Leonid Sorokin

Thesis Summary

NIO Inc. (NYSE:NIO) has rallied over 30% in the last month following encouraging delivery data as well as some other exciting developments. The company is executing well in China and continues its European expansion.

With that said, there is a very persistent threat that the Chinese economy could enter a severe recession in the coming months, which would negatively affect NIO.

The technical chart suggests that a final turn lower could be in the cards, but investors must be wary of the key resistance and support levels.

Good News For NIO

NIO shares found a local bottom a month ago when the stock traded at $8.50. Since then, NIO has rallied over 30%, together with many other automakers, but also in sync with the broader Chinese market.

Some investors have jumped back on the China train after the country seems to be easing its harsh Covid restrictions. On top of that, automakers have seen encouraging sales data in the last month.

NIO sold a record 14,178 vehicles in November, which represented a 40% Month-on-month increase. This is in line with the results released by the China Passenger Car Association (CPCA), which reported a 58.2% YoY increase in the sales of New Energy Passenger Vehicles in China in the month of November.

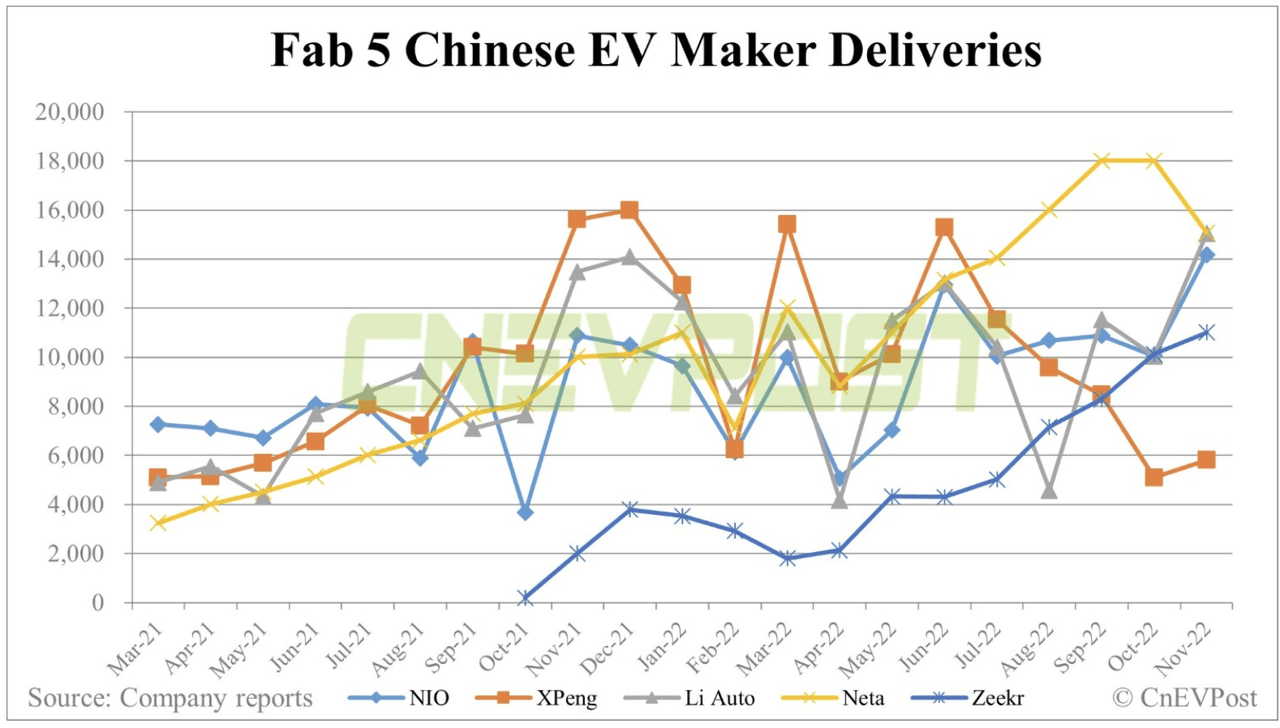

We can see that the general trend for Chinese EV makers continues to be up, with sales perking up in the last month for NIO and also competitor Li Auto (LI).

