SCStock

Necessity Retail

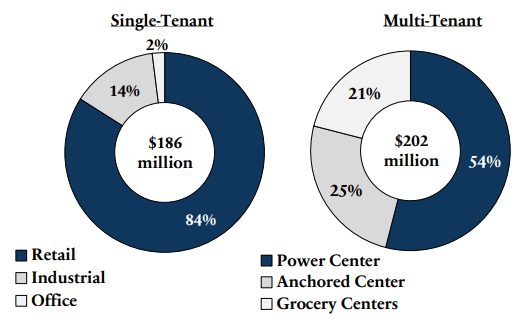

Necessity Retail (NASDAQ:RTL) is a REIT which owns single tenant properties with triple net leases and also multi-tenant properties. RTL is externally managed with properties located in the USA and geographically diversified among 48 states. They currently own 1,057 properties with a current occupancy rate of 90.9%. The average lease term on their properties is over 7 years. 61.8% of their top 20 tenants are investment grade.

RTL Investor Presentation

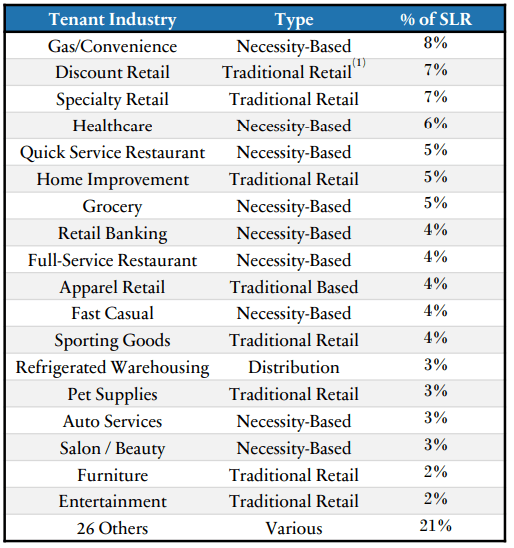

The company recently renamed themselves Necessity Retail to highlight their focus on owning properties that provide necessities that people need regardless of the economy and provide products and service that don’t have strong internet competition. So their retail properties contain stores selling necessities like grocery stores and drug stores and also stores that provide services that can’t be sold on the internet like hair cutteries, restaurants, massage parlors, dentist’s offices and the like.

RTL Investor Presentation

Common Stock

At its closing price of $6.84, RTL currently yields a very large 12.43%. Its 52-week high was $9.48, so it has come down quite a bit. Although 12.43% is a very tempting yield for a property REIT, one should note that the external manager of RTL has a history of diluting common stockholders.

Relative to other retail REITs, RTL’s stock performance has been quite poor. So what they giveth in high dividends, they taketh away with capital losses.

However, recently there has been some activist activity that is trying to oust the external manager. With RTL selling cheaply due to a manager that has not been friendly to common stockholders, a change in management would likely see a nice pop in the common stock price, providing a nice total return. However, I feel that with the excellent yields on RTL’s fixed-income securities, there is no need to speculate on the common shares of a company whose total return has been historically poor.

RTL Preferred Stocks – RTLPP And RTLPO

In this fairly treacherous market, I want to have the potential for a large total return if I am going to buy something now. I want the risk/reward to be favorable, which is what stock selection is all about. The RTL preferred stocks offer both a very high yield and more than 25% price upside. Risk/reward is our major focus at Conservative Income Portfolio.

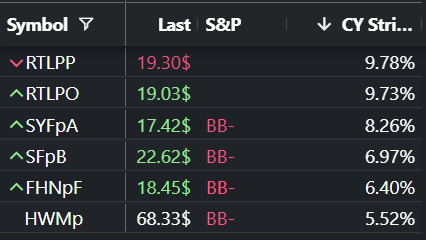

RTL has issued 2 preferred stocks. One has the ticker RTLPP (NASDAQ:RTLPP) and the other RTLPO (NASDAQ:RTLPO). RTLPP currently has a stripped yield of 9.74% at a price of $19.37 and RTLPO has a stripped yield of 9.54% at a price of $19.38. Although RTLPP is a bit better currently, both have extremely high yields for property REITs and both have large price upside potential with their large discounts from par. And as REIT preferreds, 20% of your dividends are tax free for U.S. taxpayers.

RTLPO & RTLPP Are Relatively Quite Undervalued

First, I believe these 2 RTL preferred stocks have the highest yields among property REIT preferred stocks (that pay common dividends) in the entire market by quite a bit. And this company is not distressed at all. In fact, RTL has a credit rating that is just 1 notch below investment grade at BB+. Thus, the implied investment rating on their preferred stocks is BB-. Unrated retail REIT, symbol RPT (RPT), has a preferred stock (RPT.PD) with a yield of 7.96% versus 9.74% for RTLPP. Retail REIT SITC, with an investment rating of just 1 notch above RTL, has a preferred stock (SITC.PA) which currently yields 8.07%. The 1.7% greater yield of RTLPP is huge for simply a one notch difference in the credit ratings.

