Lemon_tm

Written by Nick Ackerman, co-produced by Stanford Chemist. This article was originally published to members of the CEF/ETF Income Laboratory on July 23rd, 2022.

Virtus AllianzGI Dividend Interest & Premium Strategy Fund (NYSE:NFJ) offers a fairly unique approach to the covered call strategy. Instead of just purely investing in equity positions and writing calls, the fund also has a sleeve of convertible securities exposure. The fund’s at a fairly attractive discount at this time. They also bumped up the quarterly distribution earlier this year.

The fund has historically lagged behind its peers due to its differentiated strategy. However, the valuation of this position is also relatively more attractive than its peers, which we will discuss in this piece too.

This fund is advised by AllianzGI, which was to be removed effective July 25th, 2022, due to an unrelated fraud case. Shareholders will be asked to vote for Voya to become the new subadvisor and manage the fund going forward.

Voya doesn’t generally have a strong name in the CEF space with its offerings. Primarily due to their focus on more value-oriented investments, it has resulted in serial underperformance over the last decade. That’s a whole different subject, though.

In this case, the management teams are actually going along with the fund. So if you liked these AllianzGI funds previously, they shouldn’t be changing too much in terms of how they are managed. The investment policies are staying exactly the same too.

The Basics

- 1-Year Z-score: -0.73

- Discount: -11.15%

- Distribution Yield: 7.83%

- Expense Ratio: 1.06%

- Leverage: N/A

- Managed Assets: $1.262 billion

- Structure: Perpetual

NFJ’s investment objective is “to seek current income and gains, with long-term capital appreciation as a secondary objective.” To achieve this, the fund will “invest approximately 75% of its total assets in equity securities and approximately 25% in convertible securities.” They will then “employ an option strategy of writing covered call options on equity securities held in the fund.”

As is generally the case with covered call funds, they don’t employ any leverage. That can be a benefit during these volatile times as the underlying portfolio is volatile enough. Leverage can enhance the upside when times are good and increase the downside during market downturns. The covered call strategy can work well when the market is moving sideways.

The fund has a significant size, and the expense ratio is comparable to other covered call CEFs.

Performance – Lagging Peers

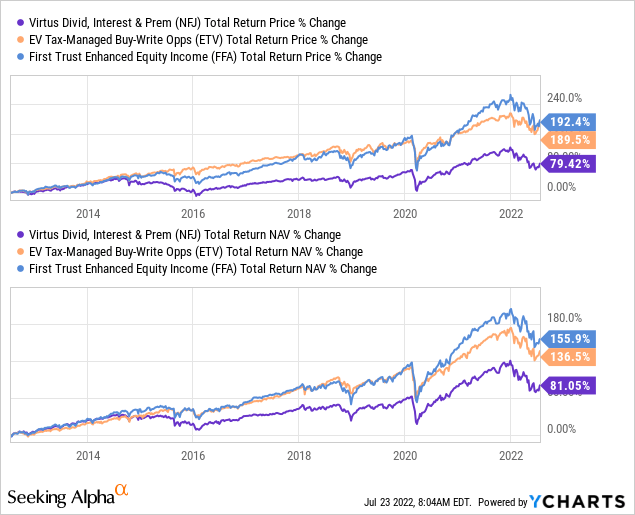

With this type of strategy, it appears that it has set the fund behind other option writing peers. Below is the comparison between probably the most popular call writing CEF, Eaton Vance Tax-Managed Buy-Write Opportunities Fund (ETV). They utilize an approach of writing index options and invest with a bit more of a tilt towards tech. This tech tilt is also consistent with NFJ but perhaps not quite as large.

I’ve also included the First Trust Enhanced Equity Income Fund (FFA). I had forgotten about this fund for a while. FFA has performed the best in terms of the last decade. That doesn’t mean it will, going forward, but the outperformance is worth noting nonetheless. The fund’s weightings here are most similar to NFJ’s in terms of sector exposure. However, they are an equity fund with no significant exposure outside common stocks.

