AndreyPopov/iStock via Getty Images

Investment Thesis

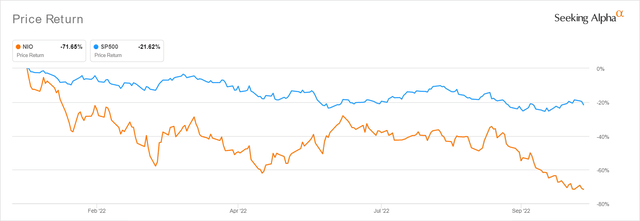

NIO YTD Stock Price

As a fellow contributor in Seeking Alpha said, Xi Jinping’s China Is Uninvestable. It seems that Mr. Market agrees as well, since the NIO Inc.’s (NYSE:NIO) stock continued to freefall by -71.65% YTD or -84.70% from its all-time high since early 2021. This is despite its excellent delivery thus far and its mammoth-sized growth ahead. Naturally, most of the headwinds are attributed to the growing geopolitical risks, on top of the ban on semiconductor chips and start/stop production volumes from the ongoing Zero Covid Policy.

Combined with the worsening macroeconomics plunging the S&P 500 Index by -21.62% YTD, things do not look great for NIO indeed, since the Feds may aggressively hike interest rates through 2023 as the US labor market remains overly robust for now. Thereby, putting further downward pressure on its stock performance ahead as 38.5% of analysts predict a 75 basis points hike in the Feds December meeting. The question is, how much more beating will and can NIO take, since it is already trading at extreme bottom levels. Some bears have even projected a further plummet down to catastrophic low single digits. Tragic indeed, since it does not parallelly reflect its excellent top-line projected growth at a CAGR of 58% through FY2024.

In the meantime, NIO has consistently delivered over 31.6K vehicles since August, consistently averaging above 10K monthly. Thereby, maintaining robust demand thus far, despite the economic slowdown in China and the ongoing Zero Covid Policy.

NIO’s Long-Term Execution Remains Robust For Now

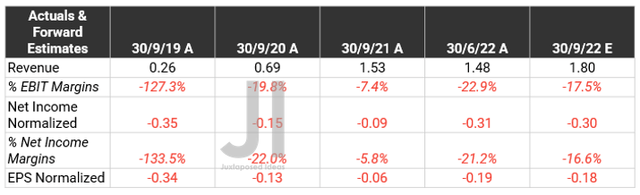

NIO Revenue, Net Income (in billion $) %, EBIT %, and EPS

In its upcoming FQ3’22 earnings call, NIO is expected to report revenues of $1.8B and net incomes of -$0.3B, indicating massive QoQ growth of 21.62% through inline, respectively. However, FX is a valid concern, since it represented a -6.27% headwind QoQ and -10.4% YoY. Furthermore, profitability remains in the red as the company grows at all costs, further impacting its short-term margins. Nonetheless, we are not overly concerned, since NIO boasts a robust $3.65B in cash and equivalents in FQ2’22. Thereby, moderately sheltering the company’s liquidity through the global recession and domestic GDP slowdown ahead.

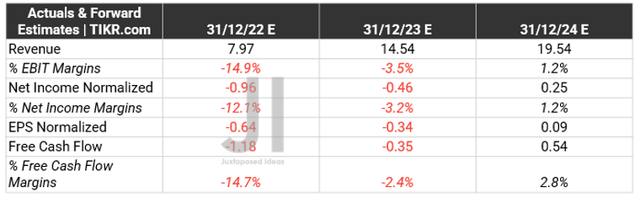

NIO Projected Revenue, Net Income (in billion $) %, EBIT %, EPS and FCF %

Despite the massive downgrades faced by multiple companies in the face of the incoming recession, it is also important to note that analysts remain confident about NIO’s forward execution since our previous analysis in September. There have been minimal downgrades thus far, with the company expected to report profitability from FY2024 onwards. At that time, NIO is expected to record excellent revenues of $19.54B and normalized net incomes of $0.25B. Its $0.54B FCF generation would be decent as well, attributed to the aggressive projected capital expenditure of $2.03B over the next three years.

While these may not bring NIO’s delivery closer to Tesla’s (TSLA) numbers, it remains impressive that the company is projected to report rapid growth despite China’s ongoing Zero Covid Policy, slower China GDP growth, and global recession in 2023. Furthermore, do remember Elon Musk’s comments that the Berlin and Austin Gigafactories remain “giant money furnaces,” in the face of global supply chain issues and, consequently, slower ramp-up. These issues are not unique to NIO after all.

In the meantime, we encourage you to read our previous article on NIO, which would help you better understand its position and market opportunities.

- Is NIO Testing The May Lows Again?

- NIO Could Fail In FQ2 2022 – But The Patient May Be Rewarded By H2 2022

So, Is NIO Stock A Buy, Sell, Or Hold?

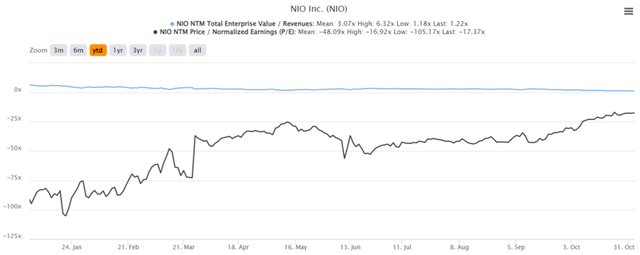

NIO YTD EV/Revenue and P/E Valuations

NIO is currently trading at an EV/NTM Revenue of 1.22x and NTM P/E of -17.37x, lower than its YTD mean of 3.07x and -48.09x, respectively. The stock is also trading at $9.49, down -78.56% from its 52-week high of $44.27, nearing its 52-week low of $8.38. Nonetheless, consensus estimates remain bullish about NIO’s prospects, given their price target of $35.00 and 260.45% upside from current prices.

The question of whether NIO is worth investing in, naturally depends on individual investors’ comfort level. The stock is definitely not for the faint-hearted, since we cannot be able to see a sustainable floor even at these rock-bottom levels. As a result, we continue to iterate our Hold rating, since most conservative investors would have sold their positions (even at a massive loss) to avoid this falling geopolitical knife. Only the extreme bulls with lead-lined stomachs for volatility will be able to call it a conviction buy, since this particular risk will not ease with the conclusion of the US mid-term elections. Either way, we will likely continue witnessing a hardline US approach toward the Chinese government.

Interestingly, TSLA does not face similar issues despite being exposed to China. Its Shanghai factory is responsible for over 750K vehicle deliveries annually, potentially crippling the company by easily 50% in output, if the Chinese government chooses to launch the speculative attack on Taiwan (as mentioned by the bears). The Chinese market also forms 27.44% of the company’s revenues in FQ3’22, pointing to further risks in its top and bottom line growth, since certain analysts have often attributed TSLA’s tremendous EV profitabilities to the Shanghai factory’s impressive gross margins of over 30%.

On the other hand, no matter the results of the HK audit, NIO holds the unfortunate position of being an ADR. Thus, bringing us back between a hard place and a rock, with more floor tests through the massive uncertainties ahead.

Be the first to comment