dima_zel

Thesis Summary

NIO, Inc. (NYSE:NYSE:NIO) has had some positive news come out in the last few weeks though this hasn’t prevented the stock from slumping with the rest of the market. The stock is now near its May low of $11.6, but I expect a swift turnaround soon.

From a technical perspective, the stock has reached the ideal retracement after rallying 100% since the low, and this is a good spot to enter a low-risk long near support. Furthermore, fundamentals support NIO’s long-term growth story, and though the company could still see a couple of weak quarters, the stock may have already bottomed.

Good News Is Good News

While stocks continue to be weighed down by the negative macroeconomic sentiment, many companies, like NIO, are still performing well in this environment.

On Saturday, NIO released its monthly and quarterly delivery update. The company managed to sell 10,878 cars in September, and deliveries for the third quarter grew at a rate of 29.3% year-over-year, with the company setting a record for the quarter.

Most importantly, though, the company sold 2,928 ET7s, which is almost a 27% growth from last quarter and shows that the market has received this model well. The company also began production and distribution of the ET5, of which it sold 221 units.

In more good news, NIO recently acquired 12.6% of Greenwing, a company which has a lithium exploration program at the San Jorge Lithium Project in Argentina. NIO also has call options to acquire 20%-40% of Andes Litio, which owns the rights to the Lithium project.

This means that NIO will potentially have its own source of Lithium, which is becoming harder to source. Furthermore, it gives NIO exposure to a different market, making the company more robust and diversified.

Lastly, it is worth mentioning that NIO continues its European expansion and will be hosting “NIO Berlin” on October 7, 2022. The company recently built its first battery swap station in the city and has plans to begin selling the ET7 in Germany by the end of 2022.

All in all, while the share price has declined, the company’s fundamentals are stronger than ever, which is partly why I believe we are close to a significant rally. The other reason is technical analysis.

NIO Technical Analysis

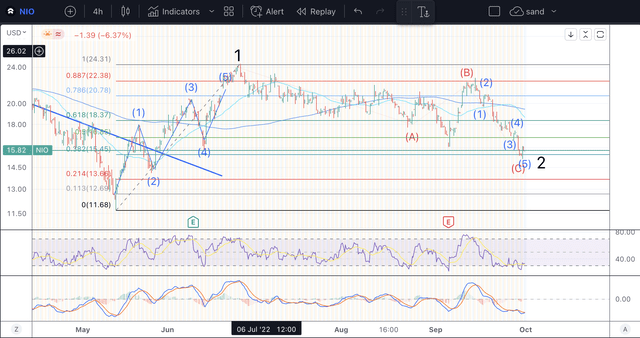

NIO Technical Analysis (Author’s work)

First off, I’d like to point out that NIO rallied 100% from its low in May to its high in July. At the very least, we have to acknowledge the potential NIO has for lucrative trades, and we currently have a low-risk setup for another strong and fast rally.

In my opinion, the rally off the lows was an initial five-wave impulse in a wave 1, and we have seen retraced almost exactly to the 61.8% Fibonacci retracement. This is/was a wave 2, which took the form of an impulsive wave A (five waves down) a corrective wave B (three waves) and a final sell-off in an impulsive wave C.

Though it’s still very early to tell, there’s a good chance we struck the low on Friday, meaning we are set to rally in a wave 3 soon. Of course, in order to confirm this for sure we’d have to rally impulsively past resistance, which sits at around $20. This has historically been an area of high trade, and we can see it’s where the 50- and 200-day MAs are hovering on the 4h chart.

Finally, the RSI on the chart is also nearing oversold, and the MACD looks ready for a bullish crossover.

Risks

With that said, there are some risks to this thesis. As I mentioned above, it’s still early days to call a bottom. If the recent low breaks, I’d expect NIO to head towards the next key Fib level at $13.6. This would be an ideal spot to average down and place a stop-loss just below.

From a fundamental perspective, it’s also true that there are various unknown factors coming into play. We still don’t have enough data on the European expansion, and the Chinese market could be facing a large property crash.

With that said, it’s worth pointing out that the CPCA, China Passenger Car Association, expects NEVs to significantly penetrate the market in the coming quarter. Demand could be accelerated as people try to take advantage of the temporary EV subsidies.

Takeaway

In conclusion, I continue to see NIO as a worthwhile long-term play, which now also has a setup for a low-risk entry point for a position or even a short-term trade. EVs are here to stay, and so is NIO.

Be the first to comment