Ycharts

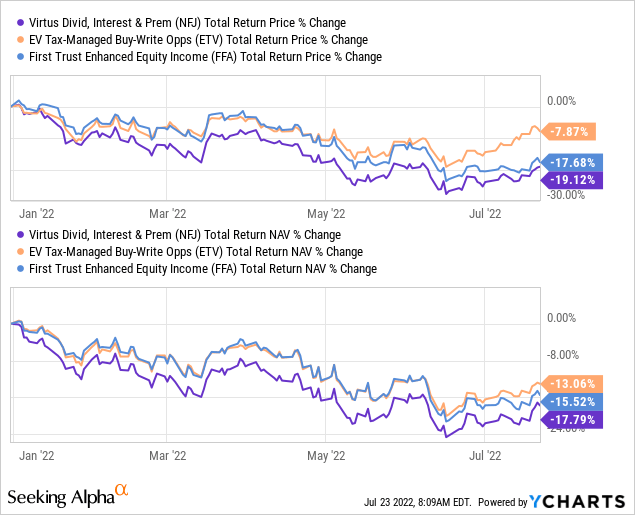

On a YTD basis, we see a difference between ETV and FFA as the performance has reversed. However, NFJ once again remains the weakest in this comparison.

Ycharts

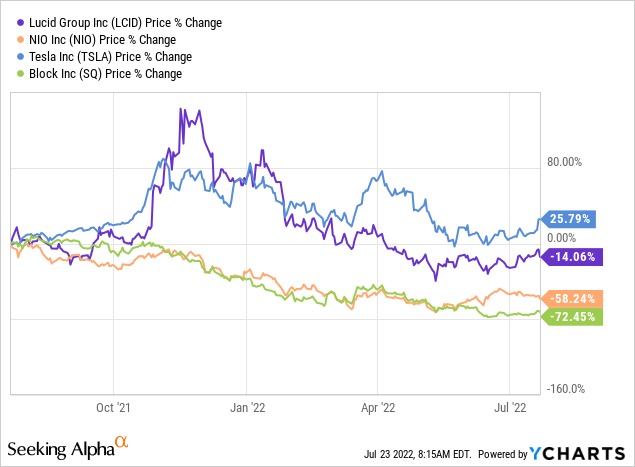

So it would appear that the convertible securities that should be offering some downside protection aren’t playing out this year. One of the causes of this could be convertible securities generally geared towards riskier companies in growth names—the exact area of what isn’t working out this year. There are names such as Lucid (LCID), NIO (NIO), Tesla (TSLA) and Block (SQ) in this portfolio.

All except for TSLA is down over the last year. SQ and NIO are down significantly. They are holding the convertible securities of these names, so there is a floor eventually. However, until then, the value of these convertibles will be tied to the stock prices of these wildly volatile names.

Ycharts

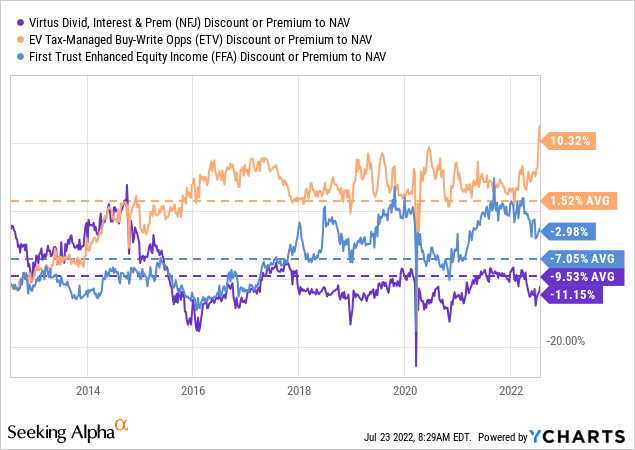

All this being said, NFJ appears to be the weaker option in the space. However, it also carries the deepest discount at this time. ETV has basically gone into the clouds in terms of its valuation. Not stratosphere yet, but it is heading that way. NFJ is trading below its decade-average discount – while the other funds are well above their historical levels.

Ycharts

Distribution – Reasonable And Sustainable

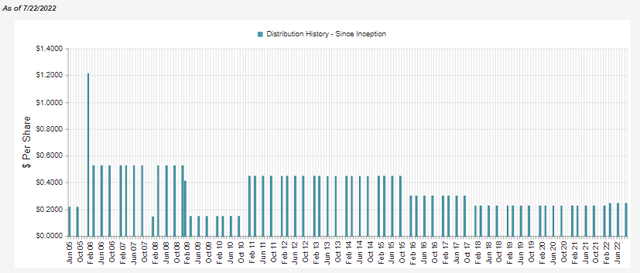

The fund’s distribution yield currently works out to 7.83%. On a NAV basis, it comes to 6.96%. This appears to be a reasonable and sustainable level. The current quarterly distribution is well below the high watermark that it achieved pre-2008. They also adjusted it lower significantly in 2015/2016. They increased heading into this year, and that was good for a 9% raise.

