Justin Sullivan/Getty Images News

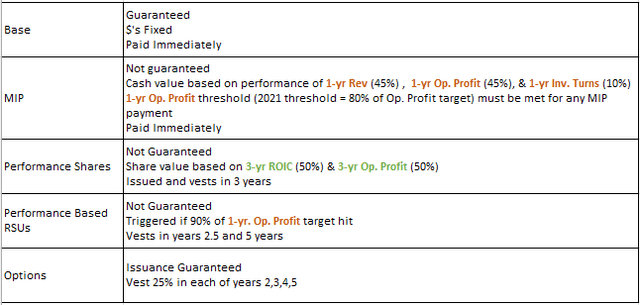

Last month, Home Depot (NYSE:HD) released their 2022 proxy, which included the usual discussion around executive compensation. The compensation plan is broken into 5 buckets, 3 of which are dependent on either 1-year or 3-year avg. performance targets. Here’s a rough summary of the plan.

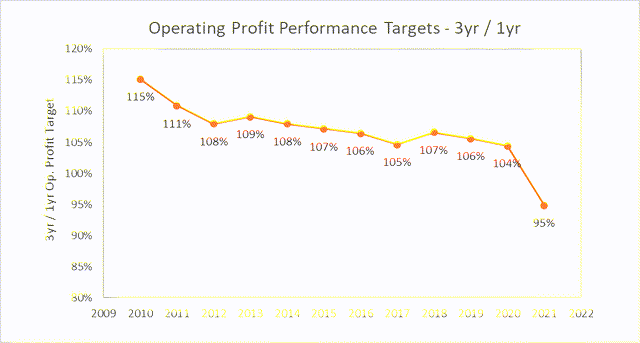

In the 2022 proxy, performance targets for the prior year were made public. Looking at the trend of these 1-year and 3-year targets over time and the relationship between them could give shareholders a glimpse into the thinking of the Leadership Development and Compensation Committee (LDC) at the time.

Operating Profit

In 2021, the Board increased their 1-year operating profit target from $16.02B to $18.93B. This was expected as the company blew away the prior year’s target. However, the LDC also set the new 3-year average target to $17.95B, well below its 1-year target. Looking at the 3-year vs 1-year target trend, the Board’s expectations around operating profit seem to have gotten increasingly bearish over time. The trend fell off a cliff in 2021, falling below 1. This likely implies that the Board was expecting a contraction in operating profit over the next 3 years.

The 2022 proxy goes on to say…

Due to the challenging economic conditions at the beginning of Fiscal 2021, our executive compensation program for the year reflected a modest increase in sales and operating profit goals from the prior year. As discussed above, results for Fiscal 2021 exceeded expectations, reflecting continued strength in home improvement, stronger demand from our professional customers, and the ongoing benefits of our strategic investments.

The drop in profit that the LDC could have been anticipating in 2021 hasn’t happened… yet.

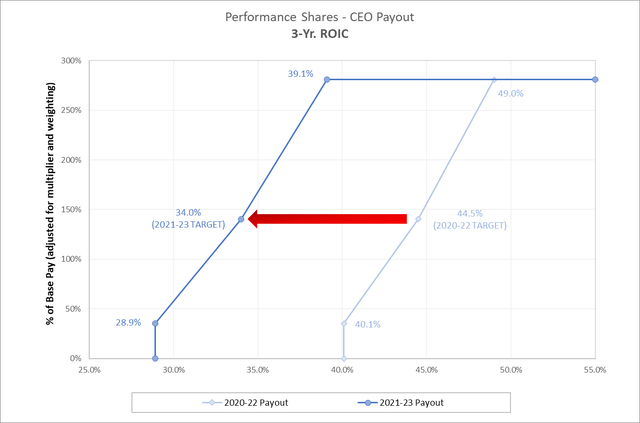

ROIC

In addition to a lower 3yr/1yr op. profit expectations, the LDC also lowered the 2021 3-yr avg. ROIC target from 44.5% to 34.0%, with a low threshold of 28.9%. This move lowered the bar significantly for the year to a performance level not seen since 2017.

