jetcityimage/iStock Editorial via Getty Images

Investment Thesis: As the stock still seems to be more expensive than in previous years on a P/E basis and sales of the Nissan LEAF have been decreasing this year – I do not see upside in the stock at this time.

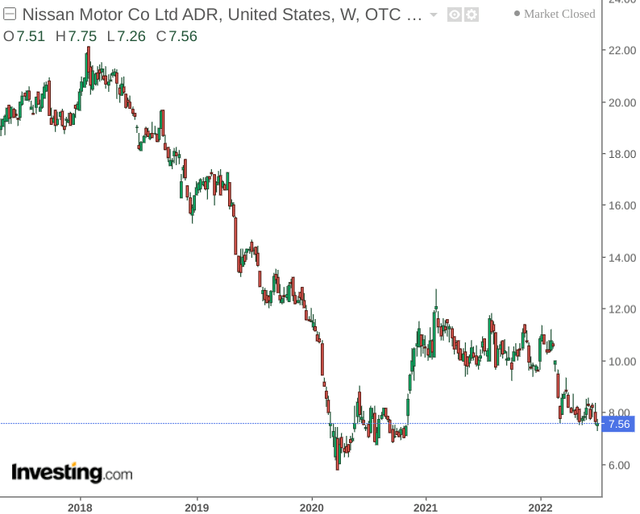

Nissan Motor (OTCPK:NSANY) has seen an overall downward trajectory over the past few years, despite a slight uptick in recovery after the broader market started to recover following the downturn related to COVID-19.

The purpose of this article is to determine whether Nissan Motor could see significant room for upside given a potential disconnect between price and performance.

Performance

When looking at the company’s balance sheet performance, we can see that the cash to current liabilities’ ratio has decreased along with the cash to long-term borrowings’ ratio (figures quoted below in millions of yen):

| Period | FY20 | FY21 |

| Cash on hand and in banks | 1,871,794 | 1,432,047 |

| Total current liabilities | 6,726,382 | 6,143,208 |

| Long-term borrowings | 2,173,677 | 1,775,221 |

| Cash to current liabilities ratio | 0.28 | 0.23 |

| Cash to long-term borrowings ratio | 0.86 | 0.81 |

Source: Figures sourced from Nissan Motor FY2021 Consolidated Financial Results. Ratios calculated by author.

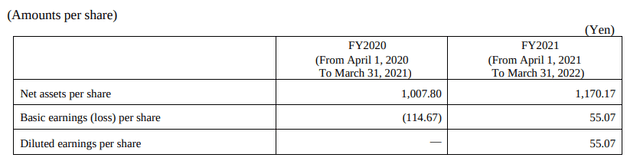

With that being said, earnings did see a recovery into positive territory as compared with the previous year:

Nissan Motor FY2021 Consolidated Financial Results

This was driven by strong growth in net sales of 7% to over 8.4 trillion yen.

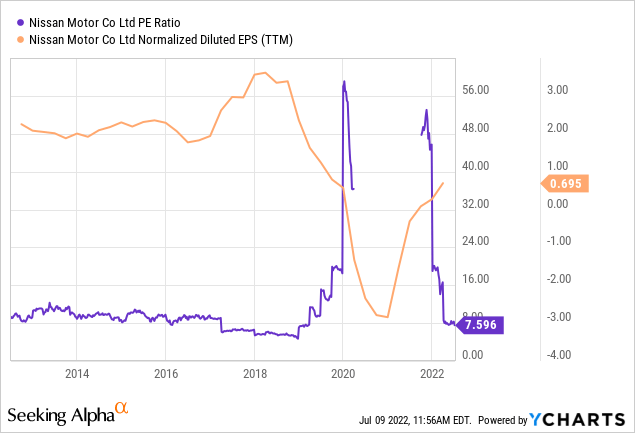

When looking at the 10-year trajectory of the company’s P/E ratio, we can see that earnings per share (normalized diluted) still remains below levels seen pre-2018 – even if the P/E ratio has started to stabilize towards levels seen during that period.

ycharts.com

From a cash and earnings standpoint – I take the view that investors will likely want to see evidence of cash growth as well as a further rebound in earnings to justify entry into the stock.

Looking Forward

Going forward, inflation is expected to have an impact on the cost of raw materials for Nissan and other Japanese automakers – with a weaker yen meaning higher costs of material imports.

In addition, inflation stands to be a broader concern, as consumers who would have otherwise upgraded their vehicles might choose to postpone doing so due to a rising cost of living.

Moreover, with China having seen strict COVID-19 lockdowns earlier this year – it is unclear as to what extent this could result in supply chain issues for Nissan going forward. Back in February 2020, Nissan reportedly had to temporarily shut down one of its Japanese factories due to a shortage of parts from China, along with Dongfang Nissan reportedly having to cease production earlier this year due to the COVID-19 outbreak. Should we see similar situations materialize in the event of further lockdowns – then this could yet add to existing supply chain pressures?

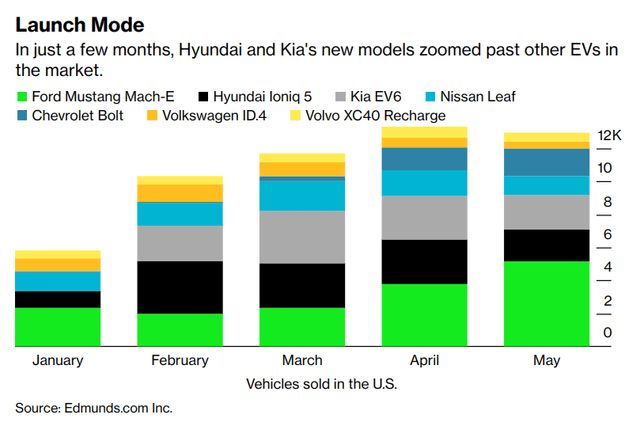

With electric vehicle sales expected to triple from current levels by 2025, Nissan has nevertheless been facing significant competition – with Hyundai (OTCPK:HYMTF) and Kia (OTCPK:KIMTF) having surpassed sales of the Nissan LEAF in the United States.

With other car manufacturers such as Volkswagen (OTCPK:VLKAF) having significantly grown EV sales in the European market – it is likely that we will see competition intensify among electric vehicle manufacturers.

So far, it would appear as though competitors are gaining an edge over the Nissan LEAF, and given that deliveries of this model in Q2 were reportedly 32% down from that of last year – Nissan is at risk of falling behind in terms of capturing growth across the EV market.

Conclusion

To conclude, Nissan has seen a recovery in earnings in the past year.

However, the stock still seems to be more expensive than in previous years, and sales of the Nissan LEAF this year have not been too encouraging.

From this standpoint, I do not see upside in the stock at this time.

Be the first to comment