monsitj

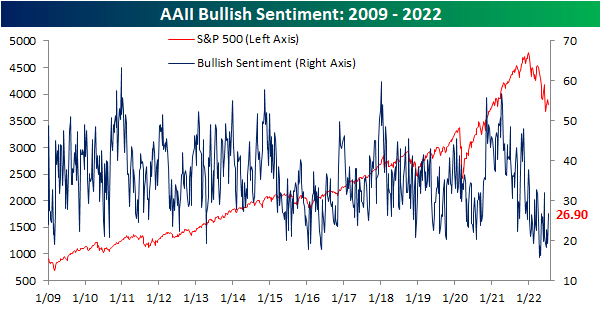

In spite of the S&P 500’s consistent declines in the past week as it failed to take out its late-June highs, investor sentiment has turned around (relatively speaking), with this week’s reading from the AAII showing 26.9% of respondents reporting as bullish for the first time since early June. The 7.5-percentage point increase in the percentage of bullish responses this week was a large week-over-week increase by historical standards, although there have been multiple even larger weekly increases over the past few months.

AAII Bullish Sentiment 2009-2022 (Author)

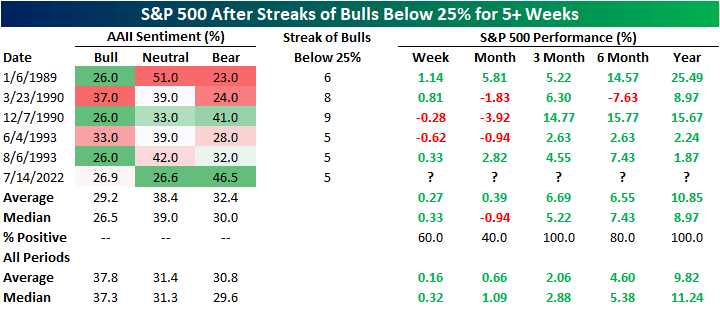

With the increase in bullish sentiment, over a quarter of respondents reported as bullish for the first time in five weeks. Such extended streaks with as depressed readings have been few and far between, with the last five-week streak occurring all the way back in the summer of 1993. Overall, there have now only been six streaks in which bullish sentiment remained below 25% for at least 5 consecutive weeks. The longest of these was in December 1990, when it went on for 9 weeks in a row. Albeit a small sample size, historically the end of these streaks have not been raging buy signals for the S&P 500 in the short term, with in-line performance versus all periods and somewhat weak returns one month out. However, three, six, and twelve months later, the S&P 500 has been higher almost every time with slightly stronger-than-normal performance (six months out from the March 1990 occurrence was the only decline).

S&P 500 After Streaks Of Bulls Below 25% For 5+ Weeks (Author)

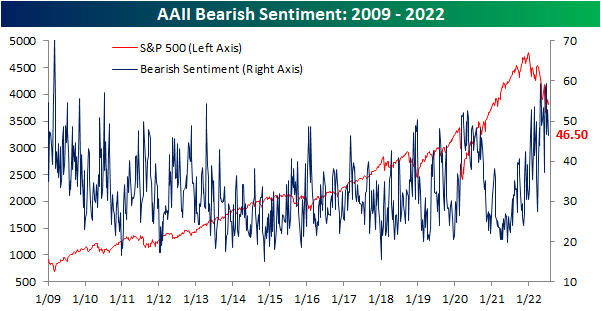

The increase in bullish sentiment was met by bears falling back below 50% to 46.5%. Mirroring bullish sentiment, that made for the lowest reading since the first week of June.

AAII Bearish Sentiment 2009-2022 (Author)

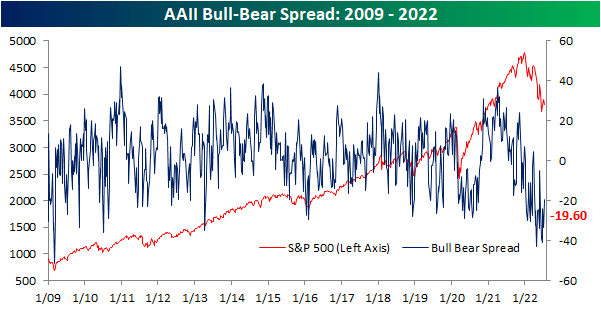

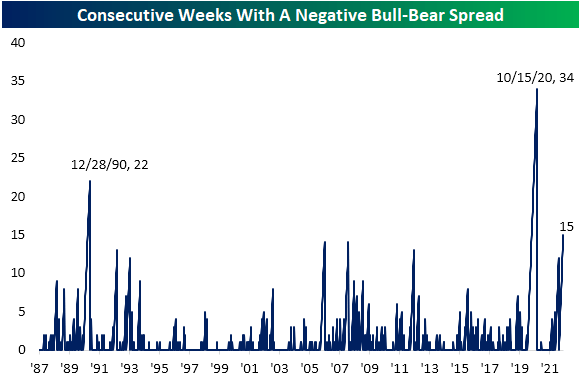

As a result of those moves, the bull-bear spread remains firmly in favor of bears. With the percentage of bearish responses outnumbering bulls by 19.6 points, for the 15th week in a row the bull-bear spread remains negative. That streak has grown to be the third-largest on record behind a 22-week streak ending in late 1990 and a 34-week streak ending in October 2020.

AAII Bull-Bear Spread 2009-2022 (Author) Consecutive Weeks With A Negative Bull-Bear Spread (Author)

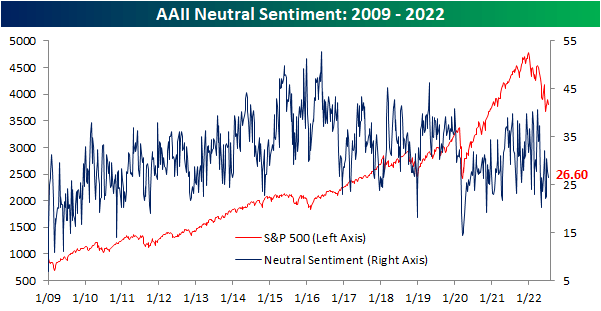

Neutral sentiment has managed to avoid major shifts in sentiment in recent weeks, and this week was no exception. This reading fell modestly from 27.8% to 26.6%. That is well within the range of the past couple of years’ readings and is only the lowest since three weeks ago.

AAII Neutral Sentiment 2009-2022 (Author)

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment