zimmytws

(This article was co-produced with Hoya Capital Real Estate)

Introduction

As I write this, control of both the US Senate and the House are uncertain with both parties still in the running to be in control of one or both parts of Congress. Expectations are if the Democrats maintain control of both houses, the odds are good that marginal tax rates for the “rich” will be raised. Secondly, the Alternative Minimum Tax system might start at lower levels, especially if not properly adjusted for inflation.

A prized solution within the Municipal bond market for such investors is AMT-Free funds that focus on their home state. I compared two for each of these states: California and New York; each review included an AMT-Free CEF. I did not find an AMT-Free for New Jersey.

This article is for residents of states where there is not a state-specific AMT-Free fund available. This article compares two CEFs from Nuveen:

- Nuveen AMT-Free Quality Municipal Income Fund (NYSE:NEA)

- Nuveen AMT-Free Municipal Value Fund (NYSE:NUW)

There is a 3rd choice, which I review last fall: Nuveen AMT-Free Municipal Credit Income Fund (NVG). I am planning an update for that ticker soon.

Rising rates = Bad results

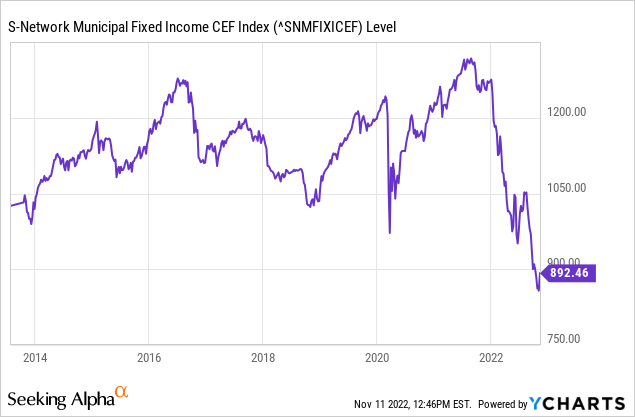

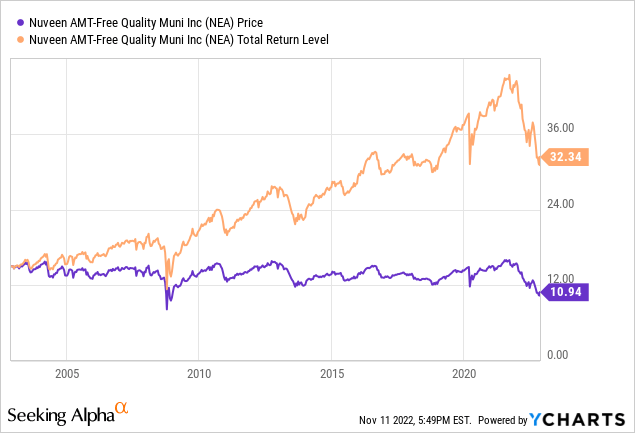

vaneck.com Muni CEF Index

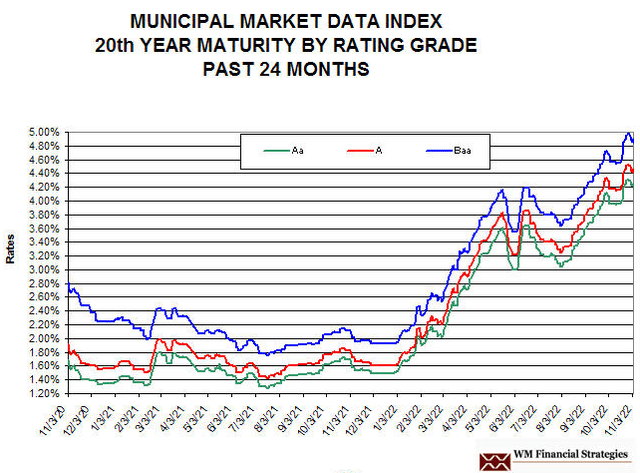

There are 56 components to this index, with NEA being that largest at just over 8% of the index’s weight. The above can be explained by the next two charts which show how rates have move over the past two years and how today’s compares to recent years data.

