Brandon Bell/Getty Images News

Introduction

Welcome back, it’s been a while since my last analysis about Netflix, Inc. (NASDAQ: NASDAQ:NFLX) (the “Company”). In such a timeframe, the Company successfully moved and reached my price target, but most importantly it finally announced its decision to join the party within the AVoD (or ad-supported video-on-demand services) market.

To account for the above tailwind, but also for other near-term headwinds, I decided to review my analysis.

The Company

Total Addressable Market (TAM)

First of all, I would like to update the total addressable market, from being represented by only the SVoD market to also including the AVoD market. According to Statista’s estimates:

- Global revenue for the SVoD market is expected to show a CAGR 2022-2027 of 11.48%;

- Global revenue for the AVoD market is expected to show a CAGR 2022-2027 of 13.88%.

All of that said, I adjusted those estimates by considering only ex-China revenue, which translates into a CAGR 2022 – 2031 of 9.59%, or into a projected market volume of $213,976 million by 2031.

Growth Stage

I believe that the Company is currently in the “mature growth” phase, with the Company looking for new ways to keep the money machine running. In fact, the Company’s top line is under pressure due to a series of revenue growth headwinds like household sharing accounts, tougher competition, and an unfriendly economic turmoil (e.g., the recession) to name a few. However, the Company is well aware of such headwinds and it tries to tackle them:

- On the household sharing accounts, it has started testing new functionality that will allow adding an extra member for an additional monthly fee. Now, I know that some of you will say that this is a bad move, but let’s be honest, personally, I would be ok paying $3.0/month for using one of my friend’s Netflix accounts;

- On the tougher competition side, in the short term, it is a big challenge, especially when one of your competitors, The Walt Disney Company (DIS), announced to spend $33B on content in 2022 and it costs you only $7.99/month. However, I believe that in the near to long-term it will be able to effectively tackle this challenge thanks to the ongoing transformation. Which one, you may ask. Today, we see Netflix only as a streaming company, however, we would be wrong to look at it only in this way. The latest acquisitions are the proof. Netflix will become an entertainment company, where people will be able to watch, play and talk about what they like. In fact, the Company keeps investing in gaming because it is well aware of the high synergies that exist between movies, shows, and games;

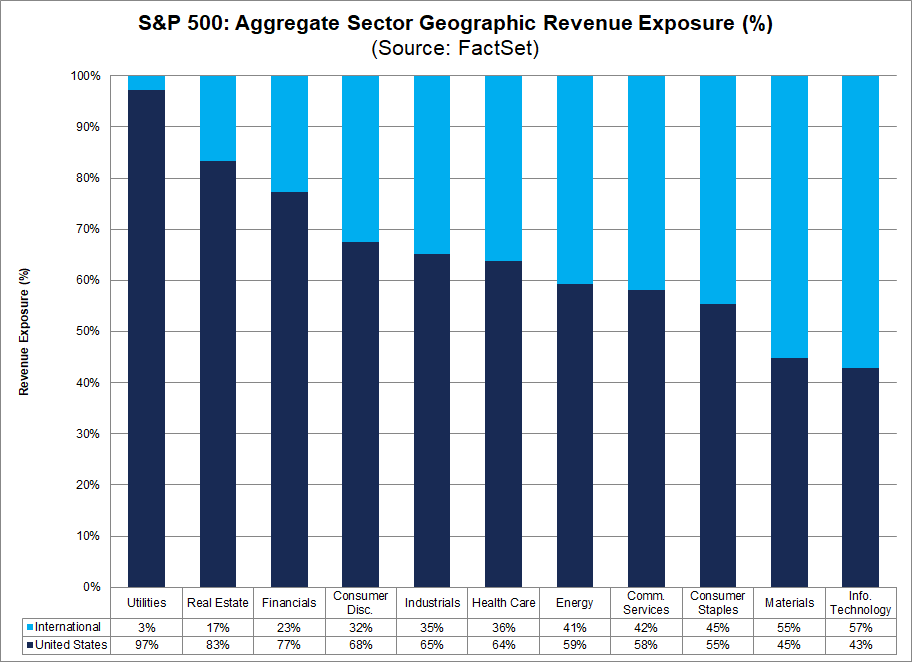

- On the recession side, well this is a little bit harder to tackle. As you well know, we are in the late phase of the business cycle, however, some of the leading indicators are signaling to us that we are heading into a recession. A recession means only one thing, most people are likely to cut their discretionary spending (e.g. Netflix subscription). However, if the Company will be able to roll out its new ad-subscription plans soon, such a move is likely to provide some sort of shield. Moreover, to protect its operating margins the Company started to lay off some of its employees, especially in the U.S. (to smooth a little bit the negative effects coming from a strong U.S. dollar). Below, you can see what sectors are more likely to be exposed to swings in foreign exchange.

