HJBC

I expect to see the nearby NYMEX natural gas futures market probe above the $10 per MMBtu level before the end of 2022. However, that does not preclude a continuation of price implosions and explosions on the way to the highest level since 2008 and 2005, when Hurricanes Rita and Katrina pushed the energy commodity to $13.694 in 2008 and the $15.65 all-time peak for NYMEX futures in 2005.

The delivery point for NYMEX natural gas is the Henry Hub in Erath, Louisiana. The storms caused catastrophic damage to natural gas infrastructure that caused the energy commodity to reach levels over $10 per MMBtu. The last time we saw the price above that level was in 2008.

Meanwhile, natural gas has become a more international energy commodity over the past decade and a half. Technological advances that process the gas into liquid for export beyond the US pipeline network have changed the US market. The war in Ukraine, sanctions on Russia, and Russian retaliation have dramatically impacted natural gas in 2022.

Natural gas volatility has always been among the highest in the commodities asset class, but in 2022, the war has turbocharged the price variance. The United States Natural Gas Fund LP (NYSEARCA:UNG) tracks the futures price on the up and downside.

Wild price swings

July 2022 has been a wild month in the natural gas futures arena.

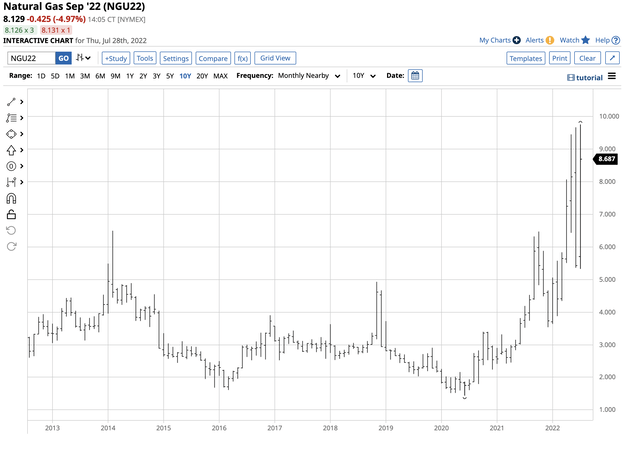

Monthly NYMEX Natural Gas Futures Chart (Barchart)

The chart highlights the $4.427 per MMBtu price range in July 2022, the widest trading band since July 2008, when NYMEX natural gas futures traded between $8.81 and $13.694, a $4.884 range. Natural gas imploded from the June $9.664 high to the July $5.325 low before reigniting and rallying to a marginally new high of $9.752 on July 26. The price corrected from the high, settling at $8.134 per MMBtu on the September futures contract on July 28.

A substantial change from the June 2020 low

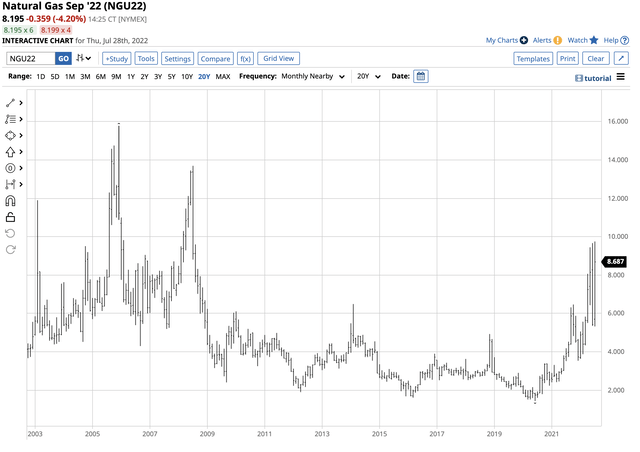

The chart shows the incredible rally from the June 2020 low that took natural gas prices to the lowest level since 1995 at $1.44 per MMBtu. At the most recent high, natural gas was over 6.77 times higher than that bottom.

In June 2020, value investor Warren Buffett seized the opportunity to increase Berkshire Hathaway’s natural gas exposure by purchasing natural gas transmission and storage assets from Dominion Energy (D) for $10 billion. The iconic investor spent $4 billion in cash and assumed $6 billion in debt, expanding Berkshire’s US interstate natural gas transmission from 8% to 18%.

Meanwhile, the technological advances in processing natural gas into LNG for transport beyond the US pipeline network dramatically increased the addressable market for US producers. Natural gas now travels by ocean vessel worldwide to areas where the price is much higher than in the US. Moreover, the war in Ukraine, sanctions on Russia, and Russian retaliation have caused European shortages. A hot summer season and increasing cooling demand in the US and Europe have only caused the demand and prices to skyrocket. While Asia remains for US LNG supplies, Europe is now starving as it looks to replace Russian flows that are now a weapon of war against “unfriendly” countries supporting Ukraine.

