Автор

Paying a premium price for any investment can be rather risky. The reason why companies trade at a premium to other firms is because of a belief in future growth and profitability. For companies that have demonstrated a good track record of achieving that growth, and that continue to follow through, that extra price could well be warranted. One example of a company where this is probably the case is New Fortress Energy (NASDAQ:NFE). If we were to value the company based on its most recent historical financial results, shares would look exceedingly pricey. They are still expensive on a forward basis, but if the company continues along the path that management has highlighted, it could make for an attractive opportunity for long-term investors.

New Fortress Energy – Rapid growth comes at a cost

The management team at New Fortress Energy describes the company as a global integrated gas-to-power infrastructure firm that uses natural gas to satisfy the world’s large and growing power needs. Truth be told, this is a fairly vague description that doesn’t tell us much. Instead, we need to dig a bit deeper to understand precisely what the company does. First and foremost, the company supplies LNG and natural gas to its own power plants for their operation and also to its customers. The company does this as a result of long-term contracts, many of which are based on index pricing with a fixed fee component added on. It also supplies the same products to its customers through open market purchases and, in the case of its LNG, from its existing liquefaction and storage facility in Florida. The company also has a fleet of 20 ships some of which it owns, while the remaining are chartered from third parties, that it uses for the transportation of fuel products. As part of this, the company has seven regasification units and 11 liquefied natural gas carriers, plus floating storage units, that it operates.

If this sounds like a space without much potential for rapid growth, you would be wrong. The company has, for years, been investing into its business. In 2021 alone, the company allocated $842.2 million toward capital expenditures. In addition to this, the company allocated another $1.59 billion, net of cash acquired, for acquisitions. But even this does not appropriately account for all of the investments the company has made. In fact, when you add in Equity consideration as well, the amount of spending the company has done increases considerably. For its merger with Hygo that occurred in April last year, the business allocated $1.40 billion in shares to make the deal happen. And of course, there were other acquisitions with complicated components to them that would add to this further.

None of this is to say that the company is not above selling off assets in order to achieve growth. Earlier this year, the company entered into a joint venture for LNG Maritime Infrastructure whereby it partnered up with Apollo (APO) in what came to be valued at $2 billion. As part of that deal, New Fortress Energy ended up selling 11 LNG infrastructure vessels previously owned by it to the newly-formed joint venture. As part of the deal, the company gets to retain 20% ownership of the entity, plus it will receive net proceeds of $1.1 billion. And a month prior to that, the company entered into the sale of a venture that it has a stake in. That sale valued the business at $2.16 billion, with New Fortress Energy ultimately receiving $550 million after paying down debt and other liabilities.

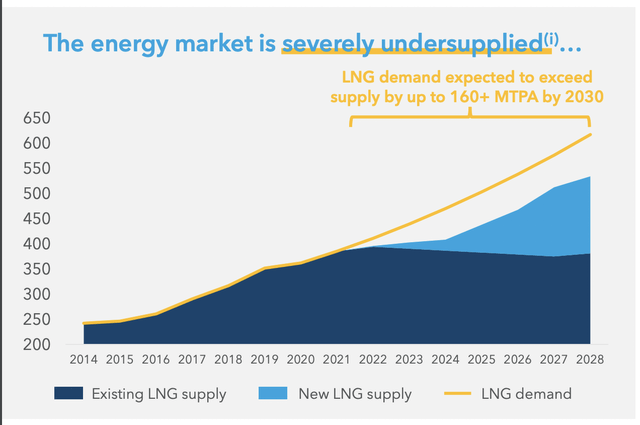

The company seems to have big plans when it comes to the proceeds it is collecting. Already, the company has terminals and other facilities across the world. But it is also developing others in places like Brazil, Ireland, and South Africa. None of this comes cheap, but it will bring with it a significant reward when you consider that current projected new LNG supply is forecasted to fall short of demand for the next several years. In the near term, the company even expects significant rewards. For the 2022 fiscal year, for instance, management expects to generate $1 billion or more in EBITDA. And in 2023, it’s expected to climb to at least $1.5 billion.