FactSet

Company Valuation

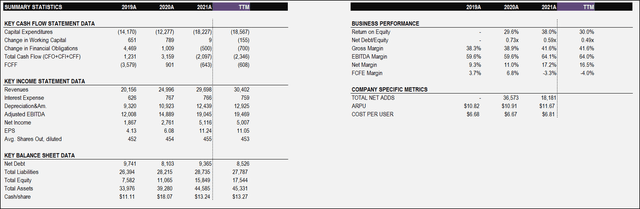

Financial Statement Analysis

Below, is a summary of the key financial statement data.

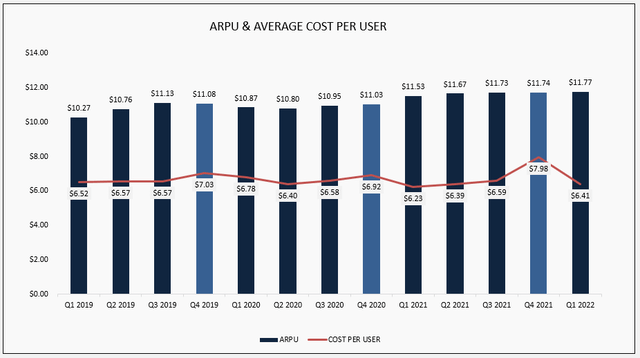

As you can see from the numbers, the Company presents a healthy financial statement with the gross debt within the top-end of the gross debt target range of $10-$15B. However, when we talk about Netflix there are two metrics that are very important, ARPU and Paid net adds.

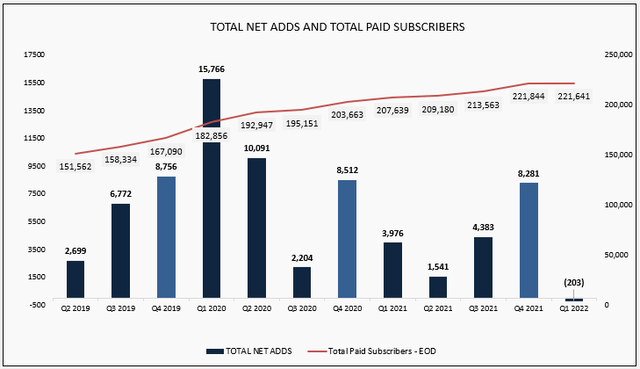

Author’s estimates Author’s estimates

As you can see from the above chart, in the 22’Q1 the Company had the first negative net adds in the last 3 years.

How much do we expect to make?

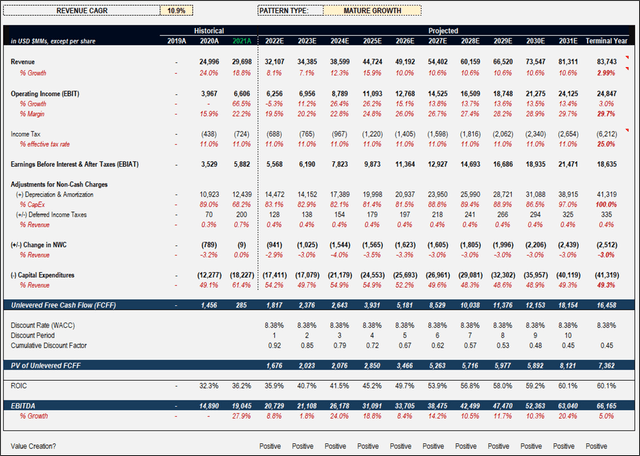

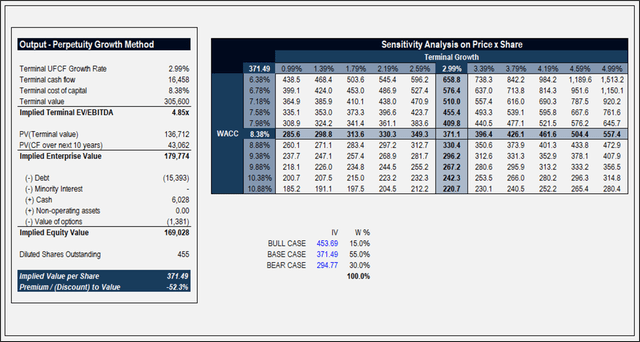

In order to answer the above question, I performed a discounted cash flow analysis under 3 different scenarios, and in the end, I computed the probability-weighted target price. The target price is $360.80/share.

