Byrdyak/iStock via Getty Images

Investment thesis

In July 2021, I wrote an article on SA about U.S. high-performance SSDs and modular memory subsystems maker Netlist (OTCQB:NLST) in which I said that the company looked overvalued based on fundamentals but that the most prudent action might be to avoid its shares as the short borrow fee rate was over 40%.

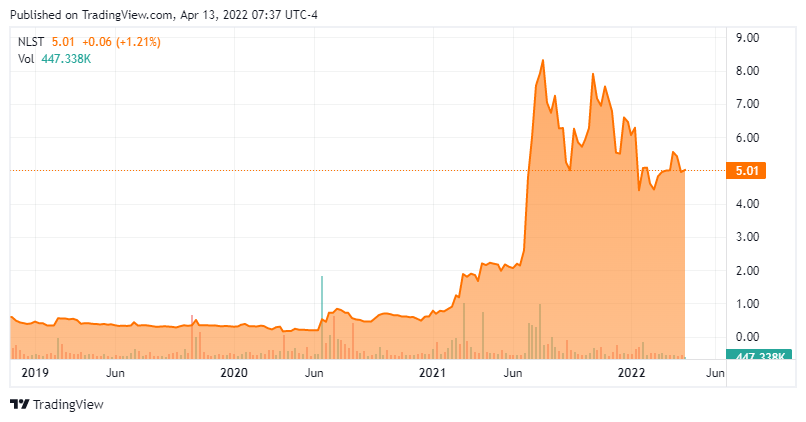

Netlist has a market valuation of $1.15 billion as of the time of writing and it had a relatively good 2021, with net product sales of over $100 million thanks to its improved relations with South Korean semiconductor giant SK Hynix (OTC:HXSCF). However, I think the company continues to look expensive and I think this could be a good time to open a small short position considering that retail investor interest seems to be fading off and the short borrow fee rate has dropped to just over 12%. Let’s review.

Overview of the recent developments

In case you haven’t read my previous article on Netlist, it’s a small California-based supplier of high-performance SSDs and modular memory subsystems to enterprise customers. The company was founded in 2000 by LG Semiconductor executive CK Hong and its manufacturing and testing facilities are located in the city of Suzhou in China. Netlist was listed on NASDAQ in late 2006 but the stock moved to the OTCQB as the share price moved below $1.00 per share. The DRAM and NAND markets are dominated by just a few players and small companies in the space don’t have the resources needed for investment in research and development to compete effectively. In the year ended January 2, 2021, Netlist had net product sales of just $47.2 million, and its research and development expenses came in at only $2.95 million.

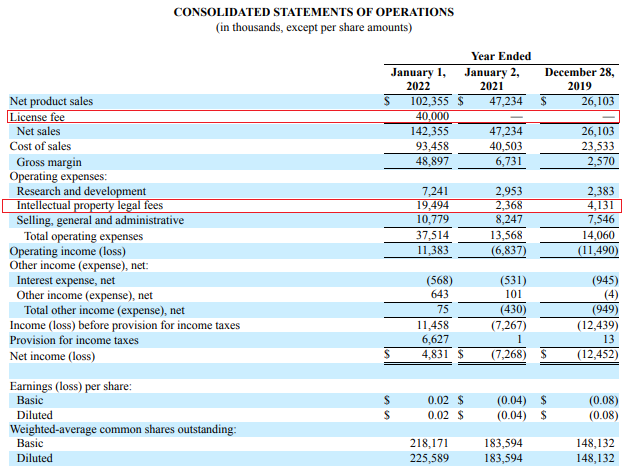

However, Netlist has a vast intellectual property portfolio that included a total of 99 active U.S. and foreign patents and 31 pending U.S and foreign patent applications as of the start of 2022. The company has been using those patents to file patent infringement lawsuits against the likes of SK Hynix and Alphabet (NASDAQ:GOOG) and in 2021 it reached a settlement with the former that included the payment of a $40 million license fee. The two companies also entered into a supply agreement and SK Hynix will help Netlist with technical cooperation on its CXL HybriDIMM technology. This led to a significant increase in Netlist’s revenues in 2021 as the resale of DIMMs and components added $52 million to its net product sales. The issue here is that the supply agreement with SK Hynix seems to bring barely any profits as the gross profit margin declined from 14.25% to 8.69%. And if you exclude the license fee income and legal fee expenses, Netlist would have finished 2021 with an operating loss of $9.12 million.