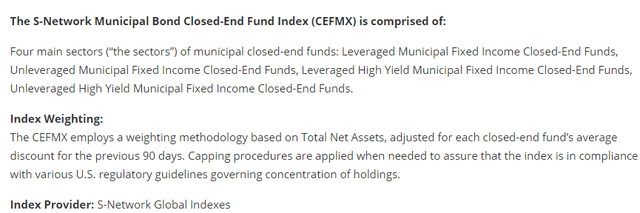

Except for brief periods, rates have been steadily climbing over the past year. Rates now are some of the highest experienced over the past decade.

munibondadvisor.com

Hopefully with the latest inflation report showing some slowdown, peak rates will be here soon and bond prices will stabilize and then start to rise.

Nuveen AMT-Free Quality Municipal Income Fund review

Seeking Alpha describes this CEF as:

The Fund will invest at least 80% of its Assets in municipal securities and other related investments that pay interest exempt from regular federal income tax. The Fund will invest 100% of its Managed Assets in municipal securities and other related investments the income from which is exempt from the federal alternative minimum tax applicable to individuals at the time of purchase. The Fund generally invests in municipal securities with long-term maturities in order to maintain an average effective maturity of 15 to 30 years. Benchmark: S&P Municipal Bond High Yield TR. NEA started in 2002.

Source: seekingalpha.com NEA

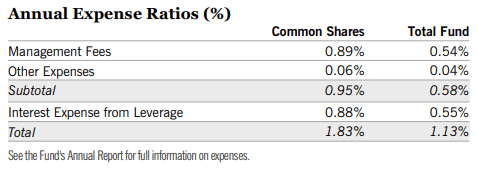

NEA has $3.4b in AUM and provides investors with a Forward yield of 4.9%. The 3rd quarter report lists the following as fees for NEA, though other sites show a lower level.

documents.nuveen.com NEA

NEA’s effective leverage is just under 44%, and the cost is shown as 2.53%. Leveraged fixed income funds should benefit twice when rates decline: better prices for its owned assets and lower financing costs for the leverage used.

NEA holdings review

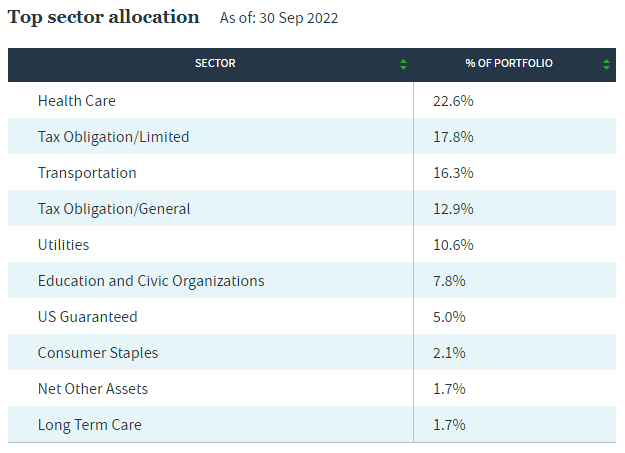

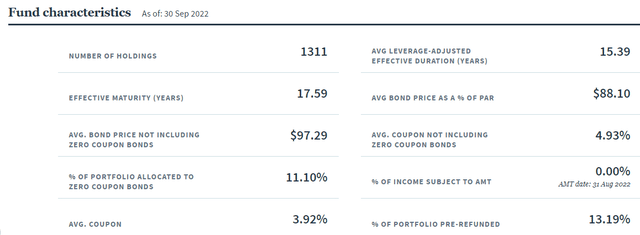

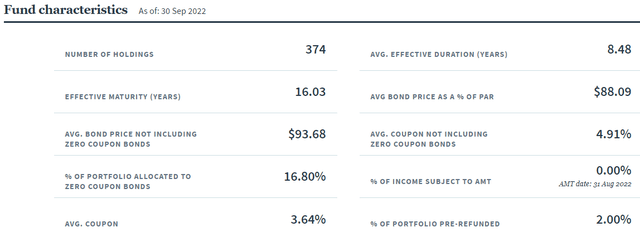

Unlike some managers, Nuveen provides lots of portfolio level data points.

