ljubaphoto/E+ via Getty Images

Investment Thesis

Netflix (NASDAQ:NFLX) kicks off tech earnings season on a positive note. Tech investors have been hit so hard in 2022 that good news may now actually be good news!

Could we now, finally, move the conversation beyond the Fed? That would be a very positive distraction.

Netflix spends a lot of time discussing the appeal that its advertising business is having with brands. Its advertising business is expected to contribute around 2% of its revenues in 2023, and grow from there.

By my estimates, Netflix is priced at 55x next year’s free cash flow. If Netflix wants investors to think about the business beyond subscriber addition figures, its free cash flow will need to grow very strongly for a period of years, irrespective of currency impacts.

Investors Welcome Results

Going into earnings results, with Netflix’s stock down so significantly, any guidance that was not horrific was going to be welcome.

Could this type of performance be the new normal for this earnings season? Recall, this time last year, share prices were getting blown to pieces, even when companies’ results weren’t all that bad.

Could this be a reversal of that performance? Could the market be finding a bottom?

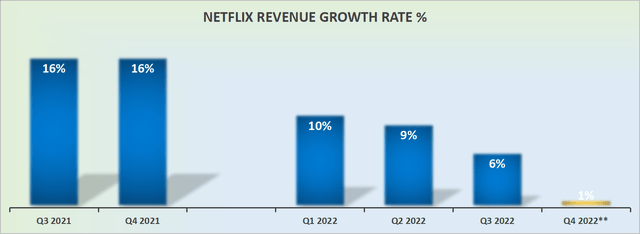

Netflix’s Revenue Growth Rates Stabilize

NFLX revenue growth rates

Excluding currency, Netflix’s Q4 2022 revenue guidance points to 9% y/y growth. And investors are perhaps hopeful that Netflix is lowballing estimates so that its Q4 2022 revenues actually end up growing 10% y/y at constant currency.

NFLX revenue beats/misses

That being said, Netflix has a history of accurate guidance, rather than lowballing estimates. Indeed, in every shareholder letter, Netflix states that it strives for accuracy rather than being conservative.

Nevertheless, one way or another, I believe that we should think of Netflix as a high-single-digits to low-double-digits growth business.

Advertising Business, The Next Leg of Growth

Brands have been getting behind Netflix’s advertising business, with the expectation that this could be a significant revenue driver for Netflix.

Looking out to Q4 Netflix states that it doesn’t expect this revenue line to be a meaningful contributor. However, there’s been some analysts stating that advertising could contribute around 2% of total revenues in 2023 and climb from there up to around 19% of total revenue by 2026.

Netflix is very clear in stating that it only intends to roll out its advertising-based video-on-demand (“AVOD”) business to new prospective members, and not to dislodge current members from their plan.

Free Cash Flow Prospects

Netflix wants investors to focus on its business in terms of revenue growth rates, returns on equity, and EPS figures. And not to be overly focused on new subscriber addition.

Thus, after Q4 2022, Netflix will no longer provide investors with visibility into subscriber figures.

Also, Netflix contends that it has a plan to adjust its cost structure if currency headwinds persist. Therefore, looking beyond its currency headwinds, Netflix declares that it can continue to strive for 19% to 20% operating margins.

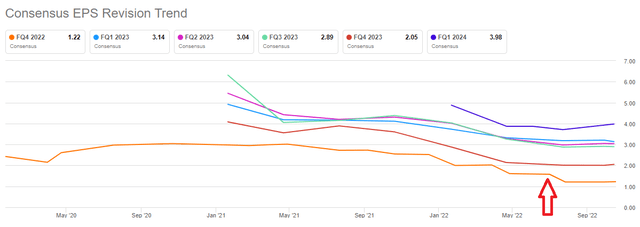

NFLX EPS consensus

Incidentally, it’s interesting to note that even though analysts had already significantly lowered Netflix’s Q4 2022 EPS estimates throughout the summer, down to $1.22, Netflix’s guided EPS figure ultimately is for $0.36.

On the other hand, Netflix contends that without currency headwinds, its operating margins would have come out to around 10%. That means that it would have beaten this EPS estimate and with its EPS figure landing close to $1.30 – $1.40, if we ignore currency impacts.

Again, this reflects that if investors are willing to look beyond currency impacts, consumer-facing tech companies are likely to be performing better than analysts were expecting.

NFLX Stock Valuation – 55x Next Year’s Free Cash Flow?

Netflix continues to state that it will make at least $1 billion of free cash flow in 2022.

To make the maths work, investors need to have a strongly held view that Netflix’s free cash flow can grow by 100% y/y in 2023, on the back of around 10% topline CAGR.

If indeed Netflix could grow its free cash flow line by 100% next year, that would leave the stock priced at 55x next year’s free cash flow.

To go some way to substantiate this premium valuation, investors need to believe that irrespective of weakening economic conditions around Europe, Brazil, and North America, subscribers will not give up their Netflix subscription.

Even if believe that’s a high hurdle to cross, I also recognize that in the very short term, during a bear market, investors can latch on to any good news.

The Bottom Line

Netflix positively surprised investors. I’m very hopeful that the market has found a bottom.

However, more realistically, I remain skeptical and continue to believe that we are in a bear market rally. After all, none of the concerns that got us here in the first place have been dealt with to any significant extent.

On the other hand, as a professional investor, I absolutely do welcome the occasional respite from consistently red days.

The crux of the thesis is this, if Netflix wants investors to start to pay more attention to its financials and not focus on its subscriber addition figures, then it will need to deliver consistently strong free cash flow growth, to go some way to support its valuation of 55x next year’s free cash flow.

Irrespective of the share soaring hard after-hours, this was a mixed-bag report.

Be the first to comment