crstrbrt

Investment Thesis

Navitas Semiconductor Corporation (NASDAQ:NVTS) is among the leading developers of gallium nitride (GaN) components used to manage electrical power, with more than 50 million devices in the field.

A public company since October 2021, sales doubled in 2021 and are expected to double again in 2022 to about $50 million.

Five actively targeted markets – mobile chargers, consumer electronics, data centers , residential solar, and electric vehicles – provide a total addressable market for GaN components of ~ $10 billion annually by 2027.

NVTS is arguable in the right place, at the right time, with the right technology to capitalize on this opportunity, and provide well above market returns.

Introduction

The electronics used for the conversion and control of electrical power – power electronics – are undergoing a transition from silicon based components to those built with GaN and other materials.

Applications for power electronics include the ubiquitous wall chargers and in-the-box power bricks that convert household AC power to the DC power needed to charge phones or laptops, the internal power supplies in consumer electronics, power supplies in data centers, power conversion devices for residential solar systems, and the power management equipment to charge and propel electric vehicles.

The shift from legacy silicon to integrated GaN offers significant real-world advantages – reduced charging times, smaller size, less weight, increased reliability, higher efficiency, wider operating temperature range, smaller and in some cases fewer components.

This transition is on the cusp of widespread commercial deployment. More than 50 million GaN power devices are in operation, but that is only a tiny fraction of the potential market.

In this article, we will discuss the Navitas origin story, technology, manufacturing, targeted markets, financial status, competitors, valuation, risks, and some implications for investors. See their slide deck here.

The Navitas Origin Story

Navitas was founded in 2014, with initial funding by the founders plus venture capital from Capricorn Investment Group, Atlantic Bridge, and seed investor Malibu IQ. Navitas generated first product revenue in 2018.

On 7 May 2021, Navitas and Live Oak Acquisition Corp II announced an agreement for a business combination. Between the announcement and execution of the business combination, Live Oak sold an additional 17.3 million shares at $10 per share to institutional investors.

On 19 October 2021, the business combination was executed, with an injection of $298 million net cash, and the resultant entity, Navitas Semiconductor Corporation, went public. The prior owners of legacy Navitas received 39.5 million shares.

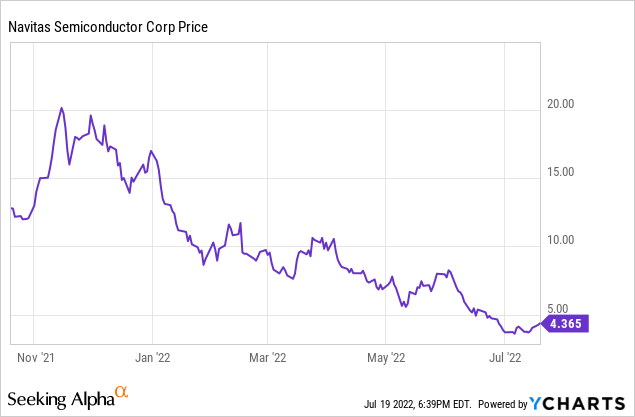

NVTS started trading on 20 October 2021, and per Seeking Alpha, the stock closed at $12.80 that day.

There is substantial insider ownership; as of December 31, 2021, executive officers, directors and their affiliates, including the investment funds they represent, as a group beneficially owned approximately 34% of the outstanding Class A Common Stock. A significant amount of the insider ownership is subject to 6-36 months lockup periods, starting from October 2021.

Five of the seven members of the board come from Capricorn, Atlantic Bridge, Malibu, or Live Oak.

As of December 2021, NVTS had about 160 employees, of whom about 60% work in research and development.

Technology

Navitas invented the first commercial GaN power IC (integrated circuit), marketed as GaNFast™. A good summary is provided here.

They focus heavily on the advantages provided by this approach, which integrates the core power transistor with the driver and other related components into a single chip, reducing parts count and improving reliability.

GaN’s much higher operating frequency vs. legacy silicon allows the physical size of inductor and capacitor components to be significantly smaller, reducing overall product size and weight.

To expedite design-in, they offer a proprietary AllGaN™ process design kit, a ‘how-to’ guide for designers to create new GaN based device and circuits, and consider this a major strength. In addition, NVTS has established three dedicated design centers in China for mobile, data center, and EV applications; Shenzhen, Hangzhou, and Shanghai.

Navitas’ third generation of GaNFast™ power ICs, with autonomous GaNSense™ technology, was introduced in Q3 2021. GaNSense technology enables real-time, accurate sensing of voltage, current and temperature to further improve total system performance and robustness.