Chinese EV sales (CnEVpost)

Over in the west, NIO continues to implement its European expansion, with the first battery swap station going live in Norway. Norway is the largest EV market in Europe and the first one that NIO has targeted as part of its international expansion efforts.

China Is Still Struggling

Although NIO had a record month, we have to take into account that this is usually a strong month for the company and that the growth in EV sales has been across the board, with rivals posting similar gains.

Furthermore, this increase in sales can be at least partly attributed to demand being pulled forward, as Chinese tax incentives for EVs will end in 2023. A lot of consumers are taking advantage of the last few months when they can take advantage of these incentives.

With that in mind, the outlook for 2023 doesn’t look that great, for NIO, EV makers or the Chinese economy as a whole.

For starters, China is still dealing with COVID, and though investors are happy today that restrictions are easing, this could literally change from one day to another.

On top of that, the Chinese economy is slowing down noticeably. Last month, Barclays cut its GDP forecast for China from 4.5% to 3.8%. China is also still dealing with the aftermath of a housing bubble, and the PBOC is caught between a rock and a hard place.

The Chinese central bank has been much more accommodating than the Federal Reserve in the last year, but in the last meeting, it decided to keep rates unchanged. This is in part due to the weakening of the Yuan in 2022, and it’s also something that American investors have to take into account when investing in Chinese companies.

All in all, 2023 isn’t lining up as a great year for China, and NIO’s sales will definitely feel this.

Technical Analysis

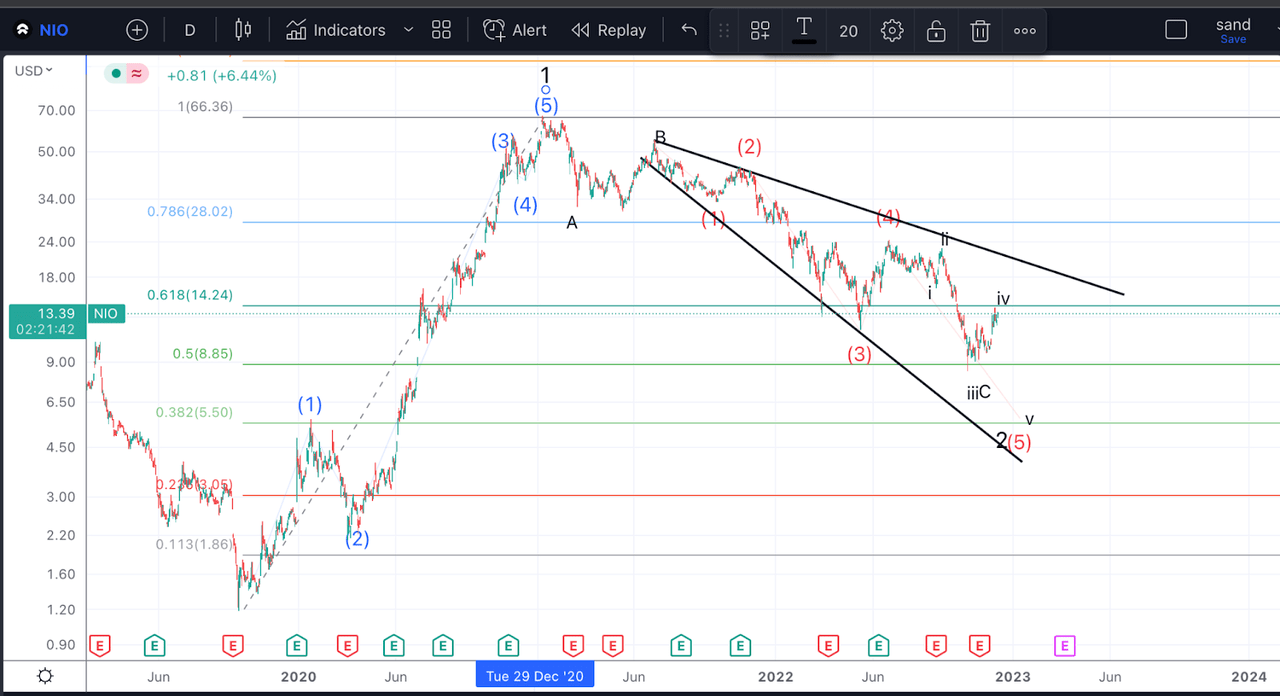

Now, let’s direct our attention to NIO’s price chart.

