CreativaStudio/E+ via Getty Images

For the first time, we decide to cover an Italian leading furniture player called Natuzzi S.p.A. (NYSE:NTZ), the only non-American company in the “furniture” sector, listed on Wall Street since 1993. The Natuzzi group was born in 1959 under the creation and guidance of Pasquale Natuzzi, who transformed a small company into an industrial group operating on a global level.

The first successes are due to the company’s ability to invent sofas and to its export-oriented attitude. Already in 1977, Natuzzi participated in the Cologne international furniture, having the opportunity to exhibit only one sofa. The first contact was made and then the company set up a full distribution chain all over Europe, followed later on by the start of sales in Canada and the United States. Vertical integration upstream began in 1986 to reduce costs, and thanking the entire production cycle direct control which achieved higher levels of productivity and efficiency. With the direct production of semi-finished products and the creation of new production units, an integrated industrial group was established. 1995 marked the first year of collaboration with IKEA, Natuzzi became an important supplier of the Swedish distribution chain, which was rapidly expanding all over the world with a preference in supply for highly internationalized global producers.

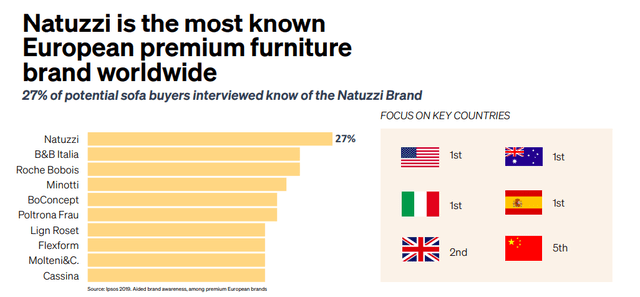

For the highly export-oriented as well as upholstered furniture sector, in 2002 there was a slight contraction in exports. The opening to foreign markets was the key factor in the success of the company but it proved to be a constraint. In recent years, the difficult Italian economic landscape and new strategies have affected the corporate governance structures. In addition to the growing managerial internationalization, which has become necessary for foreign production plants and subsidiary commercial companies, these factors have further complicated the Natuzzi structure. Speaking of numbers, the Natuzzi Group is now the largest Italian company in the furniture sector and is the most well-known brand among furniture goods. The Group controls 92% of raw materials and semi-finished products from the procurement to the process transformation of leathers, wooden, or metal load-bearing structures. The production is horizontally integrated across production plans located in Italy, China, Russia and Romania and takes advantage of the experience of professional craftsmen and know-how. The processing of materials and production takes place exclusively in Italian factories. Indeed, all the models are born in the Natuzzi Style Center located in Santeramo in Colle, where Pasquale Natuzzi personally coordinates a team of 120 creatives including designers, architects, colour experts, craftsmen, engineers, and interior decorators. Of the 6000 sketches produced each year, only 120 arrive at the final verification.

Furniture brand awareness

Source: Natuzzi Investor Presentation

The Group closed the 2021 fiscal year at €427 million, with top-line sales up by more than 30% and a positive EBITDA that reached €10 million after a few years of remaining in the negative area.

Natuzzi’s new business plan

In the new business plan for the period 2022-2026, the Natuzzi group laid the foundations for the relaunch of the company, sharing them with the Italian trade unions and the Ministry of Economic Development. There is a plan with 2 options. The former contains 512 redundancies, production over three shifts, and only three plants. The other option, which is gaining momentum, involves the reopening of the Ginosa plant, with production in 5 plants and a whole series of measures to minimize redundancies. Even the Unions agree that with the latest business plan, the company will no longer use the social safety needs provided by the Italian government.

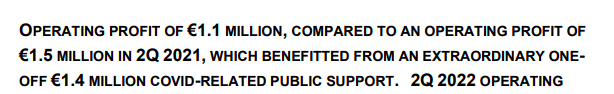

Natuzzi public support (+ one off)

Source: Natuzzi Q2 results

Current strengths:

- Natuzzi has a distribution of more than 1200 points of sale around the globe;

- A weak € currency might benefit Natuzzi’s top-line sales, and numbers in hands, the company exports in more than 123 markets with a leading market share in the EU and in the American region;

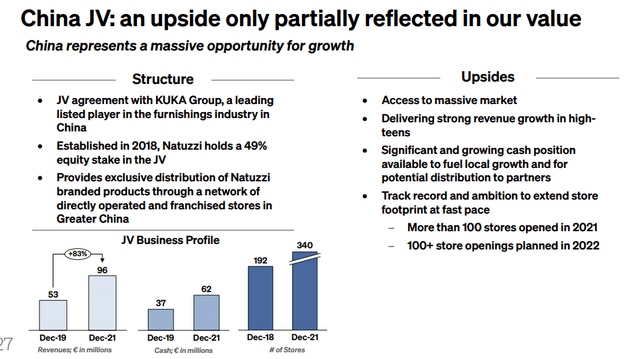

- It has now 120 stores in China alone with a solid JV (fig 1);

- mono-brand stores strategy is actually working;

- Related to point 4), the company is fully and vertically integrated;

- At the aggregate level, there is a 7% CARG in the furniture market until 2025.

Current weaknesses:

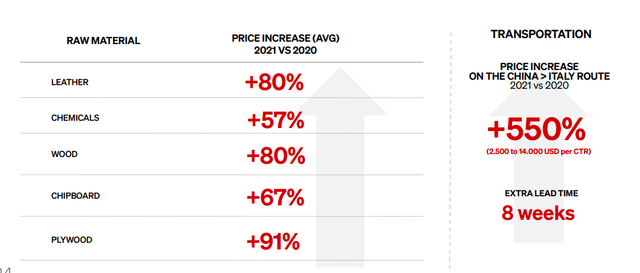

- Raw material inflationary pressure;

- Logistic constraints and higher costs;

- Debt consideration in a rising interest rate environment;

- Related to point 3), Natuzzi’s margin is already at a low single-digit number, and there is limited operating leverage, so the company is facing points 1) and 2) and will likely experience negative results. This has already happened in Q2.

Natuzzi China JV

Source: Natuzzi Investor Presentation (Fig 1)

Natuzzi raw material pressure

Source: Natuzzi Investor Presentation (Fig 2)

Conclusion and Valuation

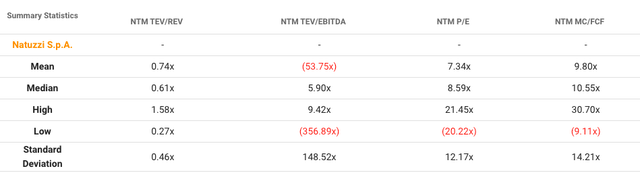

Downside risks are equally important to consider, and even if Natuzzi is trading at a very depressed valuation, we are not confident. On a twelve-month time horizon, Natuzzi will face margin pressure and most likely negative results. At this point, it is a no-go opportunity.

Natuzzi stats on valuation

Source: TIKR stats

Be the first to comment