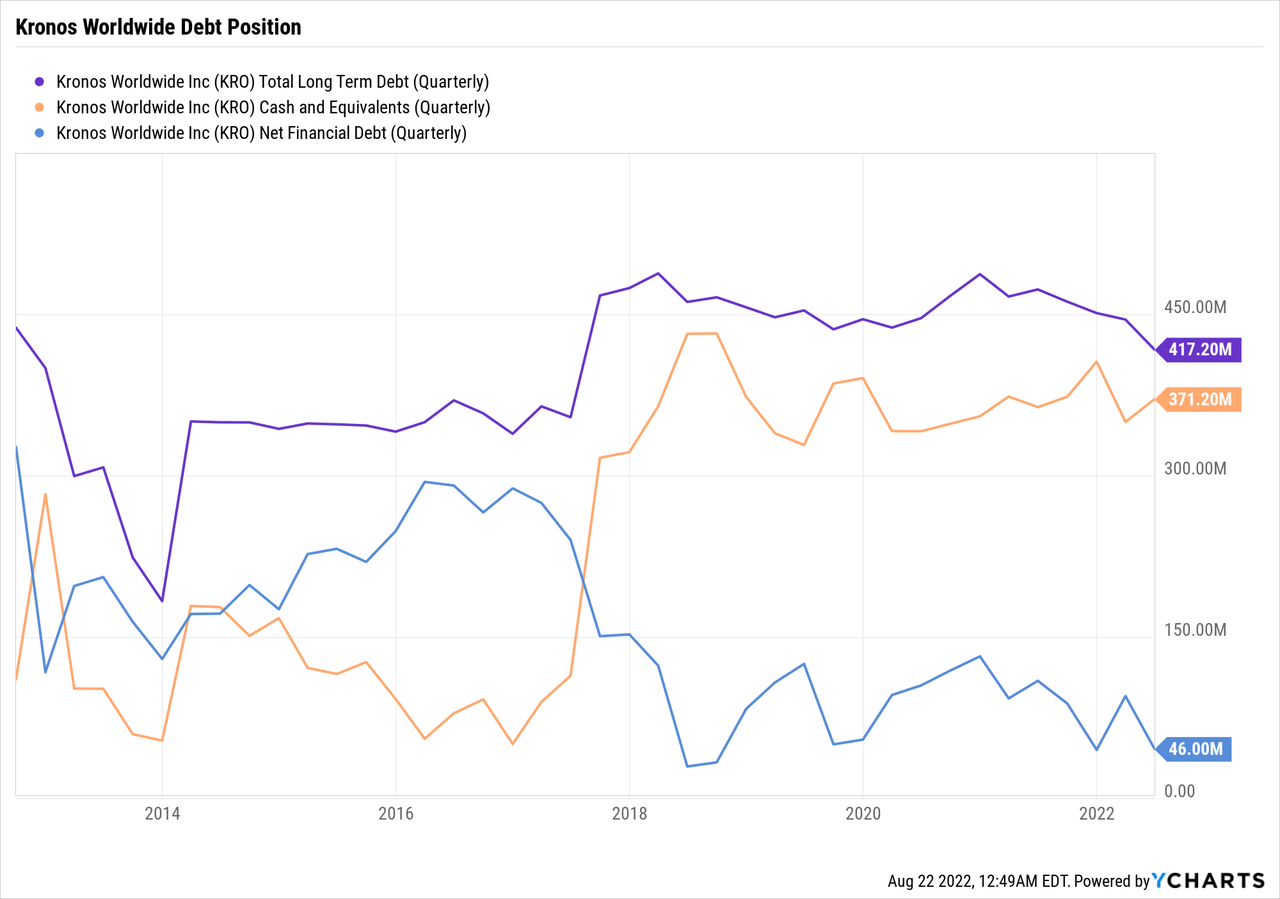

And while CompX International has no debt, it’s very important to keep in mind that Kronos’ balance sheet has a large debt load, which has been, fortunately, reduced during the last few years in terms of net debt due to increasing cash on hand and decreasing long-term debt.

In this sense, we have a very robust balance sheet from NL Industries and a debt position that has shown great improvement in recent years from Kronos Worldwide, which is very advantageous for the current times marked by added difficulties to remain competitive and profitable due to inflationary pressures and labor shortages.

