Andrii Yalanskyi/iStock via Getty Images

It’s a great time to buy net lease REITs. And fortunately for investors who would like a one-click solution to own the whole net lease REIT sector, there is an option: the NETLease Corporate Real Estate ETF (NYSEARCA:NETL).

As I’ve written about multiple times (see here for my introductory article on NETL and here for my latest article on NETL from August 2022), net lease REITs have many admirable qualities that make them worthy of owning.

- Contractually fixed rental revenue streams from long-term leases that typically feature 1-3% annual rent escalations go a long way in protecting the landlord’s cash flows from temporary economic weakness during recessions.

- Though many consider net lease REITs “bond proxies” that should perform poorly during periods of elevated inflation, NETL has actually outperformed the broader real estate index this year.

- The ability to raise capital at low enough costs to make accretive investments matters more to net lease REITs than inflation.

These qualities make net lease REITs both recession-resistant and less vulnerable to inflation than many investors think. If cost of capital is low enough, net lease REITs can simply ramp up acquisitions during periods of higher inflation in order to raise their growth rate alongside the rate of inflation.

Based on NETL’s $1.14 annualized dividend ($0.095 per share paid monthly), the ETF currently trades at a dividend yield of 4.85%.

On top of that nearly 5% yield is valuation upside. Net lease REITs typically trade at an average FFO multiple of about 17x, but today they trade at an average FFO multiple of 12.2x. That implies almost 40% valuation upside back to its normal level.

Assuming a 5% growth rate for NETL’s holdings and that the 40% valuation upside is spread across the next five years, that implies total returns of 18% annually for NETL from its current price. That’s 5% from dividends, 5% from growth, and 8% from valuation upside.

Let’s get a quick reminder on the basics of NETL, then dive into some data showing that net lease REITs don’t really act like bond proxies.

Basics of NETL

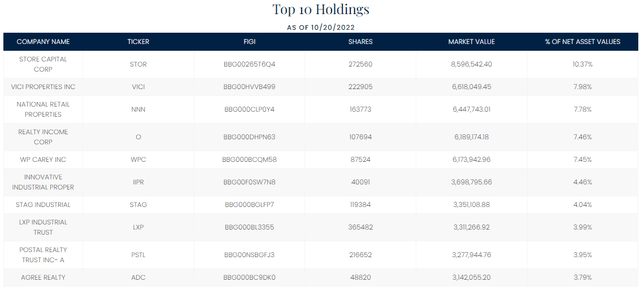

NETL is a very specialized ETF that only has 24 holdings, all of which are net lease REITs. For exposure to this specialized slice of the REIT market, the ETF charges a 0.6% expense ratio.

Across these 24 companies, NETL owns a slice of over 31,000 properties that are 99.3% occupied with an average of 14 years remaining on their primary lease terms.

Debt to enterprise value sits at 36.4%, which is only a touch above the REIT average of 35%. And notice in the above illustration, which shows data as of September 30th, that the weighted average remaining debt term is 6.7 years. That fixes net lease REITs’ interest costs fairly far into the future. Right now, the average interest rate for NETL’s holdings is 3.5%.

Turning now to the portfolio itself, it’s useful to remember that “net lease” doesn’t refer to a property type or tenant industry but rather a certain set of lease terms that puts the tenant in charge of property maintenance, insurance, and taxes. As such, NETL holds many different kinds of properties, from retail to industrial to office and even cannabis cultivation facilities.

Right now, because of STORE Capital’s (STOR) $14 billion take-private deal at a 20% premium to its stock price at the time, announced in September, that company has jumped up to the top spot. Once the fund rebalances (and later when STOR is removed from the list), other holdings will become larger shares proportionately.

Debunking The “Bond-Proxy” Myth

It’s common to see net lease REITs refer to as “bond proxies” or “bond alternatives.”

In a sense, that is intuitively correct. When Treasury yields rise high enough, investors will be lured to their safety rather than the higher risk dividend yields of REITs. And when Treasury yields are low, investors will be more attracted to the higher yields of REITs.

Many people think that this must be truer of net lease REITs because of their long lease terms with contractually fixed rent rates and only minor rent escalations of 1-3% annually. But in reality, net lease REITs do not appear to be any more susceptible to this tradeoff with bonds than the average REIT.