I will leave discussion of this data for the comparison part of this article. As with other bonds, there are different sector within the municipal bond universe, each with its own set of risks.

nuveen.com NEA sectors

Health Care bonds are interesting these days as their underlying assets ability to generate income to fund that debt is tied to how COVID, and now RSV, are affecting their operational effectiveness compared to pre-2020 years. The stronger economy should be helping the tax-back bonds, about 30% of NEA’s portfolio.

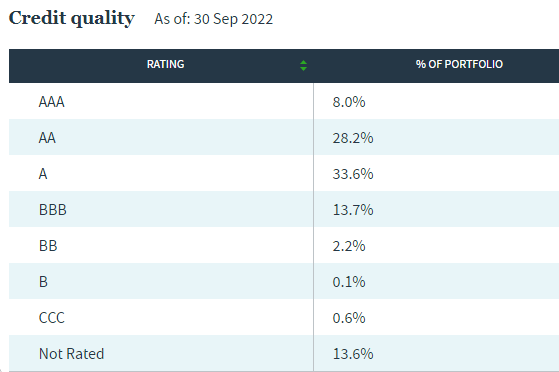

Different funds focused on bonds within different rating groups: investment-grade, non-investment-grade, or both. NEA is in the first category as I calculate its average rating as “A+”. Only 3% in below investment-grade.

nuveen.com NEA ratings

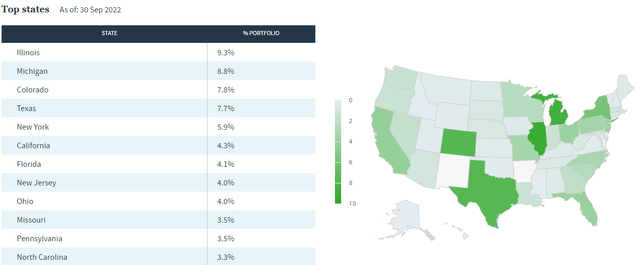

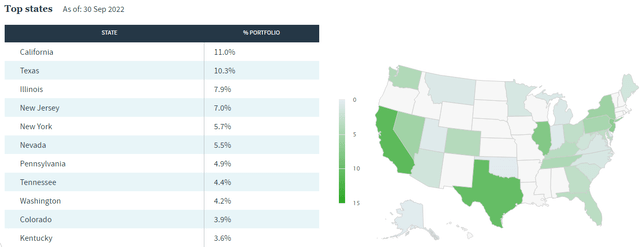

Another risk factor as it related to bonds tied to the state itself, is that allocation. I stated it that way as bonds in a poorly rated state like Illinois are only indirectly affected by the state’s bond rating.

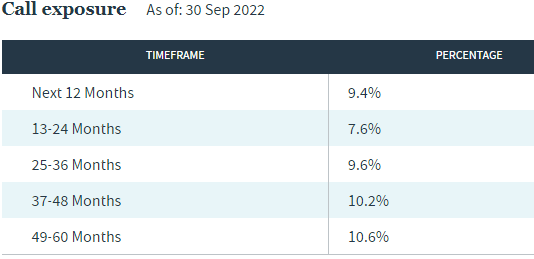

These states are 66% of the portfolio; overall it appears 48 states are represented. Two other factors provide both risk and opportunities. The first is the ability of the issuer to Call. To me, this is risk-only as Calls mostly happen when rates are falling and the issuer is issuing a new bond with a lower coupon.

nuveen.com call schedule

Here we see that 17% of the portfolio could be called over the next 24 months. If rates keep climbing, the odds drop except maybe where there are funds available to retire the bond that are earning less than the coupon. The other risk/reward is the maturity schedule where you know reinvesting those funds will be required. If rates continue to climb, this is a good thing.

