Aranga87/iStock via Getty Images

DBD Transitions To A Growth Path

Diebold Nixdorf, Incorporated (NYSE:DBD) is changing its focus and now is giving sufficient importance to the electric vehicle (EV) charging station business, which is on a rapid growth path. Recently, the company received contracts for several thousand charging stations in Europe and the US. Also, it expects to add several more by the end of the year. While this will facilitate the topline, it also plans to expand its operating margin through pricing traction and contract restructuring. The DN Series ATM machines will also help gain market share as customers move towards automation and self-service.

However, the company faces headwinds from cost and wage inflation, while increased investment in infrastructure will put pressure on the profit. It may also divest its distribution subsidiary network, which can offset the revenue growth elsewhere. This year, I expect working capital requirements to reduce following lower inventory and accounts payable. As a result, free cash flow is likely to improve in FY2022. The balance sheet will continue to carry accumulated losses and reflect financial risks. Nonetheless, the current drivers are strong enough to warrant a hold on the stock in the medium term.

EV Charging Growth Model And Projects

DBD has started to consolidate its initiatives in EV charging stations in the diversification process. I discussed the company’s strategies and challenges in my previous article. In Q4 2021, DBD received contracts for several thousand charging stations in Europe and the US and plans to service over 30,000 charging stations by 2022. According to one of the studies cited by the company, the number of public EV charging stations in Europe and the US combined will exceed the number of ATM devices. Europe is currently the principal driver in adopting EVs and, therefore, requires huge charging investments.

In Europe, the customers are more likely to use public EV charging facilities because of higher usage of rental and fleet cars and more electric vehicles being used for public transportation. Recently, the company has won an award from one of the leading providers of charging technology in Europe and will provide services for 1,000 DC fast-charging stations.

The Outlook: FY2022 and Q1 2022

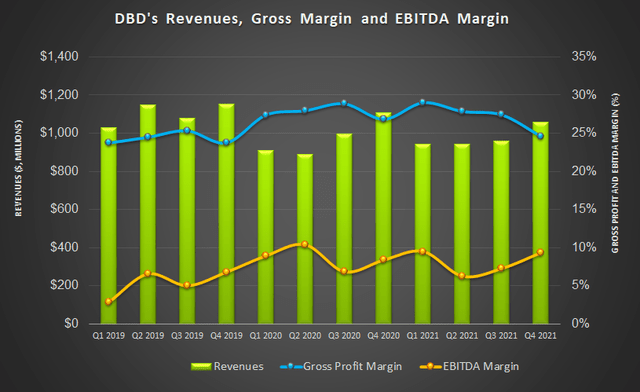

DBD management expects DBD’s FY2022 revenues to increase by 5% compared to FY2021. However, this included a $150 million in revenue deferral, excluding which, the organic revenue would remain nearly unchanged. The favorable drivers for the company in 2022 would be pricing growth and divestiture, and termination of low-profit service contracts. However, the logistics and supply chain disruptions would reduce the profit margin. These factors will drive the adjusted EBITDA margin by 8.3% (at the guidance mid-point) in FY2022.

While the margin is unlikely to change much in 1H 2021, it will start to expand rapidly in the second half due to higher volume, improved pricing, and the company’s cost management exercises. Following the pandemic, e-commerce has proliferated. Since customers now prefer lower touch options during the purchase process, DBD’s self-checkout offerings are better options.

Management expects the gross margin to remain unchanged in Q2 2022 compared to Q1 following cost inflation, wage inflation, and growth in infrastructure investments. In FY2022, the management expects the SG&A expense to decrease due to the variable incentive compensation. Although investment will rise in growth projects, the company will likely start divesting its infrastructure business, mainly the distribution subsidiary network. It also needs to upgrade and standardize processes in its distribution subsidiaries.

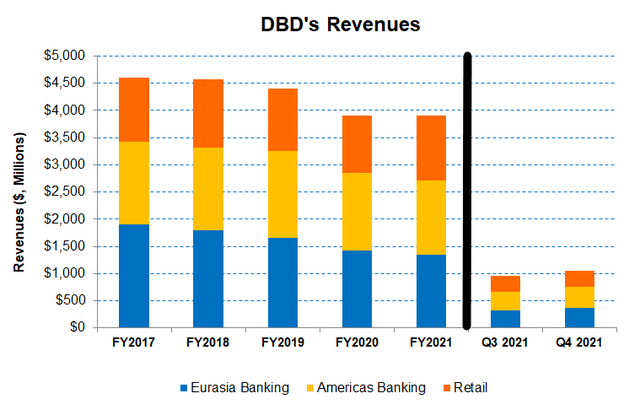

Analyzing The Segment Drivers

In Q4 2021, the Americas Banking segment revenues increased by 11% compared to Q3 due to increased demand for self-service and automation. The growth momentum followed the above-market rates in Europe for DBD’s self-service hardware, services, and software. In the US, the company’s market share for DN Series ATMs increased as customers moved towards automation. According to the company’s estimates, self-service devices connected to its AllConnect Data Engine increased by 122% in the past year. That device has helped reduce customer downtime, too.

