Igor Zhukov/iStock via Getty Images

Dear Readers,

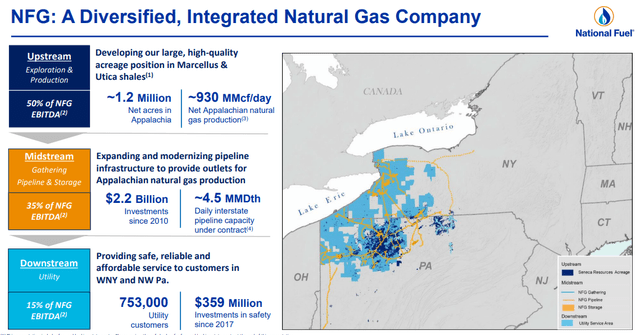

From a high level, National Fuel Gas (NYSE:NFG) is a perfect sort of energy company. It sells natgas through its attractive utility segment, it provides transportation through its pipeline/storage segment, it explores potential upstream reserves through its Texas-based Exploration/Production segment, and it markets through its energy marketing segment natural gas through a variety of industrial, commercial, public and residential end-users and consumers across the NY and Pennsylvania area.

So, what could be the issue with such a business that, after all, is one of the earliest gas utility companies in all of the United States?

Because, as I said, and as you can see above, the way the company “looks” is almost perfect. The company has a fully integrated model that enhances shareholder value. The current fossil market means that the company is set to generate excellent free cash flow in 2022E and beyond, and while NFG is taking advantage of current opportunities, they’re busily investing proceeds into the optimization of the current interstate pipeline infrastructure.

The company has a long history of returning attractive capital to shareholders, and the integrated structure means that investors, such as myself (and perhaps you as well), have the advantages that:

- The company can quickly adjust to shifting commodity pricing environments.

- It’s more efficient in CapEx

- It generally yields higher returns on investments

- Its cost of capital is generally lower than firms that lack the full integration

- It has lower operating costs

- It can play on fields with more competitive infrastructure projects

NFG has an excellent balance sheet, and unlike its peers, it does not overextend its payouts or dividends. NFG is BBB-rated, and yields a modest dividend of 2.81% – but that dividend has a payout ratio of less than 20% of operating cash flow. On an EPS basis, it’s less than 50% of annual EPS.

The company is expecting to drive that OCF/FCF up through CapEx optimization, continued stable returns from its regulated businesses, hedging the upstream commodity risks while maintaining that upside to rising pricing (as we’re seeing now), and improving that BBB- to a BBB or even higher through consistent FCF.

National Fuel Gas has paid dividends for 119 years. It has 51 years of consecutive increases, making it a storied dividend king, and it has paid out $3.4B in dividends since 1970. The latest results in no way lower the expectations of this company. NFG continues to do well and perform well.

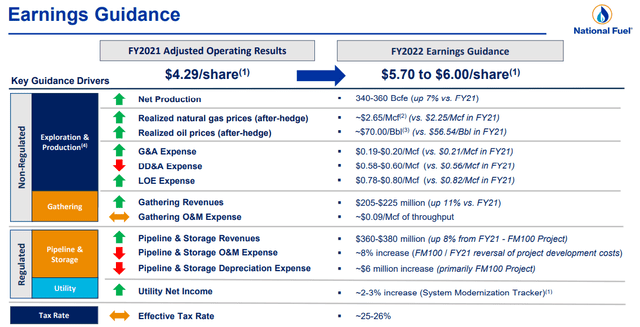

2Q22 saw operating results on a per-share basis rise 30 cents YoY, with improvements in every single sub-segment. While oil production stateside is currently down, every other driver shows positive indicators for NFG – starting with oil/gas prices, and going to natgas production and system modernization as well as colder weather.

Everything about this company currently points to this company generating earnings of $6/share on the high end, and the company can justify this ambitious target fairly well.

The company has several new projects ongoing, with growing production of the company’s capacity. NFG has plenty of wells left untapped across most of its geography.

So, with everything positive, what, you might ask, is the problem with NFG? Why not buy a lot more of the company if things are clearly going as well as they seem to be?

There are a few mixed issues with the company worth mentioning. The biggest of these is the company valuation, which I will show you in a short while. First, though – the company is pretty big on Californian oil production. As you might have expected from Cali as a state, the company’s operations here face extensive state-level regulation which hampers profit and growth – and judging by Cali overall, this might be increasing going forward.

While NFG has a mixed, appealing set of sectors, more than half of the company’s typical FCF/EBITDA tends to come from exploration and production. There’s also a decent seasonality to results from NFG, due to how gas prices work.

Inflation will impact the company in two ways. First, it will boost and has boosted commodity prices. But it will also increase company costs – and this now especially includes financing costs. This is a concern to NFG, which, as its credit rating suggests, carries a relatively high liabilities/assets ratio. As of the late report, NFG carries a debt of no less than $2.86B, and that’s net of cash. The company is currently being propped up by high commodity pricing, but it wasn’t that long ago that that debt was around half of the company’s market cap.

More conservative investors should consider limits and regulations on Cali oil drilling as well as market expectations for the company’s various operations in this very volatile climate. This restrictive state-level situation isn’t just in Cali, but it’s found in New York as well – and it’s not unrealistic that this could limit NFG’s future potential.

But none of these things are really the core “crux” of the matter I see with NFG.

