by-studio/iStock via Getty Images

Introduction

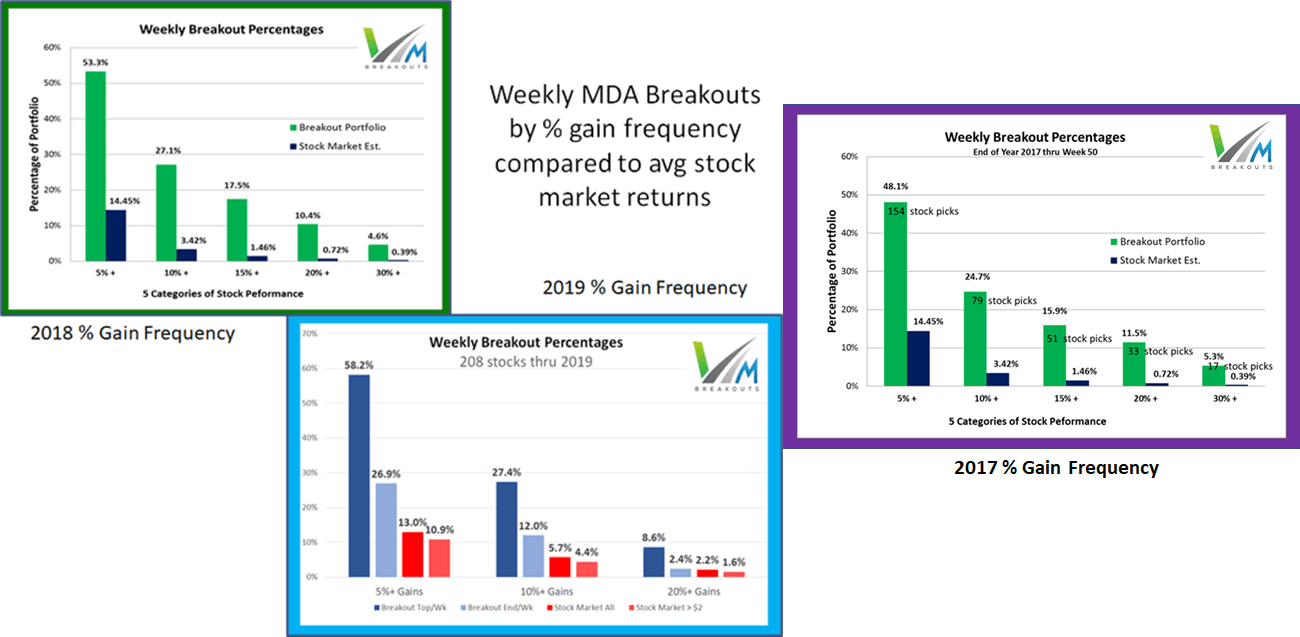

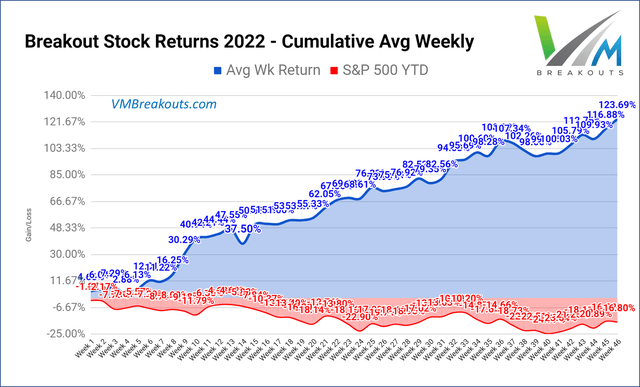

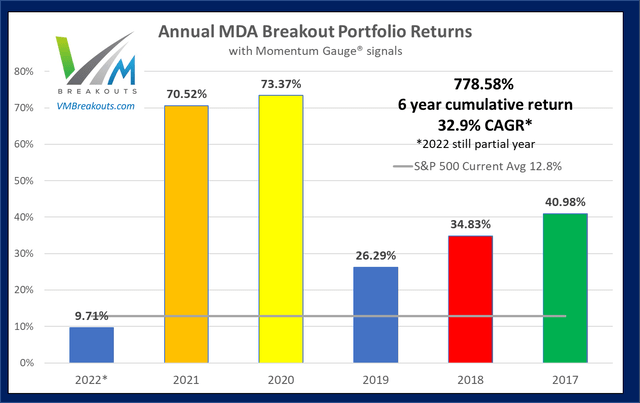

The Weekly Breakout Forecast continues my doctoral research analysis on MDA breakout selections over more than 7 years. This high frequency breakout subset of the different portfolios I regularly analyze has now exceeded 280 weeks of public selections as part of this ongoing live forward-testing research. The frequency of 10%+ returns in a week is averaging over 4x the broad market averages in the past 5+ years.

In 2017, the sample size began with 12 stocks, then 8 stocks in 2018, and at members’ request since 2020, I now generate only 4 selections each week. In addition 2 Dow 30 picks are provided, as well as a new active ETF portfolio that competes against a signal ETF model. Monthly Growth & Dividend MDA breakout stocks continue to beat the market each year as well. I