Lintao Zhang/Getty Images News

COVID disruptions and protracted industry-wide supply chain constraints were key themes in 2Q22 for the electric vehicle (“EV”) and broader auto sector. However, the situation has rapidly evolved away from said themes after production volumes staged a rapid recovery in June after China lifted lockdown orders in key production hub Shanghai, with focus zeroing-in on potential implications from a deteriorating macroeconomic outlook and the Inflation Reduction Act (“IRA”) during 3Q22.

While supply chain constraints remain a lingering factor that has been gating production volumes, consensus points to continued easing, though not as substantial as expected – specifically, component and raw material supply/demand is not expected to find a meaningful balance until mid- to late-2023 or 2024 given much of the supply chain is still under development while the EV market is ramping up at a rapid pace. Easing supply constraints are further corroborated by gradual improvements to inventory levels reported by automakers. But auto sales remain muted q/q, flashing early warnings of demand destruction amid a looming economic downturn.

As mentioned in our 2Q22 EV preview, investors will continue to focus on management commentary on inflationary pressures and recession risks in the upcoming earnings season for clues on OEMs’ near-term growth and profitability trajectory. Given valuation multiples across the EV sector have come down substantially in the first nine months of the year with no immediate catalyst in sight to stage a rebound, any signs of real demand destruction in the near-term would make it harder for investors to justify any bullishness under the current risk-off environment for equities.

The sector’s fragility is further corroborated by weakness observed recently in Tesla’s stock (TSLA) after it missed 3Q22 delivery and revenue expectations, and Rivian stock’s (RIVN) short-lived rally after reiterating its full-year production guidance. Declines in shares of their Chinese counterparts, including NIO (NYSE:NIO), Li Auto (LI) and XPeng (NYSE:XPEV) were even sharper, as they grapple with potential demand risks amid a slowing Chinese economy, as well as roadblocks to their respective international aspirations given intensifying geopolitical tensions. Even the cohort’s latest rally following supportive commentary from Chinese President Xi last weekend failed to sustain momentum, underscoring elevated investors’ angst over China’s rapidly deteriorating economy.

Let’s take a deeper look into the Chinese EV market, which currently boasts the best penetration rate and commands the largest share of global EV sales. While EV demand in the region continues to outpace supply availability by wide margins, China’s near-term macroeconomic outlook – which has been stifled by stringent COVID restrictions and a property crisis – remains a key focus area in the coming months as deteriorating consumer confidence could very reasonably drive a deceleration in order book growth, even with the help of financial incentives aimed at shoring up the sector.

An Overview of China’s EV Market in 3Q22

China’s passenger vehicle sales continue to recover from 2Q22 lows observed during the height of the region’s COVID outbreak and ensuing lockdowns. Power disruptions during August in Sichuan province resulted in a 1.5% m/m decline in passenger vehicle sales during the month, but recovered quickly with no material impact to quarterly volumes. To put that into perspective, wholesale production volumes in China fell only 2% y/y during the week of August 22 to 28 when the power cut was implemented, and resumed swiftly the week thereafter to a 45% increase y/y.

EV sales continued to take the lead on new car registrations – representing a record 28% penetration in August and 31.8% in September – with favourable policy support being a key driver of take-rates still, especially given rising prices at the pump. Domestic brands drove more than half of September’s EV sales, with premium EV makers accounting for about a third of volumes, beating “mainstream joint venture brands” led by foreign legacy automakers.

Increased production capacity recently announced by Chinese EV maker NIO with start of productions at its new NeoPark manufacturing hub, and Tesla with its completed upgrades at Giga Shanghai are expected to make a more evident contribution to China EV output volumes in 4Q22 and through 2023. However, it is currently uncertain whether accelerating take-rates observed through 3Q22 will continue as China’s economic growth slows.

President Xi’s Support for Domestic EV Development

Ramping up investments in innovation and technology was a key theme in a speech by President Xi during the twice-a-decade Communist Party congress that kicked off last weekend. This underscores “expectations that more supportive policies” will be implemented to boost development of sectors core to the country’s economic and emissions reduction goals, including EVs:

The commitment to tech and green sectors looks strong, meaning these sectors are the rare darlings with favourable government policies.

