gorodenkoff/iStock via Getty Images

Introduction

This is the sixth and final article of a series I published to cover the main truck manufacturers, starting from the three most recent spin-offs among European companies. It is now Nikola’s (NASDAQ:NKLA) turn.

Markets are once again turning red as inflation ramped up and oil prices keep increasing. This may lead many investors to put some money into electric mobility, which seems to have even more reasons now to take off. So it may be worth looking also at Nikola, the electric truck manufacturer that many called the disruptive player of the industry, seeing it as the Tesla of trucks.

Summary of previous articles

I covered at first the three most recent spin-offs among European manufacturers, to understand the reasons behind them and to begin considering the development of these companies. The main driver of these moves was to make these companies more focused on their own results, with the need to grow their margins. Daimler (OTC:DTRUY) showed that it currently is in the mid-range of the industry regarding margins and wants to reach the low double digits within 3 years. Lagging behind are Traton (OTCPK:TRATF) and, further back, Iveco (OTC:IVCGF), a strong European player that lacks worldwide scale and that I see as the most probable company to be bought by its peers or to undergo an M&A operation. Then, I turned to Volvo Group (OTCPK:VOLAF) which proved to be quite ahead of its peers, with a management team that was able to forecast before other some of the current headwinds, thus taking decisions that made Volvo Group the company that has seen its margins constant. The last company I covered was PACCAR (PCAR) and I pointed out that the company is similar to Volvo regarding margins, with a strong focus on the spare parts division of its business which is able to keep profits high for the whole company. The ratings I gave were the following: a sell for Iveco, a hold for Traton and Daimler, a buy for Volvo and PACCAR.

Nikola

Much is known on the recent history of the company, with the most famous fact being perhaps that the former CEO has been charged by the SEC with fraud and has pleaded not guilty. It is also known that the company has disappointed investors a few times postponing production of its TRE Bev, Nikola’s first electric truck.

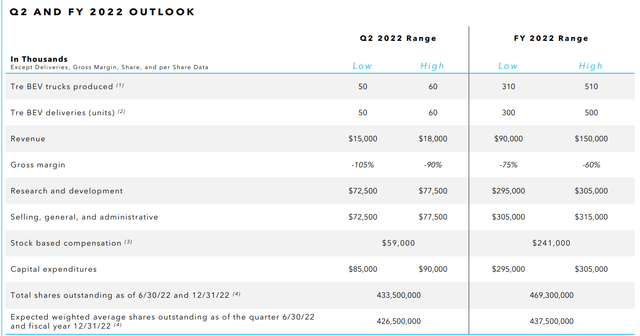

However, the company seems to be moving forward as it announced that during the current quarter it will begin deliveries of its first 50 to 60 TRE BEV produced. The company published the following outlook for Q2 and the rest of 2022.

Nikola 1Q 2022 Results Presentation

Financials

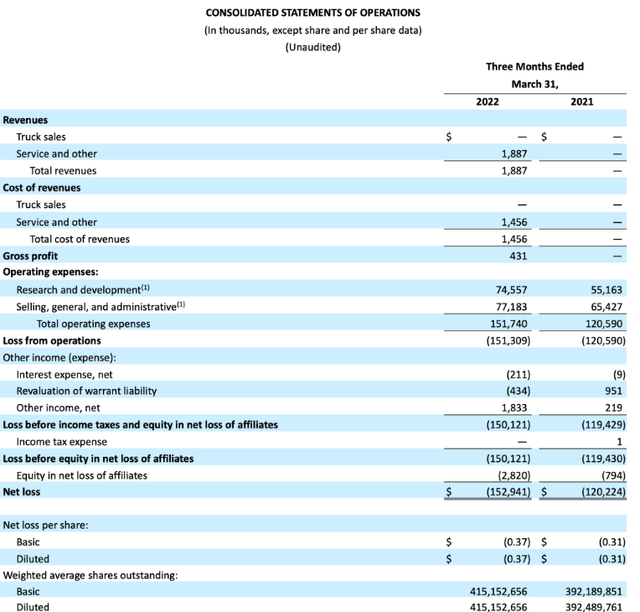

By looking at the 2022 outlook, it is clear that the company is still in its early stage, where production and deliveries lead to a low revenue compared to the increasing cost for R&D and SG&A. This is no surprise since it is well known that a company like Nikola presents itself to the market by wanting to prove its ability to deploy its new business idea and make it real over the next decade. The start of production and deliveries is a good news, since, for the first time, Nikola will have a revenue coming from its sales of trucks. This could be the first step towards profits. Now, let’s take a look at the consolidated statement of operations that the company disclosed.

