fotosr/iStock via Getty Images

GSK Overview – Company Responds To Activist Investor Challenge But Litigation & Falling Pound Sinks Share Price

Back in April I discussed GSK (NYSE:GSK), the United Kingdom based Pharmaceutical giant in some detail, sounding a relatively positive note in an article for Seeking Alpha.

GSK’s share price has been an ongoing disappointment for the best part of 2 decades. Since hitting a high of ~$63 in 2000, it has traded >$50 on only 2 occasions since – for around 1 year between April 2006 – March 2007, and in the early part of 2014.

This was a point made forcefully by Elliot Asset Management, who built a significant position in GSK last year before launching a scathing attack on management, summarized in a 17-page document sent to GSK’s Board of Directors.

GSK’s business was not performing badly, Elliot argued – revenues had grown from $39.2bn in 2018 to $46.1bn in 2021, and net income from $9.5bn to $10.8bn – but better execution and stewardship was required to reward long-suffering shareholders.

GSK has obliged by spinning out its consumer health division, creating a more streamlined company, and outlining plans to get to £33bn in revenue – growing at a ~5% CAGR – by bringing through new pipeline drugs in its Vaccines, Specialty Medicines and General Medicines divisions.

Unfortunately for GSK, its shareholders, and Elliot Asset Management, the plan does not seem to be working. GSK delivered a decent set of Q222 earnings, with turnover increasing 25% to £14.1bn, adjusted operating profit increasing 26% to £4bn, and earnings per share increasing 27% to £0.67, whilst guidance for the full year was lifted to 6-8% sales growth, and adjusted operating profit growth of 13 – 15%.

Despite this, GSK stock has sunk in value from a price of $44 before the earnings were announced, to a low of $29. This is partly due to the spinout of its Consumer Health Business into a new company, Haleon (HLN), which began trading in mid-July, with the added complication of GSK completing a share consolidation at the same time. It is also partly due to inflationary pressures and the falling pound, and partly due to cuts to the dividend payout.

Finally, it is partly due to GSK facing thousands of lawsuits in the US relating to heartburn drug Zantac, a drug it helped develop, which was later acquired by Pfizer (PFE), sold to Boehringer Ingelheim, and then sold to Sanofi (SNY). The lawsuits affect all 4 Pharmas, and attest that Zantac causes cancer. GSK could face billions of dollars of fines if it is found guilty of not properly communicating the risks of the drug.

Gloom Is Lifted (Somewhat) With A Potentially Major Win For Cancer Drug Jemperli

This week, GSK has finally been able to announce some positive news to lift the gloom surrounding the company and put an end to the bear run on its shares.

In April last year, the Food and Drug Agency (“FDA”) approved GSK’s drug candidate dostarlimab to treat mismatch repair deficient (“dMMR”)/microsatellite instability‑high (“MSI‑H”) recurrent or advanced endometrial cancer.

Dostarlimab is now marketed and sold by GSK in that indication as Jemperli. In August, the drug won an accelerated approval to treat accelerated approval to treat any type of dMMR solid tumor.

Jamperli is a programmed death receptor-1 (PD-1)-blocking antibody that binds to the PD-1 receptor and blocks its interaction with the PD-1 ligands PD-L1 and PD-L2. As such, it belongs to a class of drugs known as Immune Checkpoint Inhibitors (“ICI”), and it is the seventh PD-1/L1 inhibitor to be approved by the FDA.

The others are Merck’s (MRK) Keytruda, Bristol Myers Squibb’s (BMY) Opdivo, Regeneron (REGN) / Sanofi’s Libtayo, Roche’s (OTCQX:RHHBY) Tecentriq, AstraZeneca’s (AZN) Imfinzi, and Pfizer’s Bavencio.

Although BMY’s Opdivo generated $7.5bn of revenues in 2021, across a wide range of solid tumor cancer indications, Merck’s Keytruda is by far the most successful PD-1/L1 inhibitor. The drug generated an astonishing $17.2bn of revenues last year, and its largest market is Non-Small Cell Lung Cancer.