offer 11 top models of short and long-term value and momentum portfolios that have beaten the S&P 500 since my trading studies were made public.

Market Outlook

The Momentum Gauges® continue positive in extremely high market volatility. November started with the largest ever selloff reaction to a Fed FOMC rate hike. Then an enormous rally followed the next week in reaction to declining CPI inflation. Many of the FANG mega cap stocks hit new 2022 year lows this month, but continue to move higher to the top of the negative channel. More of these incredible charts are detailed here in my most recent article.

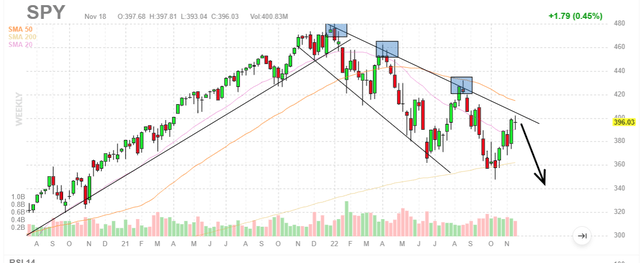

I am expecting the S&P 500 market pattern to follow with another leg lower. The timing should be consistent with the VIX reaching the lowest levels since the April and August market peaks. A market reversal may also may coincide with the next FOMC meeting and rate hike decision on December 13th.

