Wachiwit

Introduction

Warner Bros. Discovery (WBD) CEO David Zaslav probably knows it is not in his best interest to go to war with Netflix. Instead, he’s deploying capital with a focus on ROI and he is intent on bringing down the adjusted EBITDA loss in their DTC segment. Disney’s (DIS) CEO Bob Chapek is also trying to ensure that peak losses for Disney DTC are in the past. My thesis is that Netflix (NASDAQ:NFLX) is now in a more rational competitive landscape.

The Numbers

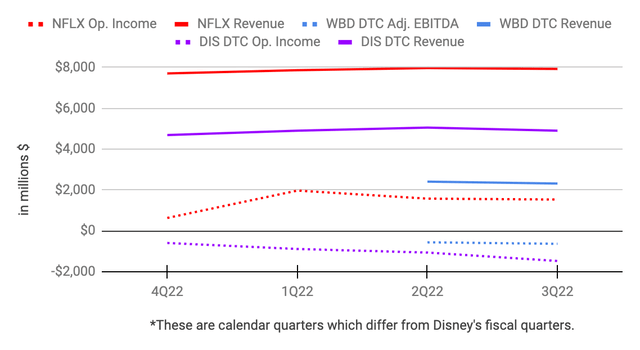

Netflix is presently at a large scale such that they have trailing-twelve-month (“TTM”) operating income of $5.7 billion on revenue of $31.5 billion. Meanwhile, Disney DTC has TTM operating income of $(4) billion on revenue of $19.6 billion. We don’t yet have an annual picture of WBD after the merger but they have 6-month adjusted EBITDA of $(1,194) million on revenue of $4,727 million:

Streaming operating income and revenue by company (Author’s spreadsheet)

I like to think about what free cash flow (“FCF”) and operating income have looked like for Netflix under different levels of revenue. The dollars below are in millions:

|

FCF |

Operating Income |

Revenue |

|

|

2017 |

$ (2,020) |

$ 839 |

$ 11,693 |

|

2018 |

$ (3,020) |

$ 1,605 |

$ 15,794 |

|

2019 |

$ (3,274) |

$ 2,604 |

$ 20,156 |

|

2020 |

$ 1,922 |

$ 4,585 |

$ 24,996 |

|

2021 |

$ (159) |

$ 6,195 |

$ 29,698 |

|

TTM |

$ 717 |

$ 5,715 |

$ 31,473 |

Netflix is ahead of Disney and WBD with respect to streaming revenue in the same way that AWS (AMZN) is ahead of Microsoft (MSFT) Azure and Google (GOOG) (GOOGL) with respect to cloud revenue. Being the early leader can have huge advantages! In the same way that AWS shows better operating margins than Google cloud when comparing similar revenue levels, Netflix shows better operating margins than Disney DTC and WBD DTC when comparing similar revenue levels. Of course this requires us to accept the accrual accounting where the content amortization can come into question. Some investors say the accrual amortization at Netflix is not correct such that we should be focusing on FCF instead of operating income. I’m optimistic that the accrual accounting is somewhat sound but I’ll feel better if FCF rises substantially in the coming years.

The churn advantage at AWS and Netflix is one factor in terms of them having better operating margins than competitors at similar revenue levels. AWS and Netflix are “older” than competitors in the sense that they have been in their respective spaces longer. This means their churn rates are relatively low and they don’t have to spend as much as competitors on marketing. This has been explained by Peloton’s (PTON) CEO, Barry McCarthy, who is also the former CFO of Netflix and Spotify (SPOT). Here is what Peloton CEO McCarthy said about churn at the 2018 Spotify Investor Day while he was their CFO:

As the average tenure of the subscriber base increases, the average churn rate falls. So if you and I both run competing subscription businesses, and yours is older than mine, then even if our services are equally light with exactly the same churn curves by customer cohort, your average churn rate will be lower than my average churn rate.

It is disturbing for Disney that they had TTM DTC operating losses of $4 billion on revenue of $19.6 billion. Looking at the spreadsheet above, Netflix did much better at a similar revenue level; Netflix had FCF of $(3,274) million and operating income of $2,604 million on revenue of $20,156 million in 2019. Disney has to be more rational with their content spend in the quarters ahead such that they reduce DTC operating losses. WBD also has to be more responsible as their DTC losses make it harder for them to pay down their prodigious debt load. WBD CEO David Zaslav said they have learned that direct-to-streaming movies don’t work for them at this time.

Regarding churn and marketing, Disney CEO Chapek said in their last earnings call that they will a meaningful rationalization of their marketing spend moving forward:

Our financial results this quarter represent a turning point as we reached peak DTC operating losses, which we expect to decline going forward. That expectation is based on 3 factors: first, the benefit of both price increases and the launch of a Disney+ ad tier next month. Second, a realignment of our cost, including meaningful rationalization of our marketing spend. And third, leveraging our learnings and experience in direct-to-consumer to optimize our content slate and distribution approach to deliver a steady state of high-impact releases that efficiently drive engagement and subscriber acquisition.

Valuation

Of course Netflix is solely a streaming company while Disney and WBD have other businesses. Obviously, it is important to keep these considerations in mind before we compare enterprise values. Streaming will be even more important for Disney and WBD in a decade than it is at the present time. Rather than distribute capital back to shareholders in the form of dividends and buybacks over the next decade, I think WBD will be forced to use proceeds from their non-streaming businesses to pay down debt, seeing as their net debt is $47.9 billion at the time of this writing.

At the time of my October 19th, article, I thought Netflix was worth close to $150 billion and I still believe this to be true given the fact that their TTM operating income of $5.7 billion is partially held down by F/X issues.

The WBD 3Q22 10-Q shows 2,428,396,015 shares as of October 21st and the November 9th share price is $9.84 such that the market cap is nearly $24 billion. Due to the prodigious debt load, we add about $50 billion to the market cap to arrive at the enterprise value of around $74 billion.

The Disney 10-Q through July 2nd shows 1,823,057,777 shares as of August 3rd and we multiply this by the November 9th share price of $86.75 to get a market cap of $158 billion. Due to short-term debt of $3,070 million plus long-term debt of $45,299 million plus redeemable noncontrolling interests of $9,499 million plus regular noncontrolling interests of $3,871 million less cash of $11,615 million, we add about $50 billion to the market cap to arrive at the enterprise value of around $208 billion.

Per the 3Q22 10-Q from Netflix, there were 445,020,494 shares as of September 30th. Multiplying this by the November 9th share price of $254.66, we get a market cap of about $113 billion. We add about $8 billion due to net debt to arrive at an enterprise value of about $121 billion.

The enterprise value for Netflix is below my valuation range and on a long-term basis, I think the stock is undervalued. Also, the enterprise value of Netflix looks sensible relative to the enterprise values of Disney and WBD.

Disclaimer: Any material in this article should not be relied on as a formal investment recommendation. Never buy a stock without doing your own thorough research.

Be the first to comment