Yesterday, GSK announced that Jemperli had delivered positive results from a 243 patient Phase 2 study of patients with NSCLC in which Jemperli plus chemotherapy was evaluated head-to-head against Keytruda plus chemotherapy. GSK noted that this is the largest global head-to-head trial of programmed death receptor-1 (PD-1) inhibitors in this population.

Full details have not yet been released and more data – including the primary endpoint of Objective Response Rate (“ORR”) and secondary endpoint of Progression Free Survival (“PFS”) – will be announced at an “upcoming scientific meeting”, GSK says.

Although head to head comparisons are difficult to make, because no 2 patients are alike and disease stages are bound to vary, this is nevertheless a momentous win for GSK against the might of Merck’s Keytruda – the closest thing there is to a cancer “wonder drug”.

Keytruda achieved an ORR of 45% in its pivotal KEYNOTE-024 study, with 4% being Complete Responses (“CRs”), versus a 28% ORR and 1% CR in patients receiving platinum containing chemotherapy. Median Overall Survival (“OS”) was 30 months, compared to 14.2 months in the chemo arm.

GSK had apparently been forecasting for peak sales of $1 – $2bn for Jemperli, but if the drug could establish supremacy to Keytruda in its flagship indication of NSCLC, then peak sales could potentially enter the double-digit billions.

There is a very long way to go before GSK can even gain approval to enter this market, let alone take market share away from Keytruda, but if that scenario did come to pass, it would have a transformative and very positive effect on GSK’s future revenue generation.

How Jemperli Could Redress Imbalance Between GSK Forecasts Vs. Market Expectations

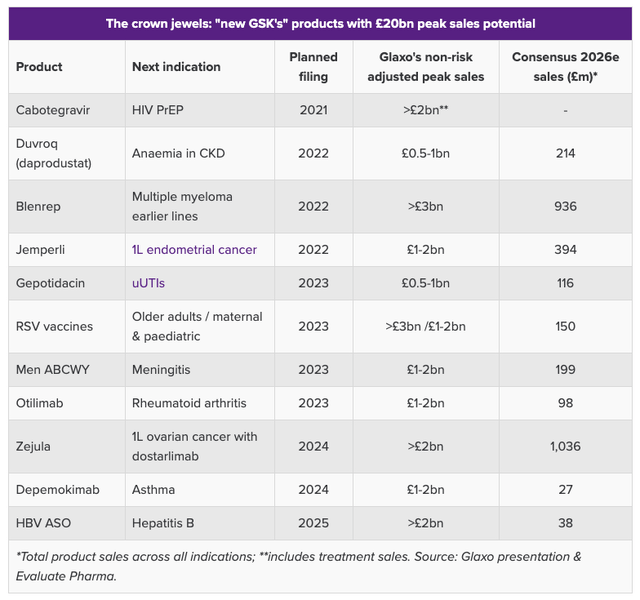

GSK projected sales of pipeline drugs, if approved. (Evaluate Pharma)

As we can see from the above table compiled by Evaluate Pharma, GSK believes it could bring products with peak sales expectations of ~$20bn to market within the next 3 years, whilst the market is adopting a much more pessimistic view, forecasting for not much more than $3bn in new revenue generation.

The out-performance of Jemperli against Keytruda, if borne out by further trial evidence, could go a long way to readdressing that imbalance. Similarly to Keytruda, Jemperli has a tumor-agnostic approval, meaning it can used to treat a large variety of solid tumor cancers, and GSK will doubtless want to trial the drug in as many indications, in as many different combinations as it possibly can in order to challenge Keytruda on as many fronts as possible. Keytruda also has a potential patent expiry upcoming in 2027.

More Good News – Jemperli / Cobolimab Combo Advances Into Late Stage NSCLC Study

GSK has additionally announced that it will advance a combination of Jemperli, its anti-TIM-3 antibody Cobolimab, and chemotherapy drug Docetaxel into a pivotal trial, after revealing that, in its Phase 2/3 study, both arms met criteria for advancement.

TIM-3 stands for T-cell immunoglobulin domain and mucin domain-containing molecule, and it is considered as potentially highly complementary target to PD-1, enhancing the work of PD-1 inhibitors like Jemperli and Keytruda. TIM-3 is associated with disease progression and shorter survival in various solid tumor cancers, as is another molecule, T cell immunoglobulin and immunoreceptor tyrosine-based inhibitory motif domain (“TIGIT”).

