simarik/iStock via Getty Images

Our view

Netflix Inc. (NASDAQ:NFLX) is one of the world’s leading entertainment services with approximately 220 million paid memberships in over 190 countries.

If the story of Netflix as a company was portrayed as a Netflix Original’s series, then investors would be sitting down to tune in to season 3. From its early days in season 1 disrupting the DVD rental business to growing into a leading global streaming platform in season 2, the company is now about to enter a new phase in its story.

In the past decade, the company has seen strong membership growth which has led to a growing top line and expanding profit margins. However, this growth has been underpinned by ever-increasing investment in new content which has absorbed all of the company’s cash generation and required the company to issue debt. In recent quarters, membership growth has not only slowed but membership numbers have actually begun to decline.

The membership boost during the pandemic plus easy monetary policy and all-round market exuberance helped push Netflix shares to all time high of $701 in November 2021. Since then, and after a much needed dose of reality, shares trade 65% below their all-time high at around $230 as of 30 September 2022. Even after such a fall, we are not convinced that they represent value.

Today, Netflix is valued at $96 billion (excluding cash), which is more than 18 times FY21 net income. As the company is required to spend increasing amounts on content to acquire and retrain users, the true profitability is likely lower than net income would lead you to believe.

The company is at a cross-roads and the outlook for Netflix is uncertain. Membership growth is slowing, content spending continues to increase and competition is intense. Our broad range of valuation assumptions reflect this uncertainty, with our analysis implying a wide range of potential annual returns of 3% – 17% over the next decade.

Overall, Netflix has demonstrated its ability to create popular content and attract users, but has yet to prove that its model can successfully generate free cash flow for its investors. We don’t feel the current price provides an adequate margin of safety given these factors and for that reason we rate it as a “hold”.

