Instagram could be left reeling alright bigtunaonline

It has been a rough half-decade for Meta Platforms, Inc. (NASDAQ:META). The stock is actually down 6% since the height of the Cambridge Analytica scandal. It is down more than 50% as TikTok garnered more user engagement than Facebook and Instagram combined. Add to that the impact of Apple Inc. (AAPL) ATT changes, and the company reported its first-ever revenue decline last quarter.

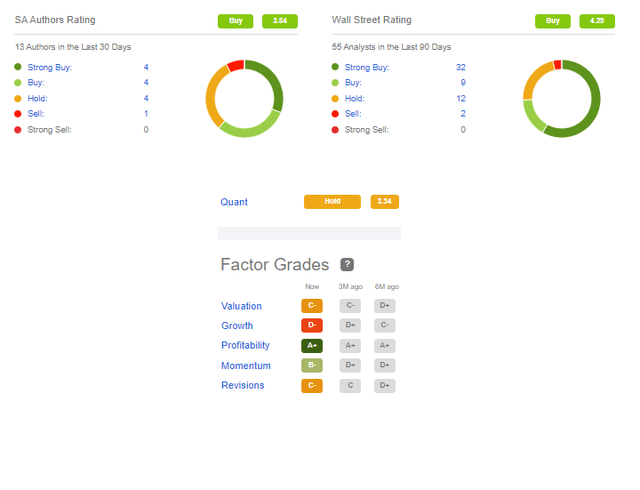

This led to diverging opinions on the future of META stock, with Seeking Alpha’s contributors splitting 5 vs. 8 on those who rate the stock a hold or less and those who rate it at least a buy. Wall Street is more bullish, with 32 of a total of 55 rating the stock a strong buy. Seeking Alpha’s own quant rating system has the stock at a hold, mostly due to poor growth and lower analyst revisions.

Bullish and Bearish Views on Meta (Seeking Alpha)

I’m in the camp of Seeking Alpha’s quant rating system as well, with a hold rating. I am bullish on Meta’s ability to navigate ATT challenges. I also believe that the company will pass the test posed by TikTok, although it might need help from governments to accomplish that. What I do believe will be a big threat to Meta’s current ad business is the introduction of ad-supported tiers by streamers, particularly by Netflix (NFLX). That challenge offsets any optimism I have over the company’s ability to navigate the ATT and TikTok challenges.

Meta is Best-Equipped to Deal with ATT Challenge

I have discussed previously the challenges posed by Apple’s ATT changes. It’s basically that applications like Facebook and Instagram have lost the signal on Apple users, and as a result cannot track them as well as before. They particularly lost the ability to figure out whether the ad they showed led to the user converting or not. That challenge can be solved mainly with size, which Meta has in abundance. The introduction of shoppable ads, for example, bridges the gap between showing the ad and conversion. The company’s reported shift of Instagram shopping features to serve the company’s ad business is in my opinion another attempt to better measure conversion in a post-ATT world. Encouraging users to engage with businesses inside Meta’s family of apps will help the company generate more first-party data, and thanks to its size it will have enough data to remain relevant to advertisers. The question currently seems to be why wouldn’t TikTok take more ad share anyway given it has much higher user engagement?

The TikTok Challenge is Transitory

Like many of the TikTok challenges, the company’s competitive threat to Meta will evaporate with time. In a lot of ways, this situation isn’t new; Meta faced a similar challenge with Snapchat’s (SNAP) stories. Mark Zuckerberg said so himself in the earnings call:

All right. Next on to ads. We faced a number of challenges here in the near term, but the investments that we’re making should give us a comparative advantage over the longer term. One near-term challenge is the growth of short-form video. Reels doesn’t yet monetize at the same rate as feed or stories. So in the near term, the faster that Reels grows, the more revenue that actually displaces from higher monetizing surfaces. Now in theory, we could mitigate the short-term headwind by pushing less hard on growing Reels, but that would be worse for our products and business longer term since we’re confident that Reels will grow engagement overall and quality and will eventually monetize closer to Feed.

Our work on ads monetization efficiency for Reels is actually making faster progress than we’d expected. We’ve now crossed a $1 billion annual revenue run rate for Reels ads, and Reels also has a higher revenue run rate than Stories did at identical times post launch. So the bottom line is I think we’re on track here and we just need to push through this one.

An important thing to note here is that growing Reels is a drag on Meta’s own revenue, because Reels currently doesn’t monetize as well as Feed or Stories. So while the decline in revenue can be viewed as the emerging competitive threat of TikTok, it can actually be the exact opposite; Meta is growing its competing product so well that it is taking ads away from Feed and Stories. Given Reels is growing faster than Stories did at identical times post-launch, and it will eventually monetize as well as Feed, the company could be back to 20% sales growth faster than many bears think. So this could be very bullish news for the stock.

The other thing going for Meta is the regulation of TikTok. There are growing debates in the U.S. over banning TikTok due to fears of Beijing accessing user data. India has already banned TikTok, so the option could be on the table for many countries. If that trend emerges, then Meta’s business will benefit as a result of lower competition.

Netflix is the Real Threat to Meta’s Ad Business

I wrote earlier this month that Netflix could easily generate $10 billion in ad revenue. Netflix has three things going for it. Firstly, it has a comparable number of global viewers. It is one of a handful of media properties in the world that has a billion users on its platform. Secondly, it could have much higher CPMs than Facebooks, with reports of management aiming for a $60 CPM. Premium video will always fetch premium ad rates, and Facebook has virtually zero premium scripted shows on any of its properties. Thirdly, Netflix has complete control over what’s on its platform while that doesn’t mean Netflix is immune to brand safety criticism, having control over the content means management can address that challenge better. The better brand safety potential and attractive customer targets mean Netflix’s ad inventory could be highly appealing to advertisers.

A new report shows that Netflix aims to have 40 million viewers on its ad-tier by this time next year. As I discussed in my article earlier this month, this number of viewers would be enough to generate $10 billion in ad revenue with a lower ad-load than traditional TV.

Meta previously (and currently) addressed competitor threats like the one Netflix could pose by simply copying the competing products. That is something that will be close to impossible to do in this case, given the amount of capital required to enter the streaming business. Meta would have to double its capex to enter the streaming market, which even if successful will be a huge drag on its margins. Meta could obviously cater to the smaller advertisers and grow its other businesses. But when it comes to ads, it won’t be a question of how will Meta fend off Netflix, it’s simply how much ad revenue will Netflix want to take from Meta.

Conclusion

The introduction of ad-supported tiers by streamers, especially Netflix, could spell the end of the online advertising duopoly held for more than a decade by Meta and Alphabet Inc. (GOOG, GOOGL). While Google search will be better positioned than Meta in general, any change in market structure usually affects the incumbents’ stock negatively. However, Meta is at an attractive valuation, and the threat from TikTok is unlikely to be a game-changing threat. Given that a tangible threat from Netflix is realistically a few years away, the stock could be worth a punt for investors with a medium-term view. For long-term investors, I believe it’s a hold.

Be the first to comment