IvelinRadkov/iStock via Getty Images

New Residential Investment Corp. (NYSE:NRZ) has a portfolio of mortgage servicing rights (MSRs) that is well-positioned to benefit from rising rates. We anticipate modest accretion to book value and earnings. This puts the company in a stable and slightly growing position which makes the preferreds a clean source of yield.

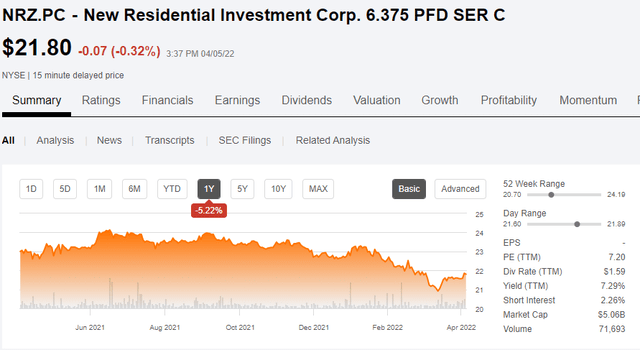

Most of the NRZ preferreds are fine with dividend yields in the 7s which provide a rough market return. The series C, however, is mispriced within the capital stack. It has the same risk profile as the other preferreds, but due to market mispricing, it has a 12.59% annualized return to call.

The company

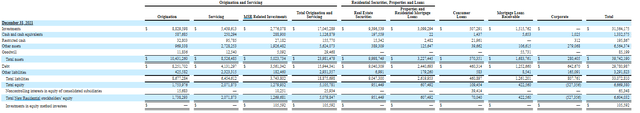

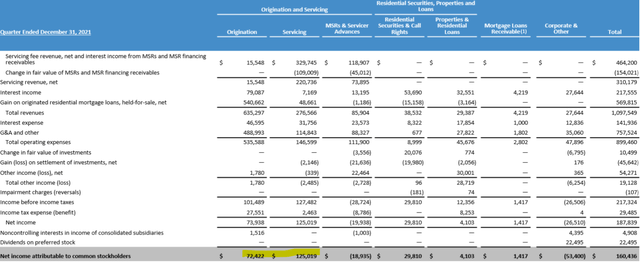

NRZ is a moderately large company with a market cap of $5B and it is the biggest non-bank owner of mortgage servicing rights. It owns assets across a variety of mortgage REIT asset types as seen in the 10-K.

The RMBS is largely used as a hedge against their MSR portfolio and it is the MSRs and originations that generate the majority of their revenue.

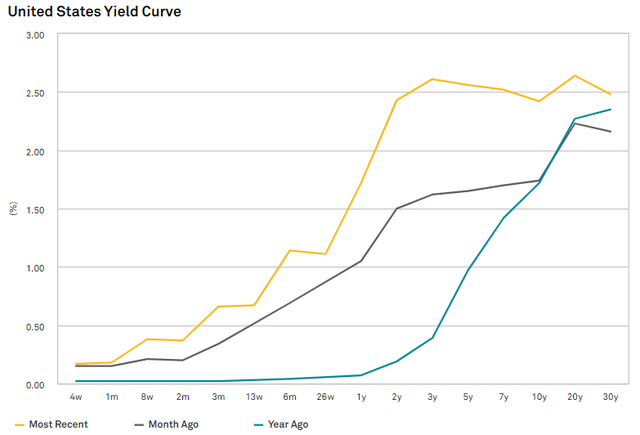

The 10-year Treasury has shot up to roughly 100 basis points since a year ago.

S&P Global Market Intelligence

Many mortgage REITs (or mREITs), and particularly the Agency mREITs are struggling right now because of rapidly rising rates. When interest rates go up, the market value of fixed income securities drops. Negative convexity caused by prepayments prevents the agency mREITs from being able to fully hedge against rising rates. As such, book values are dropping for a large portion of the mortgage REIT universe.