Business Review

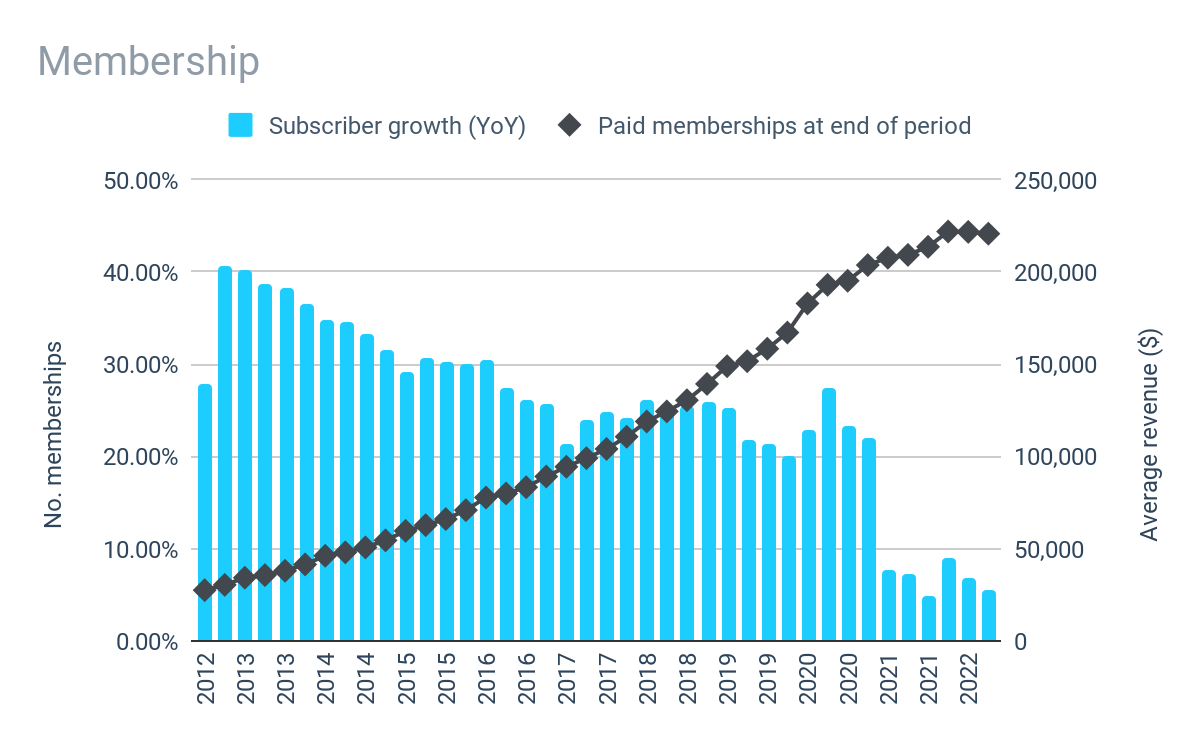

Membership

Prepared by author. Data from company reports.

Netflix streaming service was launched back in 2007. In the past decade, the company has grown its membership base by a factor of 9, from almost 22 million to over 220 million globally as of Q2 2022 – equivalent to an annual compound growth rate of 24%.

As the subscriber base has expanded, growth has naturally slowed in recent years. With the exception of a boost to subscriber numbers at the outset of the Covid-19 pandemic in Q1 2020, membership growth has slowed significantly. For example, in the period 2012 – 2014, the company continually increased its membership by over 30% p.a. In recent years, annual membership growth has slowed to less than 10% p.a. And has even started to decline in the first half of FY22.

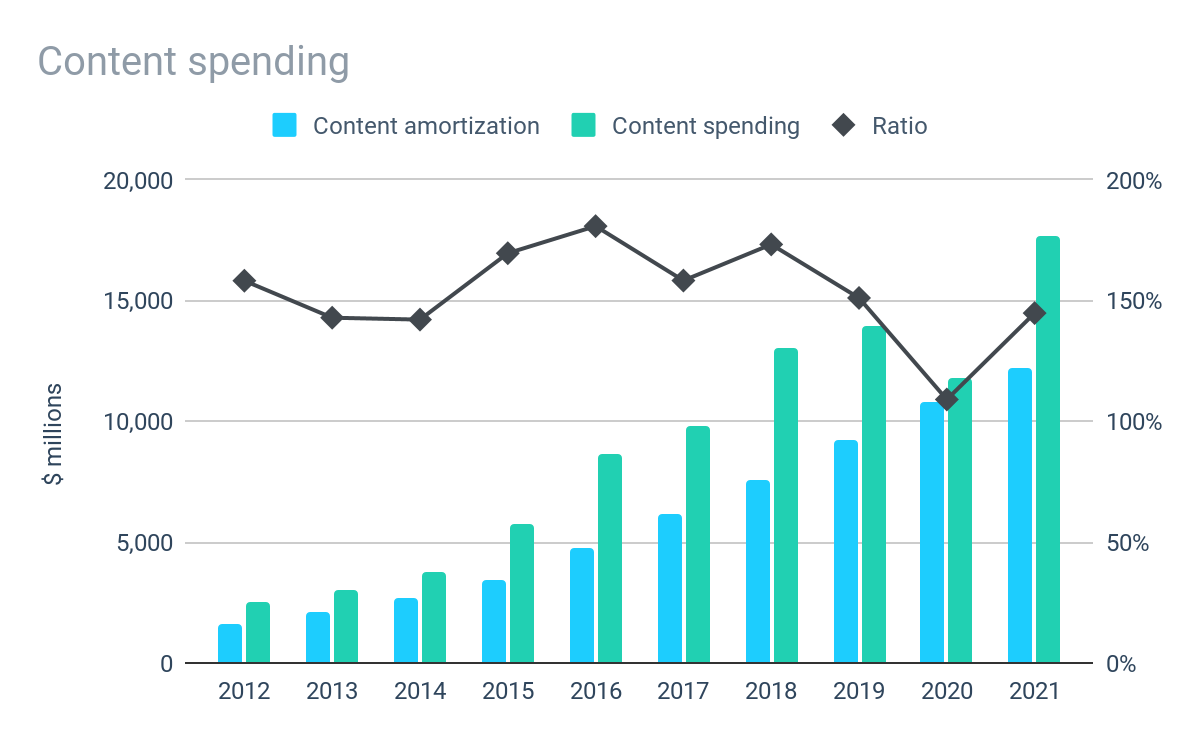

Content

Prepared by author. Data from company reports.