Source: Natixis

While the remarks lifted sentiment in Chinese EV stocks earlier this week, it was insufficient to overcome broader concerns over the central government’s unwavering commitment to COVID Zero, which has been a significant drag on China’s economic growth this year. The muted response to supportive policy packages aimed at salvaging China’s latest property sector slump has also added to investors’ angst, as it points to a looming macroeconomic crisis in the region that risks stalling demand in the Chinese EV market.

What this Means for Up-and-Coming Chinese EV Makers like NIO, LI, and XPEV

This means more Chinese EV makers will not only be focused on domestic growth in the near-term but also making inroads across fast-expanding overseas markets for EV adoption. Following earlier expansion of reputable home-grown Chinese auto brands like MG Motor (owned by SAIC Motor) and BYD (OTCPK:BYDDF/OTCPK:BYDDY) to overseas markets, which pioneered local demand for China-built cars across Europe and the U.S. in recent years, many more Chinese EV upstarts have started to follow their footsteps in recent years – today, Chinese automakers have penetrated 5% of the European EV market, and is expected to account for 9% to 18% of Europe’s total EV sales by mid-decade.

Looking ahead, investors will not only be focused on the domestic growth prospects of up-and-coming Chinese EV makers like NIO, Li Auto and XPeng, but also on their overseas expansion progress. Diversification and growth of global market share would be key to supporting the respective stocks’ longer-term valuations, as well as their competitive stance against global peers like industry leader Tesla, and China’s auto leader BYD.

NIO

3Q22 Production and Deliveries: NIO delivered 31,607 vehicles in the third quarter (+29% y/y; +26% q/q), underscoring a rapid recovery from earlier production challenges stemming from COVID disruptions, as well as positive progress on ramping up output at its new facility at NeoPark.

The company’s newest offerings, including the ET7 sedans and ES7 SUVs built on its newer higher-margin NT 2.0 platform, continued to demonstrate acceleration in terms of both productions and deliveries. More than 8,500 ET7s were delivered in the third quarter despite protracted supply chain constraints that included a shortage of casting parts in July, making positive progress from 6,749 units delivered in the second quarter and 163 units in the first quarter. NIO also recently began customer deliveries on the ET5 sedan, with third quarter results including revenues generated from the sale of 221 units of the model. The results highlight NIO’s strength in navigating through protracted industry-wide supply chain bottlenecks, while also partially compensating for the near-term increase in new vehicle and new facility (i.e. NeoPark) ramp-up costs with increasing sales of its more profitable models.

Key Focus Areas:

- Europe expansion: NIO has recently outlined its ambitions in becoming a prominent Chinese EV brand in the European EV market during its “A New Horizon” keynote event in Berlin earlier this month. The Chinese EV maker, known for its goals to create a seamlessly integrated ecosystem and simplified car ownership experience for its loyal customer base, introduced “monthly subscription and leasing options” to prospective European buyers as part of efforts to better serve the needs of different markets. NIO will establish a presence across Germany, Denmark, Sweden and the Netherlands to complement its existing sales hub in Norway, and introduce three vehicle models to the European market – namely, the ET7, ET5 and EL7 (equivalent to the ES7 SUV in China) – by the end of the year to better penetrate the region’s growing premium segment. Then, it plans to further penetrate five additional countries across the European EV market by 2023, with further expansion into the U.S. EV market by mid-decade. As part of NIO’s Europe strategy, it will be offering vehicle subscriptions “ranging from one to 60 months” in the region, starting at 1,295 euros ($1,265) per month. The business model will not only appeal to retail customers looking to experiment with the Chinese EV brand, but also allow NIO to capitalize on growth opportunities stemming from corporate fleet demand in the midst of their transition to electric. Investors will likely be looking to management commentary at NIO’s upcoming earnings call to better understand how it plans to manage roll-out costs and their related impact on the bottom-line amid a macroeconomic environment where profits are preferred over growth. Management will also be expected to provide commentary on how it plans to navigate through an anticipated slowdown in auto demand across Europe as the region deals with a rapidly deteriorating economy with rising inflation and recession fears. While Europe’s EV sales continued to increase despite an overall slowdown in auto sales due to protracted supply chain constraints, demand in the segment is starting to show deceleration. Specifically, EV sales in Europe increased by more than 26% y/y in 4Q21, but decelerated to an average of about 20% y/y in 1H22, while its share of total new passenger vehicle sales also fell from 11.8% in the first quarter to 11.3% in the second quarter, underscoring potential demand risks. However, as mentioned in the earlier section, we view NIO’s strategic entry to the European market with its subscription model an attractive offering for increasingly budget-conscious consumers in the region. The pricing model is also expected to partially compensate for the near-term demand slowdown in the region and build brand awareness for NIO.

