hapabapa/iStock Editorial via Getty Images

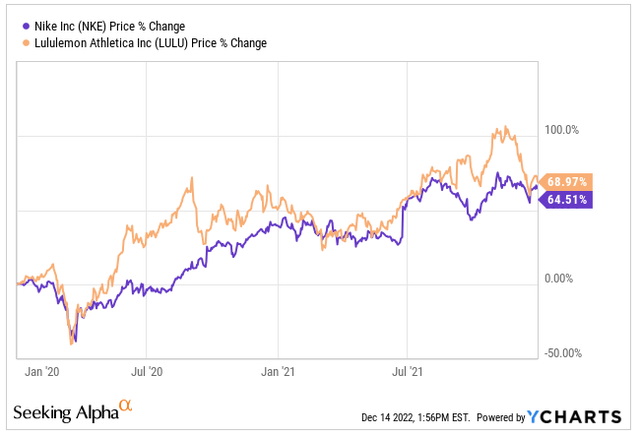

During the midst of the global pandemic, athleisure wear brands, such as Nike (NYSE:NKE) and Lululemon (LULU) raced higher as many people found themselves working from home for a number of months.

From the start of 2020 through the end of 2020, we saw NKE and LULU shares climb 65% and 69%, respectively.

yCharts

However, the year 2022 has been drastically different with shares of both NKE and LULU down 32% and 15%, respectively.

In today’s piece we will take a closer look at Nike, who enjoyed the pandemic boom, but is now dealing with a number of different headwinds heading into 2023.

Strong Headwinds For Nike

When it comes to Nike, the company has done a nice job transitioning more to direct to consumer, which can have very positive impacts to gross margins for the business.

Nike has also done a nice job building a global brand, connecting with consumers of all types across the world stage.

However, the headwinds will make things more difficult for Nike to outperform going into 2023.

- Inventory build up

- Exposure to China

- Earnings revisions

Let’s first begin with the glut of inventory, which has been a common theme amongst retailers in 2022. After a year in which we saw supply chain issues, the table has been flipped as all that excess inventory ordered has come in, but demand has slowed.

At the end of September, Nike released their fiscal Q1 results that saw revenues climb 10% on a currency neutral basis, but gross margins fell 220 basis points, which contributed to a 20% decline in EPS.

In terms of inventory, and this is where the issues exist, it climbed a staggering 44% year over year. North America inventory grew 65% and in-transit inventory grew 85%. All very negative to think of as an investor.

This is how management explained the increase in inventory:

This reflects the combination of late delivery for the past two seasons plus early holiday orders that are now set to arrive earlier than planned and a prior year that was impacted by factory closures in Vietnam and Indonesia. As a result, we are taking decisive action to clear excess inventory, focusing on specific pockets of seasonally late products, predominantly in apparel.

– Matthew Friend, CFO

The company is now forced to clear out this inventory excess, which means selling on promotion or selling at deep discounts to discounted retailers like T.J. Maxx (TJX) or Ross Stores (ROST).

These inventory issues are set to weigh on margins for much of 2023.

Another headwind for the company is related to its exposure to China. China has still been dealing with its strict zero COVID policy, which is hopefully expected to ease in the near future, but it has weighed on Nike.

During Q1, greater China sales declined 13% on a currency-neutral basis and EBIT declined 23%.

North America is the company’s largest single country exposure with roughly 40% of revenues coming from this region, but the company’s second largest market is China, which accounts for slightly below 20% revenue share.

In addition to the strict pandemic policy in the company, the US/China relations have soured in 2022, which could have a further negative impact on Nike and others with exposure to China.

Given these couple of items along with slower expectations in 2023, it is likely that 2023 expectations need to come down. This is a consensus across the investing community, not just for Nike, but for many S&P 500 holdings.

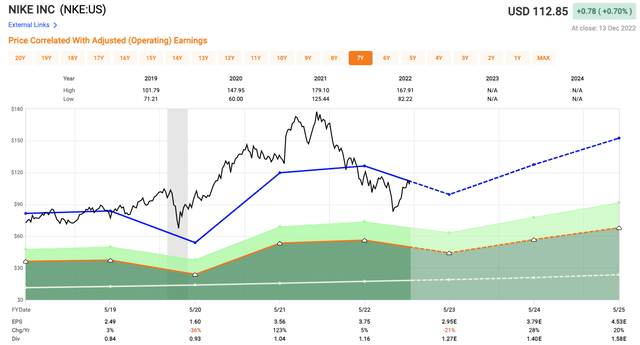

On the year, shares of Nike are down ~35% and currently trade at 31.5x, which is in-line with their 5-year average.

However, the past year and the year ahead seem to be anything but average. Inventories are up 44%, revenues are essentially flat over the past year with operating margins dropping from 15.8% to 13.2% over the trailing 12 months. In addition, we have seen free cash flow tumble over 40% in the past year.

Fast Graphs

Analysts right now are looking for FY ’23 EPS earnings of $2.95 followed by $3.79 in FY ’24. This equates to a forward earnings multiple of 38x and 30x, respectively in FY ’23 and FY ’24.

The company is already halfway through its fiscal year, so the next earnings report will be telling as to how the important holiday period was for the company, but a near 30% increase in Fiscal ’24, which is May 2024, seem very high still.

Investor Takeaway

Nike is a global icon and a company with close ties and a strong brand across the world. However, they, like many retailers, are dealing with major inventory issues that are going to weigh heavily on financials over the next six months plus.

Trading above 30x on a forward looking basis still seems too high to me, which is why I do not view shares of Nike as a buy at current levels.

The company does pay a dividend that yields 1.2% and they have been growing the dividend for 10 consecutive years and counting, having a 5-year dividend growth rate of 11%.

However, although I love dividend growth stocks, this is not a name I want to be in at the moment given the current economic environment.

Be the first to comment