FinViz.com VMBreakouts.com

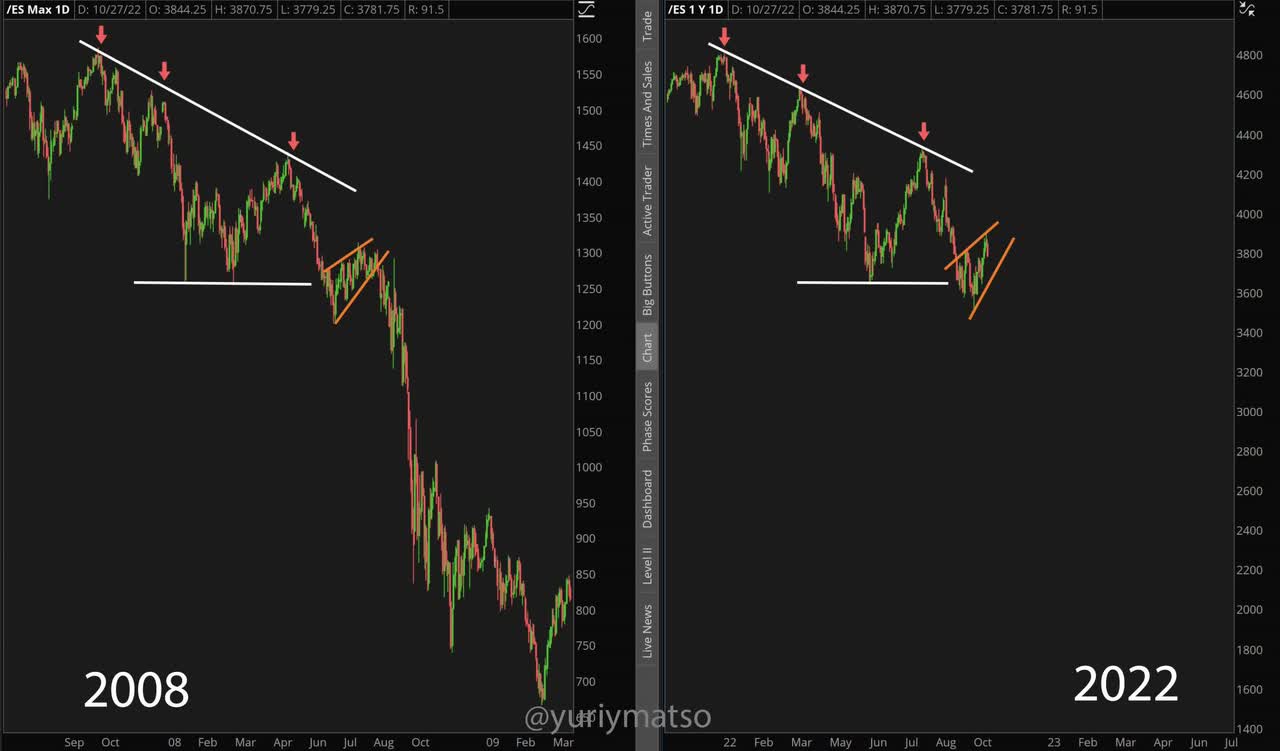

We are still in a pattern of bearish rallies in a longer negative channel from November 2021. There are strong similarities to the volatility and patterns of 2018 and 2008 with investors very cautious. Follow the Momentum Gauges and be ready for more swift changes.

At around 4100, the S&P 500 will test the top of the negative channel in 2022 shown below. S&P 500 closed at 4034 on Friday.

yuriymatso

Morgan Stanley chief strategist says “buy-the-dip” but watch out for another pullback after the S&P 500 moves above 4100. Resistance raised to 4150. Wall Street’s Biggest Bear Buys The Dip: “I Don’t Think This Rally Is Over”

JPMorgan says don’t buy here, you should be selling into S&P 500 above 3900. “We See More Selling Into Strength Here”: Why JPM’s Trading Desk Isn’t Buying This Rally

JPMorgan has changed from a bullish outlook to a base case of recession into 2023: JPM Makes 2023 Recession Its Base Case, Expects Million Jobs Lost By Mid-2024

Momentum Gauges® Stoplight ahead of Week 48. The stock market and S&P 500 momentum gauges are positive from October and the weekly gauges continue positive into a 6th consecutive week. The sector gauges have turned more positive with nearly all sectors positive again.

The first stage of weekly and monthly sector gauges have been released on the automated Momentum Gauge website to the public this week!

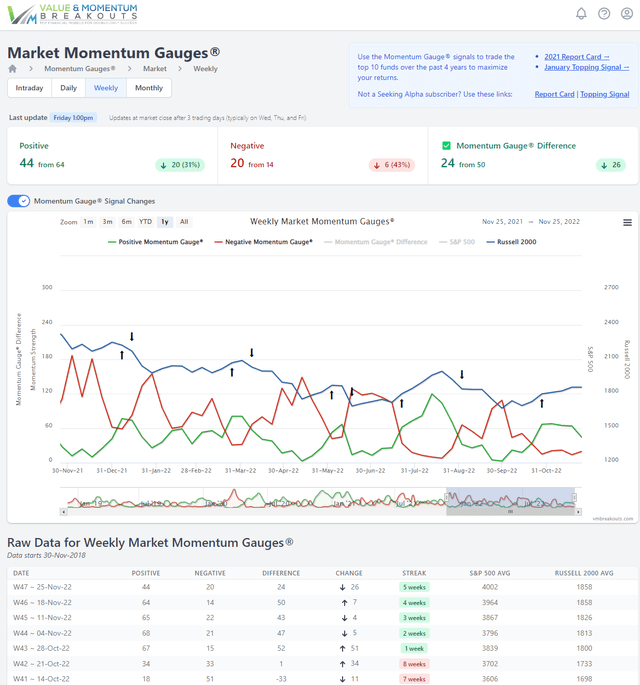

Weekly Momentum Gauges continue positive for a 5th consecutive week but with declining positive momentum.

