Jordan Siemens

(This article was originally published on October 19, 2022, at 8:27am ET, for Second Wind Capital members).

Unless you’re mostly a short seller or have been aggressively long E&P energy stocks (XLE), as well as a few other commodity stocks, 2022 has been an exceptionally difficult year. Despite last week’s rally, year-to-date, though October 21, 2022, the Nasdaq Composite (QQQ) is down 30.6%.

Before we dive, let’s look at the year-to-date returns of FAANGMNT.

- Meta Platforms, Inc. (META): -61.3% ($336.35 (12/31/21) to $130.01 (10/21/22).

- Amazon.com Inc. (AMZN): -28.4% ($166.72 (12/31/21) to $119.32 (10/21/22).

- Apple Inc. (AAPL): -16.7% ($176.84 (12/31/21) to $147.27 (10/21/22).

- Netflix, Inc. (NASDAQ:NFLX): -51.9% ($602.44 (12/31/21) to $289.57 (10/21/22).

- Alphabet Inc. (GOOGL): – 30.2% ($144.85 (12/31/21) to $101.13 (10/21/22).

- Microsoft Corporation (MSFT): -27.5% ($334.14 (12/31/21) to $242.12 (10/21/22).

- NVIDIA Corporation (NVDA): -57.8% ($293.91 (12/31/21) to $124.66 (10/21/22).

- Tesla, Inc. (TSLA): -39.1% ($352.26 (12/31/21) to $214.44 (10/21/22).

In other words, if you’ve been long technology stocks, and long most stocks for that matter, it has been exceptionally difficult in 2022, at least through October 21, 2022.

Let’s Talk Netflix, Inc.

Back on April 21, 2022, I wrote a compelling piece on Netflix. At the time of publication, Netflix shares were trading at $220. If you go back and look, the majority of other authors were bearish and if you go back and read the commentary threads, the feedback was Netflix was doomed and I was out of my mind to be so aggressively long and so aggressively bullish. The bearish commentary suggested that it was an almost a foregone conclusion that Netflix was destined to trade down to $100 per share and remain there indefinitely.

Lo and behold, this conviction has paid off. And despite looking really silly and admittedly sizing this up a wee tad early, as Netflix shares traded down into the low $160s in mid May 2022 and spent a lot of time in the $170s and $180s, during the dog days of Summer, this conviction, ultimately, has paid off.

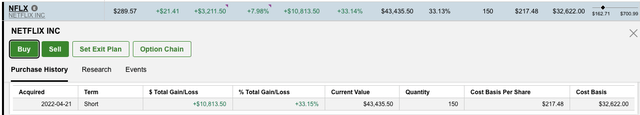

Enclosed below, and please note the purchase date, April 21, 2022. So I’m happy to both share and show that my conviction bet in Netflix is up 33.14%, as of October 21, 2022. Let’s face it, it’s fun to write an article and tells people to buy XYZ or to sell ABC, but it is a different kettle of fish entirely to size up a position and actual invest in a business.

The Netflix Thesis, Short and Sweet

Let me cut to the chase here and synthesize my thesis. There are 38 sell side analysts covering Netflix. There are countless other people, in the financial media, including on SA, covering Netflix. There is no edge from reviewing the financials. Yes, you have to understand how Netflix’s financial statement move, of course, but after the market sees its quarterly results, the market very quickly incorporates this new information into the stock prices.

The edge is understanding the business, understanding the competitive landscape, and thinking far sightedly when Wall Street tends to think quarter to quarter.

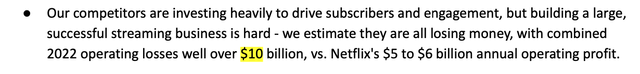

I would argue that Netflix is simply way too far out in front, is vastly more profitable, and has the resources ($17 billion per year in annual content spend) to win the long game or the arms race.

If you read the Q3 FY 2022 Shareholders Letter: (See here), NFLX’s management spells this out clearly.

Netflix Q3 FY 2022 Shareholder Letter

Back in the summer, with its stock price stuck under $200 and frequently stuck under $180, for a few-month stretch, the bearish narrative was fever pitched. And this was spun, like a ball of yarn shared with a room full of cats, like this.

1) Netflix has too much competition. This limits its ability to raise prices and competitors can try and under cut them on price.

2) The global macro headwinds are so fierce that millions of customers will cycle off and cancel Netflix to save $15 per month!

Lo and behold, and the macro backdrop has only intensified, and yet, Netflix just told the shorts, naysayers and the haters alike that they’re managing just fine, thank you! Netflix’s Q3 FY 2022 earnings report just crushed expectations, and its Q4 FY 2022 outlook looks great, notwithstanding the intense FX headwinds. Perhaps, more importantly, its Q4 2022 and 2023 content slate is as fierce as it has ever been.

Then throw in Ads, a topic that took up the first 16 minutes out of its 42 minute the October 18, 2022 conference call, and now we are cooking with gas.

Simply put, despite whispers of achieving double or triple the CPM rates compared to the industry average, albeit for Netflix’s its initial ad inventory is somewhat limited (as there is a 5 minute per hour cap rate), Netflix can’t keep up with the demand, as it is overwhelming and there are vast amounts of Madison Avenue dollars that want in, seeking an alternative pathway to reach an audience outside of linear TV or beyond the rails of the old digital guards – Google and Facebook.

Well, one of the big factors for us in picking Microsoft is that we felt like we were highly strategically aligned. They had an approach that was similar to ours, which is that we want to launch and then learn quickly and iterate quickly and that there was a lot of flexibility both in terms of innovation around the formats and approaches that we just talked about. Partly it was a lot of flexibility in thinking about how do we leverage the combined go-to-market capability that Microsoft has a lot of right now and that we have very little, but we’re going to build overtime.

