Tinnakorn Jorruang/iStock via Getty Images

As investors panic, New Residential Investment Corporation (NYSE:NRZ) is an extremely appealing mortgage real estate investment trust to consider.

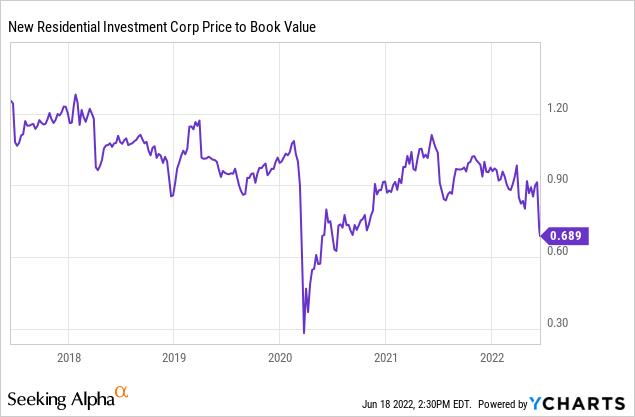

The trust’s stock is now trading at an exaggerated discount to book value, and dividend investors should keep in mind that New Residential’s dividend is easily covered by core earnings.

Furthermore, the trust recently announced its intention to internalize management, which should result in lower costs and higher profits available for distribution.

New Residential’s Dividend Coverage Not Affected By Market Meltdown

The main reason to invest in New Residential is its extremely well-covered dividend. Mortgage trusts were destroyed last week due to concerns about rising interest rates and rising recession risks, resulting in a significant undervaluation of New Residential’s earnings and dividend potential.

As I mentioned in my previous New Residential article, the mortgage trust easily covers its dividend with core earnings and has a pay-out ratio of around 57-65% over the last year.

The trust and its shareholders benefit from New Residential’s extremely low pay-out ratio. The market sell-off last week increased New Residential’s yield to 11.6%, and as I previously stated, dividend investors should keep in mind that a rise in volatility has no effect on New Residential’s dividend coverage.

Internalization And Implications For Shareholders

On June 17, 2022, New Residential announced that it had internalized its management. Previously, the company was managed externally by an affiliate of Fortress Investment Group LLC, for which the company paid management and incentive fees. Internalization is expected to result in cost savings and synergies for New Residential, as well as a potentially higher dividend in the future.

New Residential is now an internally managed REIT as a result of the termination of the management agreement. The termination of the management agreement is expected to cost New Residential $400 million, divided into three payments to the manager.

The three payments will consist of a $200 million payment made on the effective date (June 17, 2022), and two $100 million payments made on September 15, 2022 and December 15, 2022.

The company expects to save $60 to $65 million in costs through internalization, which translates to $0.12 to $0.13 in annual cost savings per share. These cost savings are expected to increase New Residential’s core earnings, implying that the trust’s dividend pay-out ratio will improve even more. If the trust can achieve annual cost savings of $0.12-0.13 per share, the dividend pay-out ratio will be closer to 55-60% in the future.

Company Name Change

The company also announced that it would change its name to Rithm Capital, effective on or around August 1, 2022.

Over-The-Top 25% Valuation Haircut

New Residential’s covered and very generous dividend pay-out is obviously only one reason to consider the mortgage trust on the sell-off. The mortgage trust’s hugely discounted valuation is another reason to buy it. I believe the 25% valuation cut in June has made New Residential too cheap, and the stock now has a very appealing risk-reward ratio.

NRZ Share Price (Finviz)

The stock of New Residential is trading at a 31% discount to book value, which appears to be exaggerated given that the trust covers its dividend with core earnings. The stock of the trust has not traded at such a high discount to book value since the pandemic’s early stages nearly two years ago.

Why NRZ Could See A Lower Stock Price

Investors are currently unconcerned about New Residential’s stock and earnings prospects, creating an opportunity to purchase the trust’s stock at a low valuation.

However, there is always the possibility that stock prices will fall further, especially in an environment marked by high inflation and rapidly declining economic growth prospects. The low pay-out ratio and high discount to book value, in my opinion, provide a sufficient buffer for dividend investors.

My Conclusion

I believe investors should buy the fear here because the mortgage trust sell-off represents an extremely attractive buying opportunity for New Residential.

The mortgage trust has consistently had a very low pay-out ratio and covers its dividend with core earnings.

The trust also announced that it will internalize its management, which is expected to result in higher core earnings and, potentially, a dividend increase, which New Residential can already afford.

Finally, the large 31% discount to book value is extremely appealing and provides investors with a very high margin of safety.

Be the first to comment