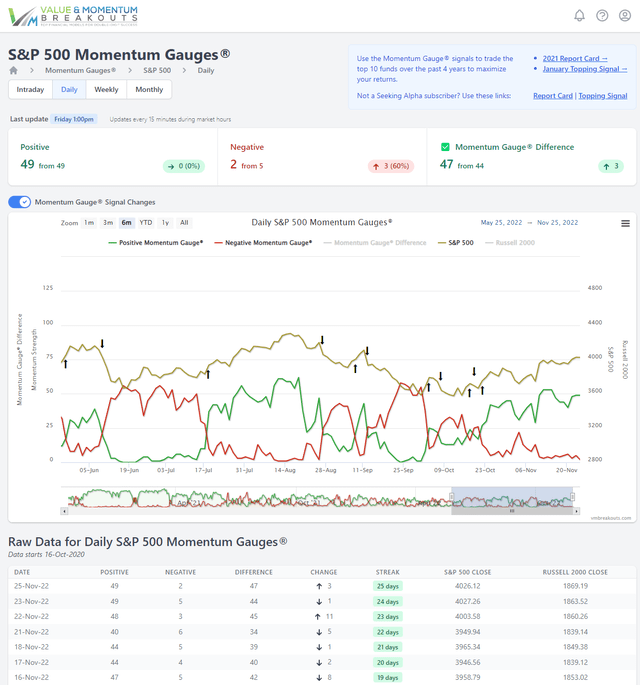

S&P 500 Daily Momentum Gauges continue positive from October 21st with very high market volatility. The gauges are 3 days away from the longest positive signal for 2022.

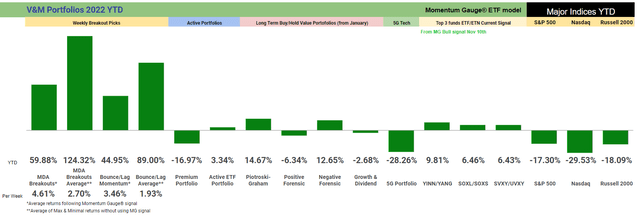

Current Returns

So far YTD 2022 there are 122 picks in 47 weeks beating the S&P 500. 99 picks are beating the S&P 500 by over 10%+ in double digits. Leading MDA gainers include (NUVL) +59.2%, (CLFD) +111.3%, (MNRL) +59.5%, (RES) +100.4%, (TDW) +157.4%, (ZYME) +43.7%, (VRDN) +77.1%, (ZYXI) +71.3%.

Despite such high negative momentum conditions all year, 49 picks in 47 weeks have gained at least 9.9% in less than a week. Additionally, 105 picks in 47 weeks have gained over 5% in less than a week in these high frequency breakout selections.

Additional background, measurements, and high frequency breakout records on the Weekly MDA Breakout model is here: Value And Momentum MDA Breakouts +70.5% In 52 Weeks: Final 2021 Year End Report Card

These are highly significant statistical results that are further improved by following the Momentum Gauge signals with only 14 positive trading weeks this year. Worst case minimal returns following the MG trading signals are beating the S&P 500 YTD by +14.5%.

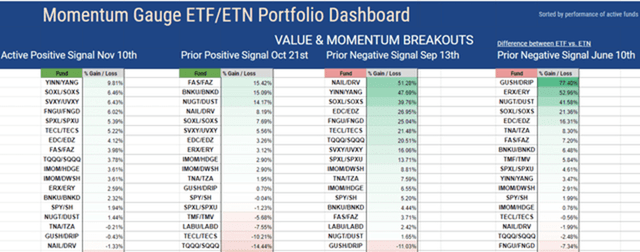

Leveraging The Momentum Gauges With ETFs

In addition to timing MDA breakout stock picks for the best returns, the gauges are used for live ETF bull/bear timing signals with strong results.

Historical Performance Measurements

Historical MDA Breakout minimal buy/hold returns are at +70.5% YTD when trading only in the positive weeks consistent with the positive Momentum Gauges® signals. Remarkably, the frequency streak of 10% gainers within a 4- or 5-day trading week continues at highly statistically significant levels above 80% not counting frequent multiple 10%+ gainers in a single week.

