jetcityimage

Early next month, we will see a rather large development take place regarding industrial conglomerate General Electric (NYSE:GE). After years of management working to transform the enterprise, one of the two major spinoffs that are cited to occur will finally take place. As we near that time, it should be no surprise to see the company provide more details for shareholders and to engage in a little creative financing aimed at bolstering the main parent company that will remain in place following the first spin-off. This also gives me an opportunity to revise my own expectations for the company based on recent developments and to see still if my original thesis that the enterprise as a whole is drastically undervalued still makes sense.

News and creative financing

On January 3rd of 2023, GE HealthCare will be officially spun off from the conglomerate currently known as General Electric. This would be one of two transactions occurring over the next year or so, with the other, the spinoff of the company’s energy businesses into a firm called GE Vernova, expected to take place in early 2024. The rest of the company will largely be centered around the company’s aviation operations, currently known as GE Aerospace. This series of transactions follows an uncounted number of transactions, some large and others small, that have been completed over the past few years as management seeks to reinvent the company, streamline operations, and focus on the core competencies of the current management team. At the end of the day, all of this is aimed at creating as much value for investors as possible after years of mismanagement and hardships caused by factors outside of the company’s control.

The first development worth mentioning here is the date of the spinoff that I already mentioned. Prior to just recently, all we knew was that the transaction would take place early next year. But now we have a specific date, with shares of GE HealthCare expected to trade under the GEHC ticker symbol beginning January 4th. The second development is that we now know that for each share of General Electric stock somebody currently owns, they will receive 3 shares of the spun-off healthcare operation. All combined, shareholders will receive 80.1% of the equity in GE HealthCare, with General Electric retaining the remaining 19.9%. This will allow the company to still have a stake in that enterprise for the long haul if they so desire, or to periodically sell off pieces of the business in order to raise capital.

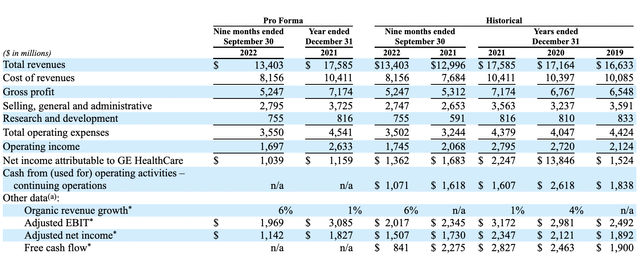

The third development announced by management involved pro forma financial data covering the new standalone enterprise for the third quarter of the 2022 fiscal year. It also included data for the first nine months of the 2022 fiscal year as a whole. Although not considered a real growth portion of the company, GE HealthCare has demonstrated some growth year over year. Revenue in the latest quarter came in at $4.58 billion. That’s roughly 6% higher than the $4.31 billion reported the same time last year. and for the first nine months of the 2022 fiscal year as a whole, revenue of $13.40 billion came in above the roughly $13 billion reported the same time last year. According to management, strong organic growth helped major aspects of the company, including its Imaging, Ultrasound, and PDx operations. Of course, just as was the case when I last wrote about GE HealthCare, profitability figures are weaker than they were last year. But given the inflationary pressures the company has been dealing with, combined with increased research and development spending, none of this should be that surprising.

