Roman Barkov/iStock via Getty Images

Natural gas prices are at a 13-year high today. To all the bears who were calling for natural gas prices to go lower following the winter, they’re still missing the point. Truthfully, we missed this precise point last year when we made bearish calls on natural gas only to reverse course later.

The reality is that natural gas prices in the US are no longer bound by the “shale era” price band. Long gone are the days when everything was dependent on the weather during the winter and prices during the summer (the summer power burn price band). Natural gas prices in the US going forward will be the tail that gets wagged by the dog (global LNG prices). What was once a landlocked market is no longer going to be “that landlocked.”

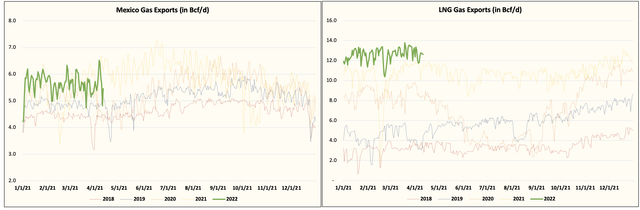

HFIR

Natural gas exports now total ~18 to ~19 Bcf/d. In particular, LNG gas exports account for ~13 Bcf/d and headed higher into year end. While most US LNG exports are on the 20-year take or pay agreements, there are still cargoes sold on the spot market. Given the low levels of global natural gas storage, and in particular Europe, the marginal cargo is capable of swinging gas prices here in the US.

Now in order for this to take place, we need certain other variables in the gas market here to be supportive. For starters, we have very low levels of coal stockpile which has pushed coal prices higher. In the past, low coal prices gave utilities the option of switching from gas to coal or coal to gas depending on the price. This is no longer a viable option as coal prices are at multi-year highs.

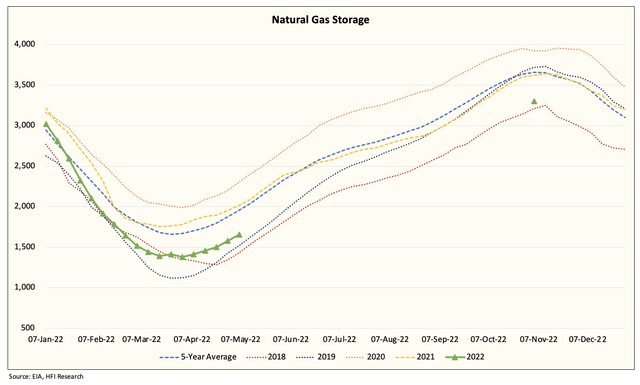

Another supportive variable is the low levels of natural gas storage in the US.

EIA, HFIR

With storage levels near multi-year lows and expected to finish the injection season near ~3.3 to ~3.4 Tcf, the market should continue to see tightness going forward.

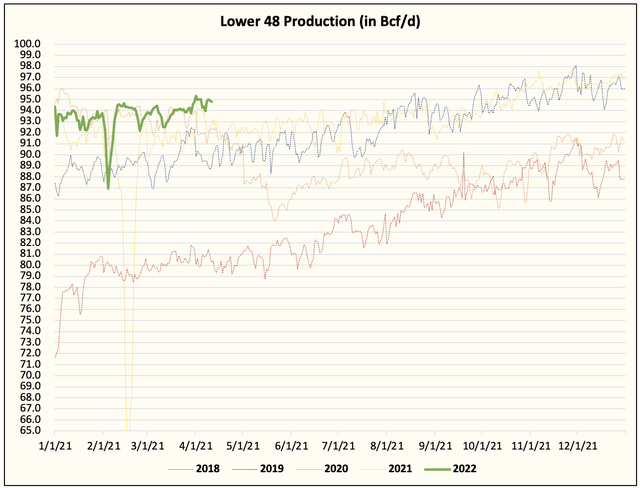

Finally, Lower 48 gas production remains in check following years of relentless growth.

HFIR

The only source of growth now is from Haynesville and associated gas production from the Permian. Northeast gas producers have already guided to flat production y-o-y.

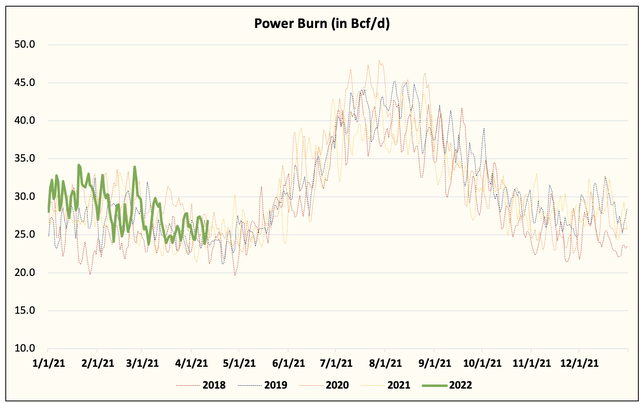

Over the summer, power burn demand in the US is expected to hit an all-time high.

HFIR

This combined with elevated exports should keep total gas demand near an all-time high for the summer months.

Putting all this together and the fact that global LNG prices are near $30/MMBtu vs. $6 and change here in the US, the recipe for even higher natural gas prices is coming.

We’re no longer in the US shale gas era price band. It’s time to accept this new reality.

Be the first to comment