Slimoche/iStock Editorial via Getty Images

What happened?

Jumia Technologies (NYSE:NYSE:JMIA) finally caught a break on Monday, April 4th. The company announced a new partnership with United Parcel Service (NYSE:UPS), causing shares of the African e-commerce business to rally 25%. The two companies will team up to expand delivery services for businesses and consumers across the African continent. UPS can now leverage Jumia’s last-mile delivery infrastructure to grow its reach across Africa. To start, UPS customers will be able to pick up or drop off packages at Jumia stations in Kenya, Morocco, and Nigeria. The plan is to eventually extend the alliance across all of Jumia’s consumer markets, such as Ghana, Ivory Coast, and South Africa, among others.

The partnership is mutually beneficial to both parties. Via Jumia’s distribution network, UPS will have a closer relationship with Africa and its population of 1.4 billion consumers. Likewise, Jumia will have access to UPS’ network across 220 countries and territories to help users deliver their packages. The partnership should be interpreted as great news by investors; however, it’s only one piece of an enormous puzzle. Jumia made impressive strides in its most recent quarter, but the company’s journey to a positive bottom-line will likely be a long one. The UPS partnership is positive, but make sure you assess Jumia’s financials and valuation before scooping up this stock today.

Improving fundamentals

After several less-than-ideal quarters, growth is starting to improve for Jumia. The company’s top-line grew 26% year over year in the final quarter of 2021, up to $62 million. Quarterly active users and total orders also experienced nice growth, expanding 29% and 40%, respectively. Since shifting its product mix toward everyday product categories, Jumia has enjoyed more customer visits to its platform. Everyday products make up 65% of sales today, with phones and electronics accounting for the other 35%. This transition was a wise one – consumers routinely need to buy day-to-day goods, which is not the case for electronics. This leads to increased customer retention because people are constantly revisiting the website to stock up on goods.

There is one major caveat – Jumia has been aggressively spending on marketing and technology in order to scale its platform. Last quarter, the company’s technology & content expense and sales & advertising expense grew a whopping 51% and 159% year over year, climbing to $13.1 million and $31.1 million, respectively. As a result, Jumia generated an EBITDA loss of $70 million, over two times more than its $33.8 million EBITDA loss in the same quarter a year ago. Management continues to stress the need to spend in order to grow its operations. They are forecasting an EBITDA loss between $200 and $220 million in fiscal year 2022, which is higher than its $196.7 million loss this past year.

It doesn’t take a rocket scientist to understand that Jumia is years away from reaching profitability. And given its ambitious spending habits, there’s no guarantee that a positive bottom-line will ever be achieved. I wouldn’t invest in Jumia today unless you have confidence that its investments will pay off down the road.

Reasonable valuation

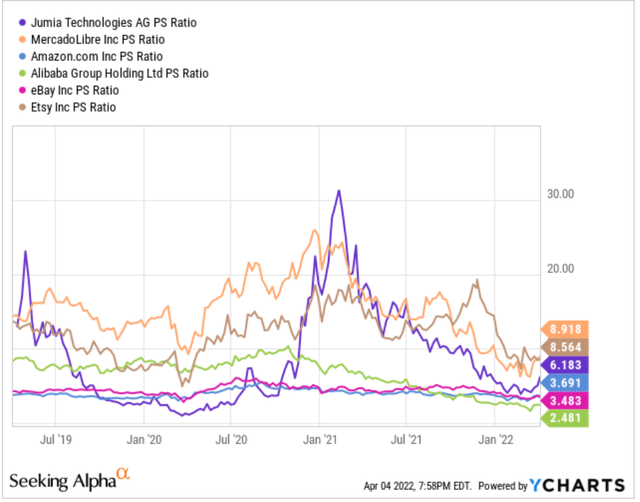

Jumia’s valuation has become more tolerable amid its latest pullback. In early 2021, the stock was trading above 30 times sales, a sky-high valuation relative to other e-commerce companies. Even after its recent sprout, Jumia carries a P/S multiple of 6.2x, which is more in line with industry peers.

I’d wait to see how the company’s share price moves following the April 4th jump. I wouldn’t be surprised if the stock sinks lower in the days ahead as hype surrounding the new partnership simmers down. That said, Jumia looks to be more fairly priced today than it has been in the past. But I’m going to let the fresh news cool off before I consider adding to my position.

Tremendous runway for growth

There’s no doubt about it – Jumia is a risky stock. Clearly, the company’s infrastructure on the continent is valuable enough to attract a world-leading delivery company like UPS. The partnership is a win for Jumia and its shareholders, but it’s a minor part of the company’s broader journey.

Growth is improving, but it’s coupled with a strong rise in operating costs. Profitability is far and away, so investors need to be committed over the long haul. I’d hold off on buying this stock until noise surrounding the partnership dies down. Still, I like Jumia’s long-term trajectory, and I’m excited to see this company’s journey play out in the coming years.

Be the first to comment