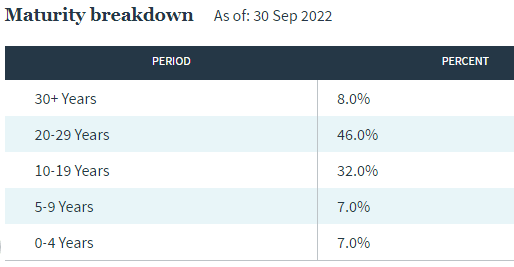

nuveen.com maturity schedule

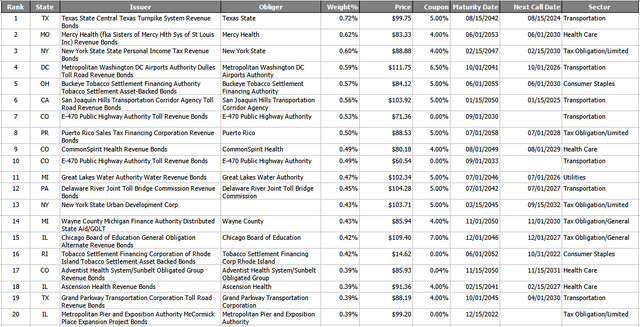

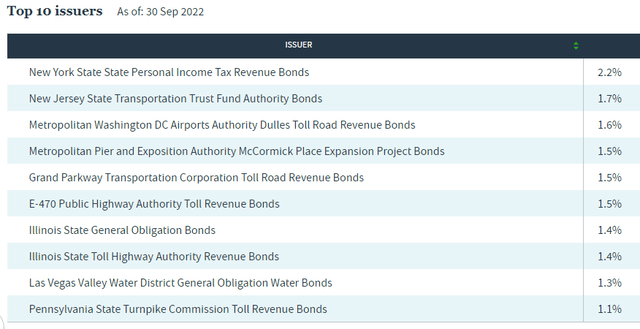

The benefit here is harder to read as the shortest grouping covers out to 2026, though, at 7%, there isn’t much built-in turnover. The last risk review is issuer concentration; to which I see little concern since most are below 1.5%.

Seven of the top ten issuers are dependent on an “open economy”, one not restrained by “lockdowns”. If New York keeps losing population, especially high income earners, the top issuer could run into repayment trouble.

Top holdings

nuveen.com; compiled by Author

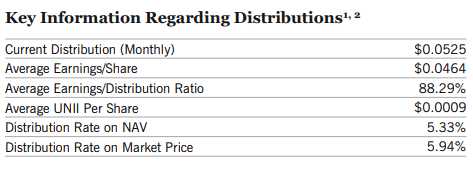

NEA distribution review

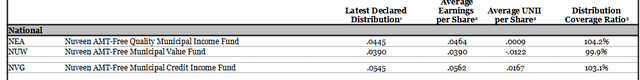

NEA shows a history of fluctuating payouts, with the current rate one of the lowest, even after a year of rising rates. The below table shows where NEA was before the recent cut to $.445, and helps explain the reduction.

documents.nuveen.com NEA

A more current calculation is shown in the comparison part of this article. The CEF does not use a Managed Distribution Policy as far as I know via my research.