Netlist

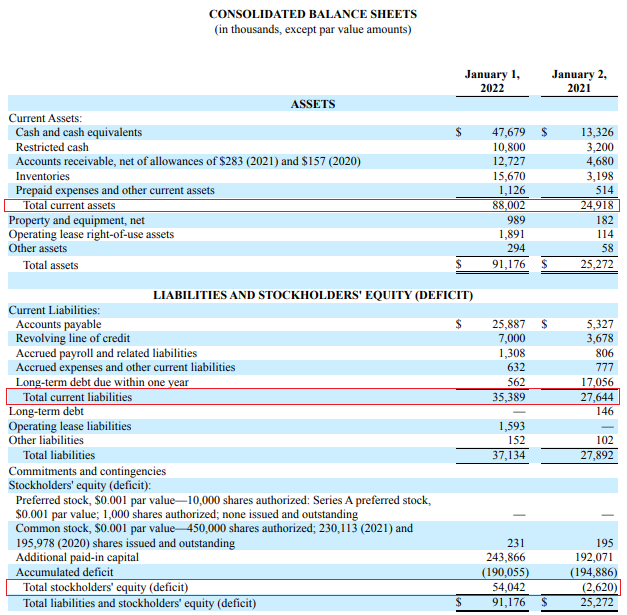

Turning our attention to the balance sheet, the situation looks much better now compared to a year ago as Netlist issued a total of 3,933,748 shares for $28.3 million to vulture fund Lincoln Capital in 2021. As of January 1, 2022, Netlist’s working capital and shareholders’ equity positions were back into positive territory.

Netlist

Netlist has a market capitalization of $1.15 billion as of the time of writing and its share price has been noticeably higher since June 2021. There is no clear catalyst for the high market valuation as the share price started to soar around two months after the settlement with SK Hynix.

Seeking Alpha

My theory is that the reason behind Netlist’s high market capitalization is retail investor interest as there have been a large number of posts about the company on websites like Twitter, and StockTwits. Netlist is also being covered by several stock trading channels on YouTube and it has two separate subreddits on Reddit that together have about 4,800 members. Note that the company isn’t doing the promotion of its business or shares itself, but this is being done by a significant number of private investors and traders.

So, why is there such high retail investor interest in Netlist? Well, it seems that many investors are expecting the company to get a large amount of cash in a settlement with Alphabet, which could dwarf the one from the license agreement with SK Hynix. Someone even created a website called googlecheatednetlist.com. However, I had to use Wayback Machine to access it as it appears to no longer be active. Is Alphabet at fault here or is Netlist patent trolling? In my opinion, it doesn’t really matter. I’m married to a lawyer, and I can tell you that the most important law principle is that it’s about what you can prove, and Netlist has been after Alphabet for more than a decade now. It seems that this lawsuit won’t be resolved anytime soon and even if the two parties reach a settlement, I doubt the funds that Netlist receives will come anywhere close to its $1.15 billion valuation. I continue to be bearish on the company and I think this could be a good moment to open a short position as data from Fintel shows that the short borrow fee rate has dropped to 12.16% as of the time of writing. Also, the share price of Netlist has been declining since early November and I think this is likely to continue as retail investor interest is likely to fade off further. In my view, the share price could return to about $2.00 per share by the end of 2022.

Looking at the risks for the bear case, I think there are two major ones. First, I could be wrong that the Alphabet lawsuit won’t result in a large settlement and that its conclusion is a long time away. Unfortunately, there are no call options for Netlist and you can’t hedge that risk at the moment so I think it’s best to open only a small position. Second, meme stocks are often unpredictable and it’s possible that the market valuation of Netlist remains high for a while despite little change in the company’s fundamentals.

Investor takeaway

Netlist more than doubled its net product sales in 2021 but the margins from the resale of DIMMs and components are very low and the company is still far from becoming profitable.

I think that Netlist’s market valuation soared in 2021 due to high retail investor interest and it has been decreasing for the past few months as this interest slowly fades off. I think this trend will continue, and that the share price could return to about $2.00 per share by the end of 2022 unless there is a significant development regarding the Alphabet lawsuit.

The short borrow fee rate stands at 12.16% and I think this could be a good time to open a small short position. However, I view this as a high-risk, high-reward type of investment idea as there are no call options on Netlist and I think that risk-averse investors could be better off avoiding this stock.

Be the first to comment