The dividend is safe and the room for further raises is significant

After a dividend suspension in 2014, the company decided to reinstate it in 2020 at $0.04 per quarter and raise it by 50% to $0.06 in 2021. In 2022, the management decided to raise it again by 16.7% to $0.07 and announced a special dividend of $0.35 in August of 2022. This is because the management is being more conservative than in the past when it comes to distributing dividends by limiting the growth of the fixed dividend, which is more difficult to cut without disappointing shareholders, and prioritizing special dividends, which carry far fewer commitments than fixed dividends.

Despite the recent fixed dividend raise, the dividend still appears very safe. In this sense, during the first half of 2022, NL Industries received $13.38 million in dividends from its stake in Kronos Worldwide, and dividends paid during the same period to shareholders of NL Industries were $6.83 million. Therefore, the company can easily keep paying the quarterly dividend as it only needs 51% of the dividends received from its stake in Kronos Worldwide to do so.

In the table below, I have calculated the Kronos Worldwide’s cash payout ratio by calculating what percentage of cash from operations is used each year for the dividend payout and the payment of interest expenses. In this way, we can determine whether Kronos Worldwide’s dividend payout is sustainable.

| Year | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 |

| Cash from operations (in millions) | $130.4 | $87.7 | $52.1 | $89.6 | $276.1 | $188.5 | $160.3 | $102.5 | $206.5 |

| Dividends paid (in millions) | $69.5 | $69.5 | $69.5 | $69.5 | $69.5 | $78.8 | $83.4 | $83.2 | $83.2 |

| Interest expense (in million) | $19.6 | $17.0 | $18.5 | $20.5 | $19.0 | $19.5 | $18.7 | $19.0 | $19.6 |

| Cash payout ratio | 68.33% | 98.63% | 168.91% | 100.45% | 32.05% | 52.15% | 63.69% | 99.71% | 49.78% |

As we can see in the table above, Kronos Worldwide has improved its cash payout ratio in recent years after the difficulties to cover the dividend in 2014, 2015, and 2016, and has managed to keep it around 50% except in 2020 when it reached almost 100%. Also, CompX International is a highly profitable company that steadily generates strong cash from operations thanks to its high and stable profit margins, and although its cash from operations has recently decreased considerably, this is because the company is expanding its inventories, and not because of any profitability issue.

Therefore, if we take into account that half of the dividend paid by Kronos International is enough to cover the dividend of NL Industries and that CompX International also generates high cash flows, we can conclude that the company has enough margin to continue paying the dividend, and the absolute proof of this is its ability to increase the cash on hand continuously.

Risks worth mentioning

NL Industries has a very strong cyclical nature, so it’s a company that is better to buy in moments of pessimism like when I wrote the last article back in September 2021, and not in times of optimism like the current one. This is because the overall risk increases along with optimism and tailwinds as there are more advantageous situations that could cease to be than before.

NL Industries’ capacity to cover the dividend largely depends on the ability of Kronos Worldwide to cover theirs. This implies that any cut in Kronos Worldwide’s dividend would have a direct impact on NL Industries’ dividend. Kronos Worldwide’s cash payout ratio has improved in recent years, although the coronavirus pandemic significantly damaged its ability to cover the dividend in 2020 and it looks like profit margins are falling again in 2022 as the results of the second quarter of 2022 suggested. We should also not forget that Kronos’ performance is directly linked to the performance of the TiO2 industry.

Kronos Worldwide has a $19 million annual interest expense as a consequence of its debt load, and it will limit its capacity to cover the dividend and grow as it consumed 9.5% of the company’s cash payout ratio in 2021. Although the risk of the debt getting out of control is very low and cash on hand is very high, it is always important to take into account the limitations that debt entails in times of reduced profitability.

Conclusion

Since I wrote the last article on NL Industries, the share price has increased by 58.33% while trailing-twelve months’ net sales increased by 16.66%, causing the PS ratio to increase significantly as investors are willing to pay more for the company’s sales due to higher optimism. Still, it is very important not to forget a fundamental reality: NL Industries has a very high cyclical nature, and this means that the bad times will eventually return while the upside potential has proportionally decreased as the share price has increased.

Still, it is very acceptable for those investors who own shares to just hold them as the dividend yield of ~2.6% along with the special dividend that is fully paid with cash on hand due to a conservative cash payout ratio represents a juicy dividend source. In the future, investors can expect further dividend raises or special dividends as the company’s cash reserves tend to increase steadily due to a low cash payout ratio. I would hardly recommend starting or expanding a position at times of relatively high optimism when it comes to highly cyclical companies due to the high risk that it entails despite a dividend that looks so safe, and this is the main reason why I consider NL Industries a hold at this price.

Be the first to comment