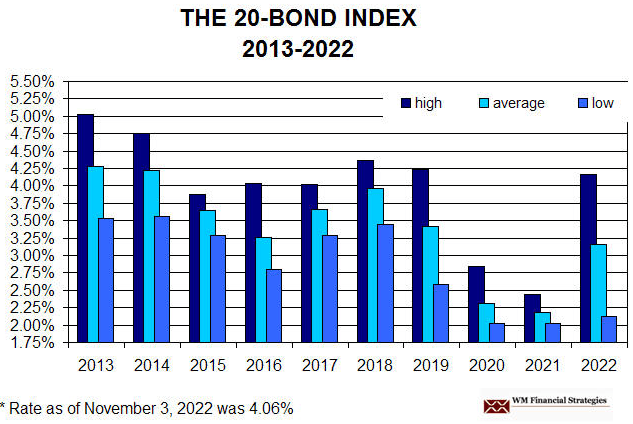

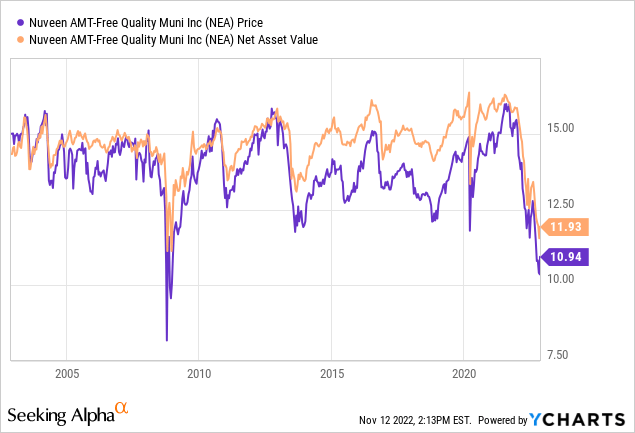

NEA price and NAV review

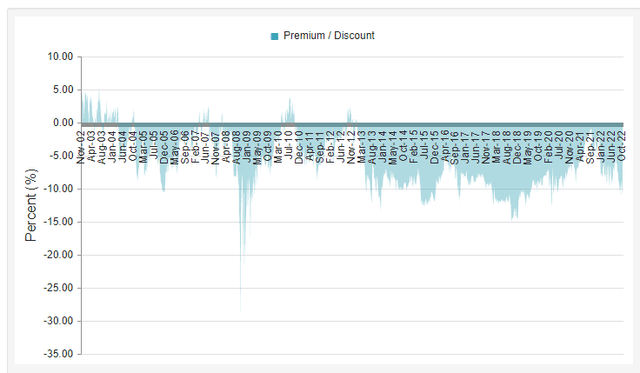

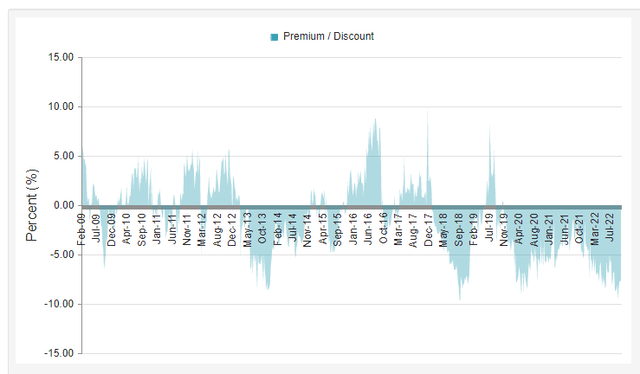

Based on the above chart, today’s price would seem appealing, though I suspect a chartist might say the support level was broken: not a positive sign. The next chart provides better insight into the Price/NAV relationship.

It has been a while since NEA has traded at a premium, with the recent low near 1% occurring a year ago. Today 8% discount seems to be in the middle of recent ranges.

Nuveen AMT-Free Municipal Value Fund review

Seeking Alpha describes this CEF as:

The Fund’s primary objective is current income exempt from regular federal income taxes and its secondary objective is to enhance portfolio value and total return. The Fund will invest at least 80% of its Assets in municipal securities and other related investments, the income from which is exempt from regular federal income taxes. Generally, the Fund expects to be fully invested (at least 95% of its assets) in such municipal securities. Benchmark: S&P Municipal Bond TR. NUW started in 2008.

