omersukrugoksu/E+ via Getty Images

Investment thesis

New Pacific Metals (NYSE:NEWP) provides investors a unique silver investment thesis of a mine in development and blue-sky exploration upside if they are willing to take the Bolivian jurisdictional risk. The company is advancing the projects at a high pace, so investors can expect much newsflow in the remaining months of 2022. For example, an updated mineral estimate on the already massive Silver Sand project drill results of the 40.000-meter drill campaign on the Carangas project. The share price has decreased 60% from its high in January of 2021, which results in an attractive entry price for new investors. Let’s review the investment thesis.

Corporate presentation New Pacific Metals

Silver Sand

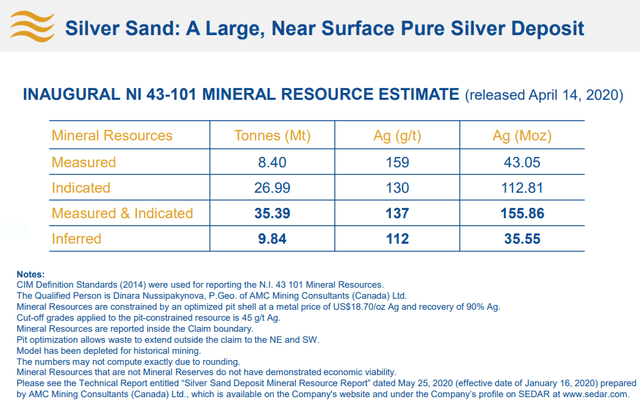

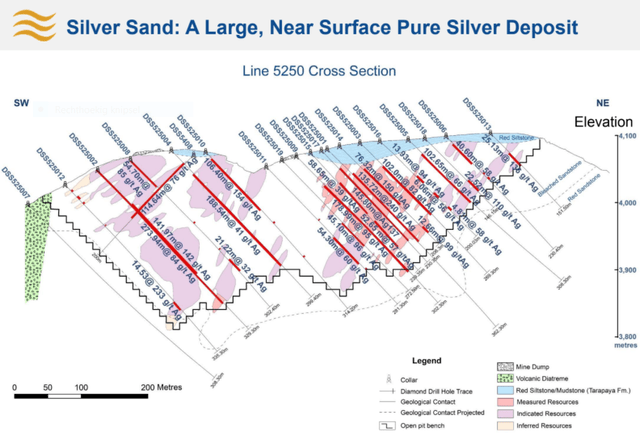

The Silver Sand project is located on the central Andean silver-tin belt and 35km from the famous Cerro Rico mining camp. This camp is the second biggest producer of silver based on the historical amount of silver. New Pacific started drilling in 2017 and published a Mineral Resource Estimate (MRE) in 2020. The MRE suggest that the project contains 155.86M oz of Ag at 137 g/t Ag. New Pacific has drilled an additional 32.700m of infill drilling and step-out drilling to explore potential satellite deposits. This will be included in an updated MRE, which is expected to be published in September 2022. The published drill results of the 2022 drill program returned incredible infill holes of long intercepts of high-grade silver close to the surface. One drill hole even returned 86.03m grading 229 g/t Ag from, including 15.35 m grading 734 g/t Ag from 37.90 m to 53.25 m. These infill drill results could increase the updated MRE much.

Corporate presentation New Pacific Metals

The company plans to publish a Preliminary Economic Assessment (PEA) based on the updated MRE. The Silver Sand project has specific elements that could result in low production costs. Therefore, the PEA could suggest a high economic value for the Silver Sand project. It is important to notice that the following arguments are elements that can make a mine potentially more economic. Eventually, only a published PEA/pre-feasibility/Feasibility study can estimate the potential economic value of the project.

-

The project is likely a rare open pit primary silver project. Open pit projects have lower operating costs with higher production output compared to underground mines. A key element for open pit mining is mineralisation near the surface and not too deep. This is certainly the case for the Silver Sand project. Most of the published drill results show mineralisation up to 200 meters at depth.