Now, we said that Nikola just started delivering its trucks during Q2. So where does the $1.9 million we see in total revenues come from? It is the result of the sale of 10 Nikola mobile charging trailers. With very low revenue and many expenses, how is the company finding the money to run its business? By issuing shares and opening credit lines. This is vital for investors to know, Nikola keeps on selling more and more shares to raise funds for its current operations. If we go to the investor relations web page, we also see that Nikola is trying to get its shareholders to vote for its proposal to increase once again the number of authorized shares of common stock from 600 million to 800 million. This is what Nikola explains to its shareholders in order to have them vote in favor of this proposal:

your vote FOR Proposal 2 is very important. As described in the proxy statement, the additional authorized shares would provide us with increased financing and capital raising flexibility to support our need for additional capital to support the growth of our business and could be used for other business and financial purposes that our board of directors deems are in Nikola’s best interest, including the acquisition of other companies, businesses or products in exchange for common stock, attraction and retention of employees through the issuance of additional securities under our equity incentive plans, and implementation of stock splits and issuance of dividends in the future.

So far, not enough shareholders have voted and this may put Nikola into trouble because it would not have permission to raise more funds by issuing new shares. There is one problem that weakens this way to raise money: the stock tanked and this obviously makes it costlier for Nikola to obtain the sum it needs. In addition, the more the outstanding shares, the less equity the shareholders own. It is clear that in this situation, Nikola relies heavily on investors’ trust, which, as we know, needs to be built up once again from the ground. It will be crucial for Nikola’s management to maintain its goals and its future guidance during this year to prove the company is now reliable.

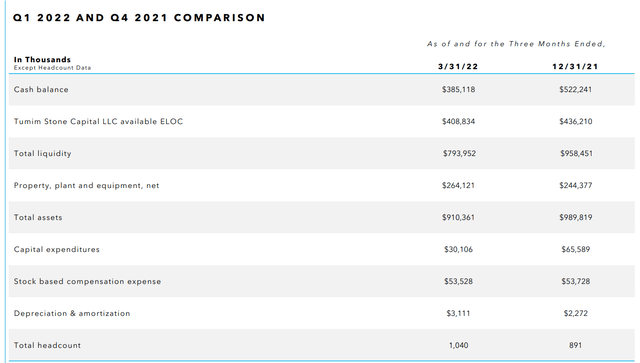

Let’s see now how much money the company had at the end of last quarter in order to estimate its needs and its strength to last.

Nikola 1Q 2022 Results Presentation

Nikola burned about $150 million in cash and saw its total liquidity reduced in three months by about $165 million. Stock-based compensation expense is constant, being around $53 million per quarter. The company is hiring workers – a good sign – and so we can expect expenses to grow. In addition, Nikola only completed its assembly expansion area which gives it a production capacity of 2,500 units per year. Still to be completed is a far bigger expansion that will bring Nikola to a 20,000 units production capacity in a year. This investment will impact a lot over the next quarters in terms of cash outflows. When asked about the cash availability for the rest of the year, Kim Brady, Nikola’s CFO, said the company is targeting to have around $1 billion in liquidity and cash on hand by the end of the year funded by newly issued shares and an $200 million agreement with institutional investors. Thus, we know the company will have enough strength to accomplish its production facility expansion which will be a key milestone toward profitability.

Partnership with Iveco

Since Nikola needs to build a manufacturing infrastructure, it signed a joint venture with the European truck manufacturer Iveco through which a facility in Germany was recently opened. While Nikola will give Iveco its electric battery technology, Iveco will provide Nikola with one of its truck platforms. This is a smart move for both since it enables Nikola to start production in Europe (the German facility should produce around 1,000 units per shift per year) without having to waste time in developing a truck platform. Iveco, too, has the chance to enter into the electric truck vehicle market, where it is still behind, being, on the other side, the leader of gas trucks. Both companies were starting to lag behind competitors either on the development of electrified trucks (Iveco) or on having the technological and mechanical know-how of all the manufacturing processes not directly linked to electric or fuel cell batteries.

Peer comparison

At this stage, Nikola is interesting for its possible future growth that may lead the company to be a market leader in an industry that is growing thanks to the increasing freight demand. As we will see, Nikola, even though it may have been perceived as having the first mover advantage, is actually a lagging behind its peers in the industry.

