ValerieVS/iStock via Getty Images

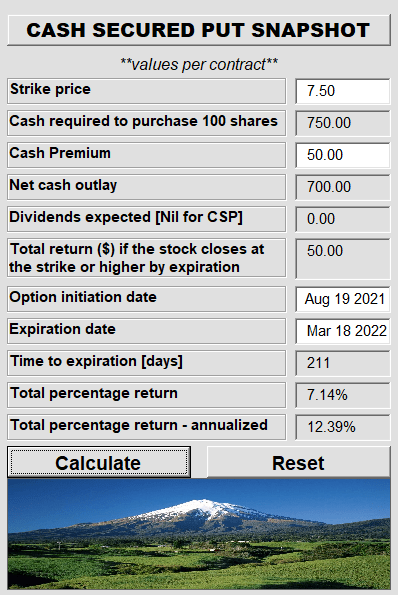

When we last covered The Necessity Retail REIT, Inc. (NASDAQ:RTL) in December, we had a mildly positive opinion on the total return prospects of the stock. Back then, our thinking was that the stock was unlikely to go up but the yield was safe. We also felt that the stock offered a very good chance at high income via cash secured puts or covered calls. The stock did a big dive in early March and currently is 9% below where we wrote that article. Of course, as option writers, our risk-reward was much better. Since we had chosen the $7.50, strikes and RTL ended March 18, 2022 above $7.50, we pocketed the entire premium and made a 12.39% annualized yield.

Trade 198 (Conservative Income Portfolio)

This normally is the best outcome. The one where a stock drops, a lot but ends above your strike at option expiration. This is because you then get to do another round of options at even better premiums thanks to proximity of the strike and the higher implied volatility. We, however, took a pass.

Why The Change?

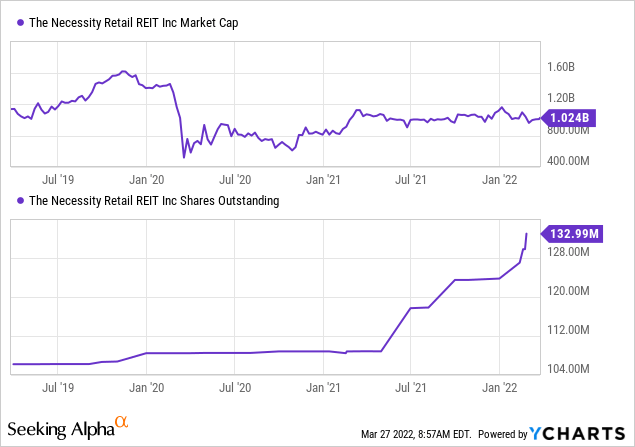

RTL announced a major set of acquisitions shortly after our article and they purchased $1.3 billion worth of properties while simultaneously disposing $261 million worth. The dispositions were building leased to Sanofi (SNY). There are a couple of points we want to make about that. The first being that this is a really large purchase for RTL. The market capitalization was just about $1.0 billion when this happened, so adding another $1.0 billion in properties obviously moves the dial. The bulk of this was financed by property level debt, although there was a small amount of direct equity issuance to the sellers ($53 million). We would note though that RTL had prepared for this by furiously issuing equity before the event (note share increases) so that additional leverage increase would be modest.

According to RTL, this is accretive to adjusted funds from operations (AFFO) and will raise near term leverage.

