gorodenkoff

A Quick Take On ASP Isotopes

ASP Isotopes (ASPI) has filed to raise $30 million in an IPO of its common stock, according to an S-1 registration statement.

The firm is developing advanced material technologies for nuclear imaging and nuclear fuel markets.

ASPI is still at a pre-revenue stage of development.

I’ll provide a final opinion when we learn more about the IPO from management.

ASP Overview

Boca Raton, Florida-based ASP was founded to develop enrichment technologies for Molybdenum-100 for use in nuclear imaging and Uranium-235 for potential use in small modular reactors.

Management is headed by co-founder, Chairman and CEO Paul E. Mann, who has been with the firm since inception in September 2021 and was previously CFO of biotechnology company PolarityTE [PTE] and otherwise has an investment background.

The company has licensed relevant technology from Klydon Proprietary Ltd. and intends to use an aerodynamic separation process [ASP] as the basis for its approach.

As of June 30, 2021, ASP has booked fair market value investment of approximately $11.6 million as of June 30, 2021 from investors including Broadband Capital Investments and various individuals.

ASP’s Market & Competition

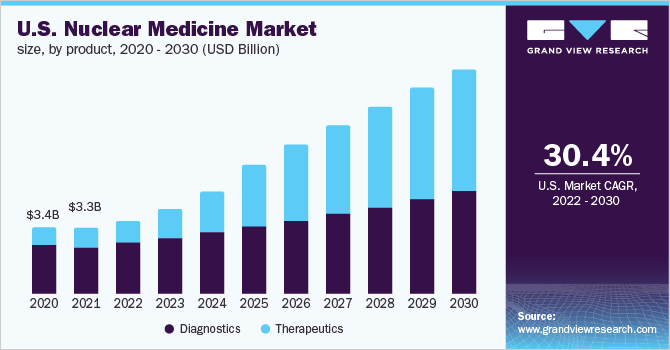

According to a 2022 market research report by Grand View Research, the global market for nuclear medicine was an estimated $8.1 billion in 2021 and is forecast to reach $24.3 billion by 2030.

This represents a forecast CAGR of 13.0% from 2021 to 2030.

The main drivers for this expected growth are favorable reimbursement policies in the U.S. as well as an increase in demand for services due to an aging global population.

Also, the chart below shows the historical and projected future growth trajectory for the U.S. nuclear medicine market:

U.S. Nuclear Medicine Market (Grand View Research)

Major competitive or other industry participants include:

-

GE Healthcare

-

Jubilant Life Sciences Ltd

-

Nordion (Canada), Inc.

-

Bracco Imaging S.P.A

-

The institute for radioelements [IRE]

-

NTP Radioisotopes SOC Ltd.

-

The Australian Nuclear Science and Technology Organization

-

Lantheus Medical Imaging, Inc.

