slovegrove

It’s been a tough start to the year for the Gold Miners Index (GDX), and Newcrest (OTCPK:NCMGF) hasn’t been spared, despite having a much better year from a margin standpoint. This was helped by the copper price, which until recently was running counter to the gold price, providing a nice boost to Newcrest’s margins (by-product credits). However, the real margin expansion comes later this decade, and Newcrest has a path to becoming a primarily Tier-1 jurisdiction producer with $1,000/oz plus AISC margins. Given this unique position, I see the stock as a buy at A$19.75.

All figures are in United States Dollars unless otherwise stated. Newcrest (NCM.ASX) trades significant daily volume on the Australian Stock Exchange but limited volume on the OTC Market. Therefore, the best way to trade the stock is on the Australian Stock Exchange, and there is a significant risk to buying on the OTC due to wide bid/ask spreads, low liquidity, and no guarantee of future liquidity.

Red Chris Mine (Company Presentation)

Newcrest Mining’s Q3 Results (CYQ1)

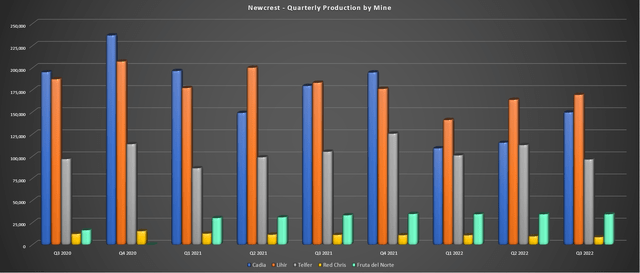

Newcrest released its fiscal Q3 (calendar year Q1) results at the end of April, reporting quarterly gold production of ~479,800 ounces and 31,000 tonnes of copper. The strong quarter was helped by a sharp increase in production at Cadia, which saw higher production now that the SAG mill motor is back operating at full capacity (replacement upgrade in fiscal Q2 impacted production). The company also saw its first contribution from the high-grade Brucejack Mine in British Columbia (acquired in its Pretium acquisition), which produced ~17,000 ounces in the three-week period following the transaction’s close. Finally, Lihir had a better quarter, benefiting from improved grades/recovery rates.

Newcrest – Quarterly Production by Mine (Company Filings, Author’s Chart)

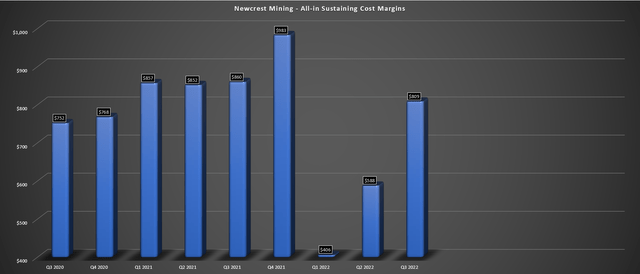

This increase in production pushed year-to-date production to ~1.31 million ounces, with the company confident it can meet its updated FY2022 guidance of ~1.92 to ~2.02 million ounces of gold. Meanwhile, from a cost standpoint, we saw a significant improvement, helped by higher by-product credits, with the copper price improving to ~$10,000/tonne, up from ~$9,600/tonne in fiscal Q2 and ~$8,500/tonne in fiscal Q3 2021. This improved margins vs. fiscal Q2 levels, with all-in sustaining cost [AISC] margins increasing to $809/oz vs. $588/oz. On a full-year basis, margins were down slightly, related to the high-cost quarter at Lihir (fiscal Q3 2022: $1,533/oz).

Newcrest – Quarterly All-in Sustaining Cost Margins (Company Filings, Author’s Chart)

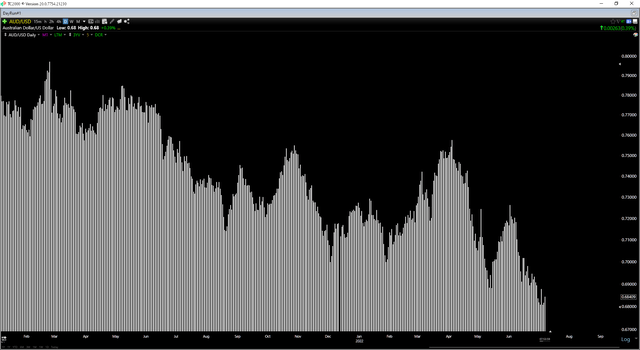

The good news is that the Australian Dollar continues to weaken against the US Dollar, which should be a slight tailwind for the company going into FY2023 (July 1st, 2022, to the end of June 2023). The same is true of the Canadian Dollar, which will also help its Brucejack and Red Chris operations. So, while Newcrest isn’t getting as much help from the copper price from a by-product credit standpoint while it’s below $3.80/lb nor the gold price after its recent swoon, it is getting a little help from a currency standpoint. Putting this all together, combined with the addition of a lower-cost operation (Brucejack), I would expect to see costs decline year-over-year despite inflationary pressures (FY2023 vs. FY2022).