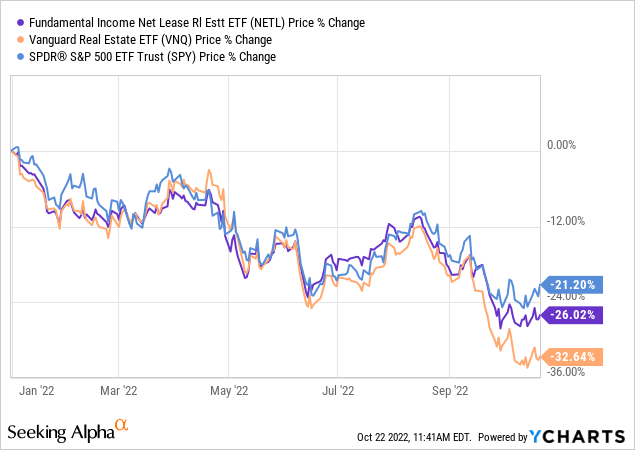

Consider, for instance, how NETL has performed this year, which has been marked by high inflation and rising interest rates, against the Vanguard Real Estate ETF (VNQ):

And this doesn’t even take into account dividends. Since net lease REITs have higher dividend yields than the average REIT, NETL’s total returns have been even better against VNQ’s this year:

Readers may mistakenly believe that net lease REITs on the whole are only performing as well as they are because of STORE Capital’s $14 billion take-private deal announced in mid-September.

First, notice that STOR’s boost only began in mid-September, but NETL has been outperforming VNQ since around the middle of Summer. Second, STOR is by no means the only net lease REIT that has been outperforming the broader REIT index this year.

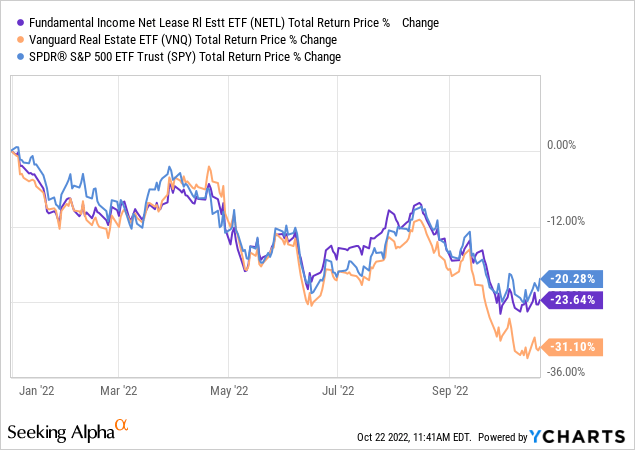

Let’s take a look at a YTD price performance chart comparing VNQ to the five largest net lease REITs (excluding STOR) by market cap, which are:

- Realty Income (O)

- VICI Properties (VICI)

- W. P. Carey (WPC)

- National Retail Properties (NNN)

- Agree Realty (ADC)

Now, I know this chart is pretty busy with lots of colored lines in it. But the primary point to notice concerns VNQ, which is the brown line. On a price basis alone, all of the biggest net lease REITs are outperforming the broader real estate index this year. And this is not even considering dividends! All of the net lease REITs listed above have higher dividend yields than the VNQ, so the total return differential is even greater than the price return differential.

If these net lease REITs are bond proxies, why haven’t they sold off more than the average REIT this year as bonds have had one of their worst years of performance ever?

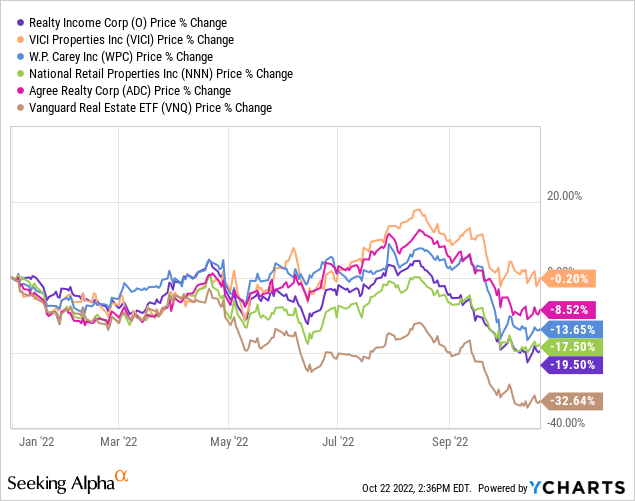

But you might say that net lease REITs had less to lose this year because they didn’t perform as well as the average REIT last year. While it is true that the broader REIT index outperformed NETL in 2021, we should zoom out to get a fuller picture of the performances of each.