Also, revenues from the Eurasia Banking segment went up by 16%. The Retail segment revenue, in comparison, saw the lowest revenue growth (3% up quarter-over-quarter in Q4 2021). During Q4, extended outbound transport times and inbound component delays resulted in revenue loss. In the US, Latin America, and some APAC (Asia-Pacific), such loss would result in an aggregate revenue deferral of $150 million in 2022.

The gross margin contracted by ~280 basis points in the past quarter, while the EBITDA margin expanded. The revenue deferral and non-billable inflation affected its margin adversely in Q4. However, the improved performance of the DN Series ATMs partially offset the adverse impact.

Financial Risks Remain, But Cash Flows Improve

In FY2021, DBD’s cash flow from operations (or CFO) turned around impressively (a 585% rise) compared to a year ago. Although the year-over-year revenues remained unchanged, a strict discipline related to days payable outstanding, lower inventories, and favorable changes in income taxes reduced working capital requirements. As a result, its free cash flow (or FCF) turned significantly positive in FY2021. In 2022, DBD is carrying excess inventory related to the $150 million of deferred revenue, as discussed earlier in the article. During the year, I expect inventory and accounts payable to normalize. On top of that, it faced revenues recognition issues on some of the ATMs in the pipeline because of supply chain and logistics delays. All these factors will largely determine the cash flows in 2022.

DBD’s accumulated deficit has pushed its shareholders’ equity into negative territory. On top of that, it had a net debt of $1.86 billion as of December 31, 2021. Its liquidity was $707 million (cash plus revolving credit facility) as of that date.

DBD expects to generate $130 million to $150 million of positive cash flow in FY2022, much higher than its previous guidance. The forecast assumes DN Now transformation, restructuring program, and the normalization of working capital.

Relative Valuation And Target Price

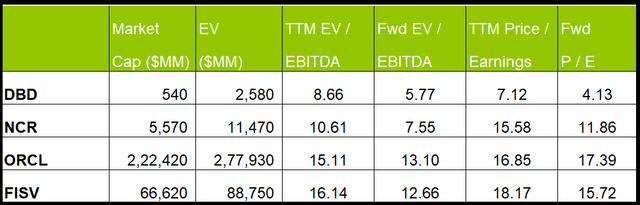

DBD’s forward EV-to-EBITDA multiple contraction versus the current EV/EBITDA is steeper than its peers, resulting in a higher EV/EBITDA multiple than the peers. However, the stock’s EV/EBITDA multiple (8.7x) is lower than its peers’ (NCR, ORCL, and FISV) average of 14x. So, the stock, I think, is undervalued at the current level.

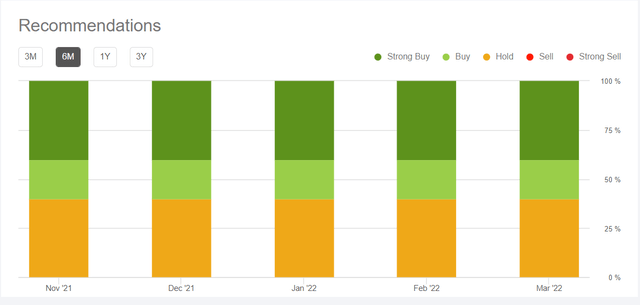

According to Seeking Alpha, three sell-side analysts recommended a “Buy” on DBD (includes “Strong Buy”), while two recommended a “Hold.” None recommended a “Sell.” The sell-side analysts’ average target price is $11.75, which, at the current price, yields 75% returns.

What’s The Take On DBD?

Recently, DBD received contracts for several thousand charging stations in Europe and the US and expects to add several more by the end of the year. While this will facilitate the topline, the company plans to expand the operating margin through pricing growth, divestiture, and termination of low-profit service contracts. On the ATM banking side, it intends to increase market share for the DN Series machines as customers move towards automation and self-service.

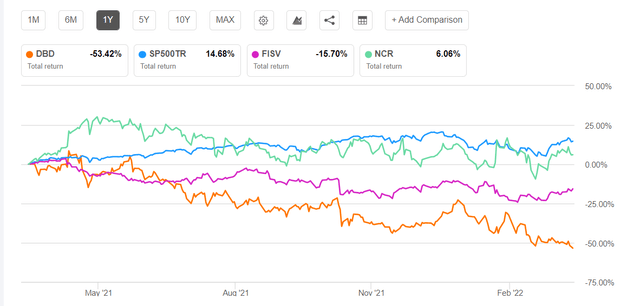

Despite these positive developments, the stock underperformed the S&P 500 in the past year following cost hikes. On the cash flow side, the company made remarkable improvements in FY2021. True, accumulated losses have placed it at financial risks over the past few years. But the situation has not deteriorated noticeably. With various factors at balance, investors might want to hold the stock for relatively steady returns in the future.

Be the first to comment