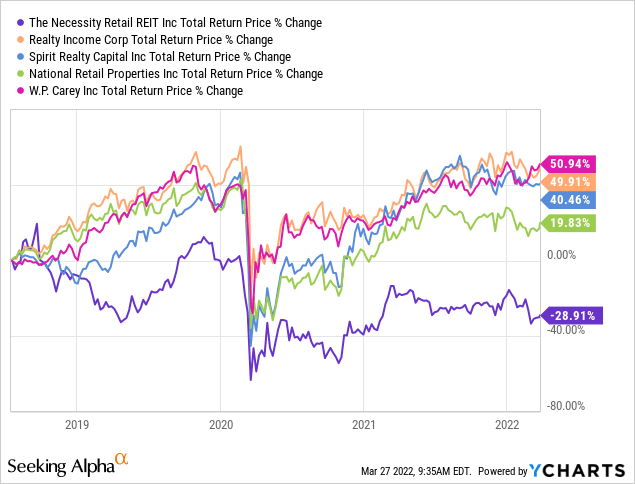

We are quite familiar with this external model of management where growth in size of the portfolio is emphasized over all other metrics. This is a great model for external management and it is a great model for writing defensive cash secured puts as the stock pretty much never goes up. It is a bad model for buy and hold investors.

The key reason is that if you issue enough shares at any price, that ultimately becomes your NAV. That is just the math of it. We expect externally managed REITs to do this. That said, we still expect some discretion and some attention to NAV/price when issuing shares. We have about 30% of common shares issued at greater than 40% discount to NAV. This speed erodes the margin of safety and makes it difficult to even time trades on melting ice cubes. We would also take that “accretive” word in the press release with an ounce of salt (hypotension runs in the family). That refers only to the transaction itself at a 7.13% cash cap rate which is financed predominantly by debt. It completely ignores the millions of shares that were issued before that at a 12% AFFO yield to allow this transaction. That is why estimates for next year’s (2022) AFFO are down 5% vs. where they were in June 2021.

Preferred Shares

Back in September 2021 we were repeatedly warning investors about the risks of rising interest rates. We suggested that the high yield of The Necessity Retail REIT, Inc. 7.375% CUM PFD C (NASDAQ:RTLPO) and The Necessity Retail REIT, Inc. 7.50% PFD A (NASDAQ:RTLPP) were excellent bulwarks against the coming storm.

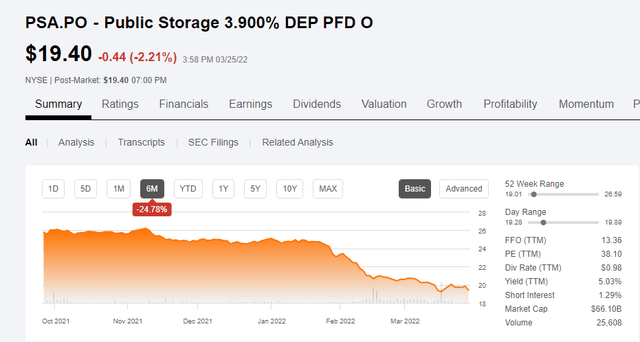

One aspect we like about both these is that yield on par is rather strong and in the case of gradually rising interest rates these two will not be hurt as much. This is quite the opposite of say Public Storage 3.900% DEP PFD O (PSA.PO), which has a coupon of 3.9% and currently yields just 3.3%.

Source: RTL Preferred Shares Offer Good Buffer For Rising Rates

That suggestion worked like a charm. While both RTLPP and RTLPO have delivered about a 2% negative total return, they have demolished the low yielding, PSA.PO and countless other yield traps.

PSA.PO shares (Seeking Alpha)

Verdict

RTL’s pace of dilution has caught us a bit off guard here. While this likely slows down in the future, we are nonetheless being cautious. If we had to get long RTL, it would still be via the $7.50 cash secured puts or covered calls. Currently there are also a lot of quality REITs that are better risk adjusted bets in our opinion and hence we did not reinitiate positions.

The preferred shares RTLPP and RTLPO, still offer value and the large share count dilution alongside a bigger property base, add to the appeal of these shares. Both are less relative values today, as even in the preferred share space, far more issues are attractive today versus 7 months back.

Please note that this is not financial advice. It may seem like it, sound like it, but surprisingly, it is not. Investors are expected to do their own due diligence and consult with a professional who knows their objectives and constraints.

Be the first to comment