The fourth generation is primarily a “classic die shrink” with some performance enhancements, and is expected to yield a 20% improvement in price/performance. Sampling in Q2, it is expected to be introduced in the second half of 2022. As a pin compatible drop in for the current 3rd generation, it is expected to rapidly reach 50% of shipments by early 2023.

Extending the product line, in May 2022 the NV6169 was introduced, the highest power product to date, targeting “higher-power applications such as 400-1000 W 4K/8K TVs and displays, next-generation gaming systems, 500 W solar micro-inverters, 1.2 kW data-center SMPS (power supply), and up to 4 kW / 5 hp motor drives”.

In its first acquisition since going public, NVTS acquires VDD Tech in July 2022, adding technology to support higher power consumer, data center, and EV applications.

NVTS has a significant intellectual property position, with about 145 patents granted or in process.

Manufacturing

NVTS is fabless; the actual manufacturing of devices is outsourced to Taiwan Semiconductor Manufacturing Company (TSM), building on a relationship established in 2014 to develop and refine the GaN manufacturing process.

NVTS devices are currently manufactured at TSMC Fab 2, with a GaN on silicon substrate process, using 250-350 nm equipment, on 6″ wafers. Yields are high, 90-95%. As manufacturing volume increases, migration to a higher capacity 8″ fab line is likely.

This fabrication capacity is readily available and cheaper than the state of the art sub-10 nm equipment and 12″ wafer fabs preferred for the latest CPU chips.

Another GaN cost advantage is that the devices are physically smaller than equivalent silicon devices. In the manufacturing process, that means that more GaN devices can be made per wafer.

NVTS notes in their 2021 Annual Report the impending shift between legacy silicon and GaN cost:

Silicon-based power devices are still the incumbent solutions used for power applications and currently have a lower-cost advantage. However, given the speed, power and size advantages of an integrated GaN IC over a silicon solution, coupled with expected cost reductions, we expect to cross the cost-parity point with silicon and achieve GaN-based power systems that are lower cost than their silicon counterparts by the end of 2023.

Markets

NVTS’s initial focus has been on the mobile charging market (i.e. charging a mobile device containing a battery, e.g. phone, laptop), where it has established a leading position.

Gene Sheridan, CEO, noted in the May 2021 earnings call that:

Navitas GaN is now in mass production with nine of the top 10 mobile OEM’s across smartphones and laptops and we expect all 10 of the 10 by the end of the year.

Key GaN advantages in this market up to a 65% reduction in the time to charge the user’s device, using a charger only half the size and weight of legacy silicon based chargers.

With about 2.5 billion chargers delivered per year, and a typical $1 GaN bill-of-materials component, this is in itself a substantial market with significant growth potential. Ultra-fast chargers, with power levels above ~ 100 watts, are a direct expansion of this market, and also typically require two (or even more) GaN chips (see for example this Dell (DELL) in-box 100W charger with two NV6117 chips).

Success in the charger market offers a good opportunity to demonstrate GaN performance and reliability, while scaling manufacturing and building customer relationships.

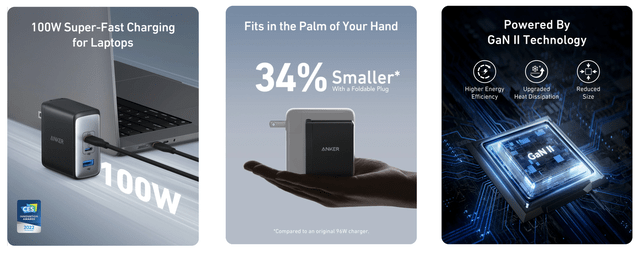

By December 2021, NVLT had cataloged 170 chargers in mass production, and another 240 in development, using their GaN ICs. Major clients include Dell, Lenovo (LNGVY), LG, Xiaomi (OTCPK:XIACF), OPPO, Samsung (OTCPK:SSNLF), and Amazon (AMZN). A recent example:

Anker 736 100W Charger with Navitas GaN (Anker)

The March 2022 introduction of a 20 year warranty, 10X the industry standard, was a concrete demonstration of confidence in product reliability. Reaching the 50 million units shipped milestone in May 2022 demonstrated manufacturing at scale.

Four additional markets have been targeted – consumer electronics, data center, residential solar, and electric vehicles.

In consumer electronics, four applications – TVs, gaming systems, desktop PCs, and internet connected smart home devices – deliver about 600 million units per year, with a potential $3 in GaN content per unit.

Data centers are an estimated $1 billion a year market for GaN, where GaN adoption could reduce power costs by almost $2 billion a year. Electricity costs, including power conversion and cooling, account for over 40% of data center costs.