NIO Price chart (Author’s work)

First off, it’s very interesting to note that NIO has, so far, found a bottom exactly at the 50% retracement of its initial rally, which took it from $1 to over $66. The 50% retracement is certainly a valid spot for a reversal, but a more secure bottom could be found at the 61.8% retracement, which sits at $5.50.

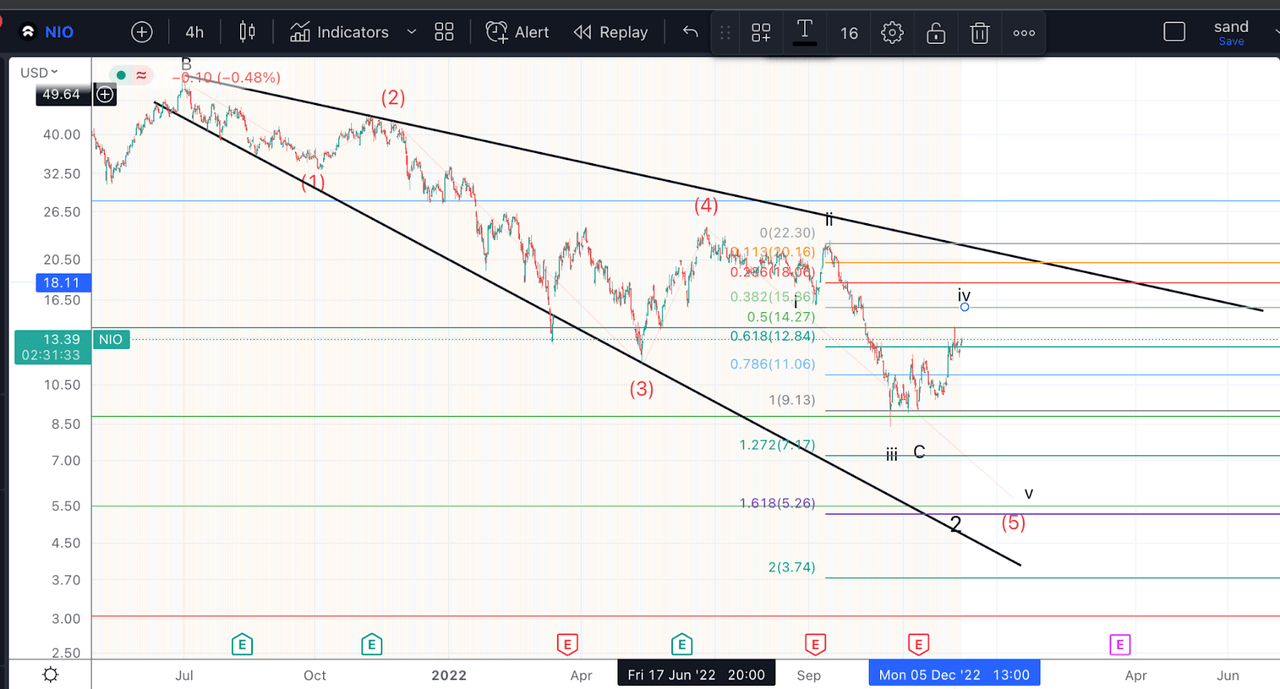

NIO Price chart (Authors’ work)

If we look at the smaller time frame, we can observe that NIO has been completing a five wave decline since July 2021. Now, though an argument could be made that this last low completed a final wave 5, I believe it is more likely that we will see one final sell-off to finish this correction.

I see this rally as part of a wave iv inside of a larger degree wave 5. If this is the case, then the recent high at $14, which represents the 50% retracement of wave iii, would be an ideal spot to turn around.

However, if we can rally convincingly over $20, then the odds increase considerably that this was indeed the bottom. If that were to happen, I’d wait for the next pullback to add more shares.

Final Thoughts

NIO is a great company with competent leadership and a good product. However, it is facing a very challenging macroeconomic environment, and I don’t think growth in 2023 will impress investors. The technical chart suggests another low could take place before we begin the next big rally.

Be the first to comment