Australian Dollar vs. US Dollar (TC2000.com)

Long-Term Potential

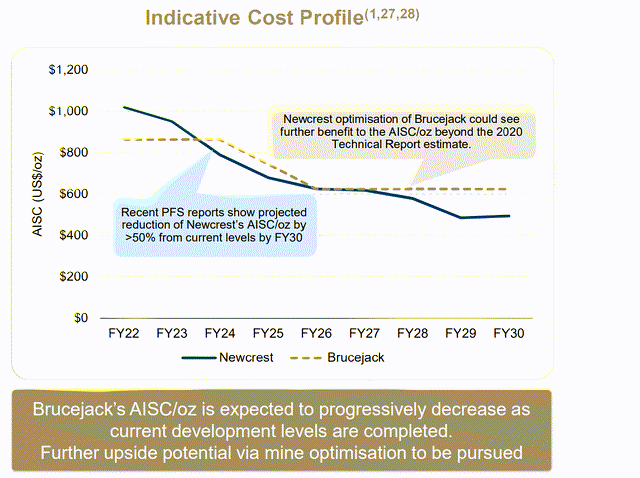

Looking at Newcrest’s long-term potential, the company may not have industry-leading production growth, but the company could make up for this with considerable margin expansion. This is because the company could look at increasing throughput at Brucejack closer to the 5,000-tonne per day mark, making this a lower-cost operation at a nearly 450,000-ounce per annum production profile (Pretium operated at less than 400,000 ounces). In addition, the company’s Red Chris Block Cave [RCBC] which is set to come online later this decade, is expected to have negative all-in sustaining costs, assuming a copper price of $3.50/lb or higher. Finally, Havieron is projected to contribute to lower costs at Telfer.

Newcrest – Long-Term Cost Outlook (Company Presentation)

The combination of negative AISC at Red Chris, a larger production profile at Brucejack, and lower costs at Havieron could pull Newcrest’s consolidated costs below $650/oz by FY2028. In the company’s recent presentation, it seems to believe that it can get costs below $550/oz, which would be a very impressive feat, placing its costs more than 50% below the industry average. There is certainly a path to achieving this if copper prices remain strong, and it can turn Brucejack into an ultra-high-margin operation from a high-margin operation. However, the key will be to bring costs down at Lihir, which makes up ~35% of production and has costs above the industry average (trailing-twelve-month costs: ~$1,400/oz).

Even if we take a more conservative outlook and assume the company misses on its long-term outlook of sub $550/oz costs and comes in at $700/oz, Newcrest would still be the lowest-cost gold producer globally in the million-ounce producer space. This would allow the company to enjoy a premium multiple relative to peers, given that it could easily weather any down cycle in the gold market and would enjoy phenomenal margins. Hence, whether the company delivers on its ambitious long-term projected cost profile (~$550/oz costs) or not, Newcrest has a very bright future.

The only real negative worth that detracts from its premium valuation is that over 30% of production comes from a Tier-3 ranked jurisdiction (Papua New Guinea), where we did see the Porgera Special Mining Lease [SML] not immediately extended in 2020. This has since been resolved, but the profit-sharing deal fell in favor of the PNG stakeholders (53/47), a degradation from the previous terms. The good news is that Lihir’s SML was granted in 1995 for 40 years, so it doesn’t come due until 2035, giving investors a lot of breathing room to avoid negotiations similar to what BNL went through at Porgera last year. Let’s take a look at Newcrest’s valuation below:

Valuation & Technical Picture

Based on ~895 million shares and a share price of $13.20, Newcrest trades at a market cap of ~$11.8 billion, a dirt-cheap valuation for a 2.0+ million-ounce producer with a path towards sub $850/oz costs by 2025. If we compare this figure with Newcrest’s estimated net asset value of ~$13.0 billion, Newcrest trades at a rare discount to net asset value, and the last time the stock traded this cheaply was in March 2020. This turned out to be an excellent buying opportunity for the stock, with it increasing more than 90% over the following six months. Obviously, this was helped by a surge in the gold price, suggesting there’s no guarantee of a repeat performance of this magnitude. Still, from a risk standpoint, Newcrest is priced very attractively here.

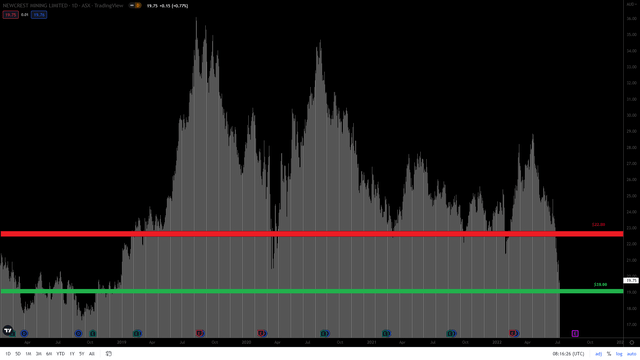

Newcrest Daily Chart (ASX) (TradingView.com)

Moving to the technical picture, Newcrest has strong support at A$19.00, within 4% of support levels. Meanwhile, its next resistance level doesn’t come in until A$22.80, pointing to a potential 16% upside from current levels before it runs into any meaningful resistance. This translates to a reward/risk ratio of 4.0 to 1.0, currently leaving Newcrest in a low-risk buy zone. Suppose the gold and copper prices continue to weaken. In that case, we could see sequential margin compression for Newcrest, especially with it lapping a favorable quarter for by-product credits (copper).

Still, with a path towards sub $850/oz AISC helped by a leaner and meaner operation at Brucejack, I wouldn’t worry too much about fiscal Q1 2023 and would be more focused on the long-term potential here from key projects like RCBC, Havieron, and growth at Brucejack. Therefore, I see this pullback in Newcrest to A$19.75 as a low-risk area to start a position in the stock if I traded on the Australian Market. However, given that I do not trade on the ASX, I continue to favor Agnico Eagle Mines (AEM), another high-margin producer with a similar valuation but much better liquidity from a trading standpoint (US/Canadian Market).

Summary

Newcrest may not stand out among its peers from a growth standpoint, given that the Brucejack acquisition will simply place it on track to recover to FY2019 production levels once optimized (~2.49 million ounces of gold). Still, the margin profile is one of the best sector-wide if Newcrest can deliver, though investors will need to be patient given that the bulk of this margin expansion will be realized from RCBC, a post-2026 opportunity. Hence, for patient investors bullish on gold and copper, I see Newcrest as a Buy at A$19.75.

Be the first to comment