In the data center market, NVTS is working with Compuware, the leading high efficiency power supply developer, who ships 2 million server power supplies per year. Estimated potential GaN revenue per power supply is $25. NVTS expects sales to begin ramping here in 2023.

GaN adoption in residential solar system inverters is estimate to improve ROI by about 10%. NVTS is working with Enphase (ENPH) in this market. The estimated size of this market is about $1 billion.

Electric vehicles provide a $2.5 billion potential annual market, with three applications; on board battery charger (~$50/vehicle), DC-to-DC conversion inside the vehicle (~$15), and traction drive ($200). First revenue is targeted in 2025.

Gene Sheridan, Navitas’ co-founder and CEO, commented:

“With up to 70% energy savings, we estimate up to 3x faster charging, and 5% longer range or a $500 saving on a typical EV battery. With a roadmap to address on-board chargers, DC-DC converters and traction drives, Navitas estimates a potential $250 of GaN revenue per EV in 2026.”

Finances

NVTS has incurred a net loss each year since inception, with the largest loss in 2021. As of December 2021 had a US federal tax loss carry forward of about $100 million. NVTS does not pay dividends, and has no plans to do so.

Revenue doubled from $11.8 million in 2020, to $23.7 million in 2021, and is expected to double again in 2022. Research and development spending also doubled from 2020, to about $28 million on 2021.

The financial highlights for Q1, from Todd Glickman, CFO, from the May 2022 earnings call (non-GAAP), and Q&A:

- all warrants redeemed, adding 3.3 million shares

- 123 million share count

- $6.7 million revenue (up 27% from Q1 2021)

- $5.8 million R&D

- $9.6 million, net loss from operations

- 44% gross margin

- $253 million cash and equivalents

and expectations going forward:

- $8-9 million Q2 revenue (up 47% from Q2 2021)

- $14 million Q2 operating expenses

- 41% gross margin, Q2

- $58 million operating expenses, full year 2022

- 42% gross margin, full year 2022

- achieve system cost parity with silicon in 2023

- cash flow positive reached in 2024

- < $100 million of cash needed to reach positive cash flow

- 55% gross margin long term

Competitors

There are multiple competitors in the GaN power electronics space particularly, and the larger power electronics space generally.

Semiconductor Today reported in October 2021 that the GaN power device market was estimated to grow by 73% in 2021, reaching $83 million. NVTS was expected to take the lead the in GaN market in 2021 (by devices shipped) with 29% market share, followed by Power Integrations, Inc. (POWI) with 24%, and Innoscience with 20%, Transphorm (TGAN) with 6%, Infineon (OTCQX:IFNNY) with 3%, and GaN Systems with 3% shipped significantly fewer devices.

NVTS identifies their primary GaN competitors to include Infineon Technologies AG, GaN Systems, Inc., Power Integrations, Inc., Texas Instruments Incorporated (TXN), Innoscience, Transphorm, Inc. and Efficient Power Conversion Corporation.

The primary silicon-based power semiconductor competitors include Infineon, STMicroelectronics N.V. (STM), ON Semiconductor Corporation (ON) and Power Integrations, among others.

Infineon’s February 2022 Investor Presentation gives an estimate of the respective market share for the top 10 competitors in the overall power semiconductor space: Infineon, ON Semi, and STMicroelectronics are the three largest, with about 20%, 8%, and 6% market share respectively.

Analysis

As I’ve spent time over the past couple of weeks researching and thinking about this article, I’ve become more impressed with NVTS.

They appears to have a well-thought-out growth strategy, sequentially targeting five markets – mobile power, consumer, data center, solar, and EVs. As an engineer, I admire efficient and reliable technology, and they seem to have delivered that.

The mobile power market allowed them to sell visibly improved charging performance and reduced size – features readily visible to end users, while simultaneously ramping up manufacturing to tens of millions of units per quarter, driving down the cost-volume curve, demonstrating outstanding reliability, and establishing a track record of success with dozens of important customers. This appears to have been largely achieved.

I purchased two of 20W GaN wall chargers and use them routinely. To my eye, they deliver as promised – small size, rapid charging, relatively cool.

The consumer electronics market is a natural extension; to some degree just moving the power supply inside the consumer product, and has some overlap of customers.

The data center market will allows them to sell reliable efficiency and operating cost reduction into a sophisticated commercial market which is highly sensitive to the costs of power and cooling.

The EV market is the biggest prize in terms of GaN dollars per unit, but is likely to be hotly contested.