The natural gas fundamentals have changed dramatically over the past few years, and the technical picture turned bullish in September 2021.

Long-Term NYMEX Natural Gas Futures Chart (Barchart)

The chart illustrates the bearish pattern of lower highs and lower lows in the US natural gas futures market from 2005 through 2021. The price moved above the November 2018 $4.929 per MMBtu lower high in September 2021 and exploded to nearly double that price at the most recent high this week. Technicals and fundamentals agree that natural gas is in a new dimension. However, the wide price variance will likely continue in the futures market that’s as volatile as the energy commodity in its raw form.

The 2022/2023 winter season is on the horizon

The US natural gas futures market tends to peak in October and November at the beginning of the withdrawal season when natural gas inventories decline through January and February when heating demand peaks. With prices already moving within under 25 cents of $10 per MMBtu, the potential for a challenge of the 2008 $13.694 and 2005 $15.78 highs is rising.

Europe already is panicking over natural gas supplies for the coming winter season, with few alternatives to Russian supplies, and the US will not likely fill the void when the temperatures drop in the coming months.

The compelling case for natural gas

The most significant factor supporting natural gas prices is the war in Ukraine. European prices rose to record levels in 2021 and remain far above the highs before this year.

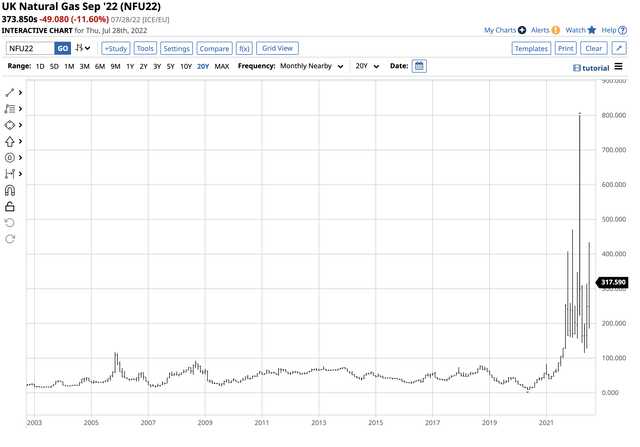

UK Natural Gas Futures (Barchart)

The chart highlights that UK natural gas prices reached a record high in late 2005 at the 117 level. After falling to 8.09 in May 2020, the futures exploded to 800 in March 2022 and were at 373.85 for September delivery on July 28, 2022.

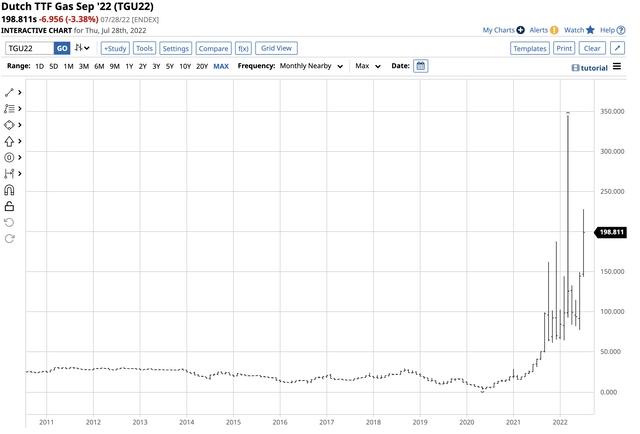

Dutch Natural Gas Futures Price (Barchart)

Natural gas futures for delivery in The Netherlands were below 31 over the past years, reaching a low of 3.365 in May 2020. In March 2022, they spiked to a record 345 and were just below the 199 level on July 28. As Europe looks for new supplies from the US, stockpiles across the US are at lows, and natural gas is trickling into storage during the 2022 injection season.