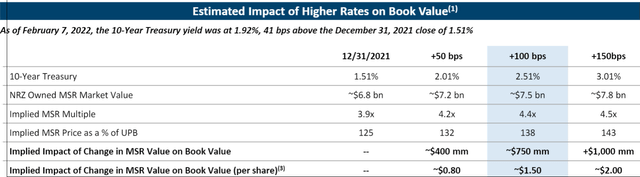

NRZ has a differentiated portfolio in that they have a heavy contingent of owned MSRs. Since NRZ gets paid for the duration of the security, rising rates is a great thing for MSRs. As present mortgage rates surpass the original mortgage rate of the existing loan, the incentive to prepay is greatly reduced. This means the MSR will pay out for a longer time period which increases its value.

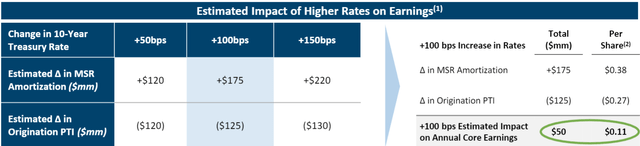

In fact, the value increase to MSRs is enough to more than offset the reduced origination volume causing NRZ to slightly net benefit from rising rates. A 100 basis point increase to the 10-year treasury yield such as what we have experienced so far this year results in an additional $0.11 of earnings.

It also helps book value by about $1.50 per share.

As mortgage rates rise, origination volumes will drop and NRZ is handling this challenge in a couple of ways:

- Reducing origination employee count to save costs

- Shifting originations to other types of loans where demand remains strong

Given the Fed’s implied intentions via the dot plot, I suspect the 10-year Treasury will continue to rise over the next couple of years.

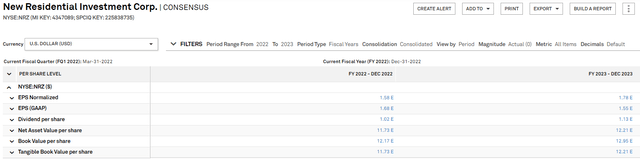

For NRZ, the benefits to owned MSRs seem to slightly outweigh the downsides, so I see it as stable and modestly growing. Analyst consensus estimates show solid growth as well.

S&P Global Market Intelligence

At 95% of book value against this fundamental outlook, the common looks decent, but I am far more excited about the opportunity in the series C preferred.

Clear mispricing of the Series C

Stocks continue to bounce around with significant volatility, and when there is this accelerated pace of change, it tends to shake some things loose. The most recent victim is New Residential Preferred C (NYSE:NRZ.PC).

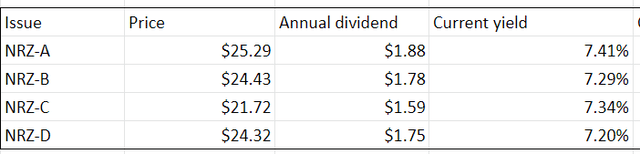

It would seem as though the market is trading the NRZ preferred with a myopic focus on current yield.

All 4 preferred issues trade in a tight band ranging from 7.2% to 7.41% current yield. Mathematically, this is ill-advised.

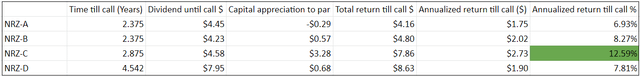

See, preferred total return comes from both dividends and capital gains. As the preferreds get redeemed, they are each redeemed at $25, so the difference in market price from $25 results in a capital gain or loss. Trading at a premium to par, the NRZ-A stands to lose $0.29 on redemption. This pulls its annualized yield till call down to 6.93%. The series B and Series D are a little better at 8.27% and 7.81% annualized return to call, respectively.

The Series C, however, stands out like a sore thumb. At $21.72, redemption results in a capital gain of $3.28 which when combined with the dividend leads to an annualized return till call of 12.59%.

