wutwhanfoto/iStock Editorial via Getty Images

Netflix (NASDAQ:NFLX), the hot topic in the equity markets this past Wednesday, delivered a brick of an earnings report on April 19.

Driven largely by a sequential decline of 200,000 in active subscribers that the company expects to steepen to 2 million in the coming quarter, the stock lost a mindboggling $50 billion-plus in market value in only one day. The losses since the November 2021 peak have now extended to a painful 67%, by far NFLX’s sharpest drawdown in a decade.

Netflix offers what is arguably a best-in-class video streaming service, which could tempt bargain hunters to buy shares on the dip. Why bet against the king on content in the era of on-demand entertainment?

But I believe that Netflix’s growth fallout leaves shares stuck between a rock and hard place: NFLX is neither a growth nor a value stock, and it should probably be avoided for now.

Growth No More

Netflix has historically been treated as a growth stock due to its position of market leadership in the fast-changing media space. For this reason, valuations have stayed consistently high over the past many years, and maybe justifiably so.

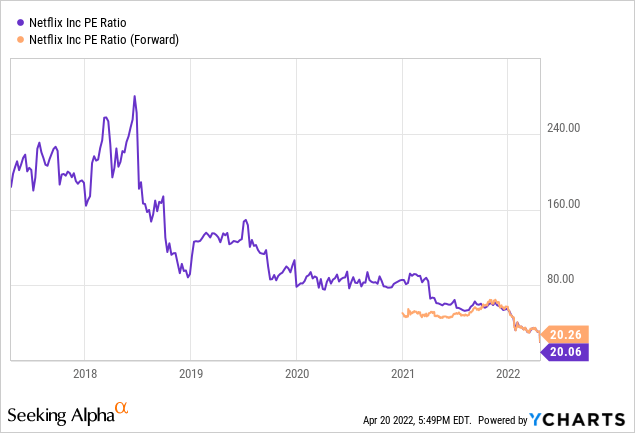

Notice that, even after trailing P/E came down sharply in 2018 as earnings per share climbed quickly from a very low base, the valuation multiple remained consistently at or above 80 times through the end of 2020.

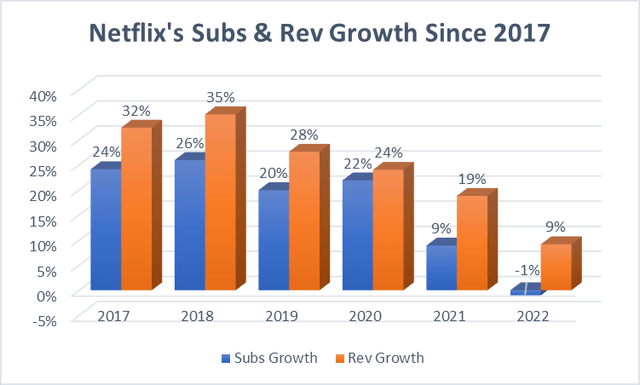

But the pipeline has started to dry out. The bar chart below, in which 2022 are estimated numbers, shows (1) how subscriber growth has understandably been tightly correlated with top-line growth, as number of users is a key revenue driver, and (2) that both metrics have been consistently dropping since 2018 – the 2022 revenue growth estimate, stale by a couple of days, is not reflective of the Q1 results and outlook and should come down.

Netflix has pointed the finger at a number of macroeconomic and industry-level headwinds to justify the slowdown in growth, including increased competition, high inflation and password sharing. The end of the COVID-19 tailwinds and stay-at-home consumption trends were not even cited as a main concern, rather as a distraction to the more fundamental issues that the company has been facing lately.

To the list of worries, I would add Netflix’s vulnerable position in the streaming space. This is not to say that the company does not offer a competitive service (quite the opposite), but rather that the once undisputed market leader stands to lose the most from the barrage of new offerings that peers Apple (AAPL), Disney (DIS) and many others have successfully launched in the past few years.

Netflix’s Subs & Rev Growth Since 2017 (DM Martins Research, data from Netflix and Statista)

The management team at Netflix would likely disagree with my point above. In fact, the company cited a slight increase in share of total US TV time between last year and early 2022 to argue in favor of its competitive position. Regardless, the bottom line is that Netflix’s status as a growth company and stock is likely a thing of the past now – unless or until the key drivers of financial performance improve substantially.

Isn’t It A Value Play Then?

If not a growth stock, couldn’t Netflix now be considered a value play instead? After all, trailing and forward P/E multiples have dropped to 20 times, the lowest in many years and a modest ratio compared to the broad market’s current average of 22 times.

But I have some reservations about this thesis. First, regarding key operational and financial metrics, the bottom is clearly not in yet. As subscriber growth numbers have only now turned negative, it is anyone’s guess how long it may take until Netflix can stop the bleeding. Until then, content and other revenue costs, which have increased faster than revenues in the past couple of quarters, are likely to stay elevated to support demand.

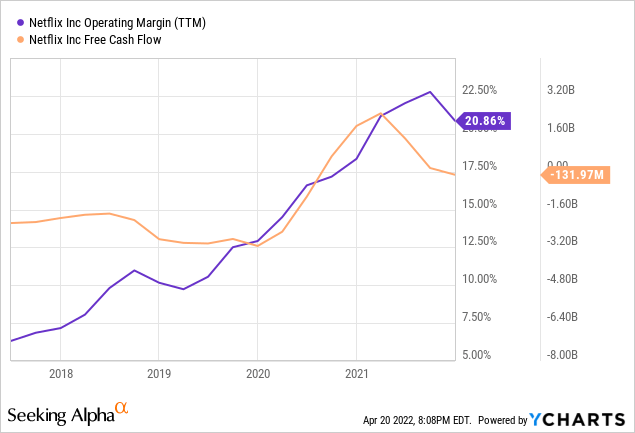

Second, I question Netflix’s status as a value play, considering (1) free cash flow that has yet to firm up in positive territory (see chart below) and (2) operating margins that, while improving consistently over the past many years, could come under pressure due to rich content costs and loss of operating leverage – assuming revenue growth continues to moderate, as it has for the past many quarters.

Best Left Alone

I understand the instinct to buy shares of a company that is still dominant in a still growing tech and media sub-sector (i.e., video streaming), especially after the stock has taken a sizable hit. But Netflix is facing severe growth headwinds that are unlikely to subside soon, while apparently struggling to produce reliable cash flow and to sustain margins at high levels.

NFLX is likely to be volatile in the near term, which could be good news for traders monitoring the stock on a daily basis and looking to time entries and exits. But for longer-term investors, I think that now is the wrong time to own shares. To me, Netflix is a sell.

Be the first to comment