Source: seekingalpha.com NUW

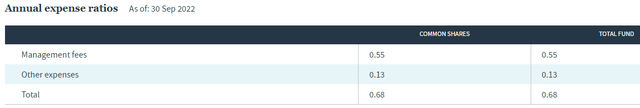

NUW has $255m, a fraction compared to NEA. The Forward yield is 3.5% and Nuveen fees for NUW are only 68bps, partially reflecting NUW’s lack of leverage. Management fees are also 34bps less than what NEA has.

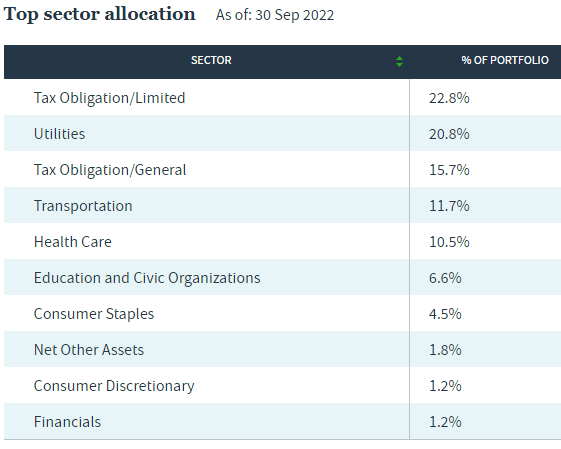

NUW holdings review

Following the same information flow as NEA, the sector allocation for NUW is:

nuveen.com sectors

Utilities and Health Care swapped places in the sector allocations between the two CEFs. Here tax obligations cover a larger slice of the portfolio: 38% versus 30%.

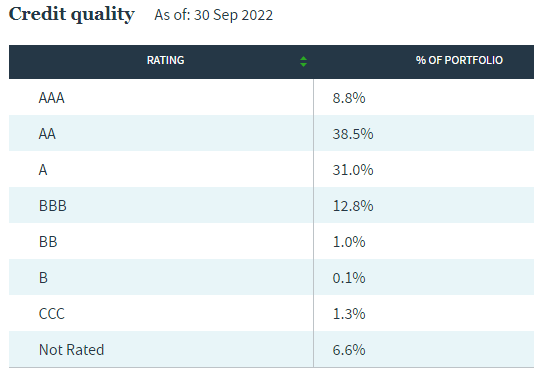

nuveen.com ratings

I also calculated an “A+” rating for this portfolio, though it is slightly more so than NEA’s. The below investment-grade weight is slightly lower; Not rated about half what we see in NEA. Bottom line: despite including “Value” in the CEF’s name, it doesn’t seem to have greatly influenced the asset allocation compared to its sister CEFs.

NUW has more exposure to California-based issuers and less to Illinois than NEA does. As the map shows, there are many more states where NUW has no exposure.

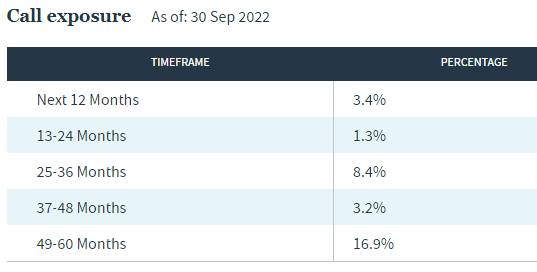

nuveen.com Call schedule

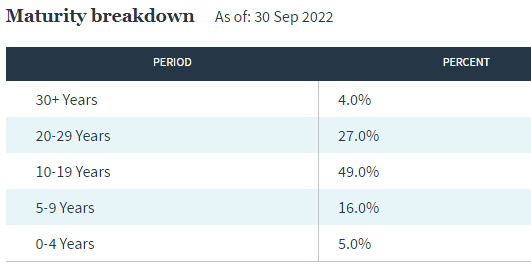

Call risk is much less with this CEF, whereas a higher percent matures in the next nine years, though less under five.