-

The recovery process could be a heap leach process. The metallurgical heap leach column tests yielded an average of 80% recovery. Heap Leach operations are relatively easy to construct as they require low infrastructure and power.

-

The project is a silver-only deposit, so it lacks by-products to reduce the AISC costs. However, the relatively high grade makes up for this. The current MRE is 112 g/t Ag, which is a much better grade than other silver open pit development projects like Discovery Silver’s Cordero, Bear Creek Mining’s Corani or Abrasilver’s Diablos.

Corporate presentation New Pacific Metals

A sweetener is that Silver Sand could enjoy an accelerated permitting process. The Bolivian government want to start production of 6 mines by 2025 and Silver Sand could be one of those mines. This would make the project even more valuable. New Pacific is doing a pre-feasibility study, parallel to the PEA to accelerate the advancement of the project. A significant benefit is that the development of a silver-only, heap-leach open pit to mine is straightforward from a development standpoint. I think it is not the question if Silver Sand will be an operating mine but rather who will build it; Silver Sand or another major mining firm.

Carangas

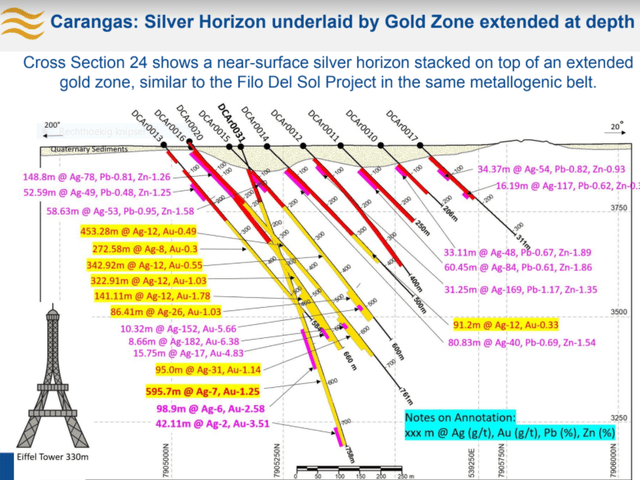

In an interview, founder and chairmen Rui Feng stated that the Carangas is the new flagship project. This is an impressive statement because the chairmen thinks it surpasses the potential tier-1 Silver Sand project. The Carangas project was staked in by New Pacific Metals. The geologists were conducting due diligence on historical drill records of the project. Historical drilling found silver near the surface but did not drill deep enough to discover the gold system underneath the silver system.

Currently, five drill rigs are running a total drill program of 40,000 meters. Three of the drill rigs are testing to 1,000m depth, the other two drill rigs focus on the shallow silver zone. New Pacific already published some drill holes of the 2022 program with phenomenal results:

- “Gold Hole DCAr0044: 514.85 m interval (from 266.35 m to 781.2 m) grading 1.10 g/t Au and 6 g/t Ag, including higher grade intervals of 14.15 m (from 436.2 m to 450.35 m) grading 3.8 g/t Au, 11g/t Ag and 0.12% Cu.”

- “Gold Hole DCAr0031: intersected 595.7 m (from 161.55 m to 757.25 m) grading 1.25 g/t Au and 7 g/t Ag, including 98.9 m (from 457.3 m to 556.2 m) grading 2.58 g/t Au, 6 g/t Ag and 42.11 m grading 3.51 g/t Au, 2 g/t Ag and 0.1% Cu (from 711.0 m to 753.11 m)”

- “Silver Hole DCAr0041: 78.68 m interval (from 37.8 m to 116.48 m) grading 75 g/t Ag, 0.71% Pb and 0.69% Zn”

- “Silver Hole DCAr0042: 79.2 m interval (from 53 m to 132.2 m) grading 77 g/t Ag, 0.73% Pb and 1.43% Zn”

The drill results suggest that the hypothesis of a near-surface open pit silver mine with a large gold system is true. Investors have to wait for more confirmation during the next few months, which could move the share price higher. All in all, this project offers a lot of potential.

