Alexander Shapovalov/iStock Editorial via Getty Images

Build-A-Bear Workshop, Inc. (NYSE:BBW) is a profitable, growing and small-cap consumer discretionary stock of $366.852 million that has been strengthening its brand presence while growing the number of workshops this year. The company has beaten revenue expectations by $1.89 million to reach $104.51 million and beating expectations by $0.13 to get an EPS of $0.51. These results had a significant impact on the stock price. The company has had their biggest one-day gain since 2015. Since my previous article in September, the price has increased by 85.06%.

Stock Trend (SeekingAlpha.com)

The company is on target to open 20 new workshops this year, which could give it some serious upside potential in the next few quarters as customers increasingly head back to their in-store buying habits. On top of that, BBW has invested in creating omnichannel distribution and customer experience to expand into the digitalisation of retail. It currently has no debt and strong cash flow and is growing the business, all while the stock price is still well under the one-year analyst estimate of $33. Investors may want to take a bullish stance on this growing stock.

Overview and Growth Drivers

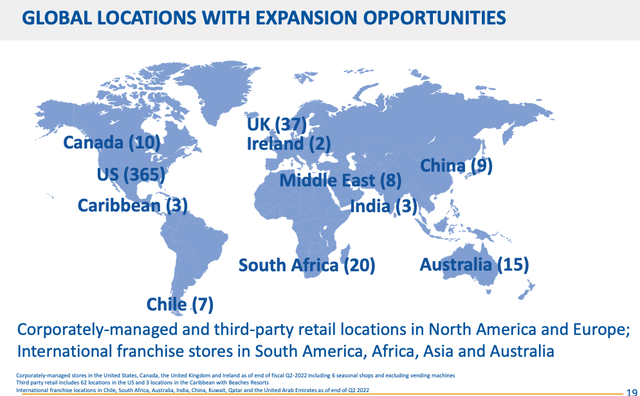

In my previous article, I gave an overview of BBW. It is an exciting time for this company of 25 years which is set to produce its most profitable year to date by the end of the financial year. One of the key growth drivers for this company has been an increase in foot traffic in a growing number of stores, both in corporate and third-party locations, which total 420, compared to 407 in 2021 across international geographies.

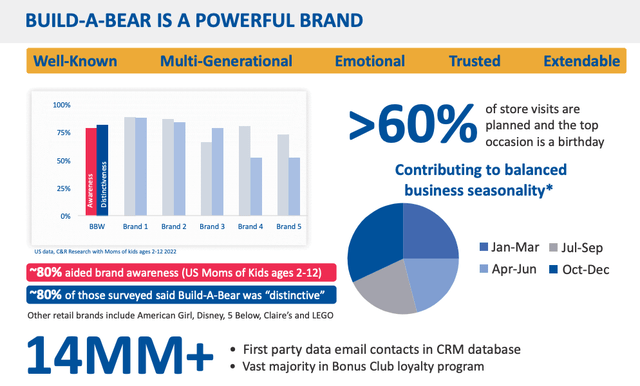

Another key driver is BBW’s brand power, which has been growing through increased interaction points both online and offline and in diverse locations in which BBW has been able to reach out to a larger audience and increase brand loyalty.

Build-A-Bear Brand (Investor Presentation 2022)

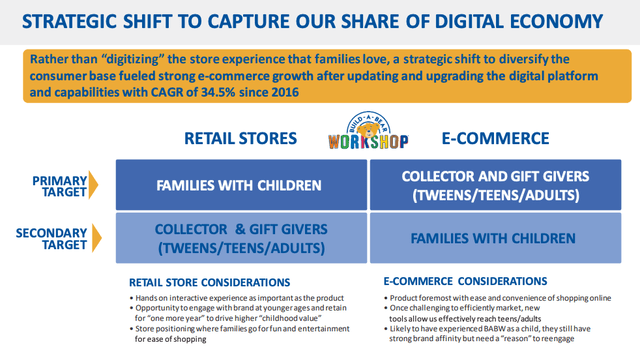

Furthermore, the company invested heavily in a digital transformation throughout the business and has integrated online and offline offerings in omnichannel distribution sales and customer experiences to keeping up to date with the digitisation of retail. This technology is also used for data analytics and fully embracing loyalty membership, which has impacted and increased the average spend per customer through more contact and engagement touchpoints.