nuveen.com Maturity schedule nuveen.com issuers

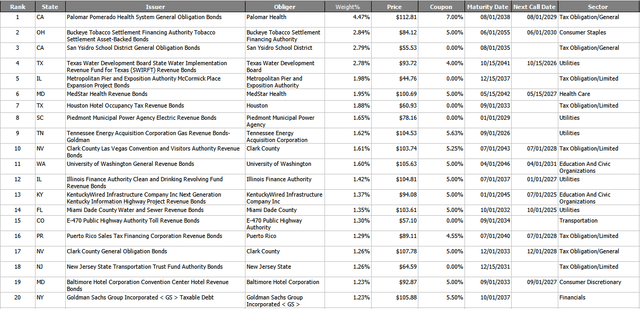

Issuer risk is higher based on its concentration levels compared to NEA.

Top Holdings

nuveen.com; compiled by Author

Holding much fewer assets shows as the Top 20 comprise 38% of the portfolio, versus only 10% is in the top 20 positions of NEA.

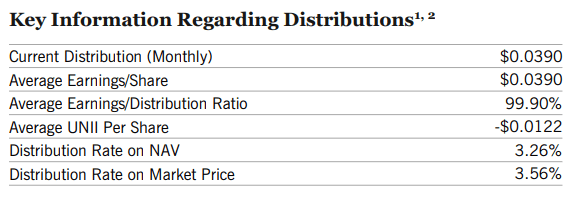

NUW distribution review

A chart like the above helps explain why NUW has less AUM than NEA, constantly shrinking payouts, which are down almost 50% over the past decade!

/documents.nuveen.com NUW

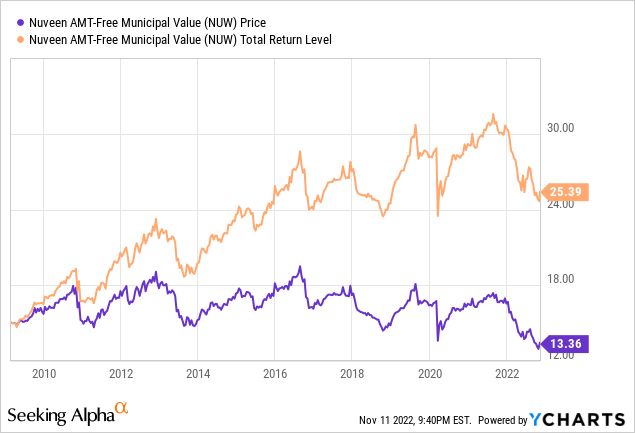

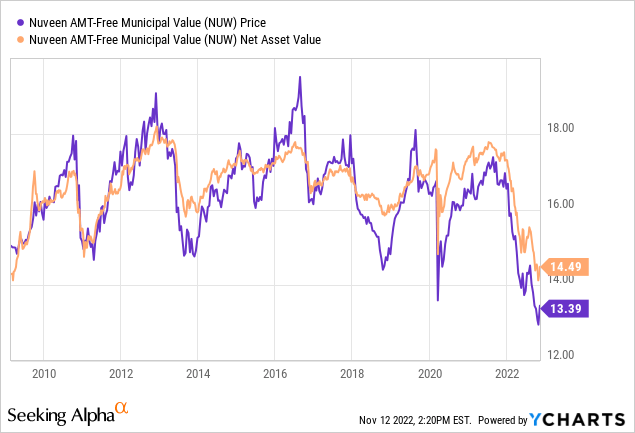

NUW price and NAV review

Like NEA, NUW is selling at prices never seen before. The next chart shows some compelling reasons to consider NUW.