NFJ Distribution History (CEFConnect)

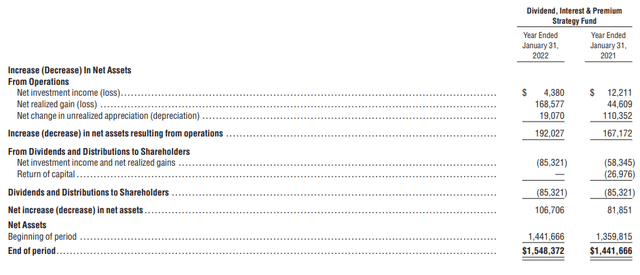

Typically, these funds will cover their distributions through capital gains. That is no different for NFJ. When taking a look at the latest annual report, we can see that net investment income we see a shortfall.

NFJ Annual Report (Virtus)

A lack of income generation on the fund isn’t too uncommon, even for the convertible sleeve. Several of the convertible bonds pay 0% rates. That TSLA position pays 2%, and that’s on the high end. The two positions in SQ are at 0% and 0.25% yields.

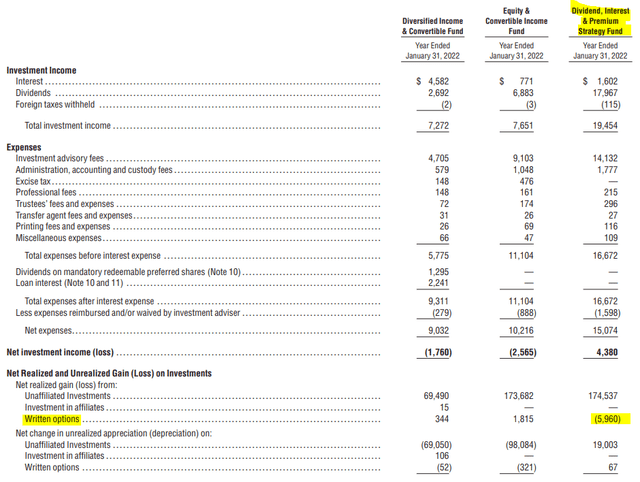

The options strategy is generally thought to bring in realized gains for the funds that utilize them. That tends not to be the case during strong performing equity years. For NFJ, it resulted in a loss of around $6 million for the previous fiscal year.

NFJ Annual Report (Virtus (highlights from author))

One way this can happen is when they close the contract at a loss after a position has run up higher. Compared to the size of the fund, this was a relatively minor loss, and the underlying portfolio’s gains were more than enough to offset the loss. The gains were also more than enough to cover the distribution for shareholders.

Capital gains can become more difficult to find in challenging years such as 2022. That being said, the reasonable level that NFJ is paying out now would make it appear safe.

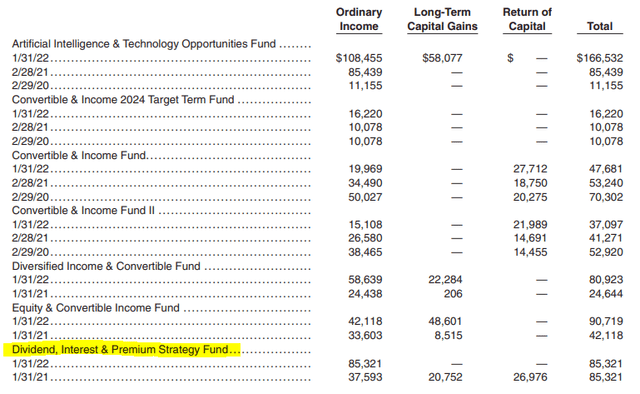

For tax purposes, the fund had attributed the entire distribution to ordinary income in the prior year. Only around 19% of this was considered qualified dividends. This was also a significant shift from the mix we saw in 2021. This is a prime example of where it can be hard to do any sort of tax planning. CEF tax classifications can shift wildly from year to year.