V&M Multibagger List

Longer term many of these selections join the V&M Multibagger list now at 112 weekly picks with over 100%+ gains, 55 picks over 200%+, 19 picks over 500%+ and 11 picks with over 1000%+ gains since January 2019 such as:

- Celsius Holdings (CELH) +2,224.3%

- Enphase Energy (ENPH) +2,209.6%

- Northern Oil and Gas (NOG) +1,250.2%

- Trillium Therapeutics (TRIL) +1008.7%

More than 300 stocks have gained over 10% in a 5-day trading week since this MDA testing began in 2017. A frequency comparison chart is at the end of this article. Readers are cautioned that these are highly volatile stocks that may not be appropriate for achieving your long term investment goals: How to Achieve Optimal Asset Allocation

The Week 48 – 2022 Breakout Stocks for next week are:

The picks for next week consist of 1 Energy, 1 Industrial, and 2 Technology sector stocks. These stocks are measured from release to members in advance every Friday morning near the open for the best gains. Prior selections may be doing well, but for research purposes I deliberately do not duplicate selections from the prior week. These selections are based on MDA characteristics from my research, including strong money flows, positive sentiment, and strong fundamentals — but readers are cautioned to follow the Momentum Gauges® for the best results.

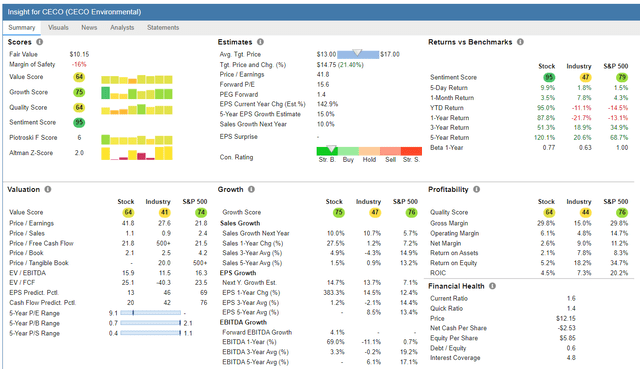

- CECO Environmental Corp. (CECO) – Industrials / Pollution Controls

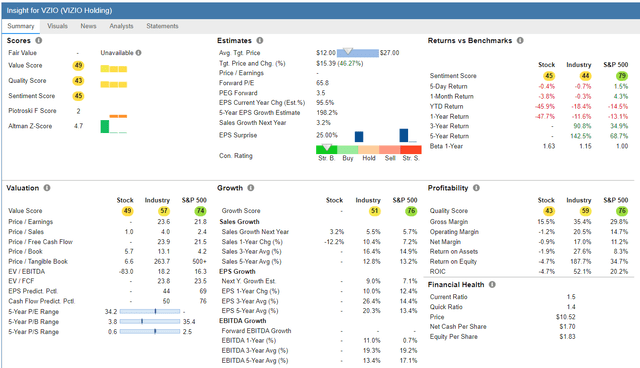

- VIZIO Holding Corp. (VZIO) – Technology / Consumer Electronics

CECO Environmental Corp. – Industrials / Pollution Controls

FinViz.com

Price Target: $15.00/share (Analyst Consensus + Technical See my FAQ #20)

(Source: Company Resources)

CECO Environmental Corp. provides industrial air quality and fluid handling systems worldwide. It operates in two segments: Engineered Systems Segment and Industrial Process Solutions Segment. The company engineers, designs, builds, and installs systems that capture, clean, and destroy air- and water-borne emissions from industrial facilities as well as fluid handling, gas separation, and filtration systems.

VIZIO Holding Corp. – Technology / Consumer Electronics

FinViz.com

Price Target: $15.00/share (Analyst Consensus + Technical See my FAQ #20)

(Source: Company Resources)

VIZIO Holding Corp., through its subsidiaries, provides smart televisions, sound bars, and accessories in the United States. It also operates Platform+ that comprises SmartCast, a Smart TV operating system, enabling integrated home entertainment solution, and data intelligence and services products through Inscape. Its SmartCast delivers content and applications through an easy-to-use interface, as well as supports streaming apps, such as Amazon Prime Video, Apple TV+, Discovery+, Disney+, HBO Max, Hulu, Netflix, Paramount+, Peacock, and YouTube TV and hosts its free ad-supported video app, WatchFree, and VIZIO Free channels.