Here is the price performance comparison between NETL and VNQ for the entirety of NETL’s existence as an ETF:

Again, the total return differential is even bigger, but I show the price performance comparison to show that, even without dividends included, net lease REITs have produced better returns than the broader real estate index over the last three years.

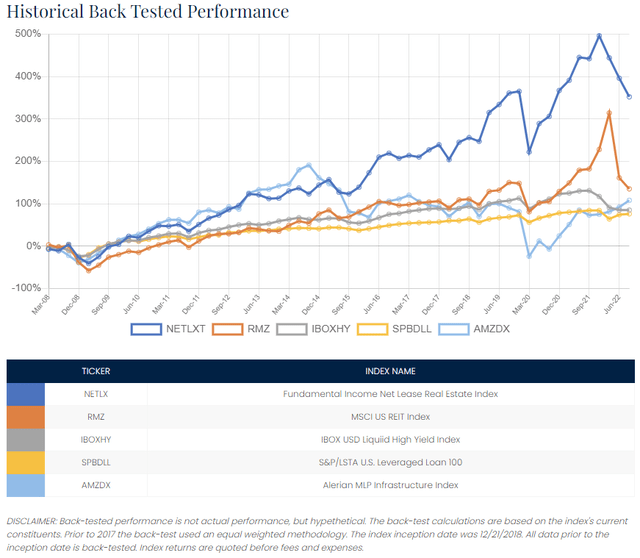

Fundamental Income, NETL’s advisor, provides this handy backtested performance chart showing that its net lease index (dark blue) would have outperformed the broader real estate index (orange) from March 2008 to the present:

To sum up this section, the two points I’m trying to make here are:

- In terms of both fundamental and price performance, net lease REITs act no more like bond proxies than the average REIT. In fact, they may even act less like bond proxies than the average REIT.

- The average net lease REIT boasts higher total returns over the average REIT over long periods of time.

Bottom Line

Let’s go back over the logic of why net lease REITs don’t really act like bond proxies.

Most net lease REITs are overwhelmingly net acquirers, meaning that they buy far more properties than they sell. They are basically portfolio growth machines. As such, what matters more than anything to net lease REITs is that the spread between their cost of capital and their acquisition cap rates remains wide enough to make investments accretive to FFO per share.

Property cap rates are responsive to interest rate movements, albeit with a lag. Net lease cap rates might be considered bond proxies. But since net lease REITs are net acquirers, their cost of capital can go up while still allowing investments to remain profitable, as long as cap rates are going up as well.

“But wait,” you might say, “cap rates only follow interest rate increases with a lag.”

True. But net lease REITs’ cost of debt only follows interest rate increases with a lag as well. That is because net lease REITs fix their interest costs for many years with long unsecured bonds, term loans, or fixed-rate mortgages. And even the cost of new debt can often be blunted with hedges, swaps, or other instruments, if CFOs have done their jobs well.

It is true that if interest rates remained high for many years, net lease REITs would face a strong headwind from higher interest expenses. But so would most other REITs. And utilities. And any other kind of company that heavily utilizes debt.

What about long lease terms with contractually fixed rent rates? Well, just as debt matures gradually over the years, so also do the leases. And just as inflation is pulling interest rates up, so also is it pulling up market rent rates. It would be entirely reasonable to expect net lease REITs to re-sign expiring leases at the market rate once all optional extensions are used up or if a property goes vacant.

In the past, as interest rates have steadily dropped over the decades, landlords have been more interested in lengthening lease terms, because term had the most value in a falling interest rate environment. To obtain longer lease terms, landlords often agreed to rent reductions. If rates continue to climb and inflation remains hot, I see no reason why landlords couldn’t simply shift focus to resetting expiring rents at the market rate, even if that meant giving up some term.

In short, net lease REITs have multiple ways in which they can try to preserve their crucial spread between cost of capital and investment returns, even in a rising interest rate environment. That makes them different than bonds in a critical and often overlooked way.

At a 4.85% dividend yield, NETL looks like a great buy today for ETF investors.

Be the first to comment