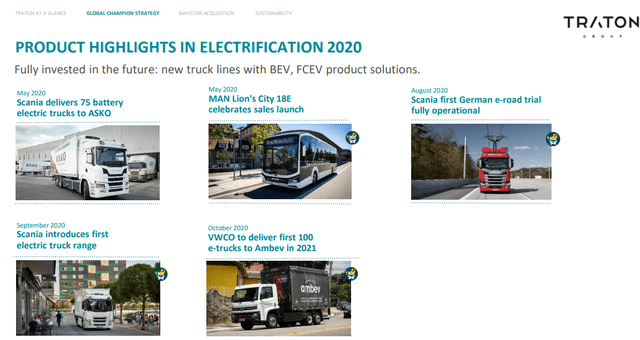

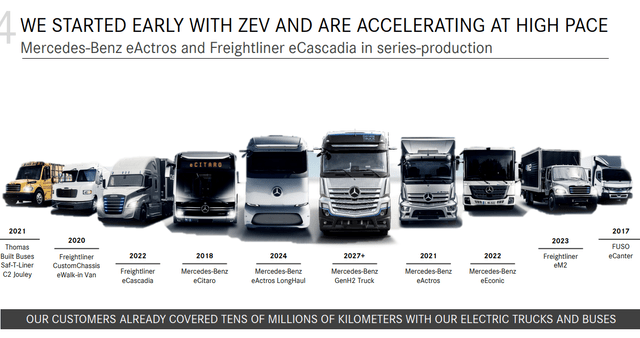

As we have seen in the other articles, Daimler, Volvo Group, Traton, and PACCAR have all already begun producing real electric trucks and buses that are functioning. These companies already cover a wide range of segments as we can see from the following slides I would like to recall. All these companies are delivering EV in the hundreds this year and are expected to reach the thousands by 2023.

This is Traton’s product range, that began being delivered two years ago.

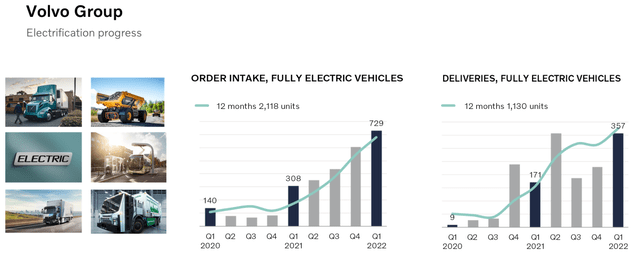

Volvo Group, on its side, is leading the European market and took 1,100 orders just last year. As we can see, the company is about 5-6 quarters ahead of Nikola in terms of deliveries, with light and medium-duty vehicles already in serial production while sales for heavy-duty vehicles just opened. During a situation where the supply chain is also an issue, it should not be easy for Nikola to catch up the difference in volumes.

Volvo 1Q 2022 Results Presentation

The following slide shows Daimler, with its first vehicles being ready and delivered already in 2017. Again, we see a whole fleet already moving and covering kilometers. To this, we should mention Daimler’s huge efforts toward autonomous trucking solutions, which still have to come. Daimler, too, delivered in the hundreds during 2021.

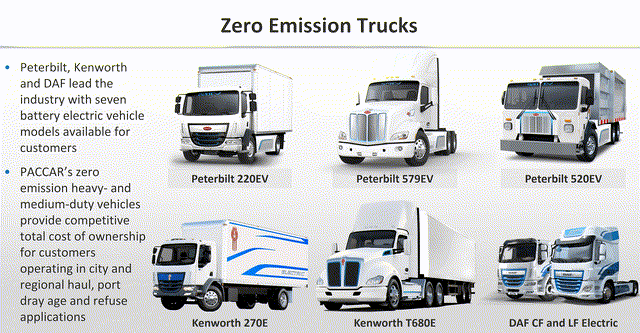

Finally, let’s look at PACCAR’s models to see Nikola’s American competitor.

Paccar 1Q 2022 Investor Presentation

These models are already available for customers and are currently operating.

From this comparison, we have to reach the understanding that Nikola is not the first mover, even though, sometimes, on the media we still hear that. In addition, we have to consider that Nikola’s financials don’t have the strength the other big manufacturers have. These are all free cash flow positive and can invest billions over the next years while scaling back their capex in traditional trucks and buses.

However, since we are at the very early stages of the electric truck market, I expect to see such a great demand for these products that will not be satisfied by the production capacity of all these manufacturers combined. This is why I expect Nikola to find its space in the market and gain a share of it. How big this will be will depend on many variables, like production quality, availability, volumes, etc, which are hard to foresee at the moment.

Thus, even though Nikola is lagging behind its peers at the moment, there is still enough room for the company to grow and build its business over the next decade.

