tumsasedgars/iStock via Getty Images

Thesis

NIO Inc. (NYSE:NIO) has been reporting mixed news to shareholders lately. On the positive side, NIO delivered a total of 10.05k cars in July, a 60% growth YoY. And this also exceeded the 10k monthly. Furthermore, the company also recently started selling its ES8 model overseas (in Norway). Although its sales are still predominately in China, this also marks the beginning of its attempts to break into the global market. On the negative side, the COVID situation in China remains fluid, competition is intensifying, and NIO has yet to translate its growth in profit.

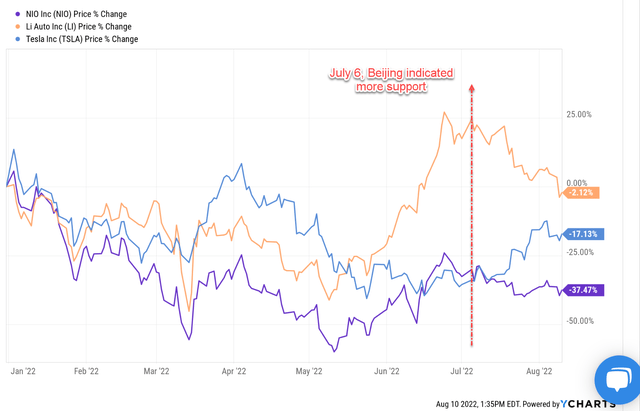

Overall, I am seeing more negatives than positives, as reflected in its stock prices as you can see from the chart below. NIO share prices have declined more than 37% YTD, lagging both its domestic peers and global peers by a large margin. For example, the share prices of Li Auto (LI) only lost about 2%, and Tesla (TSLA) about 17%. More tellingly, even the recent announcement from Beijing to extend the tax credit to support EV adaption could not lift its stock prices.

Next, we will dive into the good, bad, and ugly in more detail.

The good, the bad, and the ugly

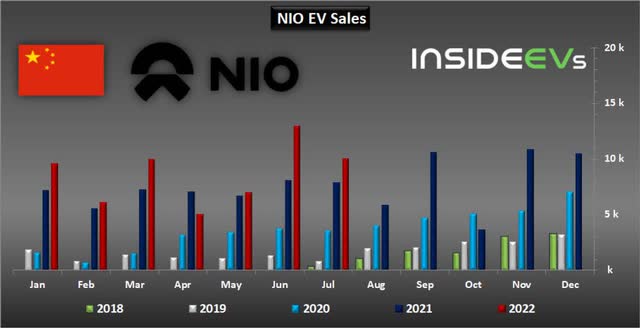

On the positive side, growth remains robust. After the China-locked alleviated, NIO quickly ramped up its productions and deliveries as you can see from the following chart. In particular, it delivered 10,052 vehicles in July 2022. Do not be under-impressed by the comparison again in June. June sets a tough comp. It delivered 12.9k vehicles during June and set an all-time monthly record. The July delivery still represented a robust 27% growth YoY. The production data also show that the company has the capability to reliably produce and deliver 10k cars per month assuming normal operation conditions.

Moreover, the company is also expanding aggressively on other fronts. It started selling cars in Norway in later 2021, marking the beginning of its attempts for overseas expansion. It also aggressively invests in its future models and infrastructure. It expects to launch the ET5 mid-size electric sedan in Q3 2022. It has also just reported in July that its battery swap stations have reached 1,047 and logged in over 10 million times usage cumulatively.

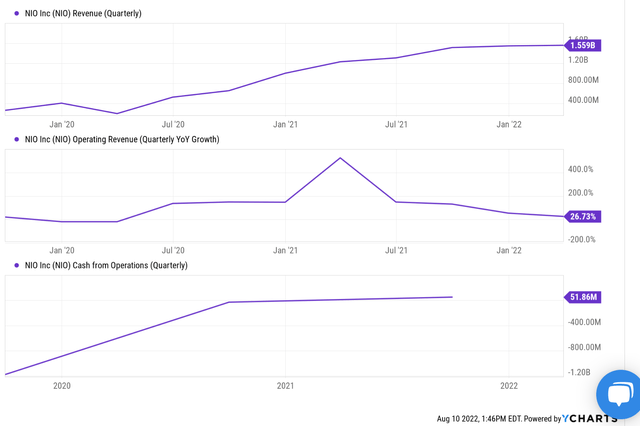

All such rapid expansion has resulted in impressive revenue growth as you can see from the chart below. Quarterly revenues grew from below $400M in 2020 to the current level of over $1.5B. And the YoY growth rates have been consistently in the double-digits.