- Mass market penetration: As NIO has mentioned in recent quarters, it has already made meaningful progress in penetrating the premium market across China’s wealthier tier 1 and tier 2 cities, and is looking to better capture share in the tier 3 and 4 cities within the foreseeable future. And this is what drives its upcoming roll-out of two new mass market sub-brands, including one that is speculated to offer an EV at under $15,000. We view this as a prescient undertaking by NIO, which first focused on ramping up production and sales of premium higher-margin vehicles, then capitalize on mass market opportunities once brand reputation is established. The roll-out of the two planned sub-brands aimed at penetrating mass market opportunities also comes in a timely manner, as much of China’s EV demand is now entrenched in the price-sensitive mass market. This is further corroborated by industry-leading EV sales by mass market automakers BYD and SAIC-GM-Wuling, which together account for seven of the top 10 best-selling EV models in China this year. As such, positive commentary on the timely and on-budget development of NIO’s two mass market sub-brands will be critical for buoying its near-term valuation prospects, as it underscores further market share gains within the increasingly competitive EV landscape over coming years.

- Profit margins: In addition to demand outlook and market share gains, NIO’s profitability trajectory is another key focus area in the near-term, especially under the current market climate where investors are skeptical over long-duration assets with cash flow realization timelines still being far out in the future. We see three major factors influencing NIO’s profit margins in the near-term – namely, 1) NeoPark ramp-up costs; 2) NT 2.0 contributions; and 3) favourable policy support. On NeoPark, which has only recently come online to facilitate productions of the ET5, we expect related early-stage ramp-up costs to weigh on NIO’s auto margins (~17% in 2Q22) in the near-term. However, the more efficient design of the newer NT 2.0 platform in which the ET5 is built on, paired with the sedan’s higher pricing are expected to partially compensate for some of the ramp-up cost headwinds. And over the longer-term, given the Chinese government’s heightened focus on making tech and innovation a core driver of its economy, we expect continued policy support for the ongoing build-out of China’s EV economy, which would be a tailwind to NIO’s profitability timeline.

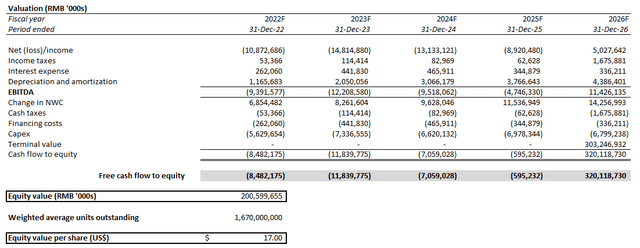

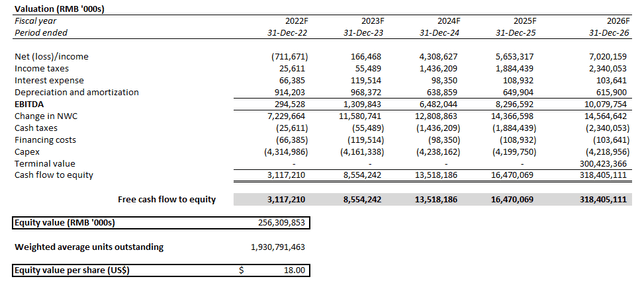

Financial Forecast: Although we had previously expected NIO’s valuation to benefit from improved demand sentiment in China, and the removal of a regulatory/delisting risk overhang, it seems that looming macroeconomic concerns paired with intensifying geopolitical tension are near-term challenges to the stock which cannot be ignored. As such, we are revising the 12-month PT for NIO from $27 to $17 (constant currency from previous coverage: $19), which would represent upside potential of 55% based on the shares’ last traded price of $10.97 on October 20.

