David Becker

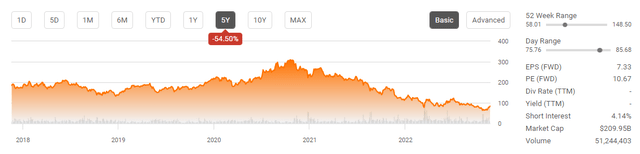

For almost every investor, including myself, Alibaba Group Holding Limited (NYSE:BABA, BABAF) has been an absolute destroyer of capital over the years. Shares of BABA topped out at roughly $309.81 in October of 2020, and since then have fallen roughly -72.88% to around $84. Over the past year, BABA has declined by -50.13%, and it’s been a difficult investment. BABA is hovering around the $200 billion market cap, and no matter what the news has been, nothing has been able to get BABA to maintain an upward trend.

With tax loss harvesting season upon us, I am looking at my portfolio and looking to see if there are any companies I am willing to admit defeat on and book the loss for tax harvesting purposes. BABA has been one of my worst investments and is at the top of the list. While BABA is deeply in the red, its Q2 results were promising, and I am making the decision to stick with BABA for the time being. This lucrative business generates billions upon billions in free cash flow (“FCF”) and income from operations. Whether the impacts from political tensions or the macro environment ease and change Mr. Market’s perception of BABA remains to be seen.

I am basing my investment on the numbers. While I was wrong in the past about BABA, and it could certainly go lower, I am starting to believe a bottom has been reached and that this is another opportunity to dollar-cost average into the position if you believe in BABA’s long-term relevance.

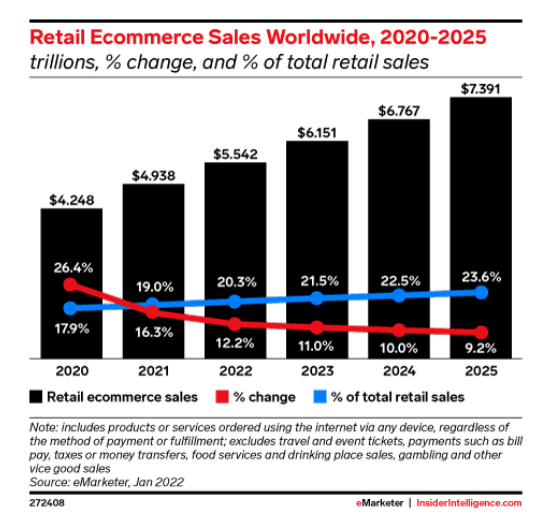

E-commerce still represents a fraction of global retail and is projected to grow YoY through 2025

I don’t typically make short-term investments. In addition to evaluating a company’s financial statements, I research the industry trends that directly impact its business to build my investment thesis. Global e-commerce sales reached $4.94 trillion in 2021, which was an increase of 16.24% YoY from 2020, yet this only amounted to 19% of total global retail sales. While e-commerce was a popular method to acquire goods pre-pandemic, e-commerce has become more popular than ever before. Insider Intelligence is a leader in e-commerce statistics and indicated that e-commerce would close out in 2022 with roughly $5.54 trillion in sales. This is a YoY increase of 12.23% but is still only projected to account for 20.3% of total retail sales.

If these projections are close to being accurate, global e-commerce sales will increase by $1.85 trillion at the close of 2025, bringing total global e-commerce sales to $7.39 trillion. This is a 33.36% increase over a 3-year period, with an average annual sales growth being $616.33 billion. $7.39 trillion of e-commerce sales in 2025 would only amount to 23.6% of the total retail sales globally, leaving significant room for future growth on the table. There isn’t a projected year where e-commerce isn’t expected to increase its position on the global stage regarding the percentage of retail sales e-commerce accounts for.