The growth of Netflix’s streaming platform has been underpinned by the expansion of its content library. Acquiring or creating enough content to attract and retain members is not cheap. For the last 10 years, the company has increased the amount of cash it has spent on new content by 26% p.a. on average.

The cost of content is amortized over its estimated useful life. In the majority of cases, this is around 4 years. In each of the last 10 years, Netflix has spent around 50% more on creating or acquiring new content than has been charged as an expense on its income statement.

Historically, Netflix has relied on licenses to stream third-party content. However, in recent years, it has been increasing the amount of exclusive content produced on its behalf or the original content the company produces itself. In FY19, exclusive content accounted for less than 25% of total content costs. In FY21, it now accounts for more than half of content costs.

It is natural that the company would have to invest in content to attract its user base. However, as membership growth slows or even declines, the company will need to find a way to reduce its content spending or find a way to generate higher average revenues per user.

Adapting The Model

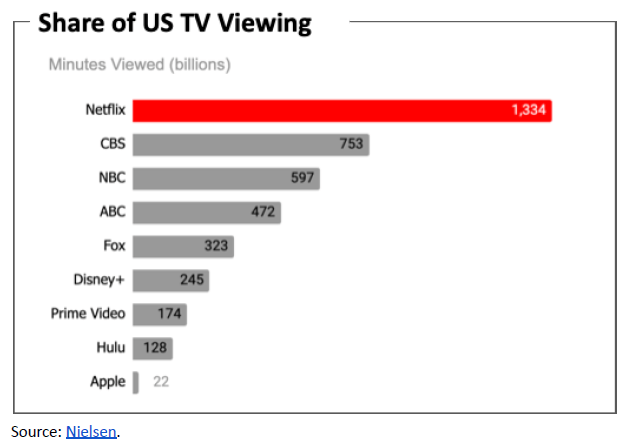

Netflix Q2 2022 Letter to Shareholders. Data from Neilsen.

In light of slowing user growth, a key priority for Netflix is to find a way to re-accelerate its revenue growth. As membership growth slows, the company is looking to do this through increased monetization and is working on two initiatives to achieve this.

The first is the introduction of an ad-supported subscription plan which is expected to be launched in 2023. The ad-supported tier will complement the existing plans which will remain ad-free. A cheaper ad-supported plan will expand potential membership base through increased affordability, while also allowing the company to monetize its vast viewership. In the 2021-22 TV season, Netflix attracted more viewing time than any other outlet in the United States according to Nielsen – more than double all of its pure-streaming competitors combined.

The second is an attempt to capture some of the revenue lost to password sharing. The company estimates that 100+ million households worldwide use the service in breach of its terms without paying for a subscription. The company is trialing two different approaches in Latin America to address this issue which includes giving existing subscribers the option to add additional members or additional households for an additional fee. It is unclear how successful this will be. And could even be seen as admission that the company sees limited scope to expand its membership base.