The PT is computed through a discounted cash flow (“DCF”) analysis that draws on our latest fundamental forecast for NIO, adjusted for its actual 3Q22 delivery progress as well as recent developments surrounding its demand and cost environment. The analysis assumes a perpetual growth rate of about 3% (previous forecast: 5%) and WACC of 9%, which is consistent with China’s longer-term economic expansion rate as well as NIO’s capital structure and risk profile.

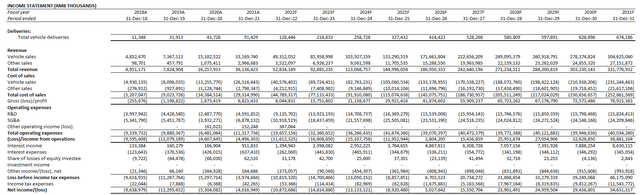

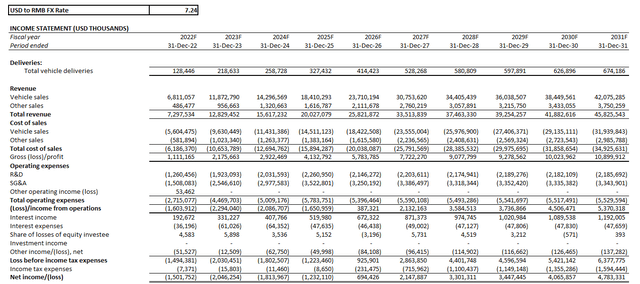

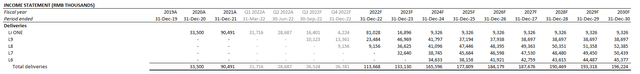

NIO Financial Forecast (RMB) (Author) NIO Financial Forecast (USD) (Author) NIO Valuation Analysis (Author)

NIO_-_Forecasted_Financial_Information.pdf

Li Auto

3Q22 Production and Deliveries: Li Auto delivered 26,524 vehicles in the third quarter (+62.5% y/y; -8% q/q), outperforming its revised guidance of 25,500 vehicles (original forecast 27,000 to 29,000 vehicles) citing acute supply chain constraints. August was an outlier – the company had only delivered a little more than 4,500 vehicles during the month, compared to preceding output monthly volumes between 20,000 and 30,000 vehicles. And in September, the company delivered 10,123 units of the newest L9 SUV during the model’s first full month of sales; meanwhile, the legacy Li ONE SUV sales dropped from more than 10,422 units in the beginning of the second quarter to merely 1,400 units by September. The results have drawn investors’ concern that the L9 – alongside the roll-out of the L8 and L7 SUVs later this year and in 1Q23, respectively – is starting to “cannibalize” demand for the Li ONE, which already boasts positive gross margins averaging 22% in 1H22.

Key Focus Areas:

- Li ONE demand cannibalization: As mentioned in the earlier section, Li Auto’s legacy Li ONE plug-in hybrid SUV sales have come down significantly since the launch of the L9 six-seater full-size SUV. While the L9 boasts a higher price of about RMB 460,000 compared to the Li ONE’s MSRP of about RMB 338,000, it is currently unknown of the newer full-size model’s gross margins – especially given early-stage ramp-up costs as well as the recent increase in input costs. Yet, the Li One has already boasted impressive gross margins of 22% on average in 1H22, matching closely to industry leader Tesla’s 26%+ (ex-credits). Under the current macroeconomic environment where profitability takes the driver’s seat for valuations, the near-term ramp-up costs pertaining to new models, paired with an imbalanced mix may spell some near-term challenges to Li Auto’s bottom-line, and inadvertently, pressure on its shares’ performance ahead of its next earnings release.