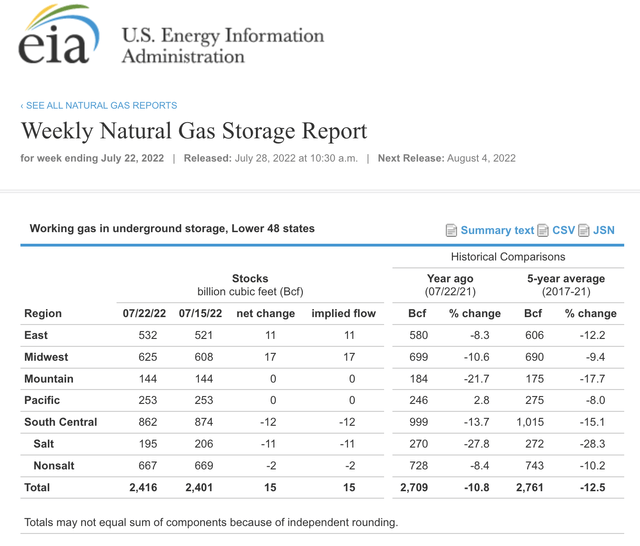

The latest EIA natural gas inventory report from July 28 shows that only 15 bcf trickled into storage for the week ending on July 22. US stockpiles are 10.8% below last year’s level and 12.5% under the five-year average. Unseasonably high temperatures increasing cooling demand and US energy policy inhibiting fossil fuel production are weighing on supplies when Europe is begging for new supply channels. The fundamental supply and demand equation and technical breakout in the natural gas arena create a potent bullish cocktail for the energy commodity as we move towards the 2022/2023 winter season.

UNG moves higher and lower with the volatile energy commodity

Investing in natural gas is dangerous as the price volatility has caused many market participants to lose their shirts. Even the most committed bulls found their confidence shaken to the core when the price dropped from the June $9.664 high to the July $5.325 low. However, those who take a disciplined approach to risk and reward, realizing that natural gas is a commodity with the potential for price explosions and implosions, can gain handsome rewards. Natural gas is a market that rewards flexible market participants and routinely punishes the stubborn that do not realize the current price is always the correct price.

The most direct route for a risk position in the US natural gas market is via the futures and options trading on the CME’s NYMEX division. The United States Natural Gas Fund LP provides an alternative for those looking to participate in the volatile energy commodity without venturing into the futures arena.

At $28.33 on July 28, UNG had over $616 million in assets under management. The product trades an average of over 6.8 million shares daily and charges a 1.35% management fee. September natural gas prices rose from $5.324 on July 5 to $9.419 on July 26, a 76.9% increase.

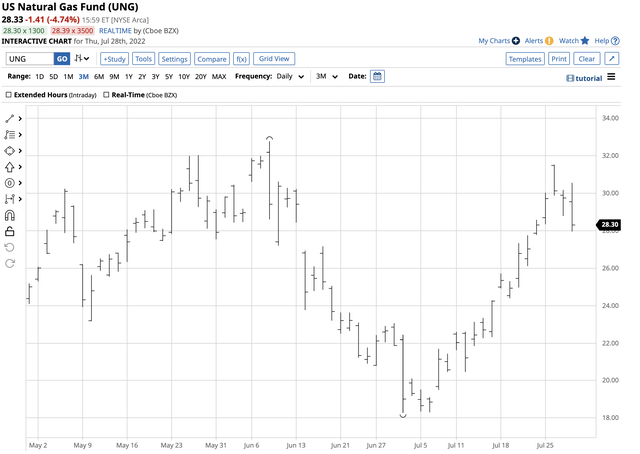

Short-Term Chart of the UNG ETF Product (Barchart)

Over the same period, the UNG product rose from $18.35 to $31.52 per share, or nearly 72%. UNG is not a product for long-term investors.

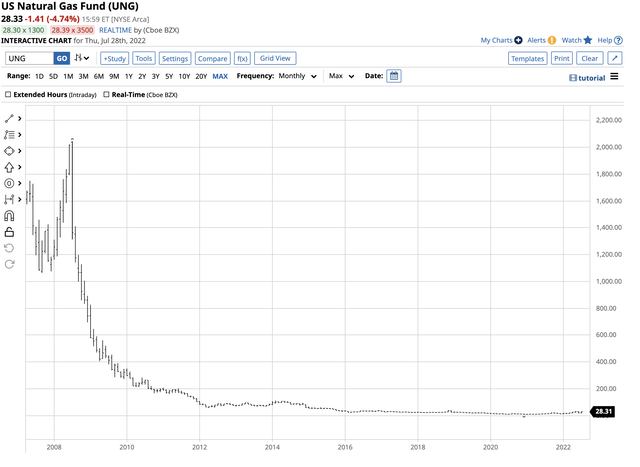

Long-Term Chart of the UNG ETF Product (Barchart)

The long-term chart shows that the roll risk in the futures market eats away at UNG’s value over time.

I believe natural gas is heading above the $10 level over the coming months, and a move to a new all-time high above $15.78 is possible. However, the route higher will be treacherous as the higher the energy commodity rises, the more the odds of periodic price implosions. Trade natural gas carefully, and never invest in this market unless, like Warren Buffett, you have the capital to purchase the nuts and bolts of the industry. Natural gas is an incredible trading market, but discipline is a critical skill, and a stubborn approach could lead you to the poor house.

Be the first to comment