Omnichannel sales and customer experience (Investor Presentation 2022)

Staying grounded in its brick-and-mortar roots, the company still sees much potential in the role of physical stores within its omnichannel strategy. 97% of the company’s retail stores are profitable, and over the last quarter, there has been an 8% increase in in-store sales, with more people heading back into stores to shop. Lastly, the company is focused on growing the business while delivering returns to shareholders. There are still a lot of white space opportunities in existing and new territories.

BBW Global Locations (Investor Presentation 2022)

Financials and Valuation

The company has just come off a solid Q3 performance, delivering the seventh consecutive quarter of increased revenue. Its net sales increased by 8.3% to $99.2 million, pushed on by retail store demand. The company’s net income has risen by 27.1 since last year to $7.5 million.

The company has had a decrease in demand on its e-commerce channel by 29.4% compared to a year ago. However, in-person shopping has significantly increased over the last few months. Although the previous year has seen a decrease in e-commerce, revenue has increased by 104.7% since 2019. The company has invested heavily in its digital transformation, and part of the drop in sales was due to updates to the system. The digital platform is vital to give insights into shopping trends and to buying behaviour and has helped increase the average spend per customer. Retail store traffic continues to show double-digit increases in the physical storefront, leading to growth in transactions across geographies year-over-year.

If we look at the gross profit margin, although it is high for the industry, we see a reduction to 52% of revenue. The reason for this was mainly due to freight and distribution costs.

The company has a healthy balance sheet, although cash and cash equivalents reduced from $48.5 million one year ago to $12 million this year. One of the causes for this was the repurchase program to give a special dividend to shareholders, and part of the money was invested in future growth initiatives. The company has no borrowings under credit, and it ended with a higher inventory than last year to go into the busy holiday shopping fourth quarter at $88.3 million compared to $26.4 million in Q3 2021. Lastly, the management team is optimistic about the year-end performance for BBW, expecting revenue between $455 million and $465 million, well above the consensus of $421 million.

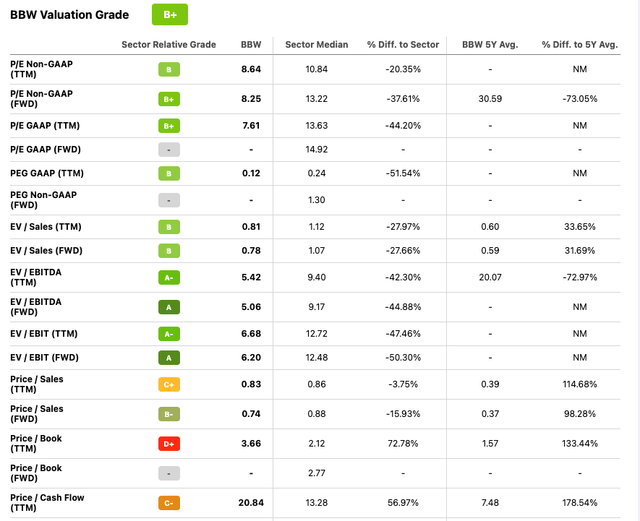

Comparing BBW to the discretionary sector shows that the company is undervalued on several ratios. BBW has a price-to-earnings ratio of 7.61 compared to the sector median of 13.63, indicating that it may be a value stock. Furthermore, we can see that investors are paying less than one dollar for every dollar the company earns, with a price-to-sales ratio of 0.83. It is currently perceived as a Hold rating by Zacks Rank and has a B+ valuation with SeekingAlpha’s Quant rating and a Buy rating. BBW is proving quarter after quarter its solid fundamentals and investing in its future growth while returning funds to its shareholders.

Valuation BBW versus Consumer Discretionary Sector (SeekingAlpha.com)

Risks

As much as BBW has been thriving this year, we cannot ignore that the macro environment is less than ideal for discretionary goods. Customers are rethinking and reducing their purchasing decisions, which can immediately impact the upward sales trend the company has experienced. However, the company has built its brand as an experienced product and has a presence in a diverse range of locations. This diversification of location and strong connection to the brand may keep BBW on the Christmas shopping list of its increasingly loyal customers who are increasing their average purchase spend.

Final Thoughts

BBW is a highly profitable business with high margins. The company is on its way to increasing its workshops by 20 this fiscal year. The locations are diverse in their location and format. The brand strength has grown significantly, and customers are given a total experience that provides them with a toy and a lasting emotional connection to the brand. With solid fundamentals and the management team giving their estimates for the year-end, it looks like BBW is on its way to another record-breaking year with more upside potential aligned with future strategies that use omnichannel selling and customer experiences. Investors may want to take a bullish stance on this stock.

Be the first to comment