- New vehicle launch: Drawing on the above concerns about mix and margins, Li Auto’s upcoming start of deliveries on the L8 six-seat large-size SUV in November, which is priced at a similar range as the Li ONE at under RMB 400,000, and the even-lower priced L7 five-seat SUV in 1Q23 bring on some short-term headwind on margins. But overall, the planned launch of the L-series (including the L6 five-seat mid-size SUV launching at a later date) is a welcomed endeavour that will likely improve Li Auto’s scale and market share over the longer-term. The build-up of consumer interest in the new models – which is further corroborated by Li Auto’s recent decision to fast-track the L8’s launch – underscores the plug-in hybrid SUV specialist’s appeal despite rising concerns of demand risk in the Chinese EV sector. SUVs represent a lucrative vehicle segment in China, accounting for close to half of the region’s passenger sales. Paired with increasing momentum in EV take-rates across China, Li Auto’s rapid diversification of its product pipeline is expected to improve its competition compared to premium electric SUV rival NIO and others over the longer-term, while expanding its total addressable market across different vehicle types and pricing segments.

- Supply chain constraints: While the broader auto industry – from legacy OEMs to EV upstarts – is sounding a unanimous chime that acute supply chain constraints are finally showing structural evidence of easing, Li Auto says otherwise. The company announced prior to the end of its third quarter that it will be taming its delivery expectations for the three months through September due to ongoing supply chain constraints. This is consistent with the sporadic COVID disruptions in Jiangsu province where Li Auto’s Changzhou manufacturing facility, as well as key auto suppliers, are located. In addition to looming demand risks, Li Auto’s underperformance in managing the supply chain snarls compared to peers as observed by its muted August deliveries draws intense scrutiny from investors ahead of its upcoming earnings release, with many now paying attention to whether the company can make up for the lost volumes before the end of the year.

Financial Forecast: Despite concerns over Li Auto’s sales mix and related impact on its profit margins over coming months as it begins customer deliveries on the remainder of the L-series, we remain optimistic that the company will be able to achieve GAAP-based net income sooner than its domestic peers. Specifically, Li Auto’s experience in ramping up productions, and earlier focus on a single-vehicle business model has allowed it to scale its operations better, albeit slowing its market share gains compared to peers like NIO and XPeng which boasts multiple models and services various vehicle segments. We are projecting narrowing operating and net losses over the next two years as the company’s R&D spending remains elevated to support the roll-out and ramp-up of the L-series models, with nominal net income realization of about RMB 166.5 million by the end of next year and auto sales driven operating profit of RMB 3.3 billion by 2024.

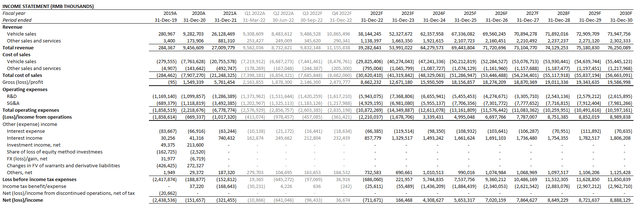

Li Auto Delivery Forecast (Author) Li Auto Financial Forecast (RMB) (Author) Li Auto Financial Forecast (USD) (Author)

On the valuation front, we are maintaining a conservative view given the same external headwinds faced across its domestic EV peers – namely, macroeconomic deterioration, regulatory overhang, and geopolitical risks – as well as protracted supply chain constraints that appear more acute to Li Auto relative to peers. Applying a perpetual growth rate of about 3% to our DCF analysis for Li Auto – which is similar to the one applied for NIO to reflect its operating environment – and WACC of 9.5% to account for the company’s greater risk profile and highly leveraged capital structure, we are setting a base case PT of $18 (constant currency from previous coverage: $20) for the stock. This would represent upside potential of 16% based on the shares’ last traded price of $17.30 on October 20.

Li Auto Valuation Analysis (Author)

Li_Auto_-_Forecasted_Financial_Information.pdf

XPeng

3Q22 Production and Deliveries: XPeng delivered 29,570 vehicles in the third quarter (+15% y/y; -14% q/q), slightly outperforming its guided range of 29,000 and 31,000 vehicles. The company started its first batch of customer deliveries on the all-new G9 SUVs in September after reservations began in August, marking its initial foray in the best-selling vehicle segment. However, consistent m/m delivery declines across all of its models during the third quarter is starting to raise concerns of whether the company is inadequately handling the roll-out and ramp-up of output after adding the G9 to its line-up (i.e. operational and cost inefficiencies), while also increasing worries over demand risks as consumer sentiment in China wanes.

