niwate bunlue/iStock via Getty Images

Introduction

When last discussing the much troubled, NGL Energy Partners (NYSE:NGL), my previous article highlighted how a recession might actually help via releasing cash from their working capital builds. Whilst the jury is still out on the recession, disappointingly, it seems they are taking too much damage, whilst simultaneously making too little progress deleveraging, as discussed within this follow-up analysis.

Coverage Summary & Ratings

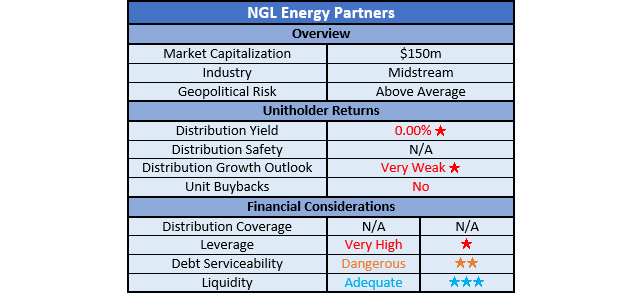

Since many readers are likely short on time, the table below provides a brief summary and ratings for the primary criteria assessed. If interested, this Google Document provides information regarding my rating system and, importantly, links to my library of equivalent analyses that share a comparable approach to enhance cross-investment comparability.

Author

Detailed Analysis

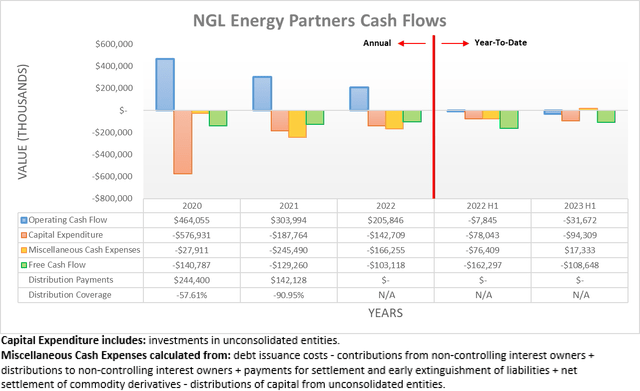

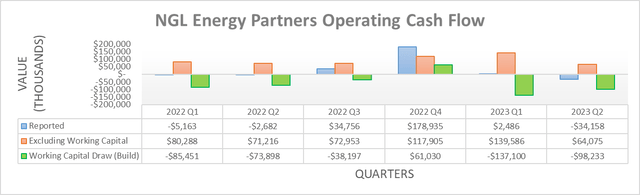

Despite seeing green shoots during the first quarter of their fiscal year 2023 when conducting the previous analysis, sadly, their cash flow performance was back to its usual disappointing ways following their second quarter. On the surface, their operating cash flow for the first half is now down to negative $31.7m, whereas one year prior it was only negative $7.8m. Admittedly, these results were battered by their working capital movements that have a larger than normal influence on their cash flow performance than is observed elsewhere with other midstream partnerships.

Most disappointingly, even after excluding the working capital movements routinely plaguing their cash flow performance, their underlying results of $64.1m during the second quarter of their fiscal year 2023 are still weaker year-on-year versus their previous equivalent result of $71.2m during the second quarter of fiscal year 2022. Even though the first quarter of their fiscal year 2023 clocked a massive increase year-on-year, as discussed within my previous analysis, their inability to see a concrete recovery makes for too little progress, at least in my eyes.

If circling back to the topic of my previous article, the second quarter of their fiscal year 2023 saw lower commodity prices, also known as the third quarter of 2022 on a calendar basis, but alas, there was still no sign of a working capital draw, as hoped would be forthcoming. In fact, their working capital build of $98.2m was larger year-on-year than the $73.9m build during the third quarter of fiscal year 2022, thereby making their latest results especially disappointing in multiple ways. Seeing as commodity prices have recently materially softened, it will be interesting to see how their next quarter transpires in regard to their working capital movements.

Equally as concerning, they are also taking too much damage via their preferred distributions, which have been suspended since early calendar year 2021. Unlike common distributions, these accumulate with their Class B preferred units already carrying $53.2m of unpaid distributions, whilst their Class C and Class D preferred units carry a further $8.1m and $124.6m of unpaid distributions respectively, as per their Q2 2023 10-Q. Even though unpaid preferred distributions cannot trigger bankruptcy, they still must be paid in full before their common unitholders can receive anything. Also, worryingly, the details within this SEC filing state that “the amount of cumulative but unpaid distributions shall continue to accumulate at the then applicable rate until all unpaid distributions have been paid in full”.

Thus far, these unpaid preferred distributions aggregate to a formidable $185.9m, which is already approaching their operating cash flow of $205.8m during fiscal year 2022. Unless they quickly resolve their subsequently discussed overleverage, these will grow larger at an ever faster rate, given the effects of compounding and their high-single-digit to low-double-digit yields. Given the capital-intensive nature of their industry, they cannot direct the entirety of their operating cash flow solely to making good on these unpaid preferred distributions. As a result, it would already likely take at least two years, if not longer to address the existing near-$200m of unpaid preferred distributions, let alone the amounts that would still be added every quarter attributable to the residual unpaid portion, which continuously kicking the can further down the road, making it ever more difficult.