Author Generated – 2022 & 2021 proxy (SEC FORM DEF 14A)

As an outsider, it’s difficult to understand the true motivation behind the ROIC reset. If the intent of the Board was to incentivize a ramp up in capex around their supply chain assets, then great – but that hasn’t happened yet, as capex is still pegged at 2% of sales. It’s also possible the LDC was throwing management a fat pitch for their stellar performance during COVID, though highly unlikely, given the company’s visibility. The most likely scenario is that the LDC was simply worried about a short-term drop in post-COVID demand, a situation that didn’t play out in 2021 but could still be in the cards for ’22. In an early 2021 interview with the Tepper School of Business, now CEO Ted Decker seemed to echo the Board’s apparent short-term pessimism.

The share of wallet and the share of time went into home improvement and our plan last year was to grow by four billion dollars… that was our normal plan. We ended up growing close to twenty two billion dollars, so we just had a year to beat all years. And… you know… at some point, to your point Alejandro, people are gonna be vaccinated and they’re gonna be happy to go on vacation and go to baseball games and soccer games and do anything with the family outside of the house… umm… not go to Home Depot again.

-Ted Decker

In fairness to Ted Decker, he goes on to talk about the business in the medium term, and makes a compelling bull case. He seems like a capable CEO, and I wish him luck in his new role. That said, I still share his 2021 view on the short-term outlook for the company. He may have been early, but that doesn’t make him wrong.

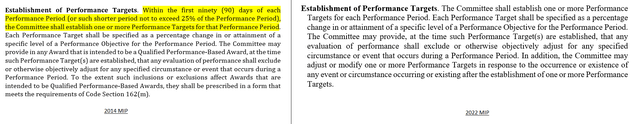

Changes To MIP Language

In addition to the notable target trends, the company also disclosed recent changes to their Management Incentive Plan that give the LDC much more flexibility around when those targets are set. Prior to the changes, the LDC was required to set executive comp performance targets within 90 days of the start of the fiscal year. That language was removed last month from the new plan.

Author Generated Screenshot – from “The Home Depot Amended and Restated Management Incentive Plan” 2014 & 2022

The 8-k states:

The Amended and Restated MIP also permits the LDC Committee to adjust performance targets during a performance period due to an event occurring or existing after the establishment of the target.

Also excluded was language regarding IRS Section 162(m). Prior to 2017, the rule allowed (or was perceived to allow) companies to deduct all performance awards on their corporate tax return. To stay compliant with 162(m), companies were prohibited from changing their performance targets later in the year to benefit management. They were still allowed to cut performance pay (negative discretion), but they couldn’t raise it if the business went south (positive discretion). Since late 2017, the IRS ruled that 162(m) does not apply to performance awards. Companies lost their ability to deduct these awards, but may have also shredded their prohibition against using positive discretion. With the removal of the 162(m) language, HD’s new MIP seems to leave the door open for the LDC to lower compensation targets mid-year in the event of downturn. (I’ve reached out to the Board to confirm this, but have not received a response as of this writing.)

Takeaway

I think it’s fair to say that COVID has impacted the predictability of HD’s near-term earnings. The Board seemed to get it wrong in 2021 and may be positioning themselves for future surprises to come. The company has reinstated earnings guidance since then, so its possible visibility has improved. It’s also possible that the Board was just early, and now has the tools they need to adjust in a downturn.

The stock has already dropped 33% YTD, but investors have yet to see business fundamentals deteriorate the way many have expected. DIY fatigue, inflation, removal of stimulus and rising interest rates are all weighing on near-term earnings prospects. If the bear thesis ultimately plays out, the stock could see additional pain in the short term. Bargain hunters would be wise to sit on the sidelines for the next couple of quarters, and shorts would be wise to position themselves now for a speed bump in the road. Feel free to comment below if you disagree. I’d love to hear what dissenters have to say. Brutal honesty is encouraged.

Also… If you want to hear more about the short-term risks of owning HD stock, please read my recent article on the company – “Home Depot’s Q1 Results – The Risks are Rising”.

Be the first to comment