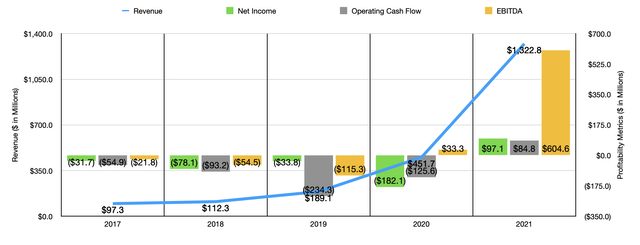

It’s worth noting that this is not an unexpected growth rate for the company. Consider how revenue has been in recent years. Between 2017 and 2021, sales skyrocketed from $97.3 million to $1.32 billion. Net income has been volatile and mostly negative. But in 2021, the company generated a modest profit of $97.1 million. Operating cash flow ended up hitting its worst year in 2019 when it came in negative to the tune of $234.3 million. But by 2021, it had turned positive in the amount of $84.8 million. Over that same three-year window, adjusted for changes in working capital, it would have improved from negative $144.3 million to positive $232.6 million. Meanwhile, EBITDA, after hitting its worst year in 2019 negative $115.3 million, turn to positive in 2020 and 2021. Last year, it came in strong at $604.6 million.

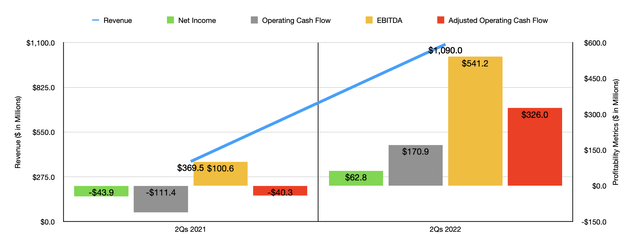

So far, the 2022 fiscal year is looking even better. Thanks to investments the company has made in capacity additions, as well as other factors like its aforementioned acquisitions, revenue in the first half of the year totaled $1.09 billion. This compares to the $369.5 million generated the same time one year earlier. Net income went from negative $43.9 million to positive $62.8 million. Operating cash flow went from a net outflow of 111.4 million to a net inflow of $170.9 million. Adjusted for changes in working capital, it would have gone from a net outflow of $40.3 million to a net inflow of $326 million. Meanwhile, EBITDA went from $100.6 million to $541.2 million.

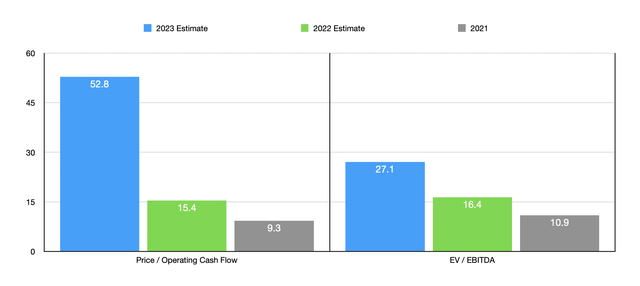

If we assume that management’s forecasts are correct, then things should be looking up. I don’t see net income as being a very reliable indicator of the company’s value. But operating cash flow would. We don’t really know what this number will be and it’s difficult to forecast it using most methods. The best thing I did was take management’s guidance for EBITDA and strip out annualized interest expense from the picture. That would give us a rating of $812.3 million this year and $1.31 billion next year. For the 2022 fiscal year, this implies a price to adjusted operating cash flow multiple of 15.4. Meanwhile, the EV to EBITDA multiple should come in at 16.4. This is down considerably from the 2021 levels when I would have calculated multiples of 52.8 and 27.1, respectively. Now, if management can achieve its guidance, shares will get cheaper still, with these multiples coming in at 9.3 and 10.9, respectively. To put this in perspective, I also compared the company to five similar firms. On a forward basis for the 2022 fiscal year, the price to operating cash flow multiples for these firms came in at between 3.9 and 10.7. And using the EV to EBITDA approach, these multiples would be between 9.3 and 14.5. In both cases, New Fortress Energy was the most expensive of the group. But then again, these other firms aren’t growing like this one is.

| Company | Price / Operating Cash Flow | EV / EBITDA |

| New Fortress Energy | 15.4 | 16.4 |

| Western Midstream Partners (WES) | 6.7 | 9.3 |

| Magellan Midstream Partners (MMP) | 10.7 | 14.1 |

| Targa Resources Corp (TRGP) | 6.6 | 10.5 |

| Plains All American Pipeline (PAA) | 3.9 | 9.5 |

| DCP Midstream (DCP) | 6.4 | 14.5 |

Takeaway

Based on the data provided, it looks to me as though New Fortress Energy should be an interesting investment opportunity for those who appreciate growth, don’t mind paying a premium for some of that growth, and who don’t mind accepting the risk that comes along with that premium. If management can achieve its targets, the enterprise could offer some nice upside potential. As such, I’ve decided to rate the business a soft ‘buy’, with the view that if management fails to deliver, shares are no better than fairly valued.

Be the first to comment