Corporate presentation New Pacific Metals

Silverstrike

This project is the most early-stage project in the portfolio of New Pacific. Rio Tinto drilled 8 diamond holes and 12 RC holes in 1995. The company hit silver and gold but they were exploring copper projects, so they left the project. According to the chairman Rui Feng, The Silverstrike project has similar geology as the Silverstrike project. This should help to identify the best drill targets for the 6,000-meter drill program, which started in June of 2022.

Management

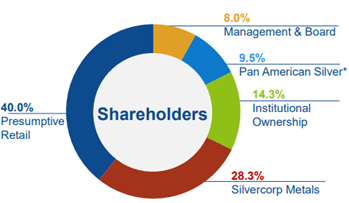

Chairmen Rui Feng founded the company and selected a great team to develop potentially world-class assets. Mark Cruise has already built five mines during his career. This provides the option for management to sell a project or build it themselves. Management & board holds 8% of the stock, so they are aligned with shareholders to create shareholder value.

New Pacific has first-mover advantages in the Bolivian exploration industry. The team has experience and expertise in Bolivian geology, which is unique given the fact that mining firms did barely invest in Bolivia to explore. This competitive advantage has enabled New Pacific to create shareholder value by staking the Carangas project. The team of geologists are reviewing historical drill results of another project to stake as they did with the Carangas project. So investors might see some new projects to be added to the portfolio.

Corporate presentation New Pacific Metals

Bolivia

Bolivia has a history of anti-international corporations, especially in the national resources industry. The government even re-nationalised the natural gas industry in 2006. As gas reserves decline, mining might become more important for the Bolivian government to generate income. Mining represented already 47% of Bolivia’s exports in 2020. The recent tax reform eliminated the value-added tax on capital goods imported. This might be the first small step in the good direction, I would recommend investors to be careful of the jurisdictional risk.

Valuation

A valuation can be determined based on the current resource of the Silver Sand project. The Silver Sand mine is exposed to many future expenditures and risks, hence the resource in the ground of an exploration firm is much less valuable compared to the resources of an operating mine. I like to be conservative in my valuations of risky stocks. Therefore, I value the silver in the ground at only 15% of the current silver price ($18.5). The current silver resource of the Silver Sand project contains 155.86M oz of Ag. This results in a valuation of $432 million. Readers have to keep in mind that an updated MRE is expected in September of 2022. The resource could increase much based on the recently published infill drill results. This increase in resources should therefore increase the valuation of New Pacific Metals.

The Carangas and Silverstrike projects provide additional shareholder value but it is very difficult to determine any value without a resource or economic study. To be conservative in the valuation of risky stocks, I do not attribute any value to these projects. This provides additional upside for the risks investors take. The current market capitalisation is justified by the conservative valuation based on the current resource of the Silver Sand project. So, investors can speculate for free on the Carangas and Silverstrike projects, which could deliver a lot of value.

Conclusion

The first mover advantage of New Pacific Metals to enter the Bolivian metals exploration industry has resulted in a unique portfolio of large silver projects. The stock is currently fairly valued based on the conservative resource valuation of only the Silver Sand project. This provides an attractive entry price for investors to speculate on the future growth of the three projects. Especially the updated MRE and the PEA could create much shareholder value in 2022. Moreover, the current valuation provides the opportunity for investors to speculate on the Carangas and Silverstrike projects for free.

The jurisdictional risk of Bolivia increases the already risky investment thesis of a silver exploration company. I think the potential rewards exceed the risks at the current valuation. Hence, I would recommend buying a speculative position in New Pacific Metals. I would hold the position for at least three years to speculate on the development of the Silver Sand project and a resource estimate and a completed PEA study of the Carangas project.

Be the first to comment