That is a massive spread for issues that presumably have the same risk profile as one another. Either the preferred C is undervalued or the other 3 are overvalued. Given the stability of the underlying company, I think the 7%ish returns of the other 3 preferreds are about right and that the C represents opportunity.

Call dates and fixed to floating structure

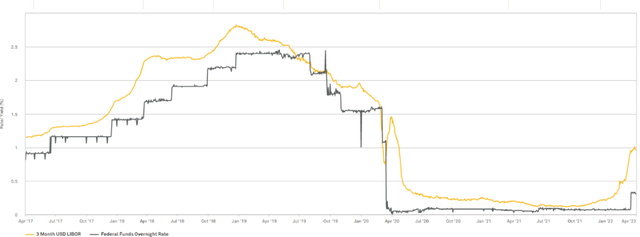

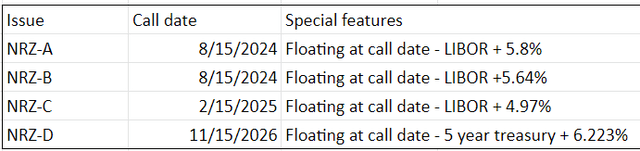

NRZ’s preferreds are structured as fixed to floating with each becoming floating rate on its call date. The first 3 are based on 3-month LIBOR with the D based on 5-year Treasury yield.

For issues trading at premiums, redemption is a negative event, and for those trading at discounts, it is favorable.

From the perspective of an investor in the C, we benefit from redemption on call date, and while I think that is reasonably likely, let us take a look at what happens if it is not redeemed.

It would start yielding LIBOR + 4.97%. Well, those familiar with LIBOR know that is no longer a great measure.

LIBOR issues

LIBOR has been under criminal investigation regarding potential manipulation by member banks. It is also referencing increasingly fewer actual transactions making it a less reliable benchmark. As such, the ICE Benchmark Administration has announced its intention to cease publication of LIBOR at least as it relates to the U.S. Dollar. Some USD LIBOR such as the one-week and 2-month will stop being reported soon with all durations to cease publication on June 30th, 2023.

So, what happens to securities such as the NRZ preferreds that reference LIBOR to calculate their floating rate payments?

Well, ICE is establishing replacement benchmarks. At this time, my best guess is that it will reference U.S. Treasury rates of the same duration or the SOFR (secured overnight financing rate). This makes calculation of the exact yield post conversion to floating rate preferreds challenging, but it is likely to be in the same ballpark as it would be with LIBOR.

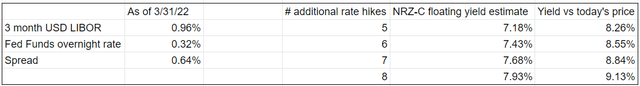

LIBOR quite consistently trades at a spread over the Fed Funds Overnight Rate.

S&P Global Market Intelligence

That spread works out to about 64 basis points. The Fed is looking to hike somewhere in the vicinity of 5 to 8 times in the next couple of years which puts the floating yield at somewhere around 7.18%-7.93%. As measured against today’s price, that would be a yield of 8.2%-9.13%.

That is a reasonably strong yield to fall back on in the event it is not redeemed.

Straight up yield instruments have been trading poorly recently out of fear of rising rates. This yield does not share that concern as it is floating rate. Given the rising interest rate environment, I would value this higher than a fixed yield of the same level.

Assuming a consensus level of Fed hikes, the NRZ preferreds are more expensive to carry than the current fixed rate structure. As such, I think NRZ will elect to replace them with a cheaper cost of capital as they reach their call dates and become floating rate.

The bottom line

The fundamental stability of the underlying company is propitious for a preferred trading at such a discount to its par value. NRZ is well-positioned to redeem the preferreds as they hit their call dates and this results in an opportunistically strong return for the Series C. The relative value advantage of the C over the other series is quite clear at today’s pricing. We have uploaded a spreadsheet to Portfolio Income Solutions to make it easy to track the relative value as it fluctuates over time.

Be the first to comment