Justin Sullivan

Glory Days

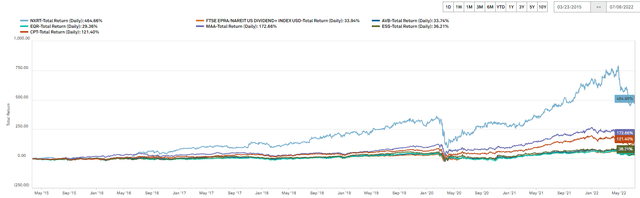

As the chart below describes, NexPoint Residential (NYSE:NXRT) shares, since their 2015 IPO, delivered a gravity defying performance in the stock market. That is until April 28th.

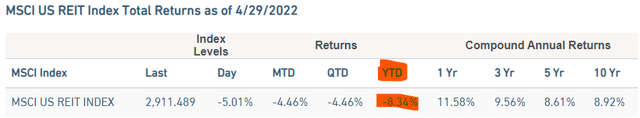

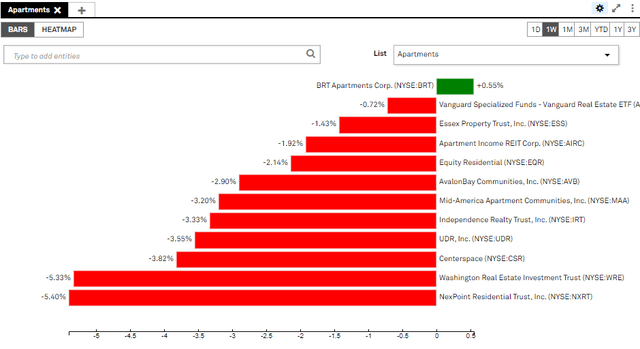

Even as everyone posed the perennial question, “How will REITs perform in a rising interest rate environment?”, NXRT’s share price continued to ascend while the RMS succumbed to mounting fear. Starting the year at $82.95, NXRT’s price slowly rose to over $95 (+14.5%) while the broader REIT market slowly deflated.

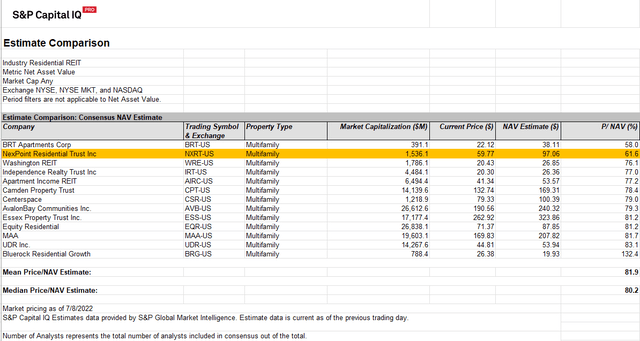

NexPoint entered 2022 with a superior valuation relative to its apartment REIT peer set and the premium just built from there.

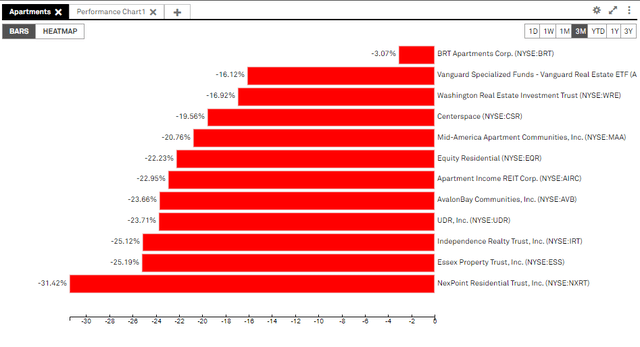

By the end of April, however, perception for the whole market began to turn darker and NXRT entered a freefall as the shares raced past peers toward a bottom.

And last week the decline accelerated.

So, What’s Happening?