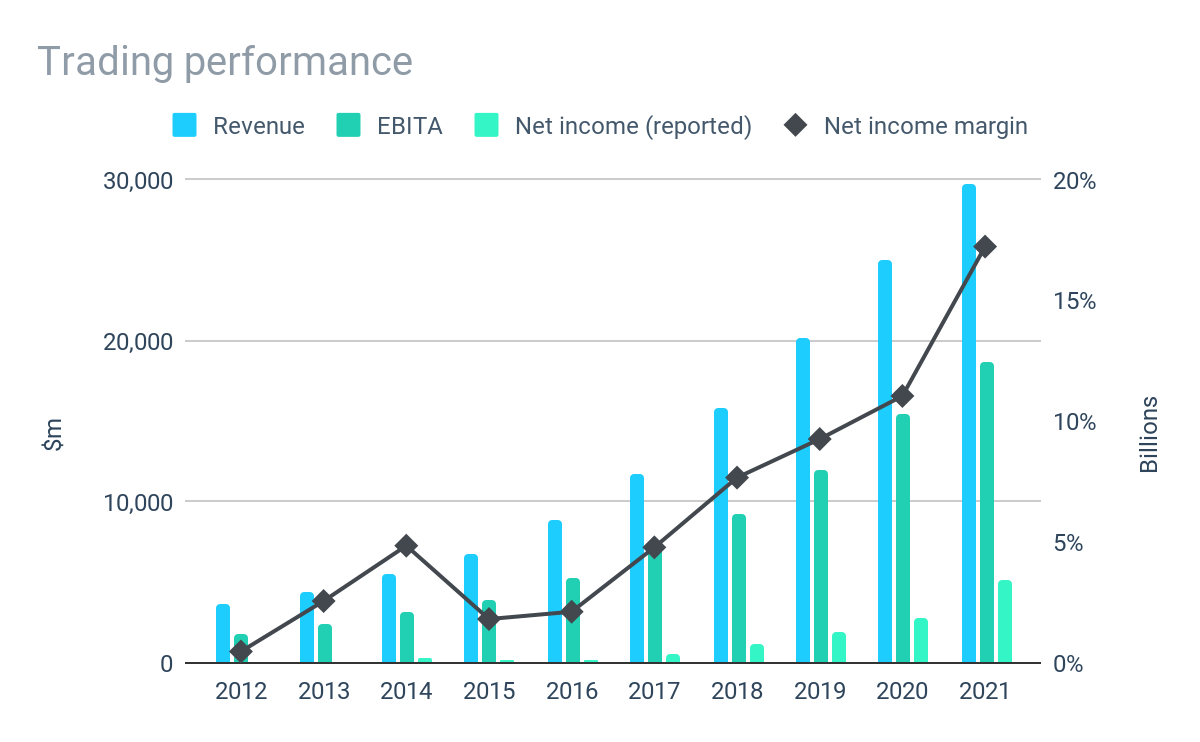

Trading Performance

Prepared by author. Data from company reports.

The strong growth in membership has naturally converted into strong top line growth, with revenue increasing 8 fold in the past decade. The increasing scale has also led to scale and cost benefits in spite of the increased content spending, which has improved net income margins from around 3% in 2015 to 17% in FY21. As a result, net income growth has outpaced top line growth. But profits on paper don’t necessarily convert to cash in investors’ pockets.

