Marina113

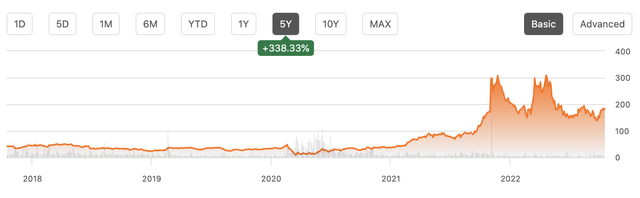

Shares of Avis Budget Group (NASDAQ:CAR) have performed extraordinarily well over the past 24 months. Aside from its status as “meme” or short-squeeze” stock, the post-COVID landscape was fundamentally very good for Avis’s business. A surge in travel demand boosted rental rates, and rental car companies are highly-levered owners of used cars, which soared as new car production was weak. Avis will report third quarter earnings on October 31st, so it is a good time to check in with fundamentals to see how the quarter may look.

Seeking Alpha

Whatever your view of CAR’s valuation, there is no disputing that the company has performed extremely well. In the company’s second quarter, revenue was up 37% to $3.2 billion, leading to record net income of $774 million. EPS was $15.71 from $5.63 last year, and in the first half of the year it has earned over $25. Thanks to strong cash flow, it has spent $1.7 billion on share buybacks, reducing its shares outstanding from 70.6 million to 49.5 million. These are real positives that have fundamentally enhanced CAR’s fair value relative to the past.

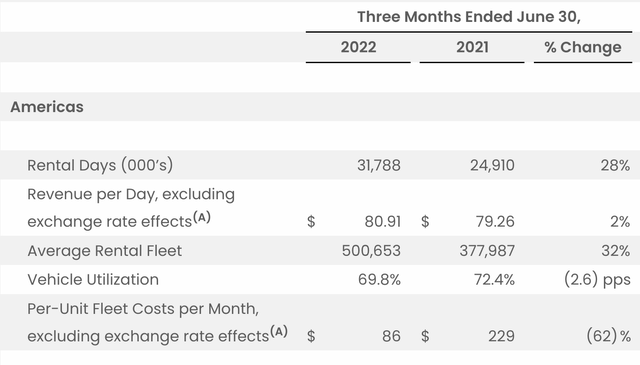

As you can see below, the company has greatly increased its fleet as new car production has recovered, and pricing rose another 2% in Q2. In 2019, revenue per day was just about $47, so rental rates are nearly 70% higher today. It is no surprise then that profits are so high. That said, fleet utilization did tick down, so Avis may be reaching the limit of what it can achieve on price. Still, if it can hold prices in the upper $70’s, that would be a significant win and better than even the biggest bulls in 2019 would have expected.

Avis Budget

Aside from higher rental rates, because used cars prices have been relatively high, the company is depreciating its fleet more slowly. Depreciation is down from $686 per car last year to $259 in the past quarter, saving $131 million. On top of this non-cash saving, because used cars have done so well, it is selling cars for more than their carrying value, generating a $497 million gain on sale this year. It has completed vehicle dispositions of $2.6 billion (page 6 of the 10-Q) in the first half of 2022, so it is essentially selling them at a 24% profit vs their carrying cost.

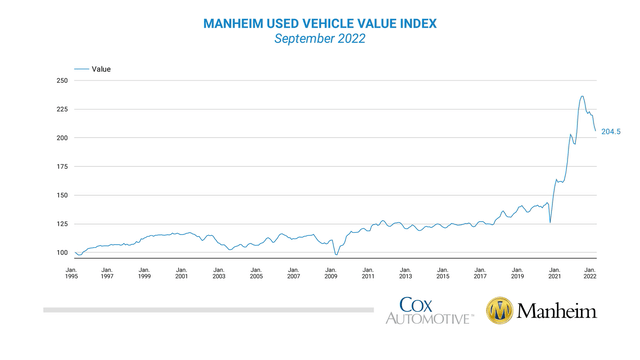

As mentioned, used cars have seen a tremendous increase in value over the past two years—they are arguably the world’s best performing asset class. That said, their prices have begun to fall. They could not rise forever, otherwise they would eventually become more expensive than new cars! Given the combination of rising new car production and fading fiscal stimulus, I am generally of the view that used cars are likely to see further price declines. One risk to this view in the very near-term is that Hurricane Ian seems to have destroyed many cars – Progressive (PGR) reserved $585 million for cars and boat damage on Wednesday. This could provide a regional boost to used car prices, but I would expect any benefit to be fairly short-term. The Manheim index shows about an 8% decline in used car prices over the past three months.