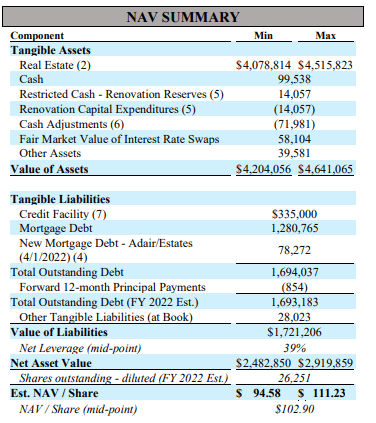

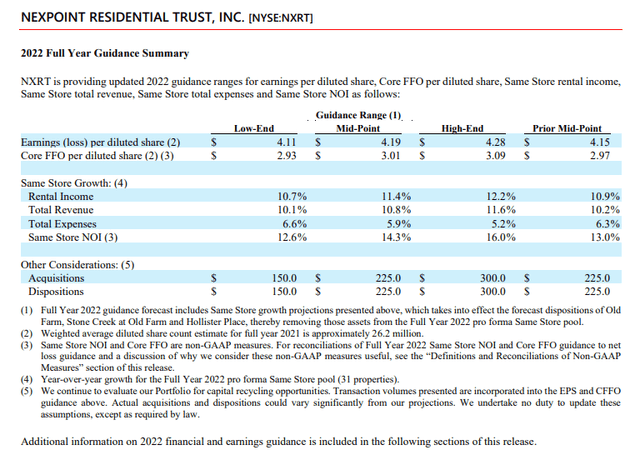

On April 26, NexPoint reported 1Q22 operating results, issued a new Net Asset Value of $102.90, and raised guidance. Same store NOI is expected to rise 14.3%, bringing core FFO/share guidance up to $3.01 at Mid-Point.

Every quarter NXRT provides a detailed breakdown of their Net Asset Value calculation and it is always driven by what they and their peers have recently experienced in their given sub-markets. What they and their sunbelt peers are experiencing are rising rents and property values. So the NAV is up.

NXRT

Is a Slowdown Looming?

In a recent report Costar Group cited that the 3rd consecutive quarter of diminishing apartment demand would lead to rising vacancy rates in the next six months and that Q2 rent growth nationally increased 9.2% compared to an 11.4% increase in Q1. The same report noted that the Sunbelt and South (NXRT’s markets) continued to exceed the national average. On Tuesday, the Wall Street Journal reported that rising rents and housing costs would continue to fuel inflation. They quoted Camden Property Trust (CPT) CEO, Ric Campo in saying he expects it will take between 18 and 24 months for supply to catch up. “Rent growth will slow down eventually”. CPT and NXRT are in many of the same markets.

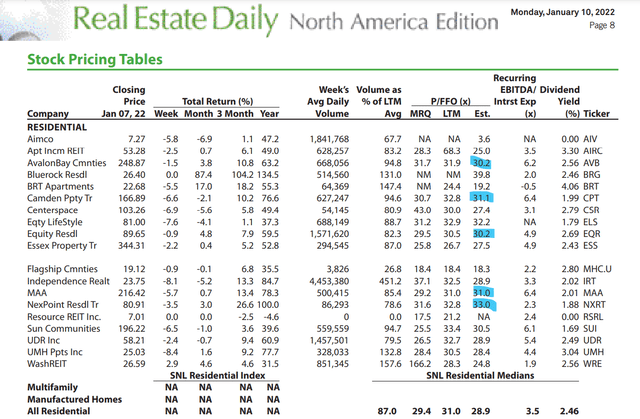

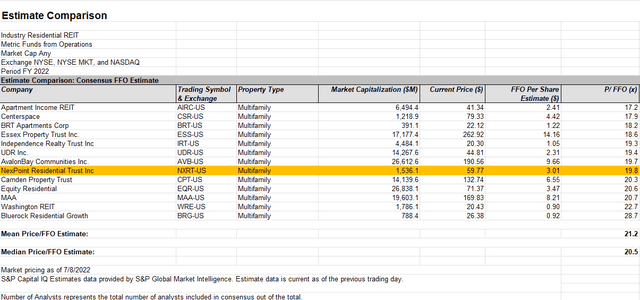

So, NexPoint upped their guidance and Camden thinks they can continue to raise rents for some time to come. This optimism is not reflected in multifamily REIT share prices and the whole sector has taken a beating in the last few months. NXRT’s premium valuation has evaporated and it is now demonstrably cheaper than its peers.

NXRT’s January 33x P/FFO listed at the top of the article has now fallen to just 19.8x, lower than Sunbelt peers CPT and MAA.