The NVTS marketing focus on environmental impact is worth a few words. I initially thought this was a “and it does this too” marketing spin, but I think it’s more than that. This focus on environmental impact through superior technology has been a key driver for Navitas since its origin, and seems to have motivated some of the original venture capitalists.

They estimate a net reduction of 4 kg of CO2 emissions per GaN chip. See the 2021 Sustainability Report for details.

This October 2021 presentation by EarthShift Global presents a detailed analysis of the impact of replacing silicon with GaN for consumer mobile device charging, including materials, manufacturing, and use. At full load, a 65 watt silicon charger is about 89% efficiency vs. 93% efficiency for GaN (see slide 31), about 35% reduction in wasted energy. Multiplied by a few billion devices, it adds up.

Valuation

Well, it’s too soon to tell. But I’ll hazard a very back of the envelope guess.

In Q1 NVTS estimated a $9 billion potential market for GaN; $2 billion fast chargers, $1 billion ultra-fast chargers, $2 billion consumer electronics, $1 billion residential solar, $1 billion data center, $2.5 billion EVs (by 2030).

How much of that potential can NVTS capture? Let’s guess – and it is only a guess – 15% market share, ~ $1.3 billion revenue. To make the math easy, assume $1.2 billion target revenue.

We assume 150 million share count (see Risks below), so $8 per share revenue.

How long to grow to that point? About 6 years is If NVTS can sustain their current rates of growth, and continue to double revenue each year; i.e. target 2027. If might be 2030 if growth is a little slower.

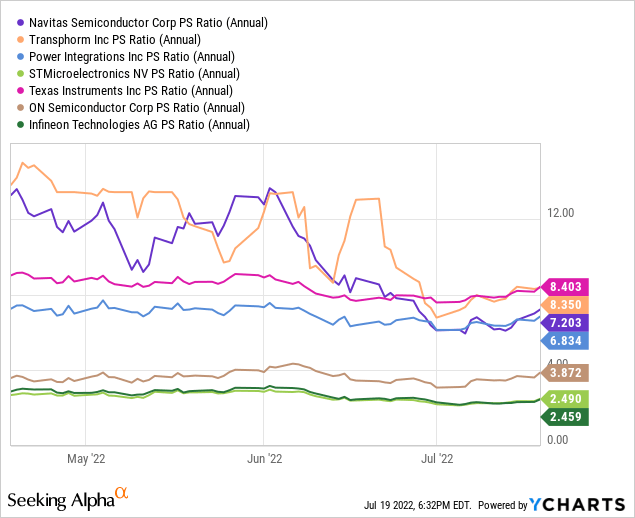

If one looks at some of the identified competitors, Seeking Alpha provides Price/Sales numbers.

Based on this data, we might assume a more mature NVTS will have a P/S ratio between 2.5 and 7, which would suggest a share price between $20 and $56, circa 2027-2030. To repeat, this is VERY back of the envelope.

What do the professionals think? Price targets have been declining since NVTS went public; Two analysts reduced their target to $9 target in May, Bank of America (BAC) set a $5 price target on 29 June 2022. But I doubt they are looking at 2027.

As a reminder, here’s the NVTS price action from going public on 20 October 2021 to 19 July.

Risks

Several risk to the investment thesis deserve mention.

There are a number of competitors in the power electronics generally and in GaN power electronics specifically; several of these are much larger than NVTS. While it appear very likely that the GaN power electronics market is going to grow, the NVTS’s share is uncertain.

NVTS face geopolitical risk. Their devices are manufactured in Taiwan, and a large fraction of their customer base is in China (74% of sales in 2021), as are all three of their design centers. Things could happen.

NVTS relies on a single vendor for device fabrication.

Some degree of dilution is likely, due to acquisitions or employee stock compensation. There are for example 10 million potential “Earnout” shares due to certain stockholders if the share price exceeds $12.50, $17.00 or $20.00 by 19 October 2026. Further, options on about 16 million shares have been granted via incentive performance plans. It’s probably reasonable to assume 150 million shares – a 20% dilution – by 2026.

Investor Takeaway

NVTS is arguably in the right place, at the right time, with the right technology to capitalize on the secular shift from silicon to GaN for power electronics. With $250 million in cash, NVTS has the financial resources to fund rapid growth.

Their very successful commercialization of GaN power ICs in the mobile charger market validates their technology and positions them to increase penetration in that market, and leverage the demonstrated technical and imminent cost advantage of GaN to successfully enter additional markets. There is a long runway ahead.

Personally, I currently have a small position in NVTS, purchased in the $6 range. I have a larger limit order in at a price below the current price. I view this as a 10 year plus investment, with a potential 8-10X return from the current price, over that time.

Be the first to comment