Both have become targets for drug developers, although earlier this year Roche announced that its TIGIT candidate tirogolumab had failed a second Phase study, damaging the TIGIT thesis and potentially opening up the market for TIM-3. The likes of Big Pharma’s Merck, Gilead (GILD), Novartis (NVS) and BMY all had TIGIT drugs in development.

GSK does not have the TIM-3 field all to itself – Novartis’ Sabatolimab is being evaluated in late stage trials in myelodysplastic syndrome (“MDS”) and chronic myelomonocytic leukemia, although these are blood related cancers, not solid tumor cancers.

As such, the Jemperli / Cobolimab / Docetaxel combo has the potential to become a best-in-class therapy for later stage lung cancer, although obviously everything will depend on what the later stage data looks like.

GSK Is Not An Experienced Oncology Operator

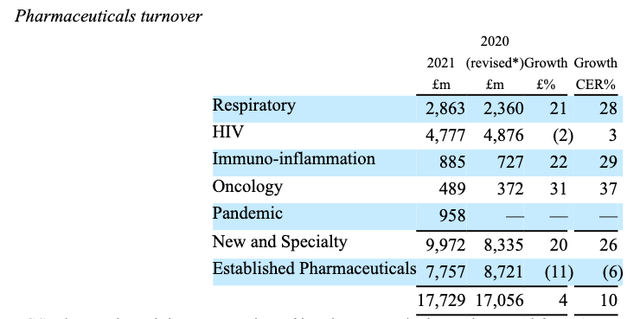

GSK Pharmaceuticals turnover summary. (GSK)

As we can see above, oncology is not a traditional strength of GSK. Out of £17.7bn revenues generated in its Pharmaceuticals division last year, oncology accounted for just $489m of revenues. Respiratory and HIV are strengths, as well as vaccines – the vaccine division generated £6.8bn of revenues last year.

Consumer Healthcare – another traditional strength – generated $9.6bn of revenues last year, but most of this division is now part of Haleon, so GSK will become increasingly reliant on success within its oncology division if it wants to achieve its ambitious target of £33bn revenues by the end of the decade.

Conclusion – Will Jemperli News Trigger More Than A Mini Revival? It Can Be A Factor But Headwinds Remain Strong

However you look at it, the news that Jemperli bested Keytruda – the best known first line for NSCLC – in a head-to-head trial is good news for GSK, although I would stop short of calling it a vindication of the company’s new direction.

We don’t have the detailed data yet, and we don’t have the detailed data for the Jemperli / Cobolimab / Docetaxel study either – there will need to be further trials of both before we can definitively say what the market opportunity here may be.

When we consider the factors dictating GSK’s share price at the present time – the spinout, the consolidation, the falling pound, the Zantac litigation, and the cut in the company’s dividend payout, from 80 pence per share, to 45 pence per share, we can probably conclude that the Jemperli news is relatively small beer.

Nevertheless, we may have said the same thing about early Keytruda data – before Merck and the rest of the scientific community knew what a powerful drug they had on their hands.

There are many similarities between Jemperli and Keytruda and it is almost inevitable that a checkpoint inhibitor would one day be developed that would compare favorably with Merck’s drug. I would certainly stop short of declaring Jemperli to be that drug, but if it generates even half the revenues that Keytruda has, it will go a long way towards restoring the markets’ faith in GSK.

Jemperli is a glimmer of hope in what has been a grim story for GSK so far in 2022, but there are at least signs that the company can begin to make progress now the spinout and consolidation is complete. Investors can at least now begin to judge GSK on Pharmaceutical and vaccine sales alone, and the promise of its pipeline.

Ex-oncology, GSK’s pipeline looks solid if unspectacular and I would not be persuaded to buy GSK stock on these assets alone. Oncology, with Jemperli at the forefront and Zejula – possibly in combo with Jemperli, Cobolimab and even Blenrep, indicated for hematological cancers, may begin to resemble a double-digit billion dollar opportunity in the next year or so, and is probably the single biggest positive to cling to at a tricky time for the UK based Pharma.

Be the first to comment