Andy Feng/iStock Editorial via Getty Images

Chinese EV startup NIO (NYSE:NIO) surprised the market this week by announcing that it is forced to curtail EV production due to a worsening parts shortage that could, potentially, materially impair NIO’s ability to double electric vehicle deliveries in 2022. In related news, NIO said that it is going to follow other EV companies and raise retail prices for all of its electric vehicle products.

I believe shares of NIO are still a long term buy based on commercial growth prospects in the Chinese EV industry, but my previous delivery estimate of 190,000 electric vehicles, due to NIO’s production suspension, is no longer defensible. While I projected a strong delivery rebound for March due to the end of Chinese holidays, deliveries are likely going to drop off for NIO in the second-quarter.

Updating my delivery projections for FY 2022 due to evolving production circumstances

To mitigate the spread of COVID-19 outbreaks in a couple of Chinese provinces including Shanghai, authorities have enacted strict new disease control measures, shutting down factories and forcing people to stay at home. Strict lockdown measures have been put in place in Shanghai and Jilin (as well as other provinces), affecting NIO’s supply chain partners and resulting in a suspension of NIO’s electric vehicle production. NIO also warned of delayed deliveries to current customers because of these factory shutdowns.

NIO isn’t the only EV company that has been affected by new COVID-19 shutdowns. Tesla’s (TSLA) Shanghai Gigafactory has effectively been closed since the end of March, which is expected to take a heavy toll on Tesla’s delivery volumes in April as well.

The secretary general of the China Passenger Car Association, Cui Shudong, expects the recent COVID-19 to curtail auto production in China by 20%… which is a significant percentage and things could get worse short term. How long the shutdowns will last is of course uncertain at this point, but they are certainly not good news for NIO, which has struggled with temporary production setbacks ever since the pandemic began in early 2020.

NIO managed to deliver a material delivery rebound that saw its month over month delivery rate jump from a dismal 9.9% in February to 37.6% in March. The rebound in March deliveries was a key argument for me to remain bullish on a significant production rebound in FY 2022. But now, with the latest production setback hurting NIO, I see no other choice but to correct my 2022 delivery estimate that I touted in my previous work on NIO. More likely than not, NIO is going to see a steep drop-off in deliveries for the month of April and possibly even in the months after that. NIO’s Q2’22 delivery forecast is likely not going to be great, either.

I believed, before the latest round of factory shutdowns, that NIO would be able to pull off a hard rebound in EV deliveries in FY 2022. However, due to changing circumstances and new, significant uncertainty surrounding NIO’s production ramp, I am lowering my FY 2022 delivery unit forecast from 190,000 electric vehicles to 160,000 electric vehicles. This marks a 16% downward adjustment for NIO’s delivery volume this year, and I may further update my delivery estimates if factories of NIO’s production partners remain shut longer.

With about 160,000 electric vehicle deliveries still possible in FY 2022, NIO would still generate about 75% year over year delivery growth. While the rate of delivery growth would still be impressive, it would mark a step-down from the FY 2021 year over year growth rate of 109%. Last year, NIO delivered 91,429 electric vehicles to customers.

Retail price increases meant to stabilize vehicle margins due to soaring material costs

NIO has been able to grow vehicle margins of its product lineup to 20.9% in Q4’21, showing an improvement of 370 basis points compared to the year-earlier period. However, supply chain issues and inflation (rising material costs) are a threat to NIO’s profit margins. To compensate for higher (battery) costs, NIO just announced on its app that it was raising retail prices across the board by 10%, effective May 10. A new NIO electric vehicle, starting next month, will become 10,000 Chinese Yuan or $1,572 more expensive. NIO’s battery prices will also go up by between 1,480 and 1,680 Chinese Yuan.

By raising retail prices, NIO follows other EV startups such as XPeng (XPEV) which also increased prices last month, in part to compensate for higher material costs but also to offset cuts to EV subsidies. Li Auto (LI) also raised prices by 11,800 Chinese Yuan, which calculates to US$1,855.

NIO’s price hike may lead to a short term dip in vehicle reservations, but I believe it will not impact NIO’s long term potential for sustained revenue growth.

NIO’s #1 risk right now

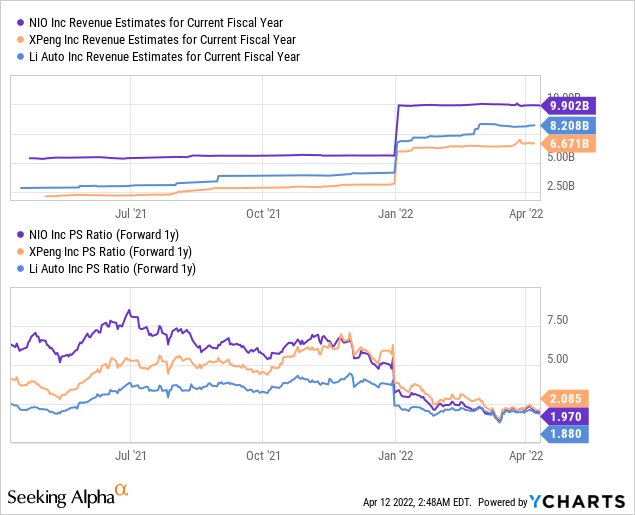

NIO’s biggest risk is the supply chain. As risks to the supply chain are growing, NIO’s ability to achieve 100% electric vehicle delivery growth in FY 2022 is also put at risk. NIO does not make full year delivery projections, but analysts are likely to refresh their delivery and revenue estimates for FY 2022 to account for the latest round of factory shutdowns… which could result in the stock revaluing lower.

NIO’s valuation and possibility of new lows

I believe, as much as I like NIO, that the stock will fall to new lows as investors have to deal with materially increased production and delivery uncertainty this year. NIO’s April delivery numbers are not going to be great either. While shares of NIO are still cheap based off of expected revenues, risks with NIO have undoubtedly increased this week.

Final thoughts

The implication of the current round of COVID-19 related shutdowns in China and NIO’s production suspension is that I now expect NIO’s delivery growth to materially decelerate compared to FY 2021… even if ET7 sedan deliveries, which began just last month, are set to make a positive contribution to NIO’s total deliveries in FY 2022.

The announced 10% retail price hike is going to help NIO offset higher raw material and component costs which may help stabilize vehicle margins. However, I don’t believe the price increase itself will result in a large number of reservation cancellations. Longer term, NIO is still attractive as a growth play on the Chinese EV market, but it may take longer for the stock to revalue higher!

Be the first to comment