-

Eckert & Ziegler

-

Mallinckrodt

-

Cardinal Health

ASP Isotopes’ Financial Performance

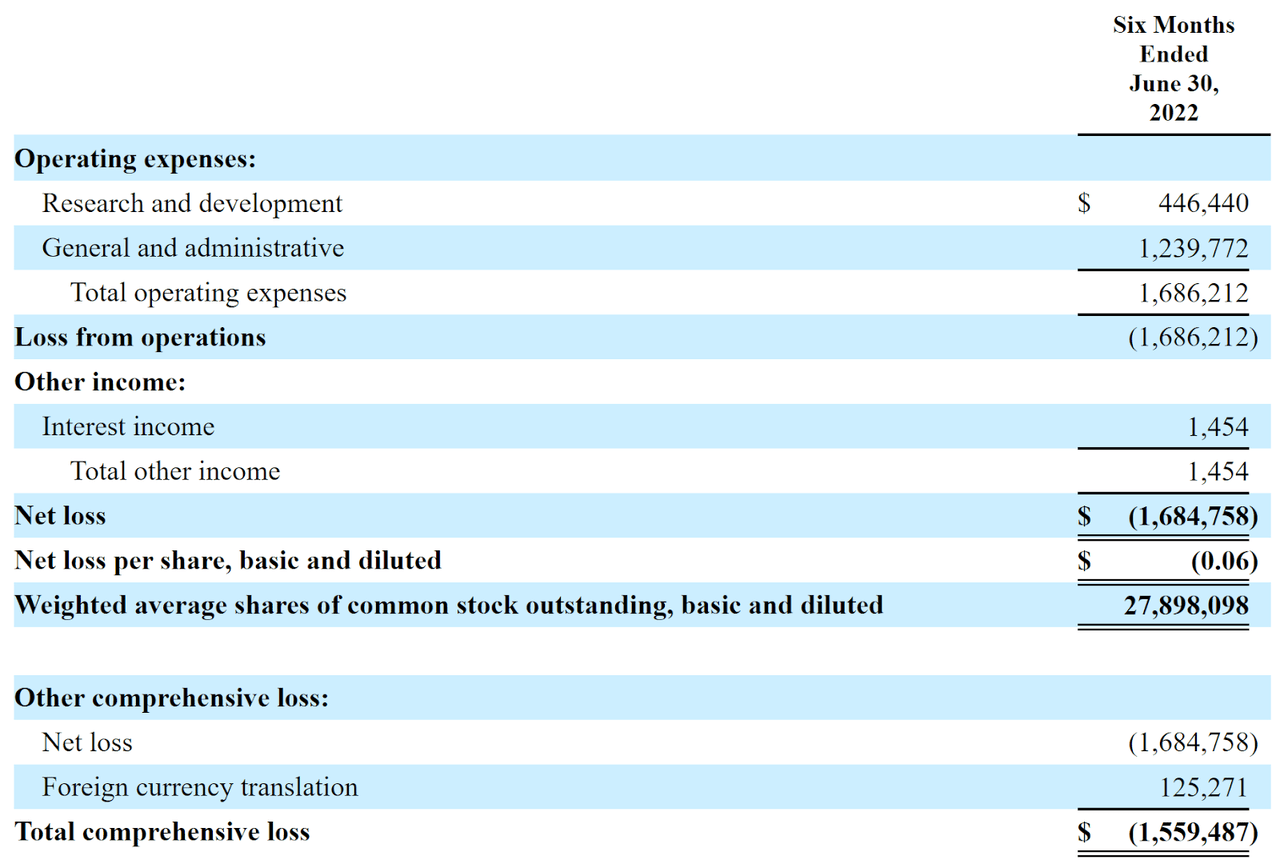

Below are relevant financial results derived from the firm’s registration statement:

Statement Of Operations (Seeking Alpha)

As of June 30, 2021, ASP had $2.8 million in cash and $2.6 million in total liabilities.

Free cash flow during the six months ended June 30, 2021, was negative ($3.1 million).

ASP Isotopes IPO Details

ASP intends to raise $30 million in gross proceeds from an IPO of its common stock, although the final figure may differ.

No existing shareholders have indicated an interest to purchase shares at the IPO price.

Management says it will use the net proceeds from the IPO as follows:

We initiated Phase 1 of the Mo-100 development plan under the turnkey contract, targeting 5 kg/year of 95% enriched Mo-100, in October 2021 and we expect to complete this phase using cash on hand during the second half of 2022. Upon completion of Phase 1, we intend to use a portion of the net proceeds from this offering (currently estimated to be approximately $6 million of the total net proceeds) to initiate and fully fund Phase 2 of the Mo-100 development plan under the turnkey contract, which targets expanded production of up to 20 kg/year of 95% enriched Mo-100. We intend to use the remainder of the net proceeds we receive from this offering for research and development for potential additional isotopes that we may offer, as well as headcount costs, working capital and other general corporate purposes.

(Source – SEC)

Management’s presentation of the company roadshow is not available.

Regarding outstanding legal proceedings, management says the firm is not currently a party to any legal proceedings that are material.

The sole listed bookrunner of the IPO is Revere Securities.

Commentary About ASP’s IPO

ASPI is seeking public capital market investment to fund expansion and ramp-up of its Mo-100 enrichment capabilities.

The company’s financials show no revenue and various R&D and G&A expenses associated with its early stage development efforts.

Free cash flow for the six months ended June 30, 2021, was negative ($3.1 million).

The firm currently plans to pay no dividends and to retain any future earnings to reinvest back into the company’s growth initiatives.

The market opportunity for producing products for use in the nuclear medicine market is large and likely to grow at a similar high rate of growth as overall demand grows in the coming years, so the firm enjoys positive industry growth dynamics.

Nuclear fuel markets also represent a potential long-term growth opportunity.

Revere Securities is the sole underwriter and there is no data on IPOs led by the firm over the last 12-month period.

The primary risk to the company’s outlook is its small status and lack of revenue history.

When we learn more about management’s pricing and valuation assumptions for the IPO, I’ll provide an update.

Expected IPO Pricing Date: To be announced.

Be the first to comment