And frankly when I see the demand that we’re in right now, we’re stretched between the two teams to really support all that. So, I’m actually excited about our ability to grow that capacity on the Microsoft side that I think they’re going to do some hiring and building and we’re going to do some hiring and building and then through that joint capacity growth be able to better serve more advertisers which we can’t even – we can’t even – actually we’re turning some folks away right now because we just don’t have the go-to-market capacity to serve everyone.

(Source: Netflix’s Q3 FY 2022 Conference Call)

Next, and I covered this in my original April 21st piece, despite the robust $17 billion annual content spend, par for the course, at this stage of the arms race, as Netflix’s top-line pulls away from the pack (FX headwind notwithstanding), the free cash flow generation will be robust in 2023 and beyond.

And if you actual take the time to read the shareholder’s letter or listen the Q3 FY 2022 conference call, you learn:

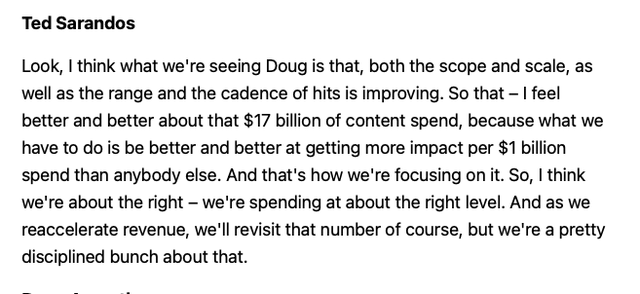

1) Netflix only continues to get better and more efficient per $1 billion of content spend. No one in the industry can match this and at such scale.

Netflix Q3 FY 2022 Conference Call

(Source: Netflix’s Q3 FY 2022 Conference Call)

2) It doesn’t take a rocket scientist to work out that if you can get lots of bang for $17 billion content buck, and if you hold the $17 billion content spend constant, given this enhanced efficiency in the spent, then when grow the top-line grows, at say 10%, this translates to oodles of free cash flow.

As Ted said, as we hope and expect to reaccelerate revenue, we’ll revisit those spend levels. But for now, given all those learnings that Ted mentioned, we think we can deliver more member value per dollar of content spend than we have in the past. So we expect our content slate to get better and better each quarter and each year over the next couple of years. And the way that then translates to cash flow for this year, we’re maintaining our roughly $1 billion of free cash flow guide plus or minus a couple of hundred million. There’s always movement at the end of the year for timing and then next year for that free cash flow to substantially improve beyond that. So we expect it to be materially above the roughly $1 billion this year. We won’t put a specific guide out now, but it will be significantly larger.

(Source: Netflix’s Q3 FY 2022 Conference Call)

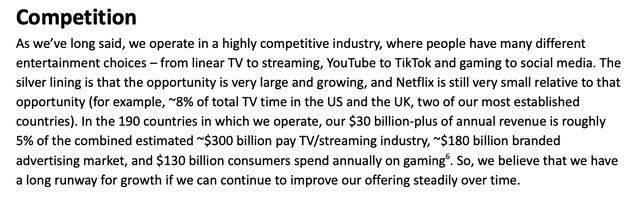

And for an encore, Netflix reminds the world of the big secular tailwinds as Smart TVs and streaming continues to eat linear TV’s lunch, live sports notwithstanding! Also, there is a great big world out there and Netflix has a lot more global market share to capture.

Netflix Q3 FY 2022 Shareholder Letter

(Source: Netflix’s Q3 FY 2022 Shareholders Letter)

Putting It All Together

As often happens, the sell side and market at large, and collectively, tends to throw the baby out with the bathwater. On the sell side, it is simply groupthink and outside of Wall Street, it comes down to sentiment, reacting to stock prices, and what is considered fashionable. Value and contrarian investing is so difficult, because it is so hard for so many people to maintain their conviction in a face of falling stock prices and aggressively argued bearish narratives. Even if those bearish narrative are pedestrian and not based on empirical evidence.

As for Netflix, the content and value proposition are off the charts compelling, for the consumer, hence why the company has 223 million (and growing) global subscribers. Growing a global subscriber base to this level and beyond is exceptionally difficult and nearly impossible to replicate. Since its big Q1 FY 2022 miss, the bears and the market have greatly underappreciated law the of physics here.

Secondly, as the company experienced a rough patch, during the first half of 2022, this is where the company and its leadership showed its mettle. The company realizes that it was time to focus on revenue growth and driving bottom line results as opposed to subscribe count growth, at any and all costs. Therefore, this means the key to success is maximizing that $17 billion in annual content spend. And in this brave new world, if Netflix get a lot more bang for its buck, think quantity and quality of hits, per $1 billion in content spend, then they can hold the line, at $17 billion, then future top line growth become super profitable.

Lastly, given that rest of its peers, collectively, are losing boat loads of money, this means that Netflix can and will continue to pull further and further ahead of the pack, as this level of losses aren’t sustainable, as shareholders of its peer group won’t fund this level of losses in perpetual. Therefore, this means 1) its peers will be forced to raise prices or 2) other competitors simply fail in this crowded race, as they don’t have the stamina to win the marathon. So, if you are playing the long game here, as an investor, then this intense level of competition was actually a great thing, as it has only made Netflix that much stronger and paradoxically enhances its longer-term chances of success and industry dominance.

Here’s to value and contrarian investing!

Be the first to comment