Key Focus Areas:

- G9 SUV: Sales and reservation volumes on the G9 SUV is a key focus area for investors, as it would infer XPeng’s progress in gaining market share via expansion into a new vehicle segment. The last official disclosure from the company indicated that the G9 had acquired more than 22,800 reservations on the first day that it became available for pre-order in China. The company delivered 184 units in September, representing a weekly run-rate of about 48 vehicles. Continued acceleration in G9 deliveries and reservation volumes would be critical to XPeng’s fundamentals, as 22,800 reservations alone already represent an estimated value of RMB 8 billion. As discussed in our previous coverage on the stock, not only does the G9 open opportunities for XPeng to compete for share in the largest and fastest-growing SUV segment, but also allowed the company to better compete for share against domestic premium electric SUV leader NIO, given comparable technological capabilities. Alongside initiating customer deliveries on the G9, XPeng has also recently rolled out “City NGP” (“Navigation Guided Pilot”), its newest ADAS system, as part of a pilot program composed of select P5 customers in Guangzhou. City NGP essentially enables next-generation ADAS capabilities – such as autonomous driving / cruising based on a set destination on the navigation system – with “coverage from highways and parking lots to much more complex city driving scenarios”. City NGP is part of XPeng’s “XPILOT 3.5” ADAS, which will roll into “XPILOT 4.0” debuting with the G9.

The G9 makes a key differentiator for XPeng against rivals within the increasingly crowded Chinese EV landscape. From a technology perspective, the G9 boasts the fastest charging speed – the vehicle is built on XPeng’s newest “XPower 3.0 powertrain“, which features an 800-volt battery pack that can add more than 120 miles of range in under five minutes. The G9 also features XPeng’s next-generation “XPILOT 4.0” advanced driving assistance system, which leverages best-in-class software enabled by “NVIDIA DRIVE Orin-X” chips (NVDA). As discussed in a previous coverage, the combination of newly introduced technological features in XPeng’s newest SUV accordingly puts it on par with competitive offerings observed in rival EV makers, such as NIO’s “Power Swap“, which switches out a dead battery for a fully charged one in under three minutes, and “NIO Autonomous Driving” (“NAD”), which also leverages the “NVIDIA DRIVE” platform.

Source: “XPeng: Moment of Truth“

- Restructuring speculations: As mentioned in the earlier section, recent observations of delivery volume declines across XPeng’s line-up is drawing up investors’ angst over demand risks and operating inefficiencies. Based on a recent report released by Chinese outlet Jiemen, the company is currently undergoing early stages of a restructuring process to arrest the recent decline of demand and underperforming sales rate across its line-up – including the G9 SUV that boasted robust reservation volumes in August, as well as the P5 sedan. Specifically, the report indicated that the G9 had fallen short of users’ expectations, with sales underperforming expectations. Meanwhile, take-rates on the P5 sedan introduced last year are also stalling. The speculated restructuring efforts would aim at improving demand for the two models, which are heavily relied on to expand XPeng’s total addressable market in the increasingly competitive Chinese EV market, while also improving its sales mix and profit margins. The report also pointed to the fact that the bulk of XPeng’s sales are currently coming from the P7 sedan introduced almost three years ago, with limited feature upgrades. This could potentially explain the delivery declines observed in recent quarters for the P7, as limited feature upgrades make it a difficult contender among an increasing slate of EV options on the market – including NIO’s newest ET7 and ET5 premium electric full- and medium-size sedans. As such, increased clarity on XPeng’s forward strategy on managing its brand appeal, and ramping up sales and production volumes would be critical to restoring investor confidence in the stock.