The macro environment isn’t optimal for BABA, but that didn’t stop BABA from delivering solid results and growing its revenue by 3% YoY despite consumption demand being impacted by the resurgence of Covid-19 in China or cross-border commerce slowing due to FX volatility or rising logistical costs. When I take these factors into consideration and insert them into an investment thesis where e-commerce sales are projected to grow YoY to $7.39 trillion in 2025 and still account for less than 25% of global retail sales, I see this as a bullish setup.

BABA could certainly face headwinds in the immediate future, but as a long-term investment where the timeframe extends past 2025, it’s hard for me to picture a scenario where logistical challenges and FX volatility haven’t worked their way out of the system, and the impacts from the pandemic are absorbed. The external environment set’s up well for BABA, and it would be very difficult to nearly improbable for another company to emerge as a serious competitor to BABA, in my opinion. No matter what, China’s population needs an e-commerce solution. As the largest population in the world, it’s unlikely for them to go backwards as more of its citizens increase their economic positions within its economy.

Insider Intelligence

What I liked about the Q2 results, and why it’s encouraging me to lower my price per share rather than taking a loss during tax loss harvesting season

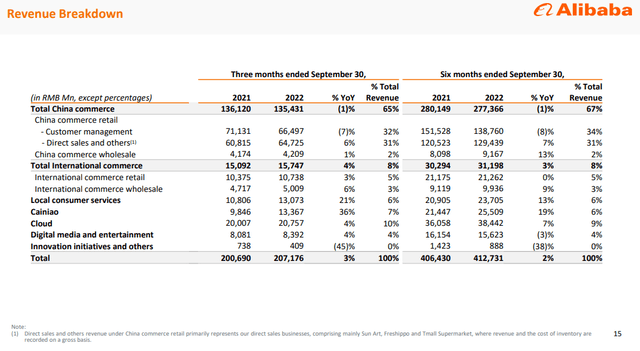

Alibaba released their Q2 results, including a top-line miss and a bottom-line beat. Revenue in U.S dollars came in at $29.12 billion, a 3% YoY increase, but the street was looking for $490 million in additional revenue. Non-GAAP EPADS was higher at $1.82, which was a $0.17 beat.

On the revenue side, China’s commerce declined -1% YoY. This includes BABA’s commerce retail businesses such as Taobao, Tmall, Taobao Deals, Taocaicai, Freshippo, Tmall Supermarket, Sun Art, Tmall Global, and Alibaba Health, as well as wholesale businesses, including 1688.com. Total international revenue, which includes Lazada, AliExpress, Trendyol, and Daraz grew 4% YoY. BABA’s Local Consumer Services, and Cainiao saw impressive double-digit revenue growth numbers YoY. Local consumer services order volume increased by 5% YoY as its YoY revenue grew by 21% ($3.23 billion RMB). Cainio ended Q2 generating $13.37 billion RMB, which was a 36% YoY increase. BABA’s Cloud segment grew 4% YoY and makes up 10% of its quarterly revenue, while its digital media and entertainment segment grew by an additional 4% YoY.

Regardless of the macroenvironment, BABA is driving earnings to the bottom line. Income from operations grew YoY by $10.13 billion RMB (67.51%), which is the equivalent of $3.53 billion U.S. BABA’s Adjusted EBITDA came in at $43.31 billion RMB, the equivalent of $6.09 billion U.S, while BABA’s FCF was $35.71 billion RMB, the equivalent of $5.02 billion U.S. For the first half of its fiscal year, in USD, BABA has generated $7.04 billion in income from operations, $11.87 billion in Adjusted EBITDA, $9 billion in non-GAAP net income, and $8.14 billion in FCF.