National Fuel Gas Valuation

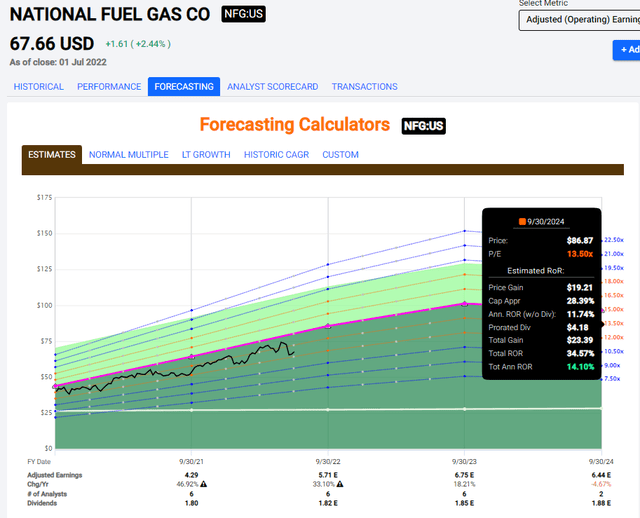

No, the real core issue with NFG is this. The company simply demands a bit of a high multiple for what it offers investors in return. The bullish thesis for NFG is based on the assumption of steadily growing commodity prices for the next few years, causing average earnings growth rates of 15-17% for 2022-2023, with a drop-off in 2024E.

However, despite these positive estimates, there is a degree (25%) of uncertainty and misses for analysts here when it comes to these forecasts. NFG traditionally trades at a premium, but I do not think it deserves as high a premium as 16-17X P/E.

While the company has done a superb job of integrating Appalachian gas into its sectors and is well managed, part of its core operations are found in states that have, historically and recently, been very anti-oil/fossil fuels – both NY and Cali – and this should cap the upside a bit. It’s also my view that the market is underestimating the impact of the company’s relatively high debt and focusing too much on the positives of the current commodities market. It’s tech all over again – assuming the upside, but disregarding what happens when things turn, or fully accounting for inflation and debt risk.

This company has an upside based on continued growth in hydrocarbons. I’m not arguing with the possibility of this – that’s why I own and continue to own shares in NFG. However, those shares were bought at close to single-digit P/E ratios, not 12-14X P/E ratios, or 16-18X P/E normalized on a non-current commodity pricing situation. My yield is almost 4%, while the current yield is less than 2.85%. Since COVID-19, that investment has netted returns in the triple digits – well over 125% with FX and dividends.

I just choose to forecast this company more conservatively at this point…

…and believe the upside to be somewhat limited from here on out.

Since 2019, NFG has consistently traded at around 11-14X P/E. If we plug this into our forecasts, we get returns of around 8% even with these positive assumptions, or around 14% annualized on the high end – or 35% in 3 years if we look at a total RoR scenario.

The simple fact is that there are companies that offer you better, more conservative upsides at a far better credit safety and even coverage ratios.

The reason NFG’s valuation is worrying me a bit here is that how much of it here is based on the positive assumptions for continued crude pricing. I know from history that when we start assuming something goes on forever, or even for a long time, that’s usually when it’s liable to turn around. And when nay-sayers are most abundant, that’s usually the time to be contrarian and start to invest.

That’s why I bought NFG, even though it was a relatively small position, years ago, and have been enjoying excellent dividends ever since.

For now, though, I’m looking at if I really want to keep my investment in the company. For now, I do – there’s simply too much to like about this company.

However, am I investing more?

No, I am not.

S&P Global gives the company an upside of around 10-12% here, based on a conservative mixed target of $77.2/share. Please note though that despite this target, only 20% of the analysts have a “BUY” rating here, meaning there’s some consideration as to if the company will actually be able to achieve what it has set out to do here. The lower-end targets for NFG come very close to the current share price of the company (Source: S&P Global), and those are the ones I tend to follow here.

Because of a combination of the factors I mentioned, I consider NFG to be only a little better than “fair value” here.

I think it’s a good time to “HOLD” NFG here, but not to buy more.

Thesis

My thesis for NFG is as follows:

- NFG is a fundamentally appealing, integrated commodities business and utility with an attractive operational profile. At the right price and conservative upside, this company constitutes an absolute “BUY”.

- However, recent risks including debt, inflation, operations in states traditionally opposed to hydrocarbons, and a rich valuation based on continued commodity pricing upside add to the risk here.

- I come in at a “HOLD” – my target is $66/share, no higher.

Remember, I’m all about :

-

Buying undervalued – even if that undervaluation is slight, and not mind-numbingly massive – companies at a discount, allowing them to normalize over time and harvesting capital gains and dividends in the meantime.

-

If the company goes well beyond normalization and goes into overvaluation, I harvest gains and rotate my position into other undervalued stocks, repeating #1.

-

If the company doesn’t go into overvaluation, but hovers within a fair value, or goes back down to undervaluation, I buy more as time allows.

-

I reinvest proceeds from dividends, savings from work, or other cash inflows as specified in #1.

Here are my criteria and how the company fulfils them.

This company is overall qualitative. This company is fundamentally safe/conservative & well-run. This company pays a well-covered dividend. This company is currently cheap. This company has realistic upside based on earnings growth or multiple expansion/reversion.

Be the first to comment