However, the business is yet to translate its rapid expansion into profits, as we will detail next.

Cash flow and capital allocation issues

As you can see from the bottom panel of the above chart, NIO’s cash flow has been largely negative over the past few years. It has been bleeding more than $1 billion of cash on a quarterly basis during 2019-2020. And only in recent quarters since 2021, its cash flow has turned positive. It is currently reporting a small positive operating cash flow of $51 million. It’s a positive sign, but the magnitude is just too small compared to the scale of the business.

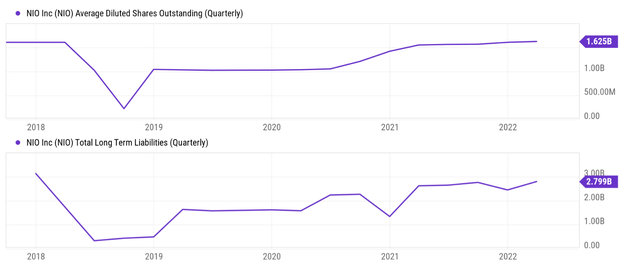

As a result, NIO has been consistently (and quite aggressively in my view) issuing new equity and debt to finance its expansion. As you can see from the top panel of the following chart, its diluted shares expanded by more than 60% since 2020, from about 1 billion outstanding shares to the current level of more than 1.6 billion shares. Total long-term liabilities have swollen substantially also at the same time. Its debt burden was the lightest during 2018 when its total long-term liabilities were only about $400M. And currently, it stands at $2.8 billion.

A reality check

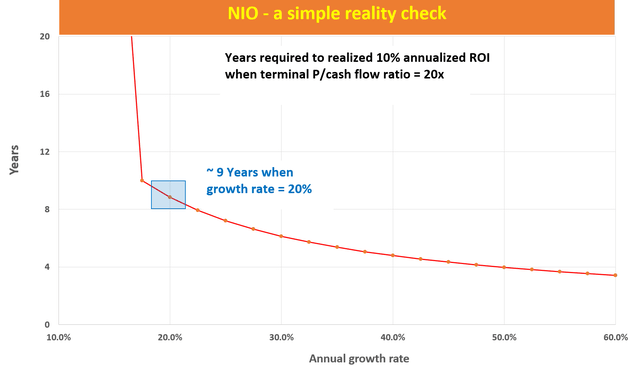

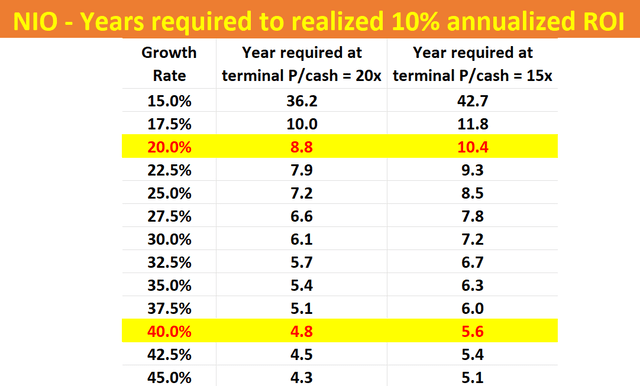

Ultimately, shareholder return cannot come from growth alone. It will have to come from the growth of PROFIT. Let’s consider a very simple analysis that I call a reality check as shown in the chart below (for readers who like to read the specific numbers, the table behind the chart provides the same information).

The calculation projects the number of many years of sustained growth required to realize a 10% annualized ROI on investments at the current entry valuation (about 100x price to cash flow multiple taken from Seeking Alpha). The calculations were performed for two terminal multiples: 20x and 15x price to cash flow ratio. As seen, if the terminal valuation is 20x (still a sizeable premium relative to the overall market), it would take about 9 years of sustained growth at 20% CAGR to materialize a 10% annualized ROI. Even at a 40% CAGR, it will take about 5 years.

To me, this is just too long, and remember that time compounds uncertainties.

Final thoughts and risks

Finally, I also feel the above reality check has already been a bit too optimistic. For example, it assumes no further issuance of new equity, and the share counts remain fixed at their current level. But I feel NIO’s share counts would be very likely to be further diluted. And even worse, the dilution could happen during times of compressed stock prices like what we are experiencing now and could be very detrimental to shareholders (at least to existing shareholders).

Besides the cash and profit issues, there are a few other risks. In the near term, the COVID situation in China remains fluid and a resurgence could happen again, triggering another wave of lockdowns. Competition is also intensifying both domestically and internationally. Both XPeng and Li Auto have posted stronger growth rates in recent months. And both are also entering the EV SUV market to compete with NIO.

Be the first to comment