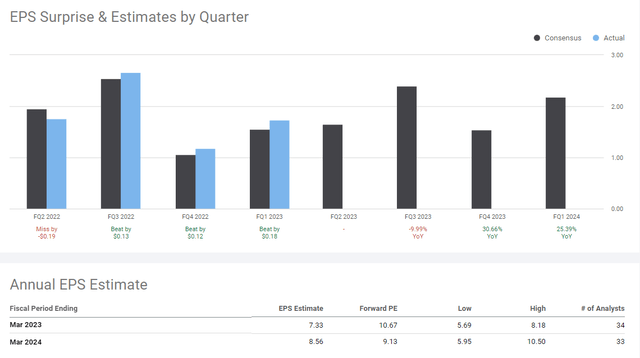

Since BABA’s IPO, its businesses have scaled tremendously, and e-commerce still accounts for less than 25% of total retail sales globally. BABA’s revenue is 12x during this period in 2014, while its Adjusted EBITDA is 4.5x larger and its FCF is 4x larger. BABA is succeeding in the face of adversity, and no matter what the narrative or obstacles have been, BABA continues to navigate skillfully in unforeseen business, political, and economic climates. The analyst estimates have BABA coming in at $7.33 EPS for this fiscal year and $8.56 for the following fiscal year. As zero-covid policies ease in China and the macroenvironment improves, it’s not unrealistic to think BABA could come in near the top end of the estimate range, which over 30 analysts have provided. If BABA can grow during China’s strict COVID policies, I believe they will see additional growth when they are eased or eventually eradicated.

BABA issued a large buyback which should be beneficial

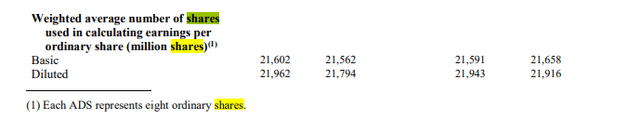

I am taking BABA’s buyback announcement as a bullish signal, as they are clearly confident about their future business endeavors. BABA had previously announced a $25 billion buyback program in U.S dollars and has utilized $18 billion from this allotment. Looking at BABA’s balance sheet, they issued shares to fuel growth as its share price was appreciating and started buying back shares during the 2021/2022 period when its share price was declining. BABA’s shares outstanding topped out at 2.72 billion shares in the June 2021 period. Per BABA’s footnotes, each ADS share is the equivalent of 8 ordinary shares. BABA finished the Sep 2022 period with 21.27 billion ADS shares, equivalent to 2.66 billion ordinary shares. BABA has repurchased 2.2% of its ordinary shares over the previous 5 quarters, as its ordinary shares have declined by -59.8 million.

BABA still has $7 billion of capital remaining on it’s previous $25 billion allocation for buybacks. On the conference call, Alibaba announced that its board had authorized an additional $15 billion toward its buybacks, bringing its buyback budget back up to $22 billion U.S. With shares of BABA at a much lower valuation, they could easily repurchase an additional 2-4% of its shares outstanding depending on market fluctuations. Buying back shares doesn’t just reward shareholders by increasing their ownership stake in BABA, but it reduces the amount of shares its earnings from operations are spread across. The additional $15 billion allocated toward buybacks could significantly increase bottom-line EPS numbers and help BABA create large earnings beats in the future.

Conclusion

BABA may be a candidate for tax loss harvesting for some investors, but the long-term story is still intact from the metrics I evaluate. Global e-commerce is projected to increase by 33.36% from the close of 2022 thru 2025 and still represents less than 25% of global retail sales. This creates tailwinds not just in the short-term picture but well into a long-term thesis. BABA has shown that it can still grow revenue and generate billions in FCF regardless of what the macroenvironment, political landscape, or COVID restrictions throws at them. Over the next year, I believe China’s COVID policies will ease, creating another tailwind for BABA as logistical pressures should also decline.

Ultimately, I feel that BABA’s additional $15 billion in buybacks signals a tremendous amount of confidence, and there is a decent chance that the bottom is in. BABA could certainly go down further, but I am optimistic that it’s business will grow, more capital will be driven to the bottom line, and buybacks will help create larger earnings beats in the future. I will be adding shares to my position to lower my PPS, as BABA did not make my list of companies for tax loss harvesting in 2022.

Be the first to comment