Cash Flow

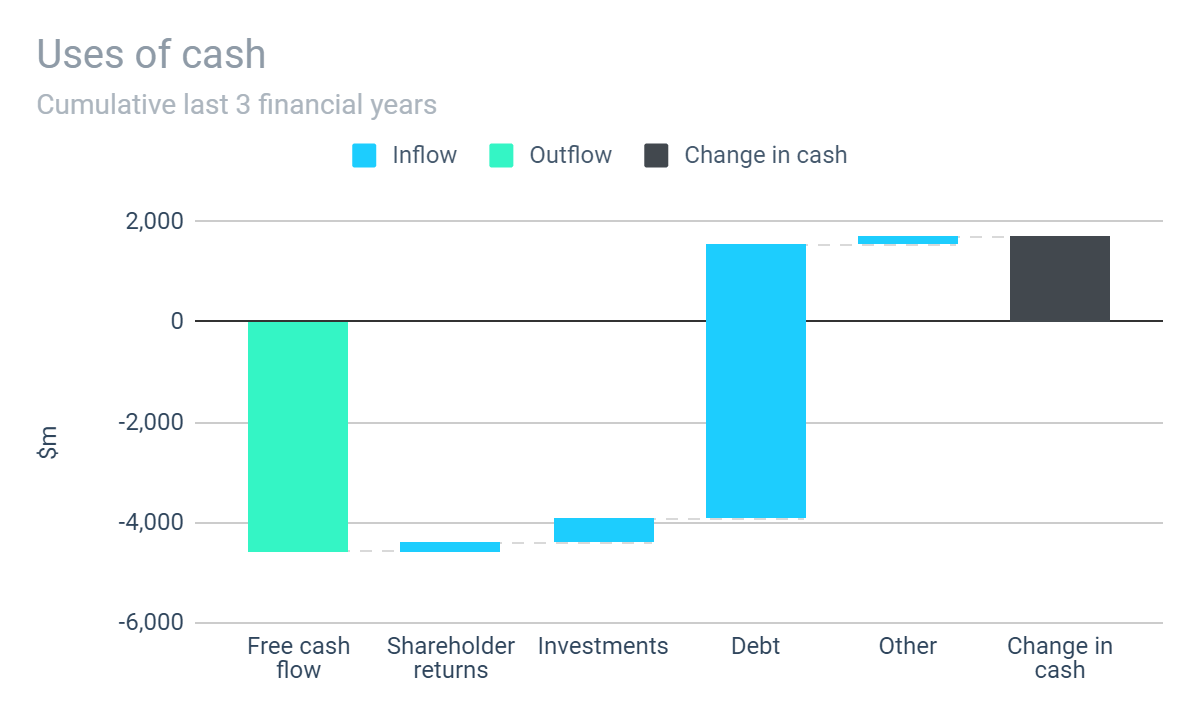

Prepared by author. Data from company reports.

The continued and increasing investment in content has been a drain on the company’s free cash generation. All of the cash that has been generated from memberships has been absorbed by content costs, leaving nothing available for investors. The company also has no intention to pay a dividend for the foreseeable future.

As the company increases its investment in exclusive and original content, the profile of its cash flows worsens. Under licensing agreements with third parties, cash outflows are spread across the length of the licensing agreement. However, exclusive or original content must be paid for at the time of production.

The company has had to continually issue debt to finance this thirst for content. In the last three years for example, the company generated negative free cash flow of over $4 billion despite generating nearly $10 billion in net income.

Balance Sheet

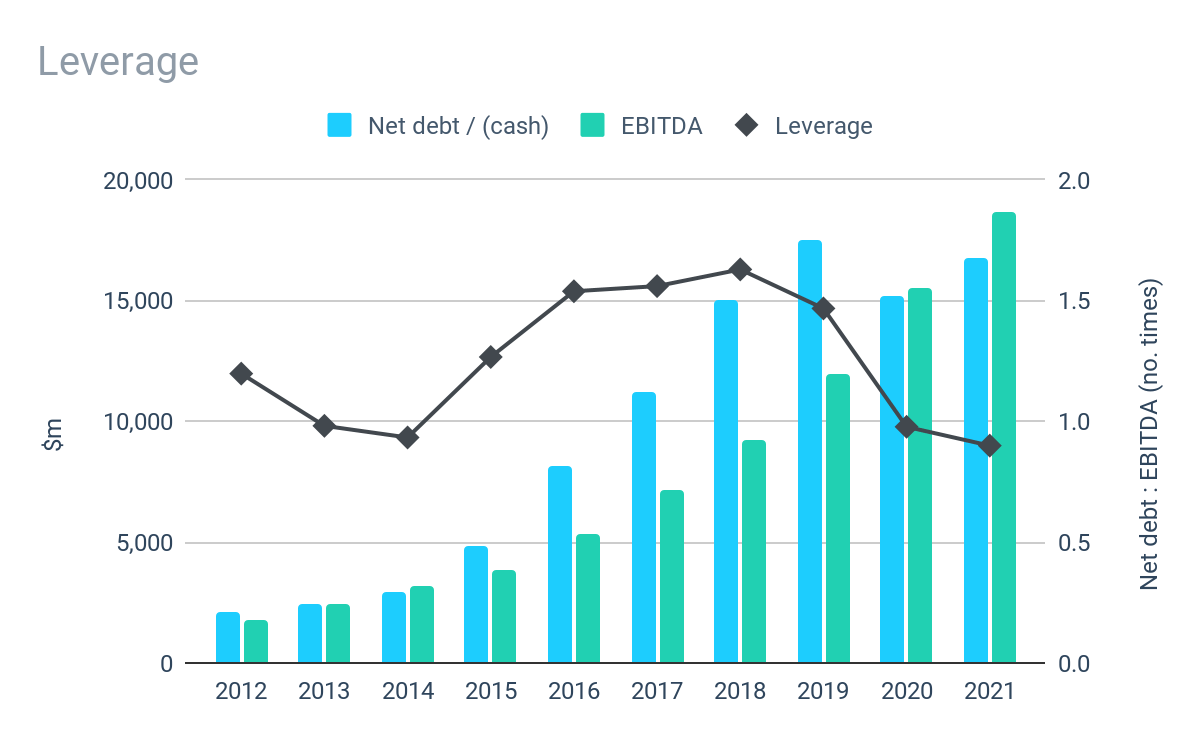

Prepared by author. Data from company reports.