Valuation

I think many of Nikola’s problems have been priced in by investors as the stock tanked from its ATH of $75 reached two years ago to the current $5.37 share price.

However, Nikola offers an interesting valuation exercise for investors. In fact, how do we value a non-profitable stock?

We could estimate a price/EBITDA ratio forecast or we could use the EV/EBITDA and discount it to the present. I recently found this article that back in 2020 had the same problem we are facing. Take a look at the author’s estimates for last year and this year. They have all been wrong, since the author assumed that Nikola would achieve certain results that were not reached. Before a company at stage like Nikola’s, in order to make a valuation, we have to steer clear of making too many assumptions, as the more they are, the higher the risk of making big mistakes.

We could use a free cash flow analysis, but Nikola is in a trend of free cash flow being increasingly negative at a fast pace. In 2017, Nikola was free cash flow negative by $15.6 million. Last year it was negative by $486.5 million. This is an increase in outflow of ∼30x. Obviously, in a forecast that looks into the future, one would assume that the company would turn free cash flow positive. But how can we make a real prediction when production and sales are at the early stages and we don’t have any elements to be sure they will be successful? Investors can only make educated guesses about the timing of Nikola’s free cash flow turn around and whoever tried could have as many reasons to back its assumptions as pretty much any other.

Traditionally, we can look at the price to sales ratio. Nikola so far has reported sales of 10 mobile charging trailers, but we know that at the end of Q2 it should report sales of 50-60 trucks for a revenue that will be around $15 million.

This is why I think, at the moment, the safest metric to use is the price to sales ratio, since it is the one that requires fewer assumptions and it can use data coming from the company’s guidance.

Nikola currently trades at a fwd P/S of 22. However, the company, as we’ve seen, is planning on diluting the current number of authorized shares by 33%, moving up from 600 million to 800 million. This has an impact on the ratio since the denominator comes from dividing the revenue by the number of shares outstanding. I worked out some charts to see what the current PS ratio would be if Nikola’s revenue guidance for this current year will be proved true. In my assumption, to make things easier to understand, I used the same share price even in case of dilution, even though we may expect the price to undergo downward pressure as a result of it.

If Nikola’s revenue falls within its guidance, either if we factor in the possible dilution or not, the shares are trading expecting Nikola to reach its high end estimates. Keep in mind that, so far, Nikola has 600 million authorized shares but the issued shares are 418,344,072, as stated on page 52 in the DEF 14A of the company. Hence, Nikola still has some room to dilute, even if the proposal will not be approved by shareholders. Let’s see what

| Share Price | Shares Outstanding | Expected revenue | FWD P/S |

| 5,37 | 418 million | 90 million | 25 |

| 5,37 | 418 million | 150 million | 15 |

| 5,37 | 600 million | 90 million | 35.8 |

| 5,37 | 600 million | 150 million | 21.5 |

| 5,37 | 800 million | 90 million | 47.7 |

| 5,37 | 800 million | 150 million | 28.6 |

(Source: Created by author with data from Nikola’s DEF 14A)

With a fwd P/S 22, investors are expecting the company’s revenue to reach $102 million, near to the low end guidance the company gave. If the company misses this target, I expect further downward pressure on the stock. However, the current ratio doesn’t factor it the 182 million shares the company still has to issue. If we reach 600 million outstanding shares, then the ratio will clearly move up and each dollar of the company’s sales will cost more. The current ratio would be confirmed only in case Nikola reaches its high end revenue guidance. Thus, the company needs to meet its high end guidance which may be difficult given the possible obstacles a company faces when it starts production. In my opinion, these metrics don’t provide with a margin of safety to protect investors from possible headwinds. In fact, in case Nikola falls short of the $150 million in revenue by achieving only its low end guidance of $90 million, in order for the share price to trade at a PS ratio of 21 we would have it drop at $3,15 (-41%), with no dilution. In case of dilution, the price would drop even further to $2,36 (-56%). I think the situation is too risky because it is pricing in almost perfect execution from Nikola. In this case, a hold is not enough for me and I consider it a sell. If we consider that it is difficult to forecast when the company will be free cash flow positive, I still would stick with a sell rating. In fact, even though it may seem that most of the selling has already taken place, from the multiples I used I still see very likely a further downward move.

Conclusion

In an inflationary environment where investors are seeking presently free cash flow rich companies, a company like Nikola will not receive much favor. Investors keen to look at the development of the industry have right now better stocks to pick, like PACCAR or Volvo Group. This is why I rate Nikola a sell, suggesting for investors who have it on the watchlist to wait at least two quarters before jumping in.

Be the first to comment