NFJ Tax Character (Virtus (highlights from author))

NFJ’s Portfolio

The portfolio is broken down to around 77% invested in equities and 22% invested in convertible securities. That’s right near their target of 75/25. A small allocation to cash makes up the small difference to come out to 100% here.

The managers are fairly active with this fund. Last year they reported a turnover rate of 63%. In the prior year, it was 104%. That means the portfolio can change quite frequently.

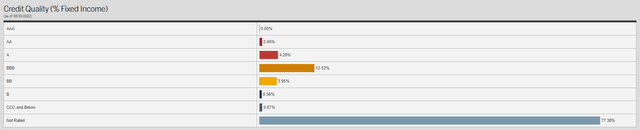

For the credit quality breakdown on their portfolio, the majority of the ratings are unrated. That isn’t uncommon for convertible funds. They are generally private and more heavily invested in by institutions rather than retail clients. The institutions can do their own due diligence. For the company issuing these securities, it means fewer costs and time for these offerings.

NFJ Credit Quality (Virtus)

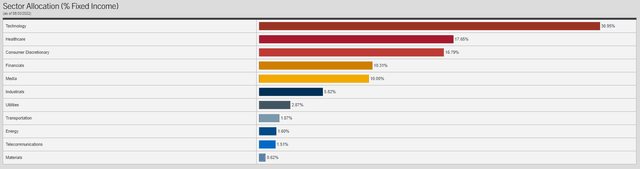

The credit quality here is only in reference to the convertible sleeve of this portfolio. Within that sleeve, the weighting to tech is the dominant sector exposure.

NFJ FI Sector Allocation (Virtus)

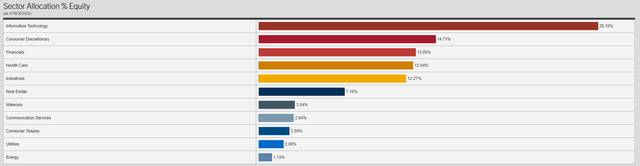

On the equity side of the equation, we see that tech also has the highest exposure there too.

NFJ Sector Allocation (Virtus)

This puts the fund in a situation where tech is the dominant weighting of the portfolio. This isn’t inconsistent with where we see other hybrid funds investing. In fact, it is almost just mirroring the general “market” these days, with tech being an overly large weighting.

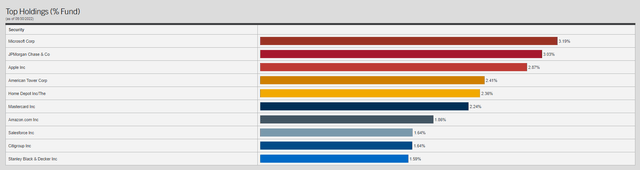

When looking at this fund’s top holdings, I’m pleasantly surprised. Despite the significant underperformance over the years, they have an interesting portfolio at the top. I hold several of the names here personally, such as Microsoft (MSFT), which is their largest holding. I also hold JPMorgan (JPM), Home Depot (HD) and Mastercard (MA).

MSFT is the type of position that we see in most of these funds. That is the same with its position in Amazon (AMZN) and Apple (AAPL). Despite these names, it wasn’t enough to offset the losses in the rest of the portfolio that the fund experienced.

NFJ Top Ten (Virtus)

As we showed above, the smaller portion of the convertible sleeve holds the more speculative names that have been crashing this year. That’s ultimately what has been dragging the fund down the most. The more growth-oriented names with the heavier exposure to tech result in subpar results for NFJ. Not that these large-cap names haven’t also been creating losses, they’ve just been relatively more stable through this volatile year.

Conclusion

On the surface, we have an interesting fund, but beneath, it has underperformed. That isn’t saying it isn’t a worthwhile fund since it also represents different weightings than what we usually expect.

In particular, the weightings of convertible securities make them a bit more unique. While these convertibles should offer some downside protection, we haven’t seen that play out. That seems to result from the convertible bond exposure going to the more speculative types of growth names.

For investors that do want more of that type of exposure, this is certainly an interesting fund. The fund’s current discount is also fairly attractive relative to its peers, which have been experiencing some stretched valuations.

My takeaway is that I already have some of the same convertible exposure in other names. I also own other covered call funds that I prefer that don’t mix in these more speculative names that convertible exposure can bring.

Be the first to comment