klosfoto/E+ via Getty Images

Defense wins championships. It can also produce alpha in volatile bear markets like we’re in right now. Consumer Staples (XLP) took a beating during May following quarterly profit reports from Walmart (WMT) and Target (TGT). Those two big-box retailers had shockingly poor inventory management execution. The upshot for us as consumers is perhaps discounts on outside patio furniture this summer.

In the kitchen, Newell Brands (NASDAQ:NWL) may be best known for producing Rubbermaid containers. The junk drawer also houses NWL brand names like Elmer’s glue, Expo markers, and Yankee Candles. According to The Wall Street Journal, Newell Brands “engages in the manufacture, marketing, and sale of consumer and commercial products. It operates through the following segments: Commercial Solutions, Home Appliances, Home Solutions, Learning and Development, and Outdoor and Recreation.”

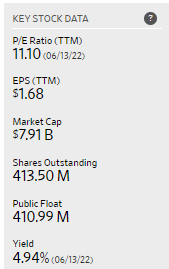

It’s an $8 billion market cap staples stock with an attractive 11x TTM P/E ratio. NWL also sports a very high dividend yield of nearly 5%, per the WSJ.

NWL Stock Data: Low P/E, High Yield

Wall Street Journal

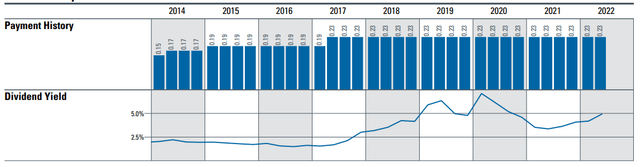

According to S&P Global Market Intelligence, NWL dividends have been on the rise. The recent pullback in shares results in a historically high yield.

Newell: A Strong Dividend Payer, High Current Yield

S&P Global Market Intelligence

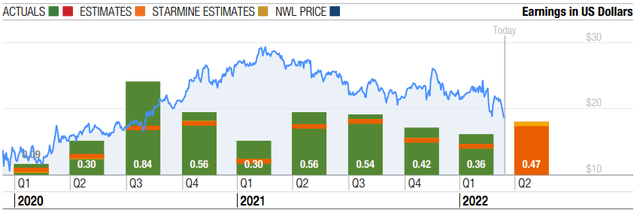

Newell has beaten on its past nine earnings reports as the company continues to execute despite rising input prices and climbing labor costs. Its Q1 report featured a 20% rise in EPS year-on-year.

NWL: Strong Earnings Beat Rate History, 20% YoY EPS Growth In Q1

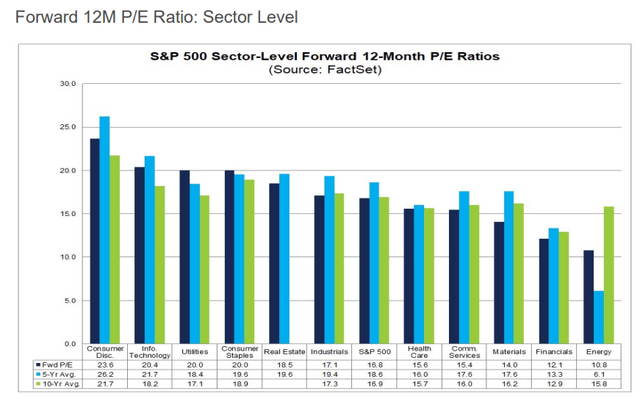

Staples companies are indeed concerned about inflation. According to John Butter’s weekly FactSet Earnings Insights report, a whopping 97% of the sector’s companies cited inflation on earnings conference calls. FactSet also reports that Consumer Staples has a steep 20x forward P/E ratio. Contrast that with NWL’s 9x P/E using the current earnings forecast, according to Nasdaq.com.

FactSet: Consumer Staples Trade With A High Forward P/E

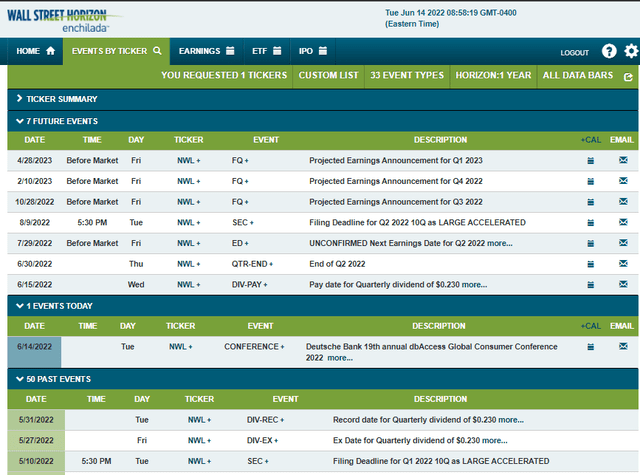

A key conference happens this week. Newell presents at the 19th annual dbAccess Global Consumer Conference held in Paris today through Thursday, according to Wall Street Horizon. Many other Consumer Staples stalwart companies are slated to speak at the event, so there could be market-moving news.

The next earnings report is unconfirmed to be on Friday, July 29 BMO.

Corporate Event Calendar: Key Conference In Paris This Week

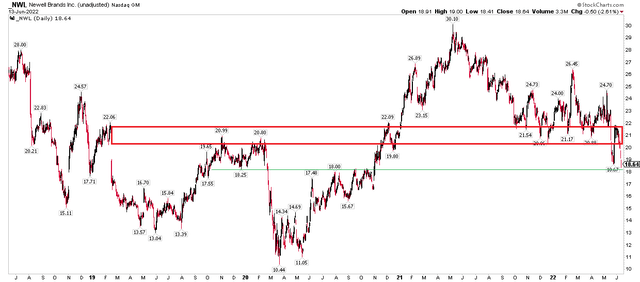

The Technical Take

Unfortunately, the price chart paints a much different picture than the fundamental earnings, valuation, and dividend trends. The stock peaked at about $30 in 2021, but then went on to lose more than one-third of its value to where we are now. A support zone in the $20-$22 range was lost earlier this quarter, too. I do see some support at $18, but I am not confident with that. Overall, it’s a poor chart. Short-term traders should consider shorting the stock if it breaks $18.

Long-term investors should understand that more pain might come, but a healthy yield and low valuations make it a good long-term play in an expensive sector.

NWL 4-Year Chart: Below Resistance, Some Soft Support At $18

The Bottom Line

Cheap valuations and a high dividend offer long-term investors a good opportunity with Newell. “Sticking” with shares could be a good move right now looking out many years, but the near-term technical view is weak.

Be the first to comment