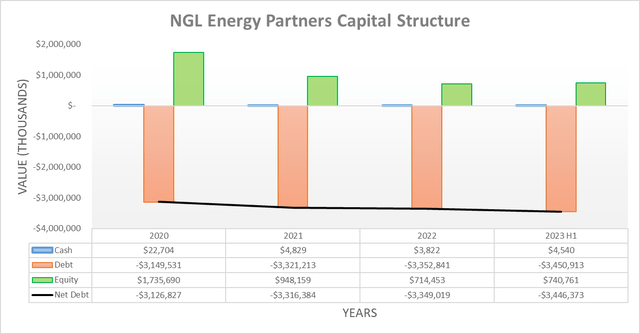

Unsurprisingly, once again their net debt climbed higher during the second quarter of fiscal year 2023 to land at $3.446b, thereby piling a few more million dollars on top of their previous net debt of $3.386b after the first quarter. Disappointingly, this shows no progress reducing their net debt with only vague accompanying hints of what is likely a divestiture on the horizon, as per the commentary from management included below.

“Additionally, as previously discussed, we are still working on certain corporate initiatives that if successful, would allow us to repay the 2023 notes by our fiscal year-end. These corporate initiatives are being pursued both, to retire the 2023 notes early and to delever to the 4.75 times.“

-NGL Energy Partners Q2 2023 Conference Call.

Apparently, they plan on repaying their 2023 notes before their fiscal year ends, which means before March 31st 2023 of a calendar year basis. These notes carry a face value of $399.3m, thereby requiring a material divestiture that would shave away almost 12% of their total debt of $3.451b. Whilst possibly helpful, assuming the loss of earnings is negligible, their leverage ratio is currently 6.11 and thus would only decrease to circa 5.40, thereby still above their target of 4.75, which is required to see their preferred distributions reinstated. Unless their divestiture is significantly higher and does not further erode their financial performance or the latter recovers organically, further deleveraging would still be required.

To be fair, I recall hearing discussions of divestitures for more than the past year and yet, nothing material has been forthcoming. Plus, as a side note, their latest balance sheet did not list any assets held for sale and thus further complicates making any judgments. Whether they successfully take this path remains to be seen, but in my eyes, it seems odd that the booming oil and associated refined product prices earlier in 2022 did not provide a desirable opportunity to divest assets. Plus, as monetary policy tightens and pulls capital out of debt markets, it could pose further headwinds in finding buyers in the coming quarters.

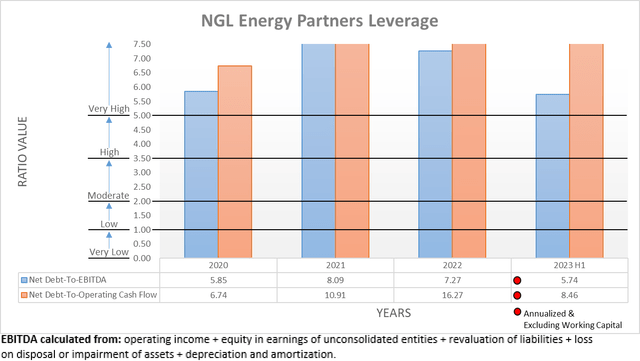

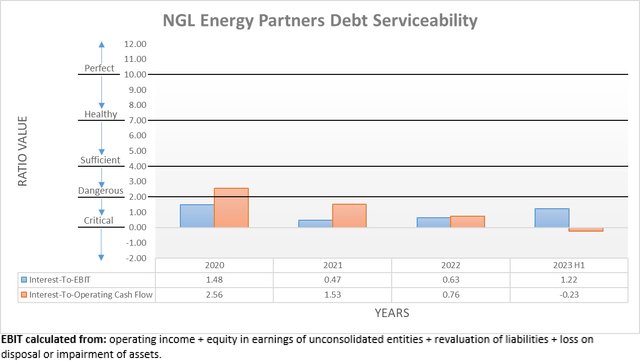

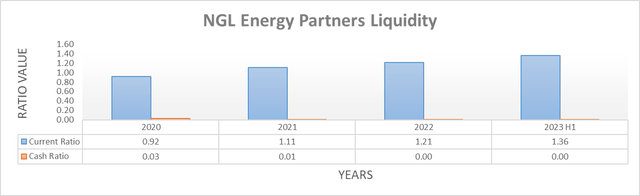

Since their net debt only increased slightly, it would be redundant to reassess their leverage or debt serviceability in detail, especially after only one quarter. Likewise, the same can also be said for their liquidity because their cash balance of $4.5m following the second quarter of fiscal year 2023 is not materially higher than its previous level of $0.8m following the first quarter.

The three relevant graphs are still included below to provide context for any new readers, which unsurprisingly shows their leverage is still above the threshold of 5.01 for the very high territory with a net debt-to-EBITDA of 5.74 and more worryingly, a net debt-to-operating cash flow of 8.46. If looking elsewhere, their debt serviceability is dangerous with interest coverage of only 1.22 when utilizing their accrual-based EBIT, whilst any cash-based comparison is obviously negative due to their negative operating cash flow. The one bright spot remains their adequate liquidity that sports a current ratio of 1.36, notwithstanding their cash ratio of 0.00, although if they fail to address their 2023 notes as apparently planned, this could quickly deteriorate as their maturity approaches. If interested in further details regarding these topics, please refer to my previously linked article.

Conclusion

I guess it could be said they are quite consistent in one way, whereby they routinely disappoint their unitholders because another quarter is now gone with too little progress evident. In conjunction with their lack of progress in concreting a recovery or reducing net debt, they are also taking too much damage as their unpaid preferred distributions continue growing larger each quarter. If they somehow manage to stage a complete comeback from this situation, it will be a very impressive feat and whilst I still believe that maintaining my hold rating is appropriate as bankruptcy is not necessarily imminent, this is poised to be downgraded to a sell rating next time if their lack of progress continues.

Notes: Unless specified otherwise, all figures in this article were taken from NGL Energy Partners’ SEC filings, all calculated figures were performed by the author.

Be the first to comment