The three scenarios with their respective probabilities are:

- Bear-Case Scenario (30% probability) – $294.77/share: This scenario assumes that the Company’s market share will decline from 34.68% to 30.0% by 2031 due to tougher competition, which will translate into higher costs and thus lower margins.

- Base-Case Scenario (55% probability) – $371.49/share: This scenario assumes an expanding market share, with a target market share of 38.0%, and an EBIT margin of 29.7% driven by the new business model.

- Bull-Case Scenario (15% probability) – $453.69/share: This is where the true opportunity lies. Under this scenario, I am no longer looking at Netflix as a streaming service company but as something more. I see high synergies coming from gaming and thus I expect higher CapEx.

Finally, below you can see the numbers obtained under my base-case scenario.

Author’s Estimates Author’s Estimates

Competition

The competition is represented by established and well-known companies. In particular, The Walt Disney Company, Amazon (AMZN), Lions Gate Entertainment Corp (LGF.A), Warner Bros Discovery (WBD), Apple (AAPL), and Fox Corporation (FOXA).

Investment Risks

Risks to my target price include:

- Missing Subscriber Estimates: Past misses resulted in severe stock declines, especially if the misses were perceived to be related to tougher competition. Thus, in my opinion, subscriber net adds are a key metric for Netflix’s share price.

- Competition: If the competition will be perceived as being a key driver of slower growth, it would negatively affect Netflix’s share price.

- FX Exchange: Large foreign exchange headwinds may lead to margin compression that would negatively affect Netflix’s share price. In particular, this will represent a big headwind in the short term given the dynamics we are seeing in the F/X market.

- Cost of Acquiring: Lower subscriber growth and higher costs of acquiring incremental subscribers will negatively affect Netflix’s share price.

Key Catalysts

Ad-Supported Plan: Currently, Netflix offers three different pricing plans to its subscribers: Basic ($9.99), Standard ($15.99), and Premium ($19.99). With the introduction of ads to the platform, I am expecting those plans to be priced at $5.99, $9.99, and $11.99 + ads. This should allow the Company to reach a relatively higher household penetration and also to tackle, partially, the “household sharing accounts” issue.

APAC region: APAC is by far one of the geographical areas with the most user growth potential even if with a lower ARPU. In particular, in India, Netflix announced at the end of December a decrease in the pricing across all plans (to align to the cables’ pricing per month per household of $3.0/month). By focusing on retaining good accessibility to the service for a broad group of people, Netflix is on the right path to boosting its net adds.

OPCO Trifecta

I have to admit that the name is very fancy. Today, I was reading this news in which there was a reference to Oppenheimer’s OPCO Trifecta list. As stated in the news, an OPCO Trifecta stock is:

- Rated Outperform on fundamentals

- Screens “positively on our trend work”

- Is supported by top-down portfolio tailwinds.

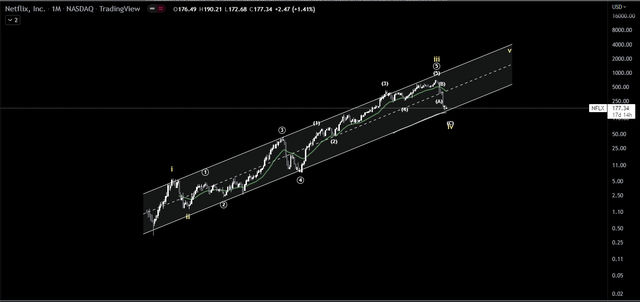

Does Netflix pass those 3 requirements? Let’s try to figure it out.

- Based on my analysis, I am rating Netflix as a BUY with a price target of $360.80/share. Thus, yes, it passes the first step.

- I don’t truly know what they mean by “positively on our trend work,” but I will assume it’s another fancy way to say “let’s see if technical analysis is telling us something good.” The short time frame doesn’t suggest anything good, while the long-term picture seems promising. Overall, I see that further downward pressure is likely to show up in the next months. Thus no, it does not pass the second step.

Tradingview.com Tradingview.com

3. “Is supported by top-down portfolio tailwinds.” Also for this one, I will give my own interpretation, which is how the sector to which the Company belongs is positioned for a recessionary phase. Since subscription to Netflix, but also to any other streaming service, is a discretionary expense, it is negatively affected by economic turmoil. Thus no, it does not pass the third step.

Final Remarks

I upgrade the Company to a “BUY” rating with a fair value of $360.80/share, which implies a 50.8% discount vs. the current price of $177.34/share.

What am I doing personally? Well, I started building my long-term position, however, I am not too greedy and I am adding on weaknesses. Currently, I am more involved in trading activities, especially through the options market, as certain option strategies offer great opportunities in this kind of market.

Be the first to comment