bombermoon

Thesis

We updated investors in our pre-earnings article in early July that the reward-to-risk profile for adding NextEra Energy, Inc. (NYSE:NEE) stock was not attractive. However, the stock outperformed the market in August, leveraging the passage of the recent Inflation Reduction Act (IRA).

Management is also confident that it could leverage the credits afforded by the IRA over the next two decades, given the scale of its renewables business, as part of the company’s long-term plan to reach true zero-carbon by 2045.

We do not doubt that NEE has been a tremendous winner for investors over the past five to ten years. Its 5Y and 10Y total return CAGR of more than 20% is a testament to the market’s confidence in its execution.

Management has also telegraphed its EPS outlook through 2025, providing clear visibility for investors over the medium term.

Despite that, we believe the near- and medium-term upside in NEE is likely reflected in its valuations. While NEE could still benefit from near-term upside bias given its robust medium-term uptrend support, we see significant downside risk compared to upside potential at the current levels.

We also gleaned that its price action could be configured for a medium-term downward reversal. The market seems to be setting up NEE for a steeper fall, digesting the froth that has led to its overvaluation.

As a result, we revise our rating from Hold to Sell and urge investors to take some exposure out of NEE. New investors should also bide their time on the sidelines and wait for a more attractive entry point to improve their reward-to-risk profile.

NEE’s Valuations Are Too Expensive

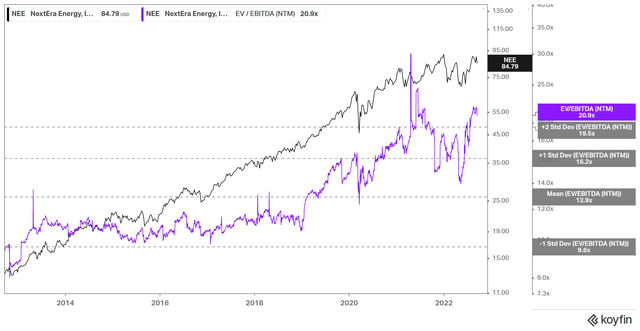

NEE NTM EBITDA multiples valuation trend (koyfin)

With an NTM EBITDA multiple of nearly 21x, NEE last traded well above the two standard deviation zones above its 10Y mean of 12.9x. Therefore, we argue that no matter how we see it, much of its near- and medium-term upside has been reflected in its current valuation.

Therefore, we believe investors looking to buy at these levels expect NextEra to execute immaculately through 2025.

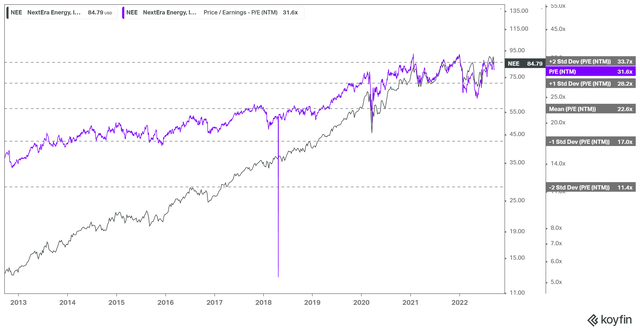

NEE NTM normalized P/E valuation trend (koyfin)

We also gleaned similar observations from NEE’s NTM normalized P/E multiples. As seen above, NEE’s buying upside has consistently faced robust resistance at the two standard deviation zone above its 10Y mean.

However, we deduce that the market has re-rated NEE, given its solid execution, with a robust medium-term outlook through FY25.

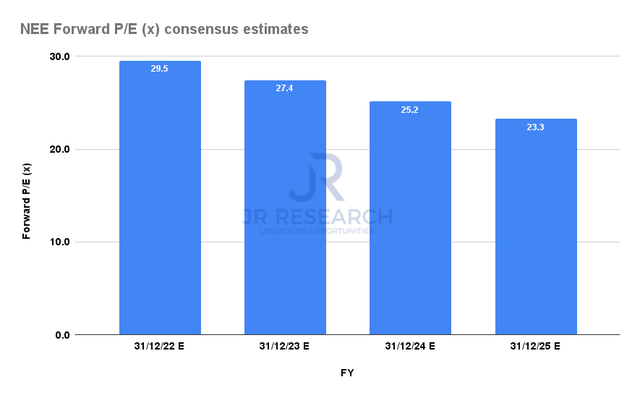

NEE Forward normalized P/E consensus estimates (S&P Cap IQ)

As elucidated earlier, we highlighted that the current valuation had captured much of its near- and medium-term upside. We parsed the consensus estimates on its adjusted EPS, predicated on management’s guidance through 2025.