Top Dow 30 Stocks to Watch for Week 48

First, be sure to follow the Momentum Gauges® when applying the same MDA breakout model parameters to only 30 stocks on the Dow Index. Conditions have delivered the worst first half to the stock market since 1970. Second, these selections are made without regard to market cap or the below-average volatility typical of mega-cap stocks that may produce good results relative to other Dow 30 stocks. The most recent picks of weekly Dow selections in pairs for the last 5 weeks:

| Symbol | Company | Current % return from selection Week |

| (HON) | Honeywell International | +2.57% |

| (V) | Visa Inc. | +1.42% |

| (CVX) | Chevron Corp. | -0.59% |

| DOW | Dow Inc. | -0.71% |

| (NKE) | Nike Inc. | +10.62% |

| (DOW) | Dow Inc. | +5.16% |

| CVX | Chevron Corp. | +0.69% |

| (INTC) | Intel Corp. | +3.20% |

| CVX | Chevron Corp. | +8.74% |

| (TRV) | Travelers Companies | +9.78% |

If you are looking for a much broader selection of large cap breakout stocks, I recommend these long term portfolios. The new mid-year selections were released to members to start July:

Piotroski-Graham enhanced value –

- July midyear at +9.23%

- January portfolio beating S&P 500 by +30.20% YTD.

- July midyear down -11.83%

- January Positive Forensic beating S&P 500 by +9.19% YTD.

- July midyear down -25.23%

- January Negative Forensic beating S&P 500 by +28.18% YTD

Growth & Dividend Mega cap breakouts –

- July midyear down -0.48%

- January portfolio beating S&P 500 by +12.85% YTD

These long term selections are significantly outperforming many major hedge funds and all the hedge fund averages since inception. Consider the actively managed ARK Innovation fund down -61.94% YTD, Tiger Global Management -58% YTD.

The Dow pick for next week is:

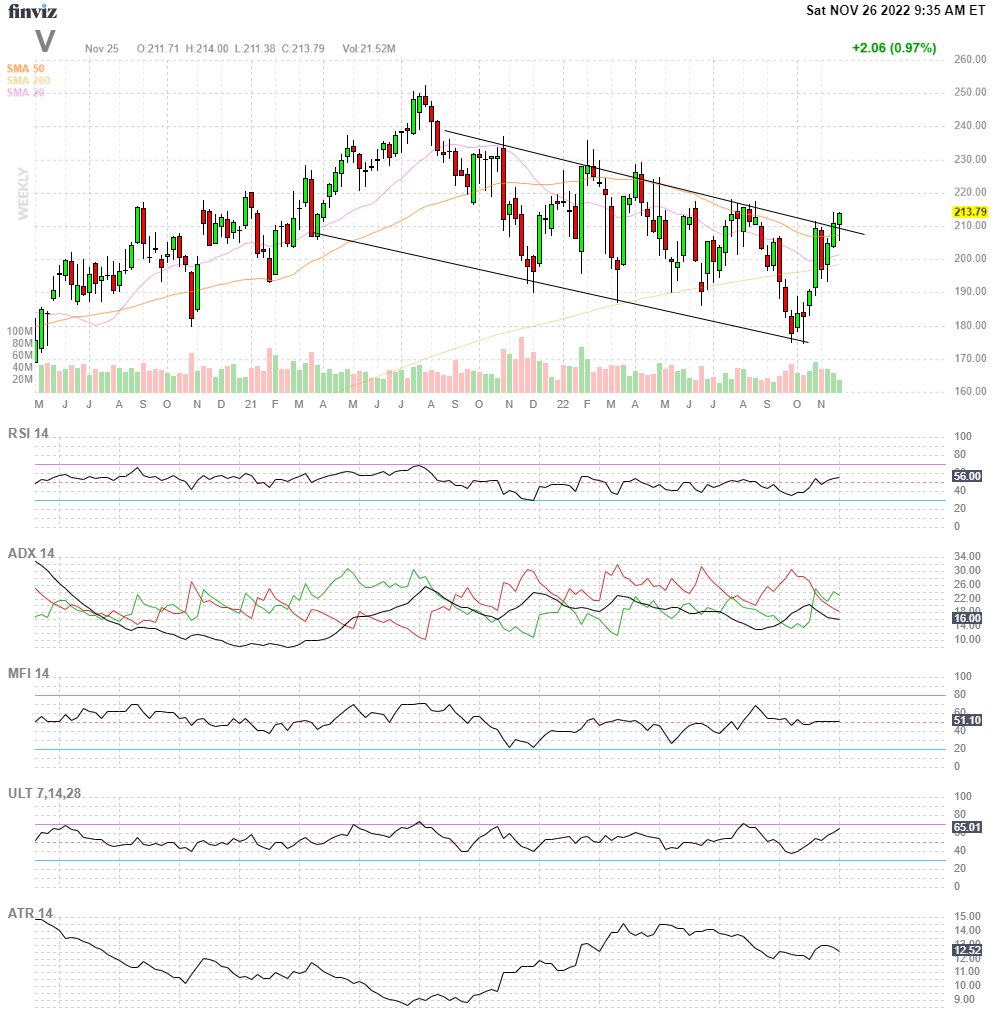

Visa

Visa was also selected last week and beat on earnings October 25th. It has cleared the top of the negative channel on the weekly char from November 2021. Analysts have upgraded with a consensus price target is $249/share back to peak 2021 levels. US consumer credit levels are at the highest levels in decades with the highest interest rates since 2008. Deutsche Bank price target is $260/share.

FinViz.com

Background on Momentum Breakout Stocks

As I have documented before from my research over the years, these MDA breakout picks were designed as high frequency gainers.

These documented high frequency gains in less than a week continue into 2020 at rates more than four times higher than the average stock market returns against comparable stocks with a minimum $2/share and $100 million market cap. The enhanced gains from further MDA research in 2020 are both larger and more frequent than in previous years in every category. ~ The 2020 MDA Breakout Report Card

The frequency percentages remain very similar to returns documented here on Seeking Alpha since 2017 and at rates that greatly exceed the gains of market returns by 2x and as much as 5x in the case of 5% gains.

VMBreakouts.com

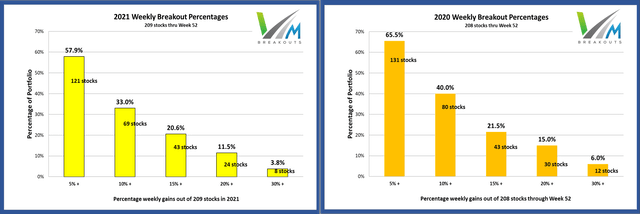

The 2021 and 2020 breakout percentages with 4 stocks selected each week.

MDA selections are restricted to stocks above $2/share, $100M market cap, and greater than 100k avg daily volume. Penny stocks well below these minimum levels have been shown to benefit greatly from the model but introduce much more risk and may be distorted by inflows from readers selecting the same micro-cap stocks.

Conclusion

These stocks continue the live forward-testing of the breakout selection algorithms from my doctoral research with continuous enhancements over prior years. These Weekly Breakout picks consist of the shortest duration picks of seven quantitative models I publish from top financial research that also include one-year buy/hold value stocks. Remember to follow the Momentum Gauges® in your investing decisions for the best results.

All the V&M portfolio models are beating the market indices through the worst 6 month start since 1970. New mid-year value portfolios are again leading the major indices to start the next long term buy/hold period.

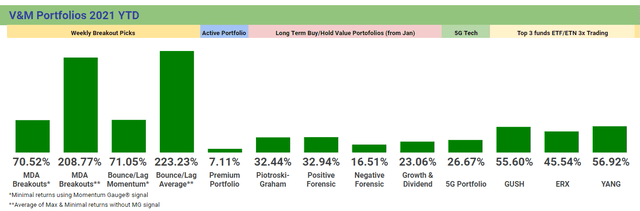

The final 2021 returns for the different portfolio models from January of last year are shown below.

All the very best to you, stay safe and healthy and have a great week of trading!

JD Henning, PhD, MBA, CFE, CAMS

Be the first to comment