Lemon_tm

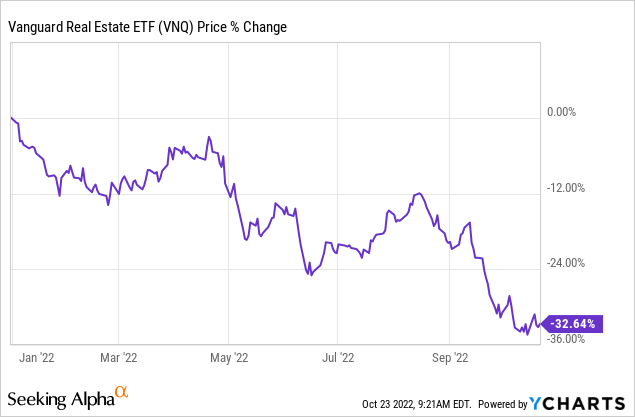

REITs (VNQ) are down 32% year-to-date:

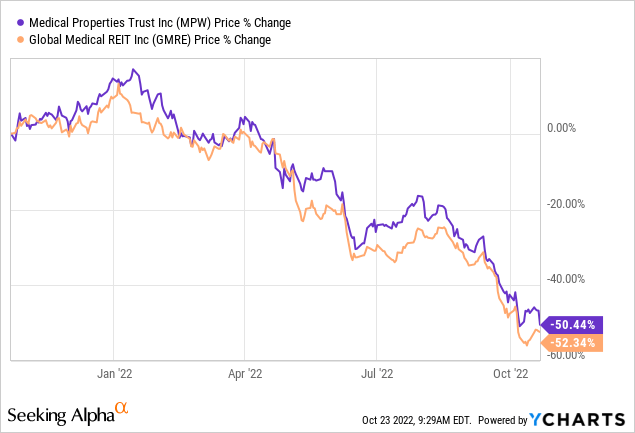

Medical Properties Trust (NYSE:MPW) is a good example of that. Its share price has been cut in half over the past year and it seems to keep dropping more day after day. This was one of my larger positions heading in 2022 so the drop has been particularly painful.

But contrary to what you would expect from a company that has lost so much value, its underlying business has actually performed quite well. Its FFO per share has risen steadily, the company has kept acquiring new assets, and the management has even attempted to address investors’ concerns, which are unwarranted according to them. The board also hiked the dividend by 3.6% earlier this year, and just recently, they announced a new share buy back plan. These are the not typical actions of a REIT that’s facing significant near-term distress.

Is the market overreacting?

Or are we the suckers in the room?

We have previously argued that MPW is undervalued and misunderstood by the market. We have covered the story in a separate article that we recommend that you read before jumping into today’s update to get an overview of the REIT and why we like it:

Since writing this article, a few things have happened:

- One of its tenants has filed for bankruptcy protection.

- It has sold a few assets.

- Interest rates have risen substantially.

- Industry-wide tenant issues have worsened.

- The short thesis has been gaining exposure and momentum.

Naturally, this has caused the share price to fall, and to be fair, some of this drop is justified since risks have risen for MPW.

But in my mind, the thesis has not changed materially enough for us to become bearish or even to change our Strong Buy rating. Risks have risen, but so has the upside potential given that MPW now trades at just ~8x AFFO and it yields over 11%. This is deep value territory for a REIT that’s been growing its FFO per share steadily at +5% per year (MPW’s organic growth has actually accelerated in 2022 because most of its leases have CPI adjustments).

So in short, MPW has now turned into a higher risk / higher reward play and we are changing our risk rating from average to high. This has a few implications that we will discuss below, but first, we share some thoughts on the recent events.

Pipeline Health Bankruptcy

Pipeline Health, one of MPW’s tenants, filed for Chapter 11 bankruptcy protection on Monday. How material is the news for MPW?

We will know more soon when MPW holds its next conference call, but based on the current information that we have, I would say that this is likely immaterial to the company.