Author

At Conservative Income Portfolio, we focus heavily on mispriced securities. Although there are not many fixed-rate preferred stocks with a BB- credit rating, you can see from the above chart that the RTL preferred stocks have massively higher yield than their peers.

While RTL operates with higher leverage than is typical, that risk is partially offset by its long term leases and also by the management’s willingness to issue large amounts of common stock which constantly liquify RTL’s balance sheet. Since the beginning of 2014, the share count has more than doubled, and the count is up 22% just since the beginning of 2021.

What is nice about external managers is that their goals are generally 1) to increase the company size and 2) to survive in order to continue receiving their management fee income. They are generally very willing to issue common shares when signs of trouble appear in order to raise needed cash and to insure survival. Their concern is not about the price of the common stock nor diluting common shareholders. Internal managers are more apt to hold on and hope for things to turn around when they are in some kind of trouble.

I think that many people believe that a company has no choice when they go bankrupt. But that isn’t the case. In the vast majority of cases, a company can avoid bankruptcy if they are willing to issue enough common shares to raise the capital they need. That is part of the reason that I am not concerned about the safety of this company. And secondly, RTL attracts investors with a large common stock dividend rather than through growing earnings. As long as they pay a common dividend, the preferred stock dividend is not in jeopardy, and I believe it is imperative for them to have a common stock dividend.

Fair Value of RTLPP and RTLPO should be around $21.50 Per Share

Given the yields on other BB- rated preferreds and retail REIT preferred SITC.PA, which is just one notch different in its investment rating than RTL, a conservative fair yield for RTLPP and RTLPO would be around 8.7%. That would put conservative fair value of RTLPP at $21.70 and fair value of RTLPO at $21.30. So RTLPP is currently $2.33 per share undervalued to where we estimate fair value.

10.1% YTM on RTL 2028 Bond

At Conservative Income Portfolio, we cover the whole space of traditional bonds. Currently, I believe the best bargains in fixed-income are in the traditional bond market, and I believe this RTL bond is just one example. The CUSIP number for this bond is U0262AAA5, it has a yield to maturity of 10.1%, and it matures on October 30, 2028. This bond is just 1 notch below investment grade with a rating of “BB+” from S&P. This yield is just extraordinary for that credit rating.

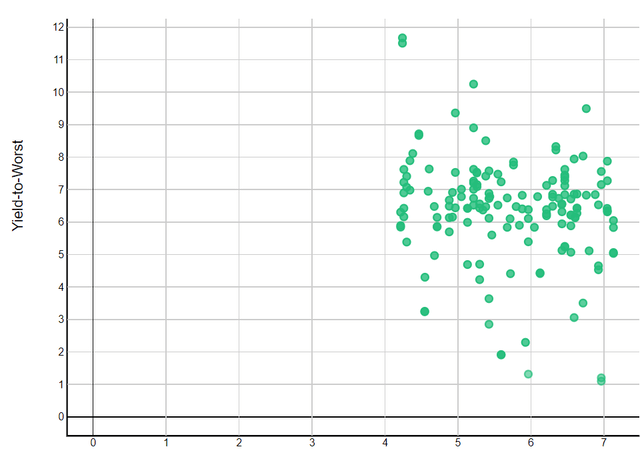

Above is a scatter plot of the yield-to-worst of all bonds with a BA1 rating from Moody’s. That is the same rating as BB+ from S&P. As you can see, BB+ bonds with about 6 years until maturity tend to concentrate in the 6% to 7% range, making our RTL’s bond just off the charts.

Final Thoughts

So should one buy the RTL bond or one of the preferred stocks of RTL? Both are quite undervalued. For most investors, they are more familiar with buying and selling preferred stocks from their broker than traditional bonds. So for those, the preferred stocks make sense unless you want to be more adventurous.

For others, it is a somewhat tougher call. For risk averse investors, the RTL bond looks great. You know exactly what your return will be if you hold it to maturity. For preferred stockholders there is more risk but more reward. Remember that the bond yield includes the capital gain you will achieve over time. The current yield of the preferred stock does not. Thus, your total return could be significantly greater than 9.7% if the RTL preferreds move higher in price over time. But of course the reverse is also true. So you are making more of a bet that these preferreds are undervalued or that rates will eventually come down, and the preferred stocks will benefit by moving closer to par. Also, the preferred stocks provide a tax benefit for Americans that the bonds don’t – 20% of preferred stock dividends are tax free. The choice is yours.

Be the first to comment