Those are:

- The current discount of 7.59% is below the 1,3, and 5-year averages and up from the recent low of 9.6%.

- Unlike NEA, NUW shows multiple times when it sold at a 5+% premium, making for a stronger case for upward price performance.

Comparing CEFs

First, lets look at some important data points.

| Data point | NEA | NUW |

| Asset Size | $3.4b | $255m |

| Assets held | 1311 | 374 |

| Fees | 183bps | 68bps |

| Leverage/Cost | 43.9%/2.53% | 1.5%/2.2% |

| Yield | 4.88% | 3.50% |

| Discount |

-8.30% |

-7.59% |

| Average Bond price | $97.29 | $93.68 |

| Average Coupon | 4.93% | 4.91% |

| Percent Zero Cpn Bonds | 11.1% | 16.8% |

| Effective maturity (yrs) | 17.4 | 16.0 |

| Effective duration (yrs) | 15.4 | 8.5 |

| Tax Obligation bonds | 30.7% | 38.5% |

Several differences stand out: AUM and assets held, fees, and duration. Since duration comes into play when rates are moving, NEA should recover faster once rates start to reverse their upward trend.

With the latest cut, NEA is in better position to maintain its payout than NUW is. For comparison purposes, I included the 3rd Nuveen AMT-Free CEF. Of course, the bottom line is what has each fund done for its investors?

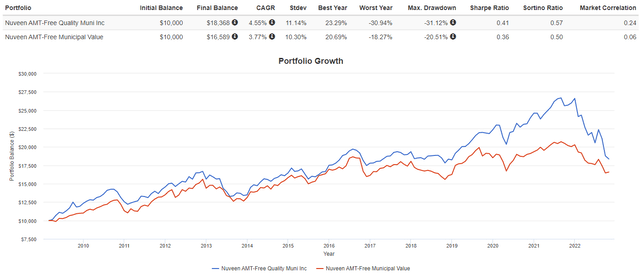

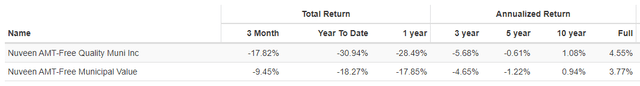

While long-term NEA is ahead, the difference in duration has shown its ugly side since the FOMC started rising interest rates.

Portfolio strategy

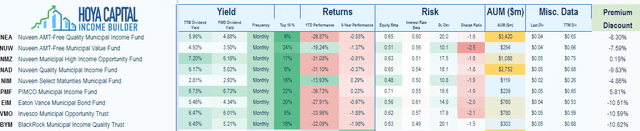

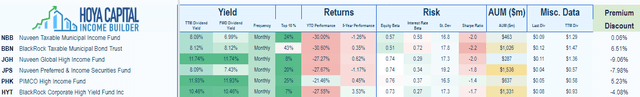

While avoiding income that triggers AMT taxes is desired, investors also need to keep in mind not to let tax-tail wag their investment-dog. What one keeps after the taxman visits is what counts! When picking a municipal bond fund, a high-yield or ones that do not worry about being AMT-Free might be better when looked at through that lens. To expand the universe beyond the two reviewed here, I list a few other choices investors could include in their due diligence.

Also, even for those in the highest brackets, fixed income funds that invest in taxable Munis or “junk bonds” might offer better after-tax returns and a higher level of income. Here are some examples for those types of CEFs.

Final thoughts

Here it gets a little complicated in making a solid recommendation, but here goes.

- Of these two plus NVG, investors expecting rates to continue to climb would prefer the shorter duration NUW has over the others.

- Investors believing the opposite, might want to research NVG as its duration matches NEA but has shown better returns and income generation.

- Investors sitting on a loss, might want to consider swapping funds. Check with your tax attorney on whether staying with the same manager will not violate the IRS ‘wash rule” if you trade within the 30-day window. Another option is sell now, hope rates peak, and buy after a month.

Be the first to comment