Accordingly, NEE last traded at an FY25 normalized P/E of 23.3x, which is still above its 10Y mean of 22.6x. While that zone has supported its buying momentum in 2021 and 2022, we believe outperformance at the current levels could be challenging.

Furthermore, unforeseen execution issues relating to its massive capital investments toward its renewables future could lead to unexpected value compression. While the IRA has certainly spurred near-term momentum, investors need to consider the criticality of executing its massive CapEx through 2025, burning through its operating cash flow along the way.

Investors Need High Conviction On NextEra Energy’s Execution

NextEra has a multi-year investment plan to capitalize on its expertise, scale, and competitive advantages to be a leader in a market it envisages worth nearly $7T by 2050 (full decarbonization of the US economy).

However, investors need to have a firm conviction of the company’s execution, which could be laden with significant risks, given its capital investments. CFO Kirk Crews accentuated:

Now, this is obviously a multi-decade vision. In the next four years, we expect to deploy roughly $85 billion to $95 billion of capital. Based on that level, we certainly expect to continue to be a top-5 capital investor in U.S. infrastructure. (Barclays 2022 CEO Energy-Power Conference)

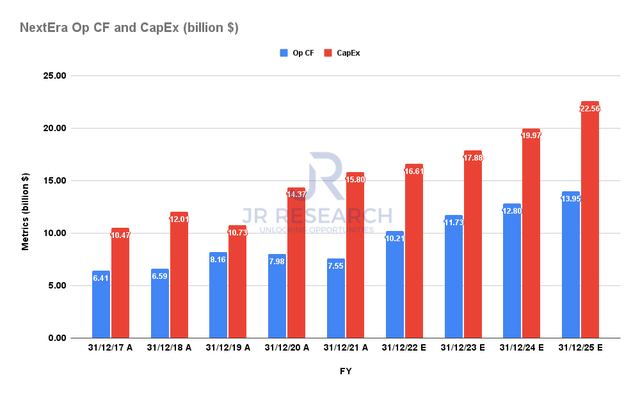

NextEra Operating cash flow and CapEx consensus estimates (S&P Cap IQ)

As a result, NextEra’s CapEx is expected to continue to surge well above its operating cash flow, necessitating the company to seek financing to fulfill its infrastructure ambitions. Therefore, we believe it increases the potential for execution challenges, even as NextEra remains the leading player in its field.

However, we postulate that NEE’s current valuations have not reflected a generous buffer to address potential execution risks. Hence, we see higher downside risks at the current levels.

Is NEE Stock A Buy, Sell, Or Hold?

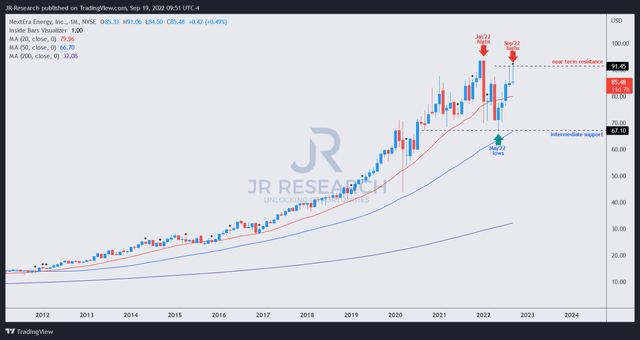

NEE price chart (monthly) (TradingView)

NEE has benefited from the passage of the IRA, as it surged toward its August highs, outperforming the broad market, despite the recent pullback.

However, our analysis suggests its upward momentum has faced tremendous selling pressure at its near-term resistance level, as annotated in the chart above.

Furthermore, we believe NEE’s price action portends a steeper fall ahead, which also corroborates our assessment of its overvaluation.

As a result, we believe investors should use the recent rally to cut exposure in NEE, as it looks overvalued and primed for digestion by the market.

We revise our rating on NEE from Hold to Sell.

Be the first to comment