cyano66/iStock via Getty Images

Netflix (NASDAQ:NFLX) had one of the worst days in the company’s history, when the company reported the first subscriber decrease in more than a decade. The company’s AH market capitalization has dropped to $120 billion, representing a more than 60% decline in the company’s market cap in a mere 6 months. However, despite this weakness, we think there’s more to come.

Our History

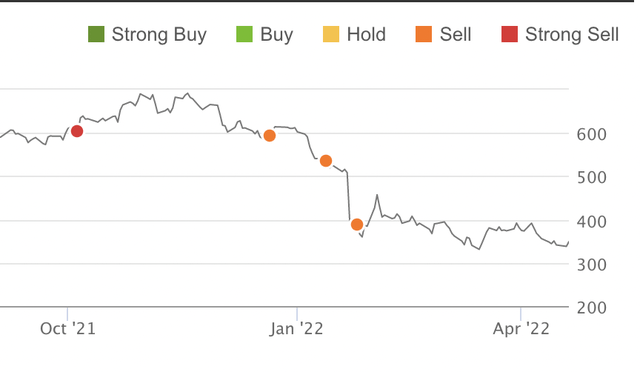

We’ve consistently been bearish on Netflix’s valuation versus its peers and these earnings are a prime example of why, as the growth story changes.

With weak earnings in January as well, the company’s stock has continued to trend downwards towards its after hours price of just under $260/share. The bearish thesis remains the same, and as the company continues to effectively lose money, what investors are seeing here is a re-evaluation of the company’s prospects.

Specifically, as competition increases and Netflix goes from a unique technology company building its own industry, to another company in a crowded market, the company is no longer a growth stock. Instead, it’s becoming more of a value stock, meaning its P/E ratio will contract and it should be valued as such on its earnings.

Unfortunately, due to management decisions, we expect things will get worse.

Netflix Price Increase and Account Sharing

In our view, Netflix is in a conundrum. The company sees financials becoming worse, subscriber count decreasing, and it’s going down the classic path of a struggling company.

Specifically, the company has been consistently increasing costs. As part of that, Netflix has announced a potential crackdown on the 100 million households sharing accounts. These are households that purchase multi-screen viewing, but potentially share the account with their friend, ex, or long-lost relative. However, we feel this path has 3 risks.

- It’s difficult to distinguish when you’re sharing the account with a random friend versus your kid who’s on vacation or off to college. Mistakes here risk a worse user experience.

- Users pay for # of screens that can view simultaneously. Restricting those screens to screens in a single location risks not only users downgrading their accounts, but also again, a worse user experience.

- Even if the experience is sufficient, such a move would cause Netflix’s users to re-evaluate their subscription. With plenty of alternative choices, they might see it as a good time to cancel.

More so, the company can only annoy users in one way at a time, and that’s where we struggle with management decisions. The company has been raising streaming service prices faster than any competitor, which again could cause users to re-evaluate their decisions. The company alluded to lost users in its earnings from the price increase, although it said it was in line with expectations.

Growing Competition

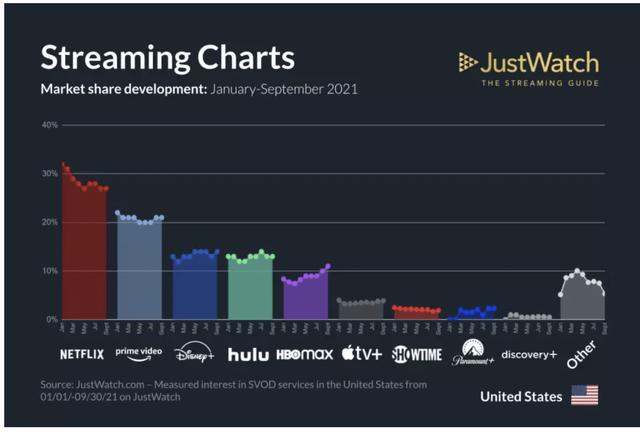

Netflix’s growing subscription means that its market share is continuing to erode, hurting its value proposition.

Specifically, most of Netflix’s decline in market share has been going to HBO Max, as visible in the above chart. With HBO Max combined with Discovery+, we see the service as now a major player in the streaming universe, comparable with Disney+ and Hulu as independent properties. New content and a strong legacy library could mean continued growth.

HBO Max has continued to post record breaking growth.

There’s one other aspect of the growing competition worth highlighting. Netflix’s competitors have much stronger financial positions for content. They have decades of connections, resources, costumes, and stages. They have connections to existing talent, lowering costs. They can operate at cost in ways that Netflix can’t, meaning that they’re more profitable at each market share.

No Content Library

Here we get, on top of price increases and no sharing, the crux of Netflix’s problem, and why we think the carnage will continue (despite management’s optimistic nature).

This thread on Reddit Investing about the company’s earnings is clear.

Maybe they should try making better content. Or stop cancelling every show before it can gain any sort of traction.

or stop giving “AAA” movie stars ludicrously expensive amounts of money for films that aren’t good.

They kept raising prices on me. I would’ve kept subscribing even though I hardly watched anything on it, but all those notices about higher pricing backfired as it finally caught my attention and I dumped them.

$19.99/mo to watch Ozarks and Stranger Things is way too much. All the new content is rushed garbage

Not only that they keep raising prices, they keep losing catalogs. How can Halt and Catch Fire disappeared??

Even if you find the perfect show that suits your tastes perfectly, good luck getting a second season because it probably doesn’t suit the tastes of 80-90% of subscribers.

To start, the company is in a worse position than its competitors. Apple (NASDAQ: AAPL) has similar struggles and has approached that by having the lowest price service focusing on few high quality shows. Netflix has done the opposite, spending $10s of billions of substantial content, normally cancelled as it tries to find that one “successful” show.

That one “successful” show might not keep users because it’s so uncommon, but users will remember the struggles to find that one show. Without a legacy content library there’s nothing to default to. Until the company redefines its approach to content, with a new focus on low-cost modest quality, we expect the company will continue to underperform.

That makes the company a poor investment in our view.

Our View

Our view is that investors considering investing in Netflix as a value stock should still hold off. We expect the company’s quarters will continue to be difficult, and the company is continuing to guide for increased subscriber loss. The company is in a more difficult position than most of its competitors and it doesn’t have a clear path to resolve that and start generating strong earnings.

That makes the company a poor investment in our view.

Thesis Risk

The largest risk to our thesis at this point is potential consolidation. We’ve talked about how Warner Bros. Discovery (NASDAQ: WBD) is a unique acquisition opportunity, and as Netflix’s price drops, the same thing could happen. Alternatively, the company could decrease content spending and focus on FCF. Or could enable stronger shareholder returns versus the difficulties we forecast.

Conclusion

Netflix deserves all the credit for defining a new and exciting industry. Unfortunately for the company, it started its content creation activities too late, and it still doesn’t have the expertise necessary to effectively create low-cost quality content. More so, the company doesn’t have a multi-decade old library of content to fall back on.

Going forward, we expect the company’s substantial capital spending to continue keeping FCF low. The company is still at an above $100 billion market capitalization, meaning if the market re-evaluates it as a value stock, it needs billions in earnings to justify the valuation. We don’t see that as likely to happen.

Be the first to comment