Its current $59 share price translates to just 61% of consensus NAV, which contrasts to 78% and 81% for CPT and MAA, respectively.

Debt, Interest Rates, and REITs

The Fed’s primary tool to quash the raging inflation we are currently experiencing is to set an aggressive pace of hikes to the Fed Funds rate. They have raised three times this year and the June Jobs report and today’s CPI report from the Bureau of Labor Statistics are reasons to believe more hikes are on the way.

Historically heavy debt loads are why REITs are commonly perceived to be a particularly interest rate sensitive business sector. After the Great Financial Crisis, however, REITs have exercised impressive discipline and pared their debt levels materially. More importantly, the industry took advantage of the decade long availability of unprecedently low cost credit and locked in long term debt in anticipation of eventually rising interest rates.

But not NXRT.

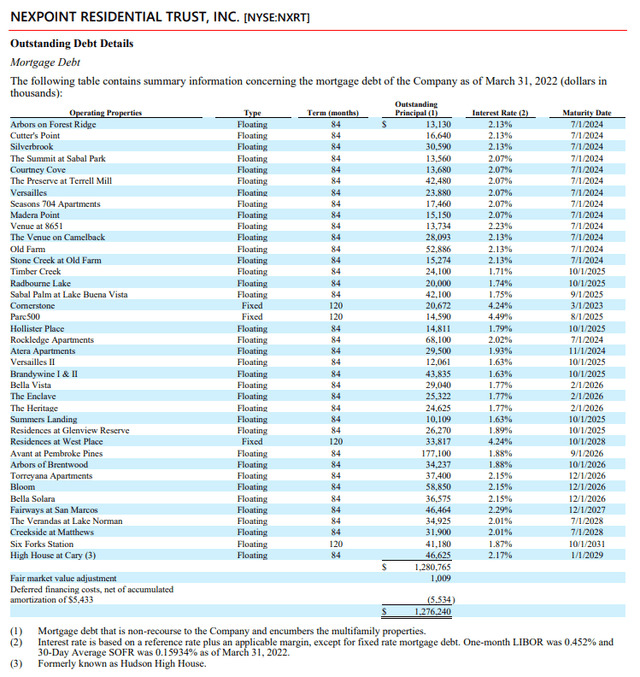

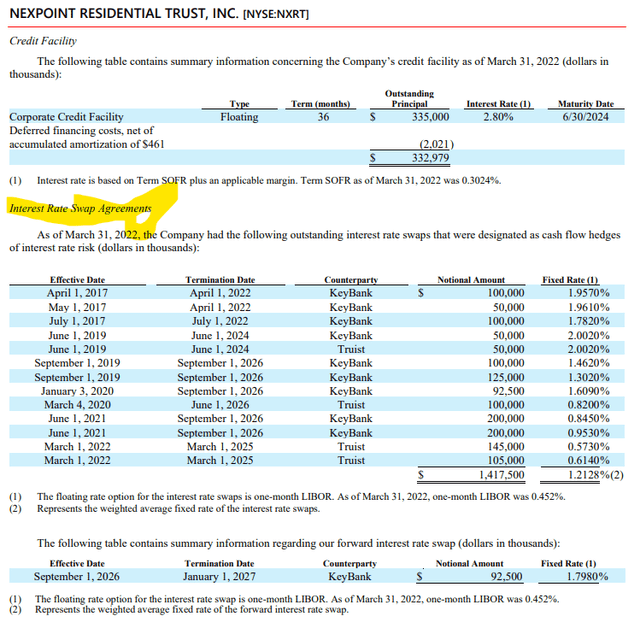

From the beginning, NexPoint management felt that their value-add strategy could be best executed in carrying ample, variable-rate debt that allowed them flexibility in property sales and capital recycling. That is how they operate still.

They are fastidious in every aspect of their management and, in addressing their debt, acted to effectively hedge their interest rate risk through an array of interest rate swap agreements.

In previous articles I have expressed how impressed I have been with NXRT management’s skill and insight. They may have operations completely under control, but to the outside world it probably just looks like risk and that may be why the markets have been so brutal to NXRT shares.

We’ll Soon Know More

NexPoint Residential has been exceptionally successful in targeting the best markets and investing for outsized profits. They report 2Q earnings on Tuesday, July 26. Fingers crossed.

Be the first to comment