Manheim

In addition to declining used car prices, Wednesday’s CPI report showed that car rental rates have fallen 8% since June. Of course, Avis may have out or underperformed this national benchmark, but there is likely to have been some rental rate moderation in Q3 that will reduce revenue.

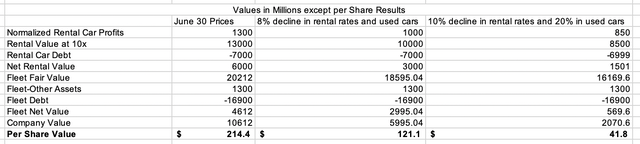

While I recognize that the large short interest and passions around the stock can drive outsized price movements in either direction, I have tried to focus on determining a fundamental fair value. I think it best to separate the company into two parts—the run-rate of its core rental business and any hidden value in its fleet given higher used car prices than their depreciated value.

If we exclude gains on sales of cars (since we are valuing cars separately), the rental business had $900 million in H1 profits. If we assume going forward that cars depreciate more normally, that will be about a $300 million increase in pre-tax costs. Based on the rental rates Avis was receiving in H1, it generated $675 million in “normal profits.” Given its cyclicality, I value the business at 10x or $1.3 billion. Given it has $7 billion in debt and operating leases, it was worth $6 billion on June 30th.

So far this year, Avis has sold cars at a 24% profit. As a consequence, its $16.3 billion in net vehicles was really worth about $20.2 billion. Factoring in $1.3 billion in receivables and other assets less $16.9 billion in vehicle debt, its vehicles were worth a net $4.6 billion.

Combining the two, based on June 30th rental rates and used car prices, Avis was worth $10.6 billion or $214. Now, I tend to think this is a generous valuation as its vehicle position includes cars purchased during the quarter from the automakers, and it is unlikely to have a 24% profit on those cars.

My own calculation

Alongside the June 30 estimate, the second column shows the company’s valuation if the Manheim and CPI indices, which showed 8% decline in used cars and rental rates, are accurate. I also assumed that CAR would be able to offset half of its revenue losses with cost reductions to get to $1 billion in profits in that scenario. Because of how highly levered its auto holdings are with $16.9 billion in debt, and 8% decrease in its used cars cuts Avis’s net car value by over 33% to $3 billion. Essentially every 1% in used car prices is worth $200 million to AVIS or about $4 per share.

In this scenario, the stock is worth $121. In an environment where we see further deterioration including a 10% decline in rental rates and 20% drop in used cars, AVIS’s value would fall to $42. Because the company has $7 billion in corporate debt and leases and $16.9 billion in vehicle financing, it is highly levered and small changes to its business have significantly larger impacts on the value of its share price. This is one reason why the stock can be so volatile, shifting model assumptions slightly has dramatic share price consequences.

This is also why I would urge caution in trading this stock; it has been and likely can continue to be very volatile. At its current share price of $180, the stock is essentially pricing in just a modest deterioration from June 30 levels while other indicators like CPI and Manheim point to larger declines. As a consequence, I see downside risk ahead of earnings and view $100-$120 as the fundamental fair value for Avis under a benign scenario where used cars and rental rates do not fall that much further. There would be greater downside in a recession, just given the large debt load Avis has to support.

For investors in the stock, I would recommend selling holdings in the $180s, as I see the Q3 earning report as a catalyst more likely to push shares lower than higher if we see the moderation in results that I anticipate. Given how volatile this stock is, I would caution against shorting shares outright. Instead I would look to buy puts to limit the downside. The $160 strike November 4th put is $7, and I view that as an attractive way to bet on the stock converging towards fair value while capping your downside after it reports earnings on October 31st.

Be the first to comment