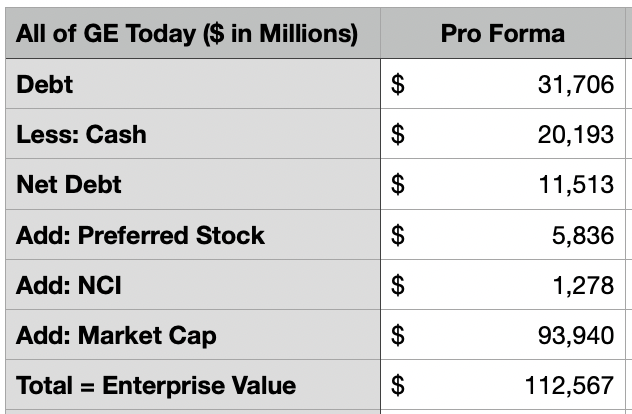

In preparation for the spinoff, General Electric has also been engaging in some interesting financing activities. Last month, management had GE HealthCare close an offering for $8.25 billion in senior notes. The capital from that was essentially given over to the rest of the enterprise, meaning that GE HealthCare has essentially taken on debt on behalf of the parent company. That capital, in turn, was mostly used to buy back $7.23 billion worth of debt at a price of $6.95 billion tender offer that General Electric initiated. In addition to reducing debt and engaging in a net cash transfer of capital over to the parent company, the move has also resulted in significant interest cost improvements for General Electric. Based on the tender offer results, General Electric should see its annual interest expense drop by $346.27 million, implying a weighted average interest rate of 4.79%. At the same time, the interest expense for the senior notes that GE HealthCare issued should be roughly $478.70 million with a weighted average interest rate of 5.80%.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Danaher (DHR) | 38.2 | 28.9 | 25.8 |

| Thermo Fisher Scientific (TMO) | 34.3 | 28.4 | 24.5 |

| Agilent Technologies (A) | 40.5 | 33.0 | 28.0 |

| Illumina (ILMN) | 75.3 | 105.4 | 50.1 |

| Mettler-Toledo International (MTD) | 51.7 | 43.8 | 36.7 |

| Average Minus Highest | 41.2 | 33.5 |

28.8 |

| Lowest | 34.3 | 28.4 |

24.5 |

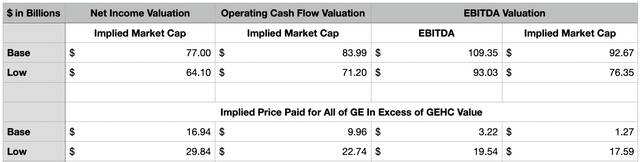

Naturally, this kind of strategic maneuver should have some impact on how valuable GE HealthCare ends up being. Since we don’t know how the market will value that standalone enterprise, I decided to take what data we had as of the end of the latest quarter, factor in the adjustments needed associated with the tender offer and the senior notes issuance, and then see what kind of value GE HealthCare might warrant based on how similar firms are priced. I took five similar companies and looked at their price-to-earnings multiples, their price to operating cash flow multiples, and their EV to EBITDA multiples. From there, I marked it two different scenarios. For the base case, I stripped out the most expensive of the companies from the five and averaged out their multiples to see what kind of value GE HealthCare might be worth, using data from 2021, if it were to trade at that average. And for the low case, I looked at just the trading multiple of the cheapest of the five companies.

As you can see in the table above, the implied market value of GE HealthCare should be somewhere between $64.10 billion and $92.67 billion. By comparison, the entire conglomerate that is General Electric today is being valued at $93.94 billion. If we look at the pictures of the lens of the enterprise value instead, General Electric is worth $112.57 billion compared to the range for GE HealthCare of between $93.03 billion and $109.35 billion when utilizing the EV to EBITDA approach to valuing the enterprise. What this all shows is that by buying General Electric as it stands today, investors are essentially getting GE HealthCare and paying only between $1.27 billion and $29.84 billion for all of the rest of General Electric as it stands. Considering this extra price includes the highly valuable aerospace operations that, in the first nine months of the 2022 fiscal year, generated operating income of $3.34 billion, not to mention the $524 million generated by the energy businesses owned by General Electric over the same window of time, and I have no doubt that the conglomerate as a whole is tremendously undervalued.

Author – SEC EDGAR Data

Takeaway

Although I have been following General Electric on and off for the past couple of years, I only finally pulled the trigger on the business recently. As of this writing, I have owned shares in the company for 49 days and have seen a nearly 13% return on my investment during that time. I ended up pulling the trigger because of the assessment I made regarding how undervalued the company is based on the pending spin-off. I do believe that, in short order following the transaction, some of this value disparity should be recognized, with some additional upside occurring between now and then. Of course, this picture could change depending on other factors we don’t know about yet. But based on the data we have available now, I do think that the outlook for investors moving forward is very favorable.

Be the first to comment