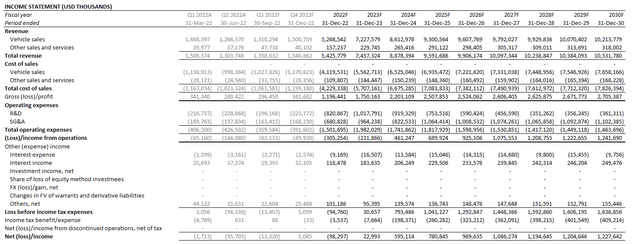

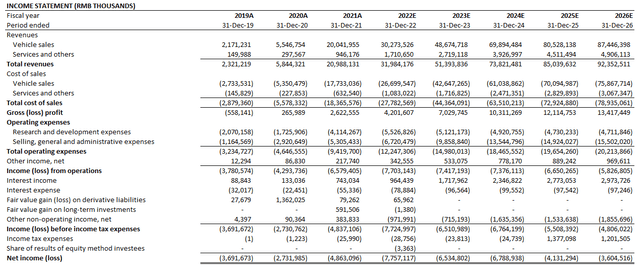

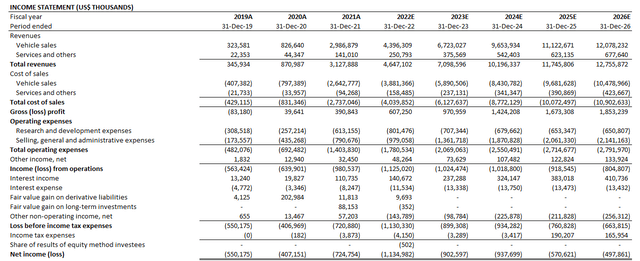

Financial Forecast: Adjusting our previous forecast on XPeng for its actual 2Q22 results and 3Q22 deliveries, we are forecasting vehicle sales of RMB 30.3 billion by the end of the year with anticipation for volumes to pick up in 4Q22. Specifically, the assumption is consistent with anticipated pent-up demand before the end of year for all Chinese EV makers due to pulled-forward consumer purchases before the EV subsidy ends on December 31, barring any material disruptions to productions/supply chains given the region’s fluid COVID situation. Paired with expectations for the continuation of cost patterns observed in 1H22 to support continued R&D developments (e.g. XPILOT 3.5 / XPILOT 4.0), alongside impact from near-term inflationary pressures that have been partially offset by the y/y increase in higher-priced sales (by value and by volume), the company is expected to experience increased net losses from RMB 4.9 billion in 2021 to RMB 7.8 billion in 2022.

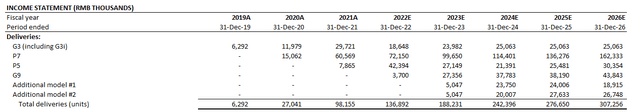

XPeng Delivery Forecast (Author) XPeng Financial Forecast (RMB) (Author) XPeng Financial Forecast (USD) (Author)

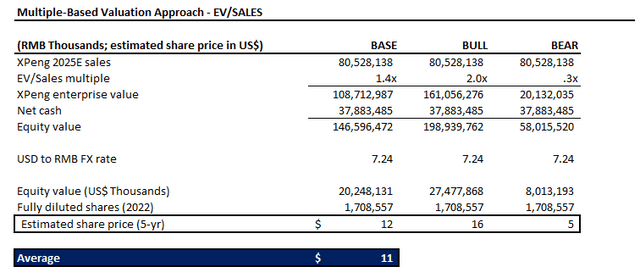

Drawing on the above fundamental forecast, we are placing a near-term PT of $11 on the stock, which has been downward adjusted from the previous PT of $36. The significant downward adjustment to valuations is the result of increasingly prominent external and internal operating headwinds, spanning company-specific risks over demand and inadequate sales mix impact on margins, as well as macroeconomic and geopolitical factors that are weighing on the broader Chinese EV sector’s valuation multiples.

XPeng Valuation Analysis (Author)

XPeng_-_Forecasted_Financial_Information.pdf

Final Thoughts

While battered valuations across Chinese EV stocks today – primarily NIO, Li Auto and XPeng – could imply a compelling entry opportunity, external factors such as regulatory and geopolitical risks harbingers further volatility over coming months. This is especially true given the rapidly deteriorating global economic growth outlook, which has already been weighing on market sentiment this year, hence the violent selloff observed across almost all industries.

Until each of NIO, Li Auto and XPeng can address and resolve internal issues that investors are raising concerns over – whether it is demand risks, cost and operating inefficiencies, supply chain constraints, and/or a lack of clarity on forward strategies to gain market share / achieve profitability – and external headwinds subside, the stocks’ valuations will likely find difficulty in sustaining momentum.

Be the first to comment