It is not a big tenant for MPW and beyond that, the hospitals that it leases to Pipeline have been operated “very, very profitably” according to the CEO of MPW. If you read Pipeline’s bankruptcy filing, they make it clear that their financial problems stem from their hospitals in Illinois and MPW does not own any of those:

This is particularly true with respect to the Company’s Illinois operations (collectively, the “Illinois Facilities”). The Illinois Facilities have required significant working capital and have posted large financial losses since they were acquired. In the twelve-month period ending in August 2022, the Illinois Facilities posted a net loss of approximately $69.7 million on a consolidated basis. – Pipeline’s bankruptcy filing

MPW owns the properties in California and those have been profitable and subsidizing the losses in Illinois:

Due to the financial state of the Illinois Facilities, the Company’s California- and Texas- based healthcare operations have effectively subsidized the Illinois operations.

Therefore, I would expect Pipeline to reaffirm its leases for the properties in California. It surely does not want to lose its profitable assets. They will probably renegotiate the assets in Illinois and also seek to deleverage, but this is actually beneficial for MPW.

So I don’t think that these specific properties of MPW are a major cause for concern. However, Pipeline’s bankruptcy could signal that hospital operators are facing greater financial difficulties than we had hoped for. Fortunately, MPW still enjoys strong rent coverage, but the margin of safety is now lower than a year ago.

MPW Asset Dispositions

MPW has agreed to sell three hospitals leased to Prospect for a sale price of $457 million. These properties were purchased in August 2019 for about the same amount and MPW has earned about $104 million in rent payments since then.

We think that this is great news because Prospect one was of their weakest tenants. Getting out of these properties, which have become riskier, at more or less the same price is a good outcome, especially in today’s environment. MPW still earned a good return on its money despite Prospect’s difficulties.

Moreover, this will provide MPW with some cash to pay off debt and fund other investment opportunities at a time when accessing capital has become more complicated and a lot more expensive.

Risk of Growing Tenant Issues

The bigger issue for MPW is really that its tenants are now facing much greater difficulties.

First, the pandemic hurt them. Then came the high inflation. And now interest rates are rising rapidly right after they took on a lot of debt to make up for the pandemic losses.

This does not mean that MPW is now a poor investment. It simply means that it now faces greater risks than it did in 2021 and it could lead to some temporary setbacks if risk factors play out. MPW owns good properties that are profitable and it has a good track record of dealing with problem tenants. Therefore, I continue to think that this is a case of short-term pain for long-term gain, but the odds of more tenant issues have risen in the past recent past. Pipeline’s recent bankruptcy filing and MPW’s decision to sell the Prospect hospitals are clear signs of that.

Implications Of Recent News

MPW has now become a higher risk / higher reward type investment and the main implication is that you should be careful to not become overly exposed if it doesn’t fit your risk tolerance.

It is tempting to keep buying more and more shares of a company as its share price dips lower, but you also need to recognize that not all our investments will be winners and therefore, it is crucial to remain diversified. While we think that MPW will be a very rewarding investment, in the long run, we could be wrong. If some of its key risk factors play out, then MPW could turn into a long-term loser. We like the risk-to-reward and this is why we own it, but there are growing risks so don’t make the mistake of becoming overly exposed.

Another implication is that since MPW is turning into a higher risk / higher reward type investment, it may not be suitable for some of you who invested previously when its fundamentals were more resilient. If that’s the case, you may want to consider selling MPW and shift the proceeds into another REIT that’s more defensive and down equally as much.

To give you an example, some of you may want to consider shifting to Global Medical REIT (GMRE) if you feel uneasy about MPW. It is down about as much as MPW, but it owns medical office buildings that enjoy higher rent coverage. It is not immune to potential tenant issues either, but you would expect its properties to be a bit more resilient:

Another option may be to divide the proceeds between the two companies to seek better diversification and book a tax loss. Selling at a loss is never pleasant, but if you are immediately reinvesting the proceeds into another company that’s down just as much, you will still enjoy the same upside potential if and when the market recovers.

A final implication is that more patience will be needed with MPW. Fortunately, this is nothing new for us at High Yield Landlord. Being contrarian isn’t easy and it does not always work out, but when it does, the gains are so substantial that it should make up for the occasional losers.

Bottom Line

I remain bullish on MPW and I have invested a fairly significant amount in the company. The shorts are taking victory laps and celebrating MPW’s recent sell-off, but the real results will be known a few years from now.

The recent news indicates that near-term risks have risen, but nothing indicates to us that the long-term thesis would be broken.

We will continue to hold patiently, expecting significant upside eventually as the company proves the market wrong, and in the meantime, we earn an 11% dividend yield.

Be the first to comment