The ever-increasing content spending has led to an increasing debt pile. As of 31 December 2021, net debt stood at $ billion. However, leverage is within a reasonable range at less than 1x EBITDA. The vast majority of debt has a maturity of 2026 or later meaning the impact of higher rates won’t be fully felt for a number of years yet.

Risks

Content costs

Content costs are largely fixed in nature and contracted over several years meaning the company has limited flexibility to reduce costs in the short-term in response to slowing growth or decline in memberships. Further, while the company has grown increasingly profitable on paper, it is yet to generate any free cash to return to investors as cash generation has been absorbed by ever-increasing content spending. The ability of the company to move from a debt-fueled growth model into a sustainable free cash flow generating business is uncertain.

Competition

The video entertainment market is intensely competitive and the number and strength of competing streaming services continues to grow. Netflix has gone from essentially having a monopoly over subscription-based streaming to competing with powerful players such as Disney (DIS) and Amazon (AMZN). As more content providers create their own streaming offerings, they may also be unwilling to license their content to Netflix which means the company is having to increase the amount of its exclusive / original content, requiring significantly more up-front investment than licensing. Competition is not limited to video streaming services, either, with the company competing for user attention with other forms of entertainment such as gaming and social media platforms such as Instagram, YouTube and TikTok.

Economic conditions

Netflix occupies an interesting position when it comes to consumer discretionary spending. On one hand, it is an easy target for households looking to reduce their outgoings. However, it is also possible that Netflix usage could increase during a time when consumers look at stay-at-home forms of entertainment during cost-of-living pressures.

Valuation

As of 30 September 2022, the company’s shares trade at around $238, giving a total market capitalization of $102 billion. Excluding cash reserves of almost $6 billion, this implies a valuation of $96 billion for the business.

Our approach to valuing operating businesses is based on determining the true underlying earnings power of the business or “owner earnings”. In the case of Netflix, net income likely overstates owner earnings as actual content cash spending has consistently outpaced the corresponding amortization charge in the income statement.

Based on FY21 net income of $5 billion, the operating businesses are valued at around 18.8x times earnings. However, if net income is adjusted to reflect the cash spent on content, then the company actually generated a small loss for the year. In reality, the true owner earnings position is somewhere between these two points.

As growth slows and the company transforms its business model, we consider the outlook for Netflix to be uncertain. For that reason, our valuation models apply a wide range of assumptions:

| Valuation assumptions | Lower | Mid | Upper |

| Earnings growth | 5% | 10% | 15% |

| Re-investment rate | 100% | 75% | 50% |

| Price-to-earnings ratio | 15.0 | 17.5 | 20.0 |

The high level of uncertainty is reflected in the results of our valuation analysis which implies a wide range of possible outcomes for investors over the next decade. At the lower end, we see investors suffering with annual compound returns as low as 3%, but could see as much as 17% at the higher end of our range.

Conclusion

There is no doubt that Netflix is a successful streaming platform with over 220 million paying subscribers. However, its growth has been cash intensive and there is no sign yet of when or how the company will generate free cash for its investors.

The outlook from here is uncertain. Membership growth has slowed (or even declined), the company is investing increasing amounts in exclusive content, and competition from well resourced competitors has increased. Its success will depend on how well it can increase the monetization of its user base and its ability to retain users while keeping content costs in check.

At the current valuation, we don’t feel sufficiently compensated for the risks and uncertainties that exist but nor do we discount the ability of the company to successfully transition to a cash generative business. For that reason, we rate Netflix as a “hold”.

Be the first to comment